👋 Hi, I’m Andre and welcome to my newsletter Data Driven VC which is all about becoming a better investor with Data & AI. Join 34,560 thought leaders from VCs like a16z, Accel, Index, Sequoia, and more to understand how startup investing becomes more data-driven, why it matters, and what it means for you.

ICYMI, check out our most read episodes:

Welcome to another edition of our Sunday “Resources” stream where we share our most valuable data & resources across four rotating formats:

Hottest Startups of the Month (last episode with Top 30 in July here)

Top Downloaded Resources from The Lab #1 (last one here with 1513 Angels that invest in startups and/or funds)

State of the Market (this is today!)

Top Downloaded Resources from The Lab #2 (last one here with 59 Pension Funds that invest in alternative asset classes)

For 1. and 3., we collaborate with best-in-class partners to ensure you get the highest quality data.

For 2. and 4., we leverage our ever-growing product portfolio and share selective snapshots of the most sought-after resources from VCSTACK.COM

State of the Market - July 2025

Most data for today’s episode was provided by our partner Multiples.vc, your go-to source for verified M&A valuation multiples and public comps based on analyst estimates, at a fraction of the price of legacy data providers.

We aim to unify market & valuation data into a single episode, so you don’t need to check various sources for a complete picture. Here’s what we’ll cover today:

#1 Markets

Top 10 private market companies + spotlight SpaceX, Tesla & X

State of IPOs: Top 50 candidates + spotlight Figma

State of M&A: Number of transactions, deal volume + spotlight Windsurf with OpenAI vs Alphabet

#2 Multiples

Top 10 vs Top 50 EV/NTM Revenue

EV/NTM Revenue over time and by sector

Efficiency Benchmarks incl. revenue per FTE, Rule of 40 & more

We have a lot on the agenda, so let’s jump in👇

1. Markets

Top 10 Private Market Companies

No change in the top 10 most valued private market companies since last month.

Source: Position.so

Spotlight: Elon’s Universe

Notably, SpaceX is in the middle of a new tender offer that is expected to bump its valuation up from $350 billion in December 2024 to around $400 billion, cementing its position as the most valuable private company right now.

This transaction is being driven by strong secondary market demand for its shares, underpinned by consistent performance in satellite launches, Starlink expansion, and strategic alignment with U.S. government interests. The tender offer allows existing shareholders—particularly employees—to sell a portion of their equity, providing liquidity in lieu of an IPO, which Elon Musk has publicly dismissed as unnecessary for the foreseeable future.

Meanwhile, over at Tesla, there's talk of a different kind of tender-like move. Musk is floating the idea of having Tesla shareholders vote on investing company money into xAI, his new AI startup that just merged with X (formerly Twitter). The valuation for xAI is already up around $113 billion, and Musk wants to pull in funding from across his empire—including Tesla and SpaceX—to supercharge its growth.

That’s raising some eyebrows, with critics saying it's risky and blurs the lines between his companies. But Musk sees it all as part of a bigger plan to tie together AI, cars, rockets, and social media into one mega tech ecosystem.

Top 50 IPO Candidates

From our April 2025 IPO candidate list below, we just saw Figma officially file for its IPO on July 1, 2025, marking a major turning point after its proposed $20 billion acquisition by Adobe was blocked by regulators in late 2023.

Figma’s S-1 reveals strong financials: for Q1 2025, revenue hit $228.2 million—a 46% year-over-year increase—and net income soared to $44.9 million, up from $13.5 million in the same period last year. Full-year 2024 revenue approached $749 million, growing 48%, though net losses totaled roughly $732 million on one-time equity expenses. Figma will list on the NYSE under ticker FIG, with plans to raise up to $1.5 billion, according to Renaissance Capital and other analysts.

Strategically, the IPO enables Figma to pivot from being Adobe’s acquisition target to asserting its independence, while fueling growth through further investment in AI and M&A. The S-1 underscores Figma’s AI-forward roadmap—new offerings include website building tools, AI-assisted coding (Figma Make), and marketing suites—though the company warns that these AI investments may strain efficiency in the near term.

Governance remains founder-centric: co-founder Dylan Field controls around 75% of voting power, ensuring tight oversight as the business scales. With 13 million monthly users and adoption by nearly 95% of Fortune 500 firms, Figma is positioned for a high-profile debut—but faces public-market scrutiny and competitive pressures from Adobe and rising AI-centric rivals.

State of M&A

Even more interesting than public filings is the M&A market these days.

Source: Multiples.vc

We only include M&A transactions with confirmed EVs available at Multiples.vc, thus structurally exclude the long tail noise of smaller EV transactions. With 1728 (vs 1477 in June) disclosed transactions YTD, we’re still behind the same period in 2024, continuing to be the lowest in over a decade.

While we’re at 47% in number of transactions relative to the FY2024, the deal volume is at $1.6T and 62% relative to FY2024 - a clear indication towards fewer but significantly bigger transactions as confirmed by the increase in average deal size close to $938 million.

Source: Multiples.vc

Looking at the largest transactions of the last 30 days, we see the acquisition of Windsurf by Alphabet coming up second.

In June’s episode, I wrote about “A New Breed of M&A: Minority Investments and Acquihires” in light of Scale AI’s acquisition by Meta:

Although formally not an acquisition, the lighthouse deal in the last 30 days was the 49% minority investment by Meta in Scale AI - that informally equates an acquihire as Scale’s founder, Alexandr Wang, is joining Meta to work on Meta’s AI efforts.

Amid increasing global antitrust scrutiny, major tech firms are shifting from traditional acquisitions to minority investments as a strategic workaround. These investments—typically below regulatory thresholds—allow companies to gain access to innovation, influence product direction, and establish preferred relationships with startups without triggering formal merger reviews. Oftentimes, an acquihire and transition of key talents is the consequence.

Only few weeks later, we saw the same playbook applied to AI startup Windsurf—known for its smart IDE and widely adopted among enterprise developers. Initially, OpenAI had planned to acquire Windsurf in a $3 billion deal, but the agreement unraveled following pushback from Microsoft, which holds IP stakes in OpenAI.

Almost immediately after, Google stepped in with a $2.4 billion acquihire deal, securing Windsurf’s CEO Varun Mohan, co-founder Douglas Chen, and key engineers for its DeepMind division. This left the rest of Windsurf’s 250+ employees and its product line in limbo, until Cognition—the team behind the AI coding assistant Devin—acted swiftly, signing a letter of intent on Friday evening and closing the acquisition by Monday morning.

Cognition ultimately acquired Windsurf’s full product suite, brand, intellectual property, enterprise customer base (over 350 clients), and roughly $82 million in ARR, while also guaranteeing financial upside for remaining employees via accelerated equity vesting. CEO Scott Wu of Cognition called the deal a “perfect fit,” citing how Windsurf’s developer tooling complements Devin’s capabilities and vision.

While this chapter seems to be closed for now, the question remains of who’s next in the AI M&A frenzy.

2. Multiples

Compared to last month, multiples are up.

EV / NTM Revenue Multiples

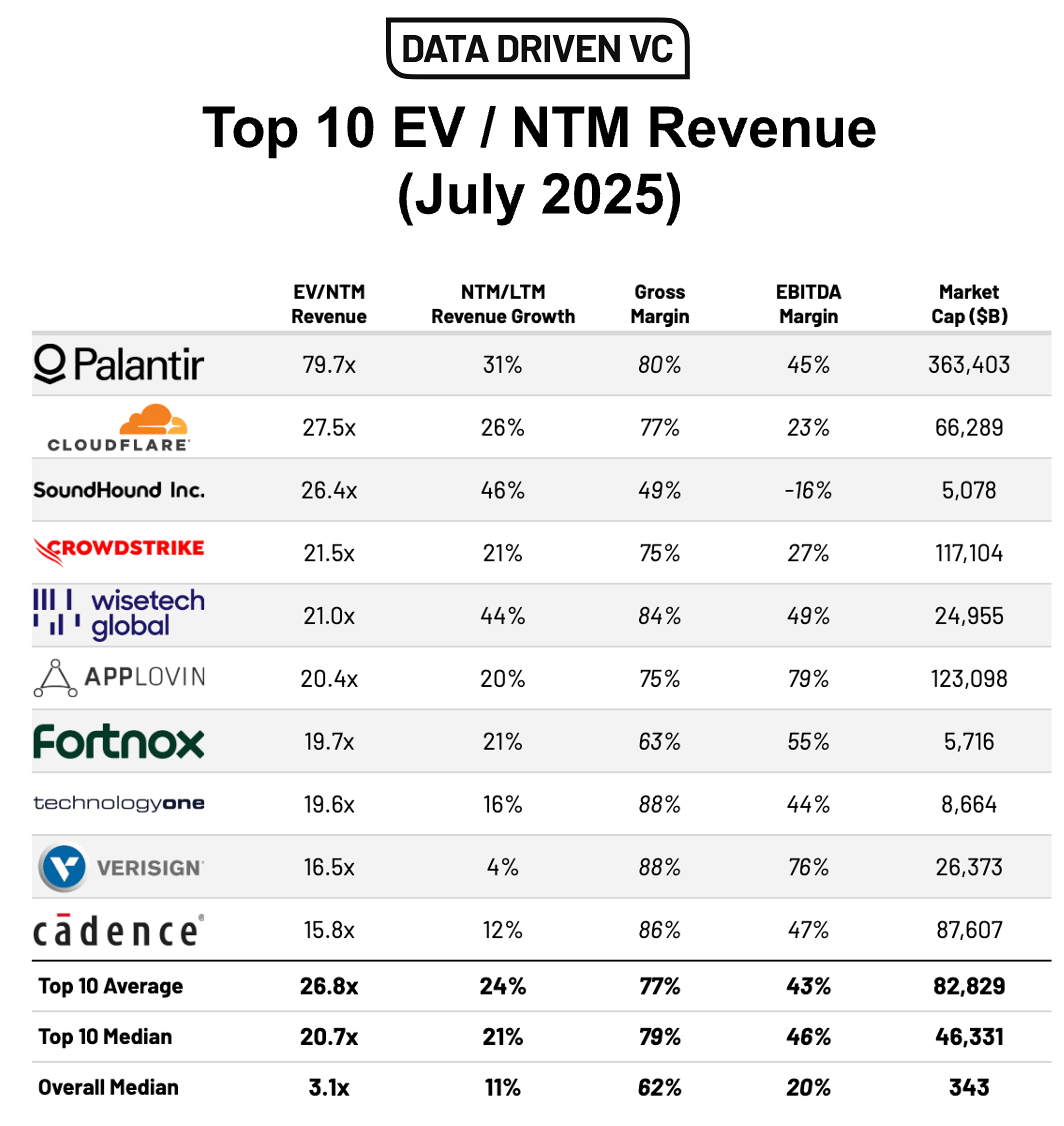

Let’s start with a snapshot of top companies based on EV / NTM Revenue multiples. For all analysis below, we exclude companies with market caps below $1B and non-meaningful multiples above 100x.

Source: Multiples.vc

Top 10 average grew month-over-month from 24.6x to 26.8x and the median increased from 19.8x to 20.7x. Palantir continues to lead the pack with a 80x EV / NTM revenue multiple, likely due to a combination of 31% growth and 80% gross margin.

Source: Multiples.vc

Historic trend line of top 10 median and overall median hits an inflection point where the significant gap starts closing again. While significant capital is concentrated in few outliers at the top, the broad majority has started to surge in valuation multiples.

Source: Multiples.vc

While top 10 average increased to 26.8x, the top 50 average decreased from 14.8x in the previous month to 13.7x EV / NTM revenue, indicating that the bar is very high and the gap between the leaders and the rest already starts somewhere in the top 20.

Below table shows the average and median EV / NTM revenue multiples by sector.

Subscribe to DDVC to read the rest.

Join the Data Driven VC community to get access to this post and other exclusive subscriber-only content.

Join the CommunityA subscription gets you:

- 1 paid weekly newsletter

- Access our archive of 300+ articles

- Annual ticket for the virtual DDVC Summit

- Discounts to productivity tools

- Database Benchmarking Report

- Virtual & physical meetups

- Masterclasses & videos

- Access to AI Copilots