👋 Hi, I’m Andre and welcome to my newsletter Data Driven VC which is all about becoming a better investor with Data & AI. Join 35k+ readers from firms like a16z, Accel, Index, Sequoia, and more.

Brought to you by Harmonic - The Startup Discovery Platform

Harmonic now automatically prioritizes search results.

You describe what you’re looking for in natural language.

Scout — the AI agent made for VCs, then finds the startups that best fit your thesis and ranks them by relevance.

More needles, less hay.

Harmonic is the discovery engine trusted by thousands of investors from firms like 8VC, Insight and HOF Capital.

Welcome back to another INSIGHTS episode, where we cover the most interesting startup research & reports from the past two weeks.

How Fundraising Size Influences Unicorn Odds

Research from the Stanford Graduate School of Business examines how the total amount of capital raised correlates with a startup’s chance of reaching unicorn status. The data shows that larger fundraising totals are directly linked to higher probabilities of becoming a billion-dollar company.

Early Capital, Low Odds: Startups that raise less than $20 million have only a 0.3% chance of becoming unicorns. Those raising between $20-40 million nearly triple their odds to 1.2%.

Growth Stage Boost: Companies raising $40-60 million see their probability rise again to 2.2%, while those raising $60-80 million double that to 4.1%.

Peak Probability Range: The odds peak between $180-200 million raised, where unicorn likelihood reaches 10.1%, before slightly declining beyond $200 million.

✈️ KEY TAKEAWAYS

The more a startup raises, the higher its chance of reaching unicorn status, but the relationship plateaus at very high fundraising levels. The sweet spot appears to be between $180-200 million, where the probability of becoming a unicorn is highest.

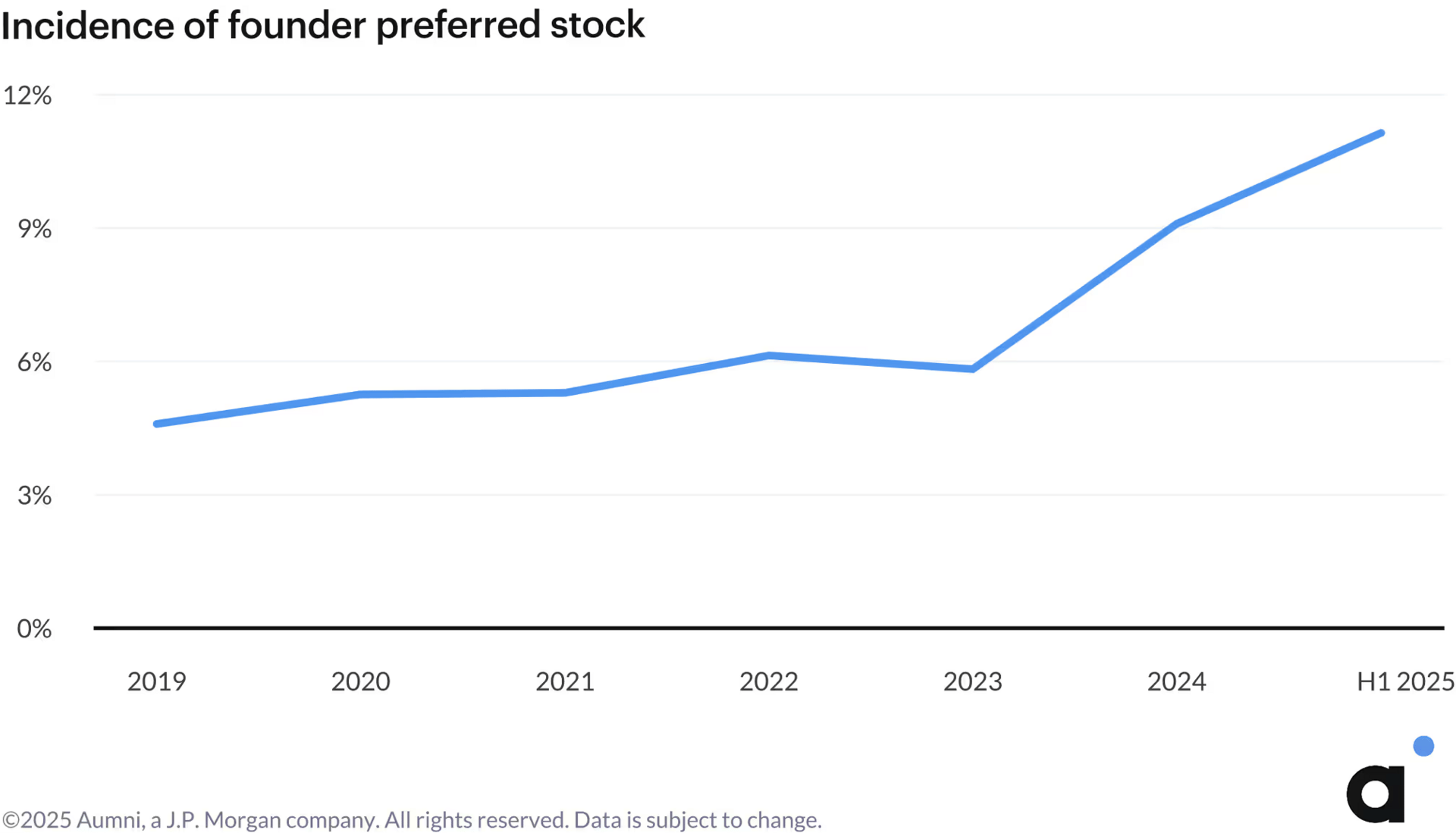

Aumni and Fenwick’s recent webinar analyzed over 80,000 venture transactions to uncover how founder preferred shares are reshaping equity structures. They explore why pref shares for founders have gained momentum, its legal implications, and how it’s influencing investor-founder dynamics.

Adoption Trends: Founder preferred shares appeared in nearly 11% of companies during their priced equity rounds in the first half of 2025. This marks steady growth from 9% in 2024 and 6% in 2023, showing that the structure is becoming more mainstream among startups.

Motives Behind the Shift: Longer exit timelines, more financially savvy founders, and the need for early liquidity are driving adoption. Founders are increasingly using this share class to manage personal financial needs while retaining control and optimizing tax outcomes.

Investor Reactions: VC sentiment remains divided. Some investors worry early liquidity signals misalignment, while others see founder preferred as a practical retention tool when structured transparently with strong legal and tax oversight.

✈️ KEY TAKEAWAYS

Founder preferred shares are re-emerging as a strategic tool for liquidity and alignment in private companies. Their growing adoption highlights founders’ desire for flexibility and tax efficiency, but success depends on clear governance, investor communication, and legal precision.

Upgrade your subscription to access our premium content

LP list with 2500+ contacts

350+ deep dive articles

100+ master classes

Prompt database

AI copilots

& more

Executive Turnover Benchmarks by Role

Pave analyzed data from over 14,000 VPs, SVPs, and CXOs to uncover how frequently executives change roles across functions. The findings reveal sharp contrasts in turnover and tenure depending on whether leaders sit in go-to-market, operations, or product-oriented positions.

GTM Leadership Volatility: Chief Marketing Officers have the highest turnover, with 32% leaving annually, translating to a median tenure of just 1.8 years. CROs and VPs of Sales also show high churn, suggesting consistent movement in revenue-facing roles.

Operational Stability: COOs record the lowest turnover at 18%, implying a median tenure of 3.5 years. Operations and G&A leaders display nearly twice the role stability of their GTM counterparts, highlighting stronger continuity in these functions.

R&D in the Middle: CTOs (17% turnover, 3.73-year median tenure) and CISOs (20%, 3.11 years) are relatively stable, while VPs of Engineering (24%) and Product (26%) experience higher mobility within the tech sector.

✈️ KEY TAKEAWAYS

Executive turnover varies widely by function, with GTM leaders changing roles fastest and operations executives remaining longest. The data underscores how leadership stability, or lack thereof, differs across disciplines, shaping company culture and performance over time.

Illiquidity as Venture Capital’s Hidden Advantage

John Rikhtegar’s analysis spanning 28 years of U.S. equity fund flows reveals how liquidity often undermines investor performance. While public markets see investors buy high and sell low, venture capital’s illiquidity forces discipline, patience, and alignment across market cycles.

Liquidity Fuels Emotion: During major drawdowns like the Dot-Com Bubble and Global Financial Crisis, equity fund flows flipped sharply negative as prices fell. Liquidity offered flexibility but encouraged investors to sell precisely when long-term returns were greatest.

Illiquidity Enforces Patience: Venture’s closed-end model prevents reactionary selling and keeps GPs and LPs focused on value creation over time. Returns compound because capital stays committed, allowing investors to capture upside during recoveries.

Strong Vintages Follow Downturns: Historically, post-crisis vintages (2001-03 and 2009-12) have outperformed, as lower entry prices and reduced competition set the stage for higher returns. Illiquidity transforms discomfort into opportunity.

✈️ KEY TAKEAWAYS

Illiquidity, often viewed as a constraint, is venture capital’s structural advantage. By limiting emotional reactions and enforcing time in the market, it aligns investors with the long-term compounding that liquidity too often disrupts.

Share this article with others who might benefit.

Paid AI Adoption Declines as Market Matures

Ramp’s latest data reveals that paid AI adoption among U.S. companies fell by 0.7% in September, the second drop this year and a much sharper decline than June’s 0.1% dip. Despite high penetration in tech and finance, the overall pace of adoption appears to be slowing as businesses shift focus from exploration to optimization.

Adoption Plateaus in Tech and Finance: About 73% of U.S. tech firms and 58% of finance companies now pay for AI models, platforms, or tools. Tech remains the clear leader, but growth has started to flatten as early adopters consolidate spend and refine their use cases.

Retention and Stickiness Surge: AI products are becoming significantly stickier. Ramp’s data shows annualized retention rising from under 50% in 2022 to around 60% in 2023, with forecasts suggesting it will surpass 80% in 2025.

Enterprise Spend Accelerates: Enterprises are spending more on AI, even amid slower adoption. The average contract value jumped from $143k in 2024 to $530k in 2025 and could reach $1M in 2026, though year-over-year growth is expected to moderate.

✈️ KEY TAKEAWAYS

The AI market is entering a new phase of maturity. While adoption rates plateau, retention and enterprise spending are rising, signaling that companies are moving from experimentation to scaling. The next challenge will be sustaining growth as major AI players face pressure to monetize beyond subscriptions.

The Outsider Advantage in Building Billion-Dollar Companies

Adam Shuaib’s latest analysis of 1,500 unicorn founders challenges one of venture capital’s biggest myths: that industry experience, elite education, or technical expertise are prerequisites for building billion-dollar companies. In reality, most successful founders started as outsiders, not insiders.

Experience Isn’t Everything: Nearly 60% of unicorn founders had no prior experience in the sector they disrupted, and 65% had less than a decade of professional experience before founding. Only 10% had ever worked at another unicorn, showing that unconventional backgrounds often drive exceptional outcomes.

Credentials Don’t Predict Success: Half of all unicorn founders held no postgraduate degree, and just 35% came from technical fields. The majority didn’t have traditional markers of expertise, but leveraged fresh perspectives to challenge incumbents.

Education’s Long Tail

Only 15% of founders came from the top five universities. The other 85% represented a wide range of schools, proving that innovation and scale emerge from diverse educational backgrounds, not just elite institutions.

✈️ KEY TAKEAWAYS

The data reveal that unicorns are rarely built by perfectly credentialed insiders. Instead, they’re driven by founders who see markets differently, question established norms, and turn inexperience into an advantage.

Thanks to Lea Winkler for her help with this post.

Stay driven,

Andre

PS: Check out Harmonic’s sourcing engine here