👋 Hi, I’m Andre and welcome to my newsletter Data Driven VC which is all about becoming a better investor with Data & AI. Join 34,875 thought leaders from VCs like a16z, Accel, Index, Sequoia, and more to understand how startup investing becomes more data-driven, why it matters, and what it means for you.

ICYMI, check out our most read episodes:

Welcome to another edition of our Sunday “Resources” stream where we share our most valuable data & resources across four rotating formats:

Hottest Startups of the Month (last episode with Top 30 in August here)

Top Downloaded Resources from The Lab #1 (how to turn Google Sheets into your competitor radar here)

State of the Market (this is today!)

Top Downloaded Resources from The Lab #2 (last one with 997 accelerators you should know here)

For 1. and 3., we collaborate with best-in-class partners to ensure you get the highest quality data.

For 2. and 4., we leverage our ever-growing product portfolio and share selective snapshots of the most sought-after resources from VCSTACK.COM

State of the Market - August 2025

Most data for today’s episode was provided by our partner Multiples.vc, your go-to source for verified M&A valuation multiples and public comps based on analyst estimates, at a fraction of the price of legacy data providers.

With this monthly format, we aim to unify market & valuation data into a single episode, so you don’t need to check various sources for a complete picture. Here’s what we’ll cover today:

#1 Markets

Top 10 private market companies + spotlight OpenAI

State of IPOs: Top 50 candidates + the Figma evolution

State of M&A: Number of transactions, deal volume

#2 Multiples

Top 10 vs Top 50 EV/NTM Revenue

EV/NTM Revenue over time and by sector

Efficiency Benchmarks incl. revenue per FTE, Rule of 40 & more

We have a lot on the agenda, so let’s jump in👇

1. Markets

Top 10 Private Market Companies

We have a new #1 most valued private company!

With their envisaged secondary sale at $ 500bn valuation, OpenAI becomes the most valued private company in the world. While not officially confirmed yet, trusted sources assume it as a done deal - and so does Position.so as per the table below.

Source: Position.so

Last month, we covered how Elon’s universe has evolved, from SpaceX over Starlink to Neuralink, Tesla, and X. Now, only one month after rumours of the SpaceX tender offer that had valued the company at $ 400bn, we see Elon’s toughest competitor Sam Altman pull ahead with OpenAI, degrading SpaceX and taking the pole as the most valuable private company.

A question I got asked a lot in recent weeks:

Is OpenAI overvalued?

I don’t think so. I actually think it’s quite reasonably priced and has lots of room to grow.

On the commercial side, they’ve more than doubled from $ 5.5bn revenue run rate in Dec 2024 to reportedly $ 13bn in July 2025, aiming for $ 20bn by EOY 2025. With a 3.6x relative growth (at billions!!), a $ 13bn revenue run rate, and an at least $ 25bn NTM revenue, a valuation of $ 500bn represents a 38x run rate multiple and a conservative 20x NTM revenue multiple.

Putting this into context with two comparisons:

Their closest private market competitor is likely Antrophic which has just raised on a $ 170bn valuation with $ 4bn revenue run rate, pricing it at 42x run rate multiple. So even at 1/3 of the absolute revenue levels, they’re priced higher. Likely due to the fact that they’ve grown from $1bn revenue run rate in Dec 2024 to $4bn in June, showing 4x growth in the same period where OpenAI has grown 2x. So all in all, Antrophic more aggressively priced compared to OpenAI

Compared to public market software leaders like Palantir (see details further below) with 84x NTM rev multiple, or even the top software company 10 average and median with 28x and 21.5x, respectively, OpenAI seems reasonably priced.

Top 50 IPO Candidates

From our April 2025 IPO candidate list below, we just saw Figma officially file for its IPO on July 1, 2025, marking a major turning point after its proposed $20 billion acquisition by Adobe was blocked by regulators in late 2023.

Figma priced its IPO at $ 33 per share, giving the company a fully diluted valuation of approximately $ 19.3bn. On its first day of trading, the stock soared over 250%, reaching between $ 115 and $ 118, which pushed its market cap well above $ 60bn. Since the peak, however, the stock has retraced significantly, now trading in the $76–$80 range, roughly in the middle between the initial offering and the peak.

In light of an exceptional public debut of FIG, several other companies are now lining up to follow path, hoping the IPO window remains open.

One thing is clear: H2-2025 starts with high hopes.

State of M&A

At least as interesting as public markets these days is M&A activity.

Source: Multiples.vc

Ahead of the summer break, the last month marked significant deal activity. We only include M&A transactions with confirmed EVs available at Multiples.vc, thus structurally exclude the long tail noise of smaller EV transactions.

While we’re at 54% in number of transactions relative to the FY2024 (2008 deals YTD vs 3708 deals in FY 2024), the deal volume is at 77% - a clear indication towards fewer but significantly bigger transactions as confirmed by yet another increase in the average deal size that’s now at $ 1bn.

Source: Multiples.vc

Looking at the largest transactions of the last 30 days, we see the $ 85bn acquisition of Northfolk Soutern by Union Pacific in the railroad market and the $ 60bn acquisition of Hess by Chevron in the energy market.

Source: Multiples.vc

In terms of highest EV/Revenue transaction, German scale-up Cognigy leads the way with their sale to NICE at $ 955m and an implied multiple of 26x. That’s about three times as high as the top 10 median multiples of 7.3x.

2. Multiples

Compared to last month, multiples are (again) up.

EV / NTM Revenue Multiples

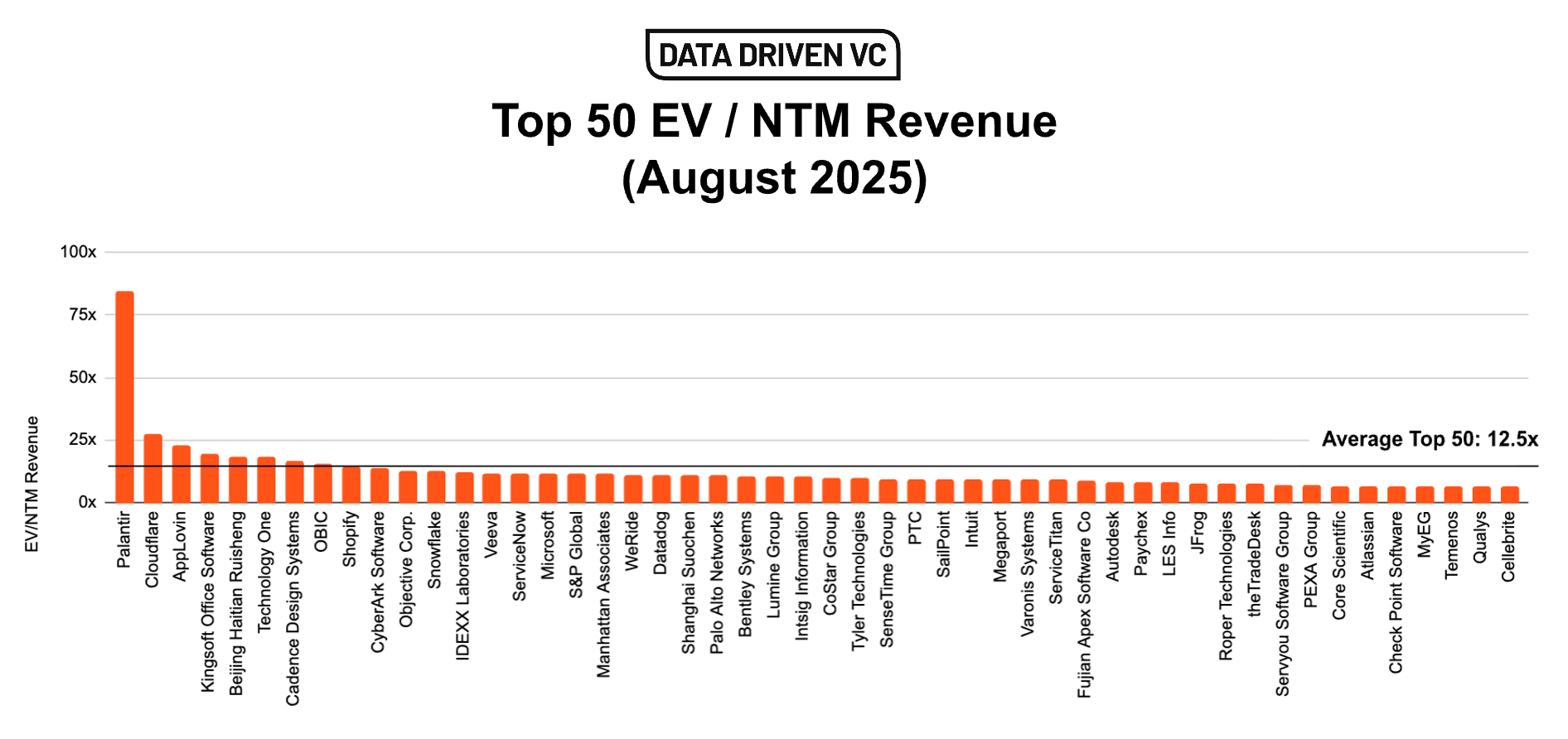

Let’s start with a snapshot of top companies based on EV / NTM Revenue multiples. For all analysis below, we exclude companies with market caps below $1B and non-meaningful multiples above 100x.

Source: Multiples.vc

Lots of movement in the top 10!

New entrants

Figma makes the podium on rank #3 only 1 month after their debut (27.9x EV/NTM, $37B market cap)

Synopsys (14.9x EV/NTM, $114B market cap)

Shopify (14.3x EV/NTM, $188B market cap)

Dropped out since July:

Fortnox

TechnologyOne

Verisign

After their best quarter ever, SoundHound stock soars 20%+ and brings it to rank #2 - despite -10% EBITDA margin.

The key consistency? Following exceptional Q2 numbers, Palantir continues to lead the pack with a 84x EV / NTM revenue multiple, likely due to a combination of increased growth at 38% (vs 31% before) and profitability at 47% EBITDA margin (vs 45% before). A standout role model showcasing how initial service business, integrating their platform deeply into customer workflows, can later scale into product-like margins.

Top 10 average grew month-over-month from 26.8x to 28.1x and the median increased from 20.7x to 21.5x.

Source: Multiples.vc

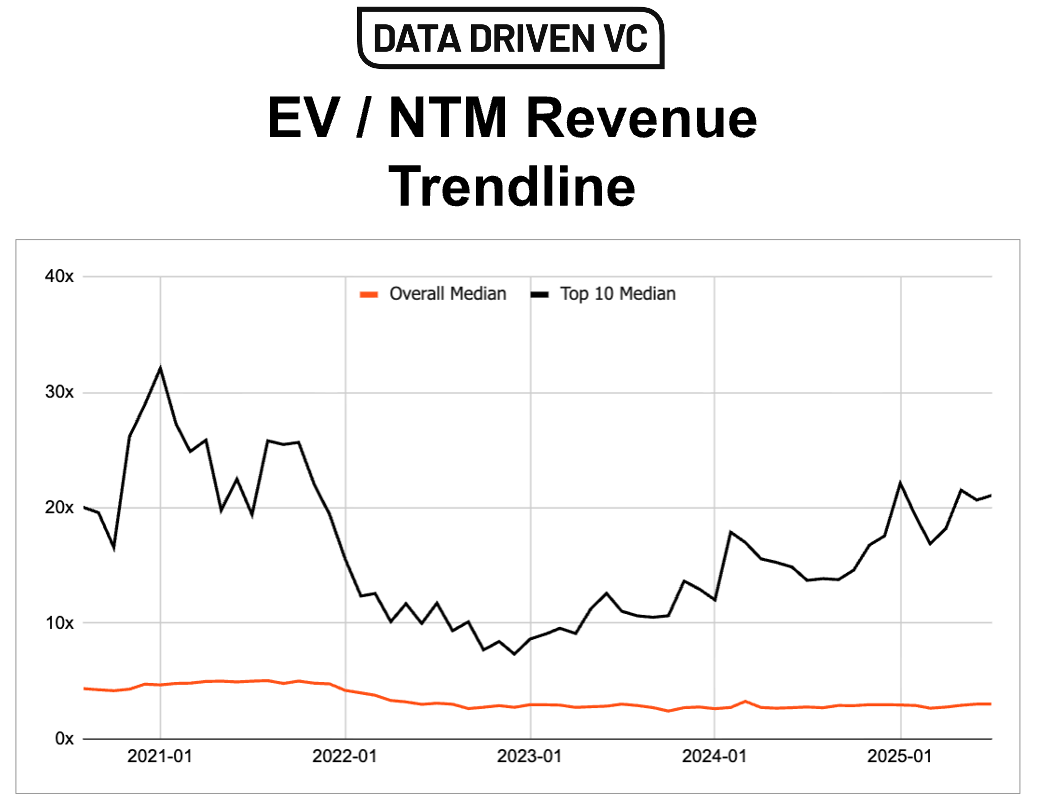

Last month, the historic trend line of top 10 median and overall median hit an inflection point where the significant gap started closing again. This was only for a short moment as this month, the gap continues to widen with Top 10 Median growing stronger than the Overall Median. Top companies continue to attract more capital than the median.

Source: Multiples.vc

While top 10 average increased to 28.1x, the top 50 average decreased once more from 13.7x in the previous month to 12.5x EV / NTM revenue, indicating that the bar is very high and the gap between the leaders and the rest already continues to increase.

Overall, the August snapshot shows a market where leadership is more geographically diversified, but sentiment has cooled slightly across the board, with only a few companies like Palantir bucking the trend by stretching their valuation multiples higher.

Below table shows the average and median EV / NTM revenue multiples by sector.

Subscribe to DDVC to read the rest.

Join the Data Driven VC community to get access to this post and other exclusive subscriber-only content.

Join the CommunityA subscription gets you:

- 1 paid weekly newsletter

- Access our archive of 300+ articles

- Annual ticket for the virtual DDVC Summit

- Exclusive DDVC Slack group

- Discounts to productivity tools

- Database Benchmarking Report

- Virtual & physical meetups

- Masterclasses & videos

- Access to AI Copilots