👋 Hi, I’m Andre and welcome to my newsletter Data Driven VC which is all about becoming a better investor with Data & AI. ICYMI, check out some of our most read episodes:

Brought to you by Affinity - The Leading Deal Intelligence

The 2025 Private Equity Benchmark Report, built from data on more than 200 PE firms, uncovers how dealmaking is shifting this year. From a 10.7% YoY rise in U.S. deal value ($227.7B) to a 29% increase in network growth, the report highlights the four behaviors that set high-performing firms apart. Use these benchmarks and insights to sharpen your strategy and compete more effectively in 2025.

👋🏻 Welcome to our monthly wrap-up episode where we cover October’s most relevant content at the intersection of startups, VC, data & AI👇

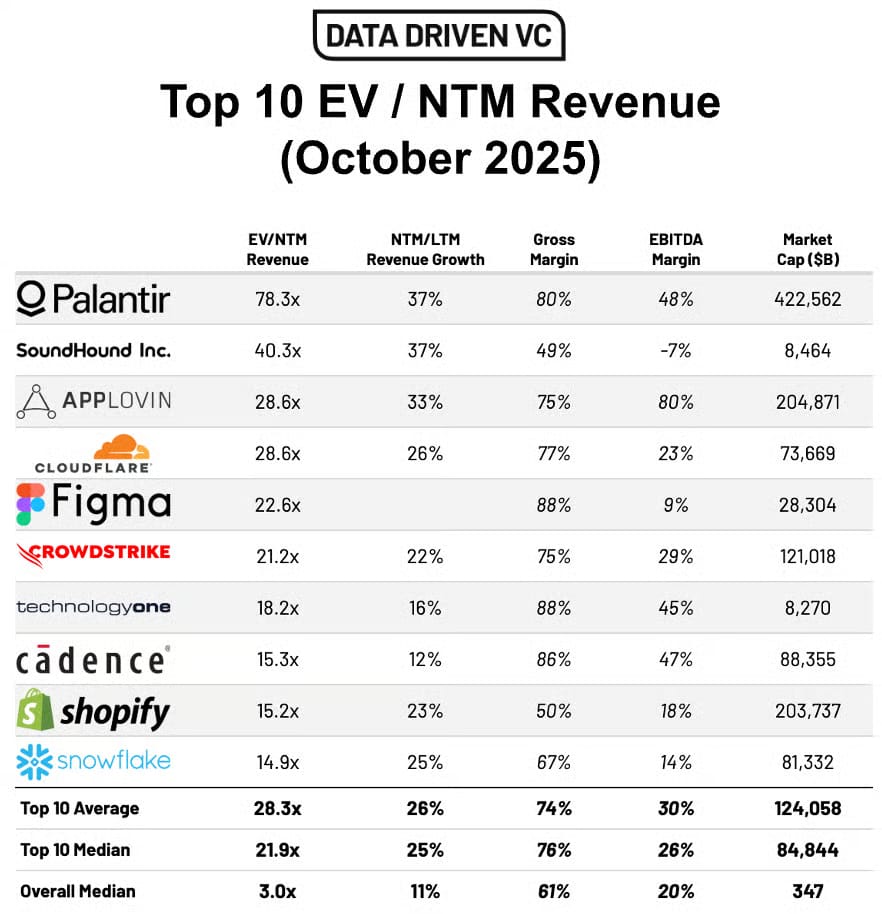

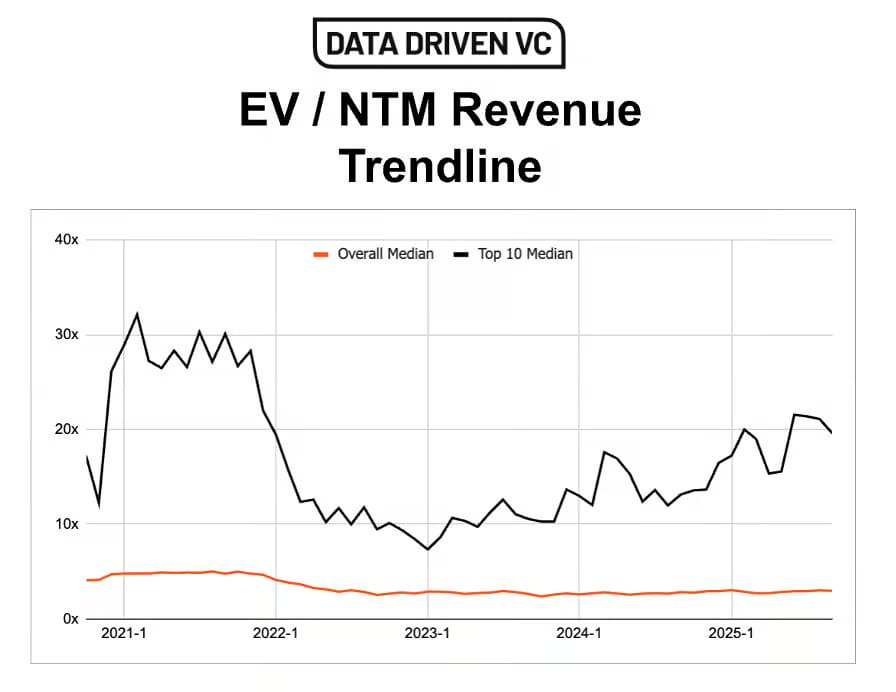

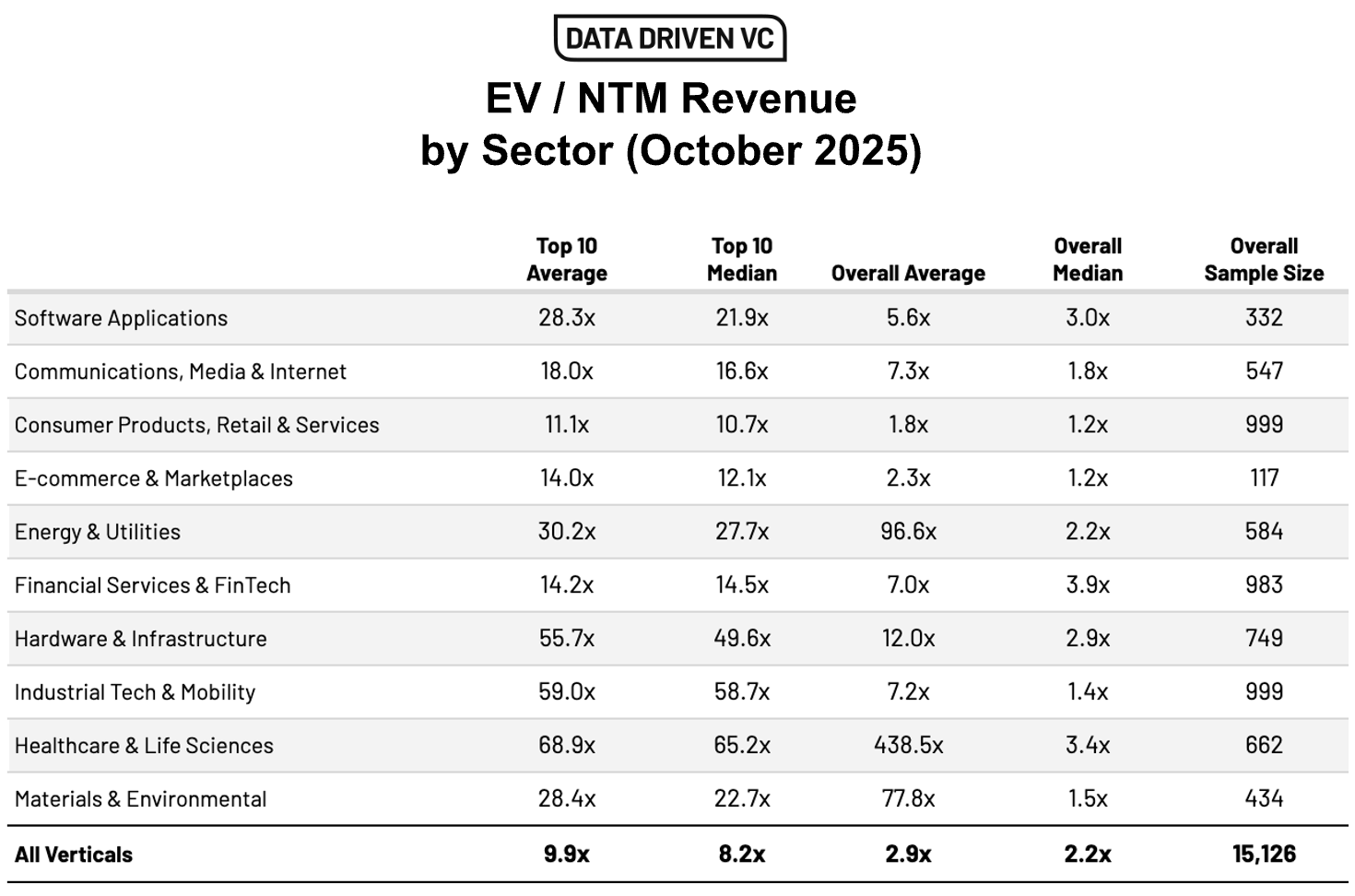

MULTIPLES SNAPSHOT📸

Here’s a snapshot of the most important October numbers. Full episode with all tables and deep dives here.

INTERESTING RESEARCH & REPORTS📈

The Founder Files: What Drives Startup Funding Outcomes

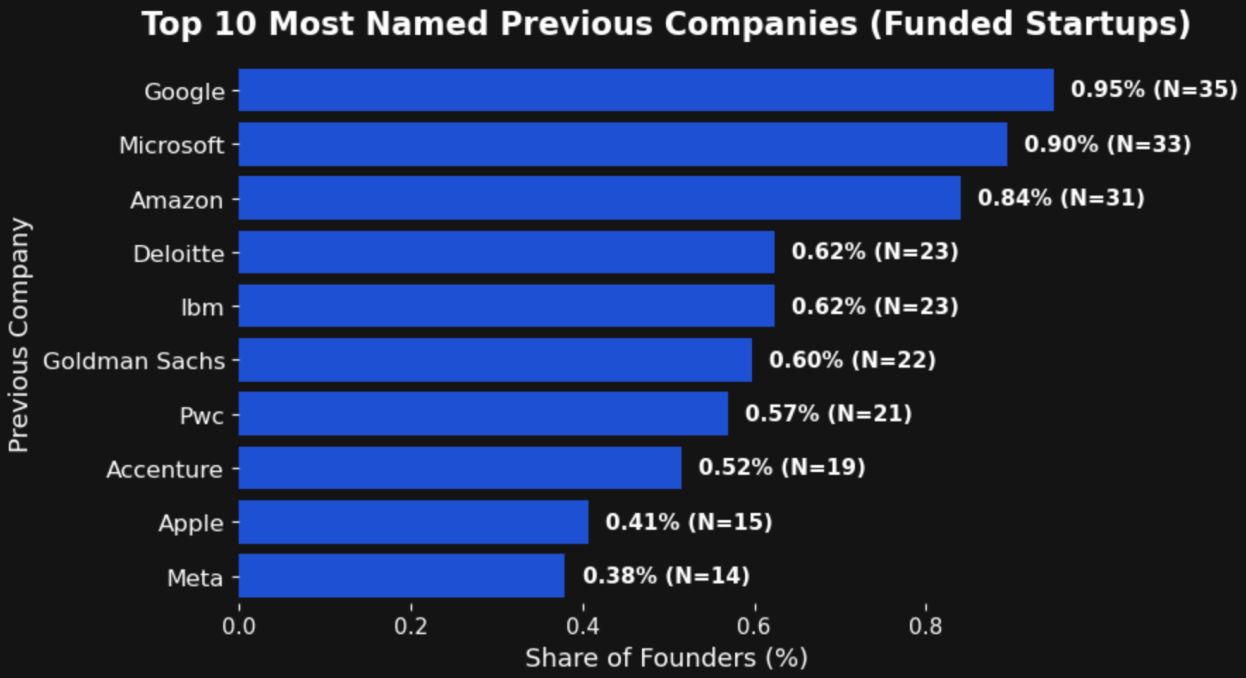

A Sequel analysis of 12,000+ founder decks and funding rounds reveals what separates top-performing startups from the rest — from founder backgrounds to fundraising tactics.

Team Composition: Startups with multiple founders outperform solo founders by a wide margin. Teams of 2–3 founders are 2.5× more likely to raise institutional funding than single founders. Diverse skill sets, especially combining technical + commercial expertise, correlate strongly with success.

Founder Background: Experience matters, but serial founders and former operators stand out most. Companies led by founders with prior startup or scaleup experience have 3× higher funding odds, while ex-consultants and ex-finance backgrounds trail slightly. However, technical founders still dominate at the early stage.

Fundraising Tactics: Deck quality and clarity are strong predictors of investor response. Top decks feature crisp one-liners, clear traction metrics, and visual storytelling - 45% shorter than average but 2× more likely to convert meetings. Startups that updated their decks after initial outreach saw a 30% increase in investor engagement.

✈️ KEY TAKEAWAYS

Teams with complementary skills and experience drive the strongest funding outcomes. Clear communication, concise decks, and measurable traction consistently outperform volume-based outreach. In essence, investors back founders who combine depth of experience with clarity of vision.

Measuring True Efficiency in Venture Exits

John Rikhtegar introduces the Exit Velocity Index (EVI) that ranks 3,317 North American VC-backed exits above $10M between 2010 and 2025, factoring in exit value, total primary equity raised, and time to exit. It highlights how efficiently enterprise value was built, rather than just how big the exit was.

Long Duration, Lower EVI: Some of the most famous exits like Yahoo (23 years), StubHub (20), Reddit (19), Procore (19), and ServiceTitan (17), took unusually long to exit, resulting in lower efficiency scores despite their large valuations.

Low Efficiency Multiples: Well-known companies like Scopely (2.9x), pony.ai (3.3x), Postmates (4.5x), Oscar Health (4.8x), and Uber (5.3x) delivered lower returns on invested capital relative to their size, falling short on capital efficiency.

Exceptional Efficiency Leaders: At the top, Mir achieved an EVI of 100 ($400M exit in 2 years on $2M raised), outperforming even WhatsApp ($22B exit in 5 years on $60M raised). Only 27 exits exceeded an EVI above 20, or 0.81% of all exits analyzed.

✈️ KEY TAKEAWAYS

EVI shows that speed and efficiency are stronger indicators of performance than headline valuations. Many large exits underperform when adjusted for time and capital, while a small subset of highly efficient companies drive outsized value creation.

Investment Processes Across VCs

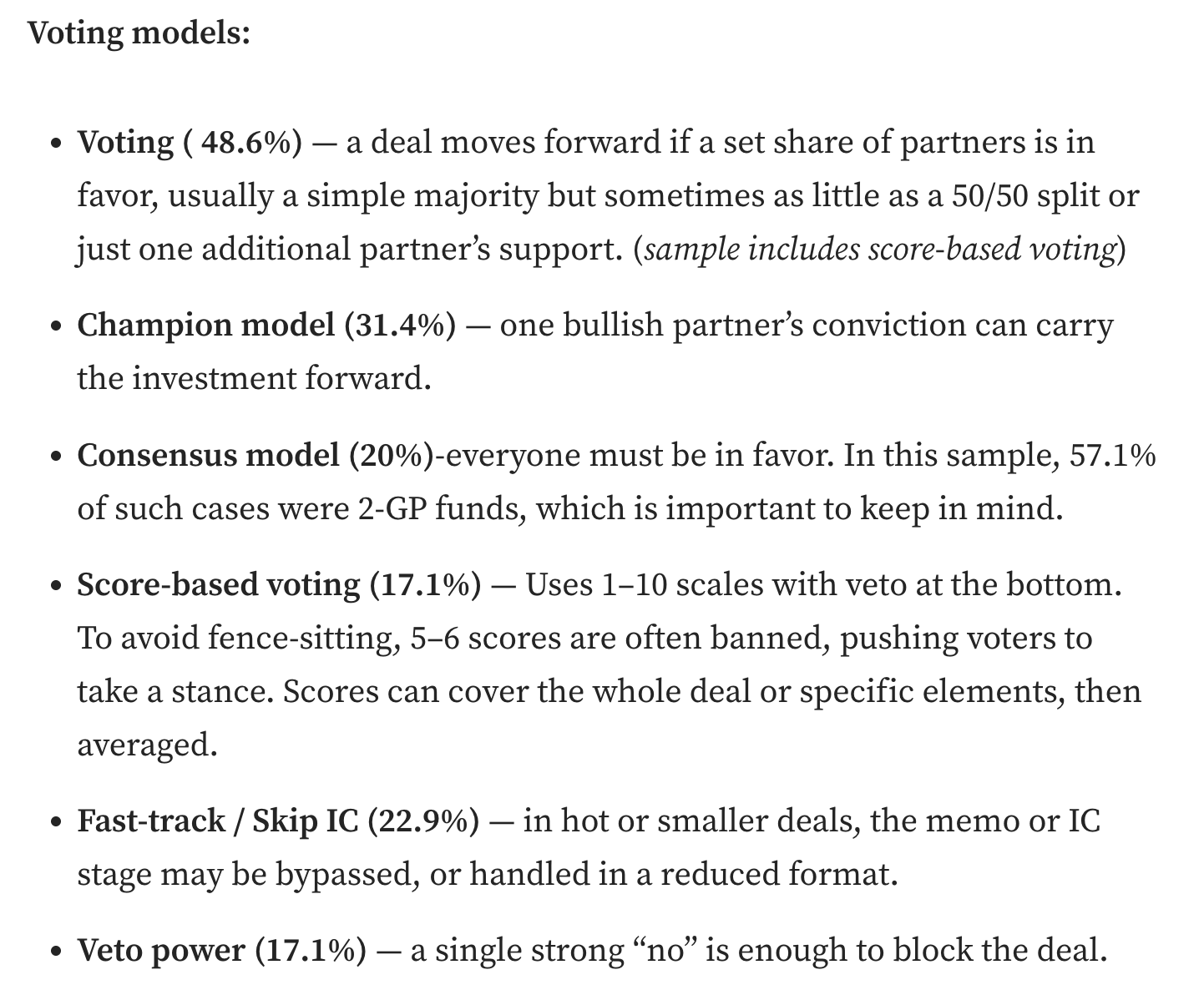

Kamil Weglinski from Market One Capital Corner shares an in-depth look at how leading VC firms structure their investment workflows from thesis and screening to decision-making and post-investment support. The most surprising to me was the voting models:

✈️ KEY TAKEAWAYS

VCs that scale efficiently use tight theses, structured funnels, and clear decision ownership. Founders can improve their odds by tailoring outreach to a fund’s focus, communicating traction in data form, and building early trust through transparency. Firms that track funnel metrics and formalize post-investment playbooks outperform peers on both speed and follow-on success.

INSPIRING TECH IN VC CONTENT💡

How AI became the ultimate partner for Venture Capitalists

This Calcalistech article explores how funds are now leveraging AI tools to scan thousands of startups, assess traction signals in real time, and automate due diligence steps once handled manually. What once took analysts days now happens in minutes, driven by data pipelines that merge internal CRM data with open-web intelligence.

This shift marks the rise of a new VC operating model: part analyst, part engineer. Firms are building proprietary copilots to process deal flow, forecast growth, and benchmark founders dynamically. Yet despite the automation, investors stress that human intuition and judgment remain irreplaceable - AI may surface the best signals, but people still decide which stories to believe.

AI Clones, Chatbots, and the Rise of the “Cyborg VC”

Bloomberg reports how VC is getting an AI-powered facelift. From Tim Draper’s digital twin, a lifelike avatar trained on eight hours of motion capture, to Andreessen Horowitz’s internal database Argo and LP chatbot LPY, firms are deploying custom agents to scout, analyze, and communicate faster than ever. Thrive Capital’s “Puck” and GIC’s “Ask Charlie” exemplify how institutional investors now blend automation with human insight, using AI to challenge assumptions, simulate debates, and forecast deals in real time.

The tools extend beyond chatbots. Platforms like Specter compress what used to take analyst teams hours - scanning LinkedIn, job boards, patents, and web traffic - into minutes. Yet as automation spreads, analysts face obsolescence and investors warn of homogenized decision-making: if every fund uses the same data and models, they may all chase the same founders — a paradox in an industry built on finding the undiscovered.

How Davidovs Venture Collective (DVC) Reinvents Venture Capital Using AI

Founded by Marina Davidova and Nick Davidov, DVC has eliminated its analyst team and instead leverages an AI-agent-driven workflow plus a network of 170+ LPs drawn from leading tech firms (e.g., OpenAI, Google, Meta, Tesla). Their AI agents pull together deal memos, mine data for traction signals, and monitor portfolio companies — tasks once done manually — freeing human partners to focus on qualitative founder dynamics and strategic oversight.

DVC’s fund is also rethinking incentive structures: LPs don’t just provide capital, they contribute expertise, work with founders, and earn carried interest based on deal performance. The model emphasizes speed and data-driven signal detection (e.g., identifying inflection points via hundreds of real-time metrics) while insisting human judgement still sits at the heart of major decisions — especially founder-fit and vision.

Share this article with others who might benefit.

“TECH IN VC” JOBS👩💻

Other open positions:

Tech Lead @All Iron Ventures in Bilbao here

Analytics Engineer @Dawn Capital in London here

Senior Data Engineer @Dawn Capital in London here

Fullstack Software Eng @Equation Cap in Munich here

Senior Data Engineer @Growth Equity Firm in the Bay Area here

Engineering Fellow @Pear VC in Austin here

AI Lead @USV in NYC here

If you’re recruiting tech in VC jobs, just hit reply with the URL to your job posting and we’ll include it in our next monthly wrap-up episode + share via VCSTACK.COM

THIS MONTH’S DATA DRIVEN VC EPISODES⏮️

Essays

Insights (from the data)

Resources

Stay driven,

Andre