👋 Hi, I’m Andre and welcome to my newsletter Data Driven VC which is all about becoming a better investor with Data & AI. ICYMI, check out some of our most read episodes:

Brought to you by Affinity - Campfire 2025 is coming to London!

Private capital teams are drowning in emails, data, and shifting markets—just as competition for the best deals reaches new heights. On October 28, 2025, Affinity Campfire London will bring together leading investors, dealmakers, and operators to turn that noise into actionable insight.

Join peers for an afternoon of networking and hands-on learning. From smarter sourcing and fundraising to practical AI integration, you’ll take home proven tactics, hands-on demos, and real-world success stories you can deploy immediately.

How Board Composition Impacts Startup Success

Theranos, FTX, OpenAI - these high-profile cases shone a light on who sits around a startup’s boardroom table can make or break a company. Private company boards usually operate out of the spotlight, only surfacing in headlines when governance fails spectacularly (think Elizabeth Holmes’ Theranos or Sam Bankman-Fried’s one-man FTX board).

Such fiascos raise a critical question for founders and investors alike: Does having independent or operator-directors on a startup board actually tilt the odds toward survival and successful exits?

Data from recent years suggests yes – done right, independent board representation correlates with stronger fundraising, more innovation, and higher-value exits. Here’s what the latest research reveals about board composition and startup outcomes, and how to put these insights into action.

Let’s dive in!

✅ TL;DR (5 Key Takeaways)

Only 34% of startups add a truly independent director by Series A, yet by IPO, the average board has 2 independents. Founders should plan for at least one independent director no later than Series B to stay ahead of governance norms.

Startups with an outside (non-investor) director raise significantly larger follow-on rounds and have a higher IPO probability. Evidence from 5,562 European ventures shows the optimal setup is 1–2 independents - too few limits perspective, too many hurt cohesion.

Boards dominated by VCs skew toward faster, lower-value exits and show reduced innovation (measured by fewer patents). Adding at least one operator-director (non-investor) increases the likelihood of IPOs and higher-value outcomes.

Independent directors expand growth levers: Studies show they directly bring new investors, executives, and even acquirers, functioning as “free” senior advisors with voting power. This network effect compounds over time.

Lack of independents correlates with higher governance risk. Catastrophic failures (e.g., FTX) often involved insider-only boards. Even a single seasoned outsider reduces deadlock risk and forces accountability, materially lowering downside risk.

The Evolving Startup Board: From Founder-Controlled to Independent

In the earliest days, a startup’s board is often just the founders (or even a sole founder) making all the decisions. Once they raise funding from VC firms, boards expand to include investor directors, with a typical Series A board having 3 seats (e.g., two common stock seats for founders and one for the lead investor) (Pena, 2025).

As more rounds are raised, boards often grow to 5 members (founders, investors, plus an independent seat) to maintain an odd number for voting (Malenko & Ewens, 2020). In practice, however, most early-stage startups delay filling the independent seat.

One study found that only about 34% of startups had added a non-executive (outside) director by Series A (Venugopal & Yerramilli, 2024). Those who did often left the seat vacant until a later round, or filled it with someone who was actually an investor in the company (Venugopal & Yerramilli, 2024).

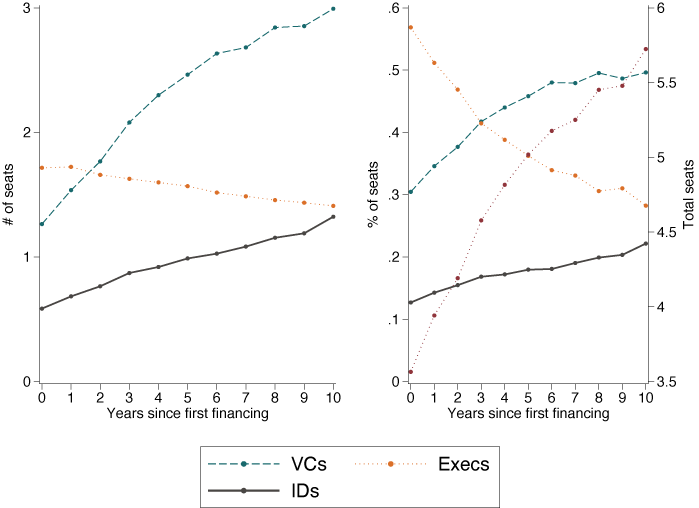

In short, truly independent or operator-directors (not beholden to management or VCs) are rare in young startups, but that begins to change as companies mature. Research shows that by the time a startup is nearing an IPO, it has, on average, two independent directors on its board (Malenko & Ewens, 2020), moving closer to public-company governance norms (where exchanges require a majority independent board) (Carta, 2024).

✈️ KEY INSIGHTS: Only 34% of startups add a truly independent director by Series A, and most boards stay founder- and investor-dominated until later rounds. By IPO, the average board includes two independents, signaling a major governance shift toward public-company norms and offering a clear benchmark for founders planning long-term board composition.

Do Independent Directors Improve Funding and Exit Outcomes?

Emerging data indicates that adding independent or industry-experienced directors early on can materially boost a startup’s trajectory. A recent large-sample study of venture-backed companies found that startups that appointed a non-executive outside director in their early stages went on to raise significantly larger follow-on funding and were more likely to achieve a successful exit, especially via IPO (Venugopal & Yerramilli, 2024).

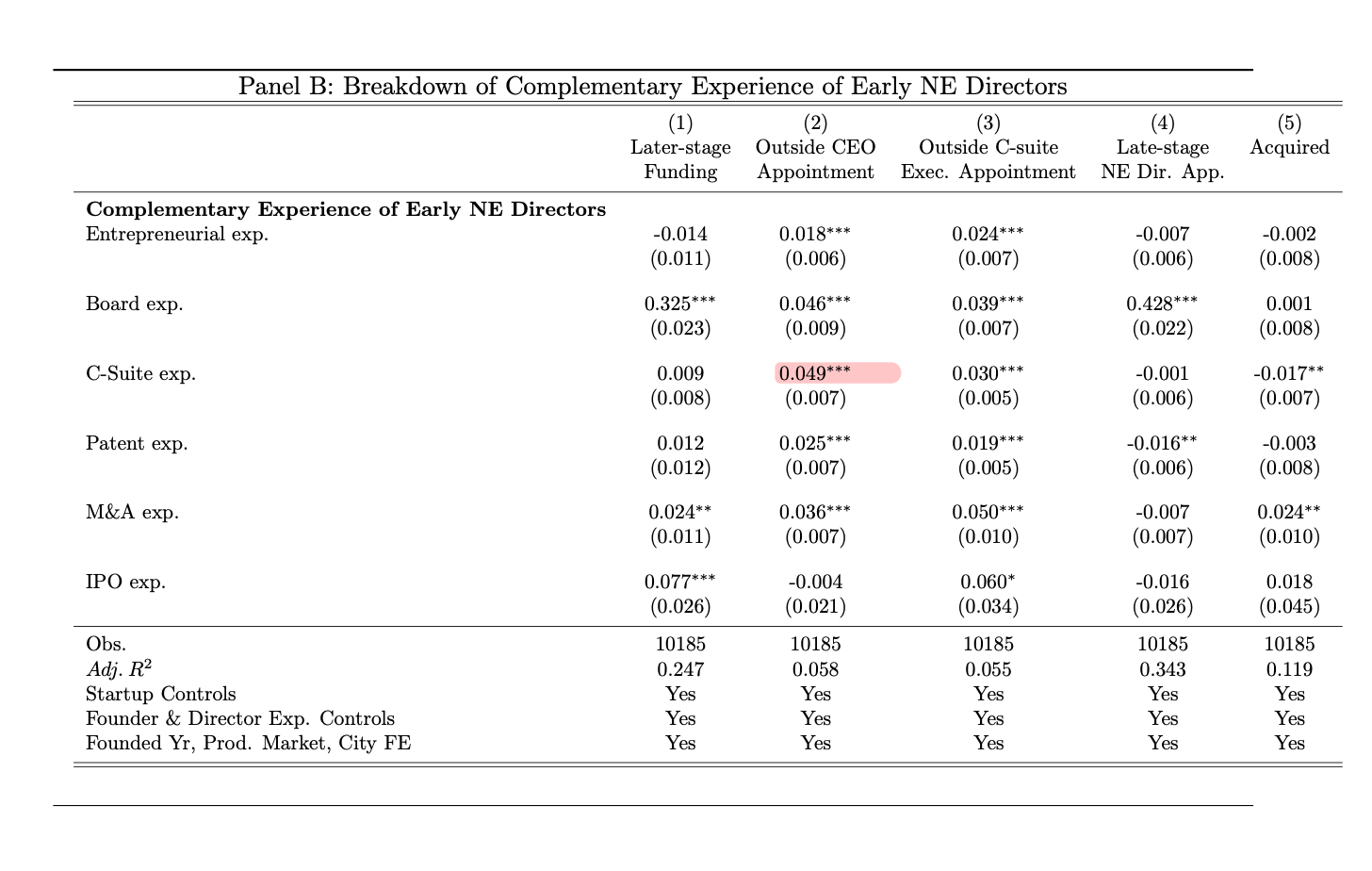

Early-stage boards are more entrepreneurial and technical, favoring founders and operators who can help build the business. Later-stage boards are more professionalized, adding directors with transactional, governance, and exit experience, a sign of institutionalization as firms mature (Venugopal & Yerramilli, 2024)

In fact, these companies not only secured more capital in later rounds, they also demonstrated greater innovation (measured by patent filings) and stronger growth prospects – factors that make them attractive IPO candidates (Venugopal & Yerramilli, 2024).

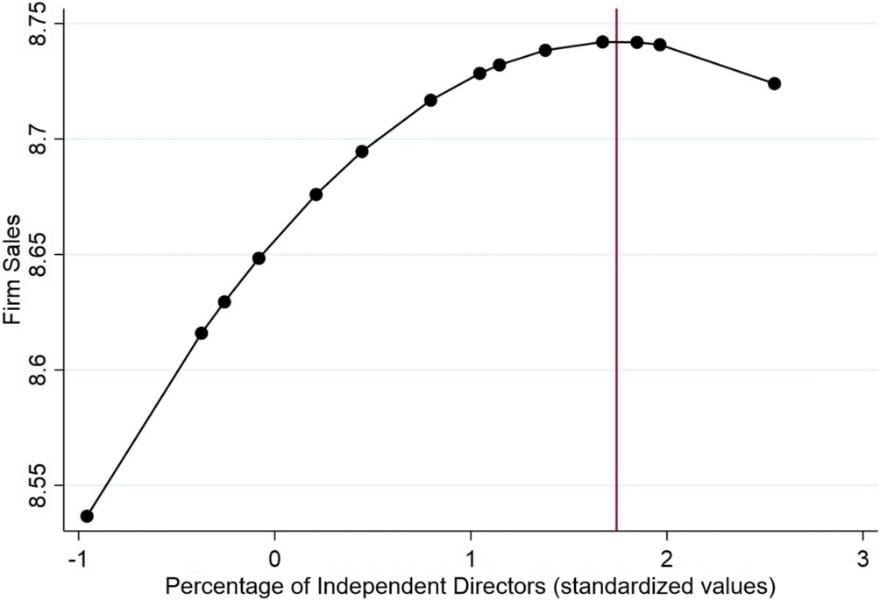

Complementing these findings, a 2025 study of 5,562 new ventures in Europe likewise reported that involving outside directors has a positive impact on performance; interestingly, the effect followed an inverted-U curve, meaning a moderate presence of independents yields the best results (Arnoldi, Flickinger & Sorensen, 2025).

Upgrade your subscription to access our premium content & join the Data Driven VC community

Too few independent voices, and the company may lack perspective outside the founding team and investors. Too many, and the board could become detached or conflict-prone. The takeaway: Startups benefit from independent board members, but usually one or two are enough.

From an investor’s perspective, independent board representation can also signal quality and staying power. According to research by Y Combinator Continuity, ventures with well-composed boards (mixing operators and independents alongside investors) tended to attract more follow-on capital and at higher valuations, since VCs see robust governance as a plus in risky early-stage deals (Malenko, 2023).

Put simply, an independent director can bolster investor confidence that the startup is being wisely guided and overseen, which in turn can open checkbooks for the next round. And in the long run, that oversight may help the company avoid costly mistakes that derail fundraising or exit plans.

✈️ KEY INSIGHTS: Startups that add an outside director early raise larger follow-on rounds and are more likely to IPO, with one or two independents delivering the strongest performance boost. Evidence from 5,562 European ventures shows that too few independents limit perspective, while too many hurt cohesion, making moderate representation the optimal governance strategy.

Share this article with others who might benefit.

Who You Add Matters: Operators vs. Investors on the Board

Not all “independent” directors have the same impact. The background and incentives of your outside directors can shape your outcomes. Many startups eventually fill an outside board seat with an investor-affiliated director (for example, an angel investor or a VC-friendly industry exec). Such investor-directors do bring connections and financial savviness, and studies find they indeed correlate with higher overall exit likelihood (Venugopal & Yerramilli, 2024).

Firms with higher proportions of founder-directors and VC-directors are more likely to achieve this milestone at an earlier stage, illustrated by the more rapidly climbing hazard plots associated with these director categories. This figure offers a graphical depiction of the positive and significant association with these director categories (Venugopal & Yerramilli, 2024)

However, there’s a catch! Boards dominated by investors often steer startups toward faster, lower-value exits (think acqui-hires or trade sales) rather than nurturing longer-term opportunities (Venugopal & Yerramilli, 2024).

In a detailed study of 156 U.S. ventures, boards with greater VC representation achieved more exits but also saw significantly lower R&D spending and patent creation (Garg, Howard & Pahnke, 2025). The presence of VCs on the board was negatively associated with innovation (patents) and product development, even as it was positively associated with achieving an exit (Garg, Howard & Pahnke, 2025). This suggests that investor-led boards may prioritize shorter-term liquidity events over bold, risky bets on technology. Not a greatly surprising outcome, given a typical VC’s need to return funds on a timetable.

By contrast, independent operator-directors (those with no financial stake in the company) tend to push for bigger, innovation-driven outcomes. The same research that noted more acquisitions with investor directors found that startups whose independent directors were non-investors were far more likely to go public (IPO) than those whose independent directors were actually investors (Venugopal & Yerramilli, 2024).

These truly independent directors often come from relevant industry executive roles or have prior startup experience, and they focus on long-term value creation over exits. In fact, data shows non-investor outside directors are much more likely to have backgrounds in entrepreneurship, product development, or scaling operations, whereas investor-affiliated directors more often bring M&A or IPO deal experience (Venugopal & Yerramilli, 2024).

✈️ KEY INSIGHTS: Investor-affiliated directors increase exit likelihood but skew outcomes toward faster, lower-value sales, with data showing reduced R&D and patenting when VCs dominate boards. In contrast, non-investor operator-directors drive higher IPO rates and long-term innovation, making one or two true independents a high-leverage addition for scaling startups.

How Independent Directors Add Value (and Reduce Risk)

Why do independent and operator board members drive better outcomes? Researchers point to a few key contributions. First is expertise and networks: A great independent director brings skills or knowledge the founding team lacks, be it enterprise sales, scaling engineering teams, or building distribution partnerships (Venugopal & Yerramilli, 2024).

They can fill experience gaps in a very tangible way, effectively acting as a “free” senior advisor with decision-making clout. Many independents also leverage their professional networks to benefit the startup. For example, one large-scale study showed that early-stage outside directors actively used their connections to bring in new investors, key executive hires, and even potential acquirers for the company (Malenko, 2023). In other words, independents serve as force multipliers for recruiting talent, opening business development doors, and introducing the startup to growth opportunities that the founding team might not access on its own.

Second is objective oversight. Unlike management or investor directors, a truly independent board member has no vested interest beyond the company’s success, which enables them to provide unbiased oversight and a reality check in board deliberations. This impartial perspective can be critical during high-stakes conflicts or strategic pivots. Academic research describes independent directors in startups as mediators in early stages – neutral parties who can broker peace when founders and VCs disagree (Malenko, 2023). By having a tie-breaking vote in a 2-2 deadlock, an independent can prevent stalemates and encourage compromises that keep the company moving forward (Malenko, 2023).

Then, as the company grows, the role of independents evolves into more of an advisory capacity: They often become mentors who help professionalize the organization and prepare it for an eventual exit (IPO or acquisition) (Malenko, 2023). Seasoned independents typically have “seen the movie before”. Many have run larger companies or served on public boards before – so they know what strong governance and controls look like. This experience is invaluable in guiding startups through later-stage complexities like international expansion, compliance, or going public.

Crucially, independent oversight also reduces the risk of governance failures and scandals. With insider-only boards, there’s a danger of groupthink or unchecked power in the hands of a dominant CEO or lead investor. An independent director can ask hard questions about financials, ethics, and strategy that others might shy away from. When boards lack this oversight, the results can be dire: As one governance expert bluntly noted, “the board’s action (or inaction) can destroy value, hurt customers, and land the CEO in hot water” (Potapoff, 2025).

FTX’s collapse, for instance, has been partly attributed to its virtually nonexistent board governance. A lone founder-director, rubber-stamping decisions until it was too late (Potapoff, 2025). Similarly, several venture-backed unicorns (from Uber to WeWork) delayed bringing in independent directors and saw governance slip-ups that dented their trajectories. The pattern is clear: Independent board members act as a safeguard, catching red flags early and insisting on accountable practices. They won’t guarantee a startup’s success, but they meaningfully improve the odds of avoiding catastrophic mistakes on the road to scale.

✈️ KEY INSIGHTS: Independent directors act as force multipliers, with studies showing they directly bring new investors, key hires, and acquirers while providing unbiased oversight that prevents deadlocks and governance failures. Startups that delay adding independents risk groupthink and unchecked power, as seen in cases like FTX, whereas even one or two seasoned outsiders significantly improve scale-up readiness and reduce catastrophic risks.

Thanks to Jérôme Jaggi for his help with this post.

Stay driven,

Andre