👋 Hi, I’m Andre and welcome to my newsletter Data Driven VC which is all about becoming a better investor with Data & AI.

Join 45k+ readers from firms like a16z, Accel, Index, Sequoia, and more and get 30% off on all paid plans until New Year’s Eve

Welcome to another edition of our Sunday “Resources” stream where we share our most valuable data & resources across four rotating formats:

For 1. and 3., we collaborate with best-in-class partners to ensure you get the highest quality data. For 2. and 4., we leverage our ever-growing product portfolio and share selective snapshots of the most sought-after resources from The Lab.

At the end of this post, you’ll find a unique deep dive on “how to unify different data sources into a single source of truth and make it accessible with AI” with experts from Dawn Capital, Norwest Venture Partners, and Foresight.

RESOURCES OVERVIEW🛠️

✅ Summarize 50+ newsletters with ChatGPT

✅ Evaluating startups with ChatGPT

✅ VC Co-Pilot for deal sourcing

✅ Top 10 Prompts for startup sourcing

✅ Top 10 Prompts for startup screening & due diligence

✅ Top 10 Prompts for deal winning & closing

✅ List of 312 family offices

✅ List of 59 pension funds

✅ List of 1513 angel investors

✅ List of 997 accelerators

Access these and more resources like our 100+ masterclasses, automation templates, Notion templates, copilots, and more via our Annual and Premium subscriptions to The Lab with 30% discount until New Year’s Eve.

What I read this week🤓

Here’s a summary of the best content that I consumed in the previous week…

Thought-provoking piece about how a generation locked out of traditional wealth creation, by asset inflation, stagnant wages, AI-driven job insecurity, and social-media-amplified status anxiety, is rationally gravitating toward high-variance “casinos” like crypto, prediction markets, sports betting, and guru economies, not out of ignorance but because these arenas offer the last remaining sense of agency and a non-zero chance of escape on a shrinking timeline, making the real winners not the gamblers themselves but the platforms that monetize hope as long as these structural conditions persist.

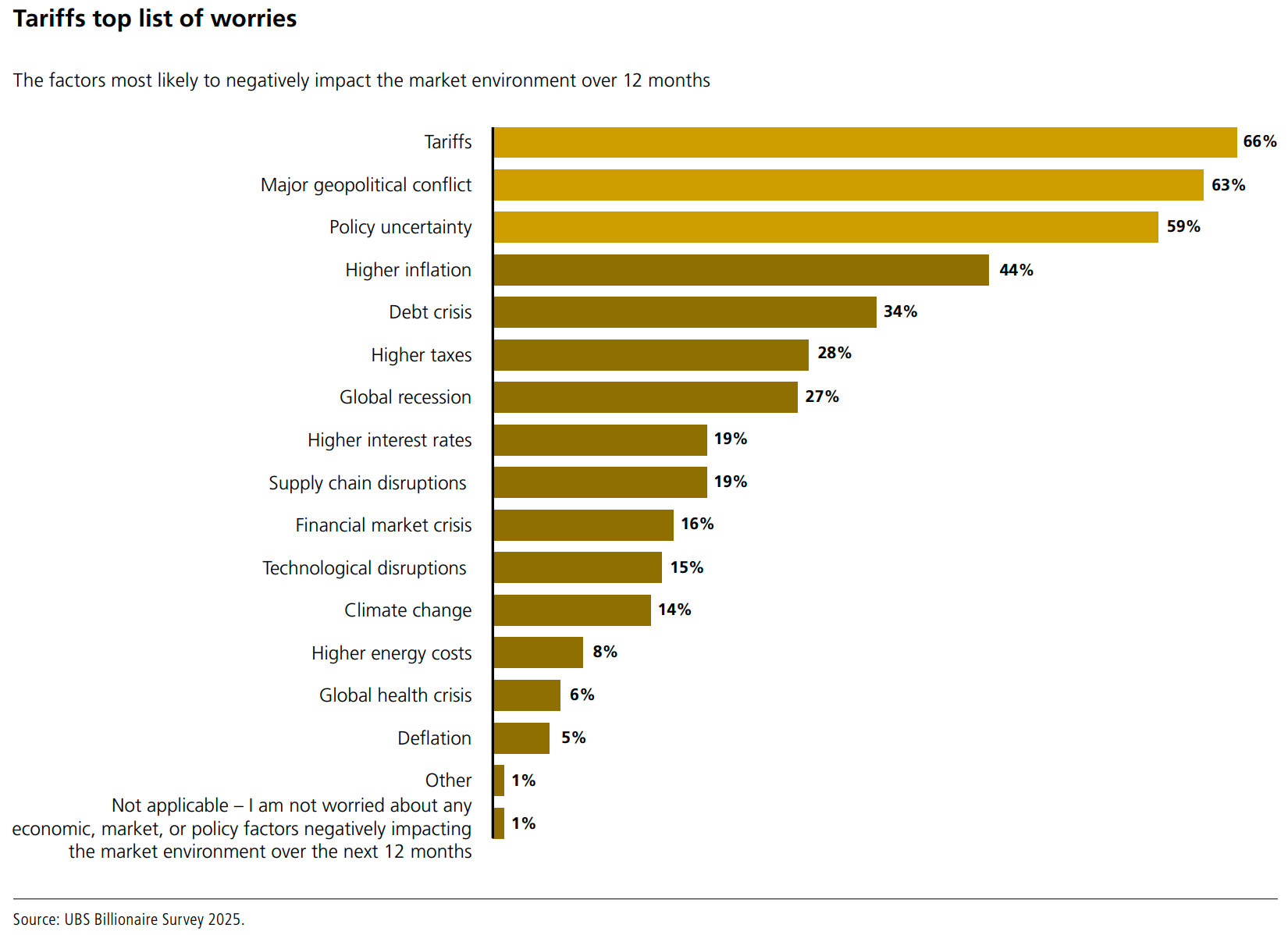

The UBS Billionaire Ambitions Report 2025 finds that global billionaire wealth reached a record USD 15.8 trillion in 2025, driven by entrepreneurial innovation and the largest intergenerational wealth transfer in history, with nearly 3,000 billionaires worldwide and strong gains led by self-made founders in technology, industrials, and financial services. The reports reveals deep insights about their values, worries, aspirations, locations and relocations, family situations, and more.

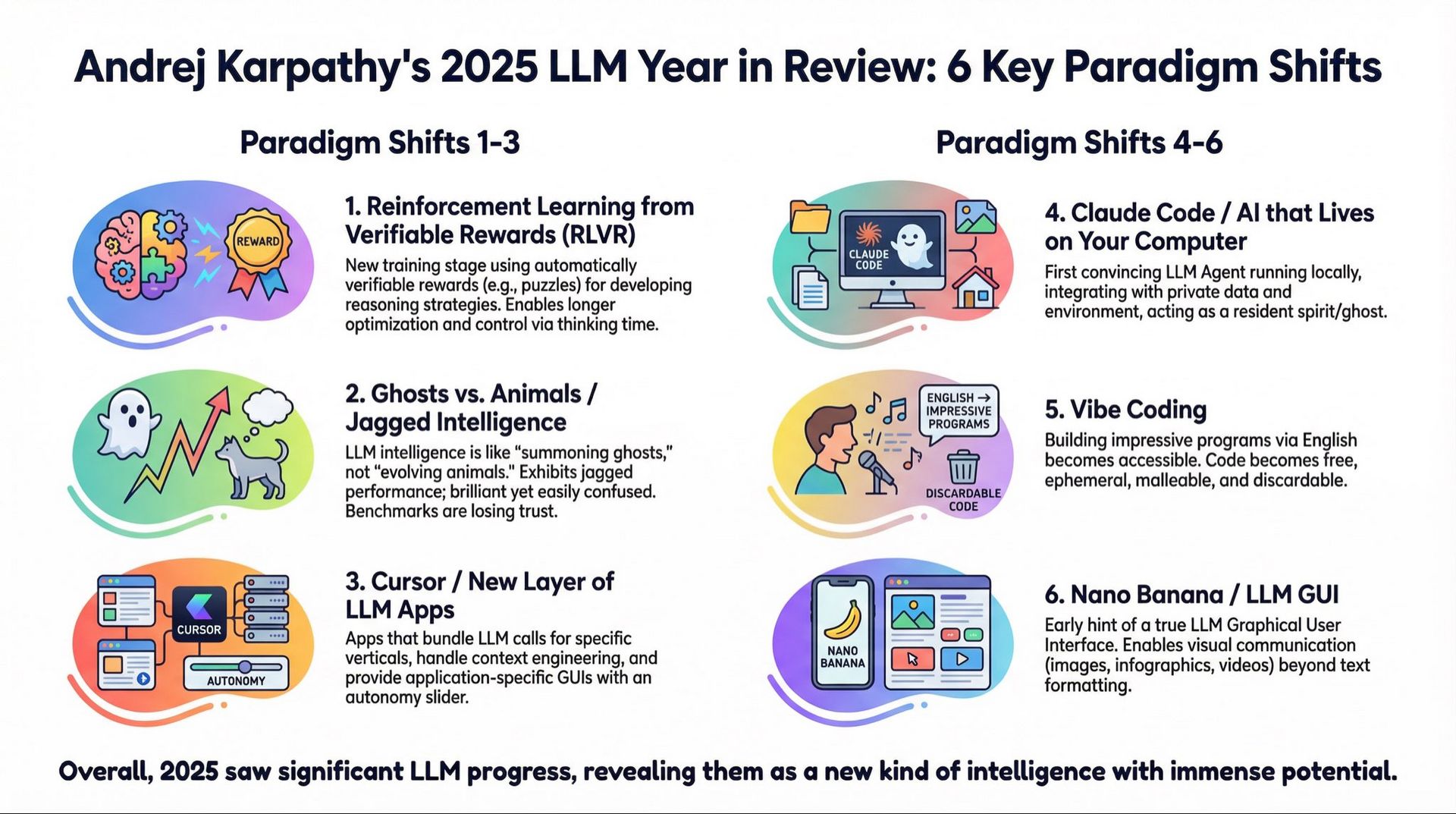

Andrej Karpathy reflects on 2025 as a pivotal year for LLMs, marked by several conceptual paradigm shifts: the rise of Reinforcement Learning from Verifiable Rewards (RLVR) as a new core training stage driving “reasoning-like” behavior and reshaping scaling laws; a clearer understanding of LLMs as fundamentally non-human, jagged “ghost-like” intelligences rather than animal analogues, undermining trust in benchmarks; the emergence of a distinct LLM application layer exemplified by Cursor, which orchestrates models into domain-specific tools; the arrival of local, agentic AI like Claude Code that “lives” on a user’s computer; the normalization of “vibe coding,” where natural language enables anyone to create software cheaply and ephemerally; and early signs of a true LLM GUI through multimodal systems like Gemini Nano Banana, pointing beyond text-based interaction - alltogether suggesting LLMs are a new computing paradigm that is simultaneously more powerful and more limited than expected, with vast unrealized potential and rapid progress still ahead.

Integrating Data Sources and Making Them Accessible with AI

I’m excited to share the recording from one of the most watched recordings in our platform The Lab from a panel with Dawn Capital’s Head of Data & AI Ties Boukema, Norwest Venture Partner’s Head of Data & Eng Amanda Widjaja, and Foresight’s Founder and CEO Jason Miller.

Watch if you want to learn:

Which commercial data providers to rely on for startup sourcing and screening

Which data has become the true moat and how to automatically collect and process it

How LLMs are being used for data extraction from unstructured data to turn it into structured format

How to break data siloes and unify public and private data into a single source of truth

Why and how the buy versus build situation has changed, what leading firms still build and what they buy

The most common AI applications built on top of unified data

… and a lot more

Here’s the link to the full panel discussion👇

Subscribe to our premium content to read the rest.

Become a paying subscriber to get access to this post and other resources from our exclusive Data Driven VC community.

UpgradeA subscription gets you:

- Products like automation templates, prompt libraries, AI copilots

- 100+ masterclasses with experts from leading funds

- Access to our exclusive Slack community

- ... and lots more