👋 Hi, I’m Andre and welcome to my newsletter Data Driven VC which is all about becoming a better investor with Data & AI. Join 34,140 thought leaders from VCs like a16z, Accel, Index, Sequoia, and more to understand how startup investing becomes more data-driven, why it matters, and what it means for you.

ICYMI, check out our most read episodes:

Brought to you by Affinity – Strategies of Top European Dealmakers

How do Europe's top VC firms maintain their edge in an increasingly competitive market? Affinity's 2025 European venture capital benchmark report analyzes data from over 640 firms to reveal the strategic differences in dealmaking approaches, network engagement, and portfolio support that separate market leaders from their peers. Read now to benchmark your firm against Europe's top firms.

The Impact of AI on the Cost of Starting and Running a Business

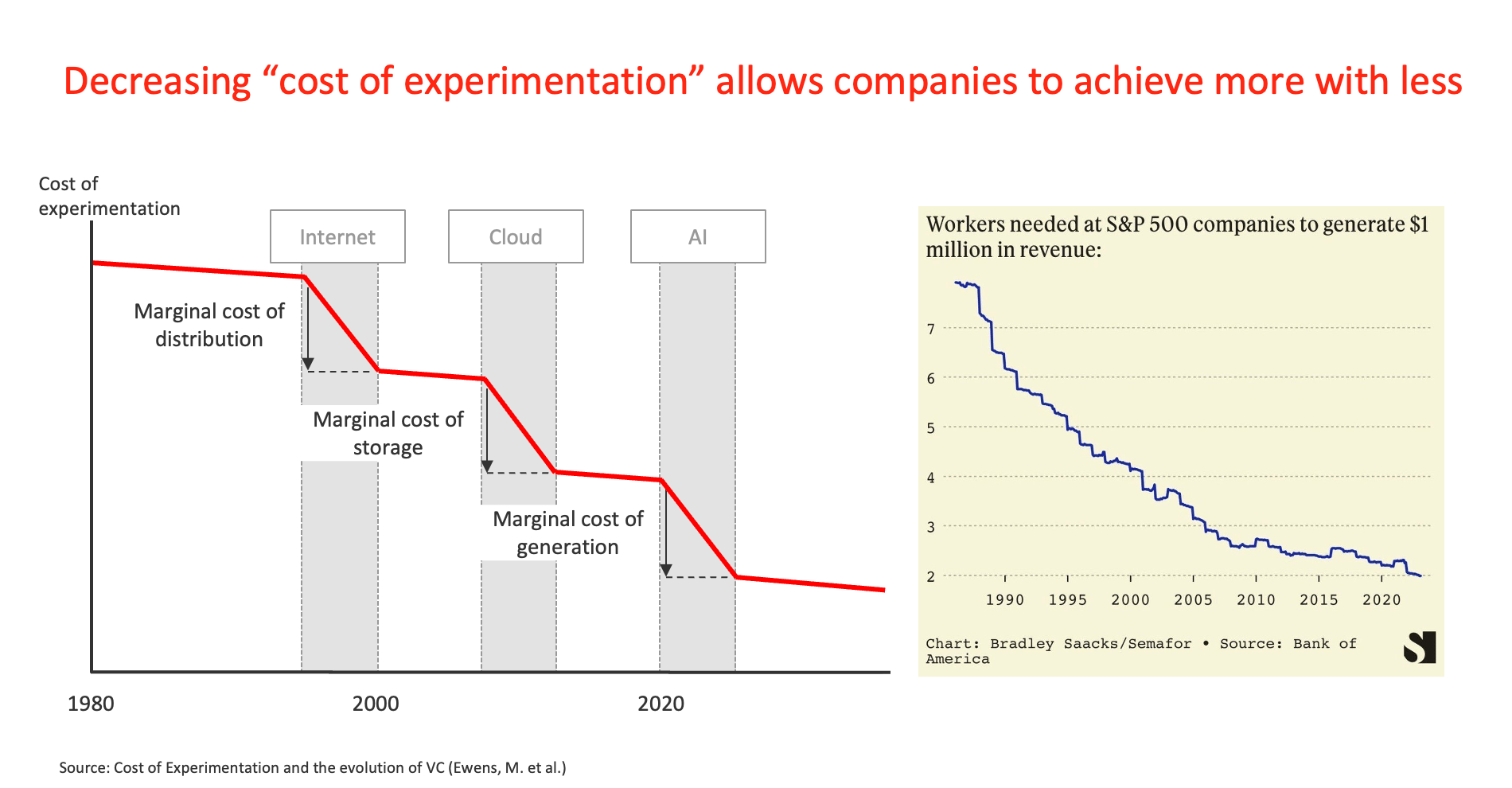

In early 2023, shortly after the launch of ChatGPT, I wrote a piece about “The impact of AI on the cost of starting and running a business”. When brainstorming the potential impact of AI on startups back then, I recalled a 2018 study about “the cost of experimentation”:

The introduction of cloud computing services by Amazon is seen by many practitioners as a defining moment that dramatically lowered the initial cost of starting Internet and web-based startups. (..) We show that subsequent to the shock, startups founded in sectors benefiting most from the introduction of AWS raised significantly smaller amounts in their first round of VC financing. (Ewens, Nanda, and Rhodes-Kropf, 2018)

Rereading the paper, it left me thinking “Will AI be the next cloud-moment? Will it have the same impact”. My answer was a clear yes & yes. I expected the impact of AI to be structurally in line with the introduction of cloud, mobile, the internet, and other disruptive technologies - but likely in more extreme magnitude.

The primary effect that AWS had was on the initial fundraising by startups rather than on the cost of running the business at scale — effectively allowing startups to shift their large capital investments to later stages when uncertainty had been resolved. (Ewens, Nanda, and Rhodes-Kropf, 2018)

In line with the paper, I also expected the impact of AI on businesses to be primarily in the earliest stages of their evolution. Here’s my take from early 2023:

Effectively, the question is whether the number of milestones to be achieved with a fixed amount of capital will increase (=more runway) or whether the resources required to achieve a fixed milestone will decrease (=smaller rounds).

Intuitively, I’d say that Pre-Seed and Seed round sizes are likely to decrease as more capital does not necessarily increase the chances of achieving product-market fit. This would also mean that funds dedicated to these stages would eventually become smaller.

In line with my arguments above, I expect a different dynamic for the growth stages where it’s a lot about excellence and execution. For Series A+, it’s likely that round and fund sizes will stay unchanged. I’d expect that companies will either grow more profitably and extend their runway or parallelize activities to dominate the market even more aggressively.

In short, Pre-Seeds and Seeds get smaller as companies become leaner early on and time to milestones like $1M ARR or $100M ARR compresses.

Fast forward to today, only 2 years later, we see exactly this happening. Bootstrapped companies reaching the magical $1M ARR product-market fit (PMF) milestone in no time. Growing to $5M? Easy.

It seems that dozens and dozens of new companies are born in days and reach PMF with ease. Oftentimes no VC money needed. At least for the beginning.

Just this week, we witnessed the staggering news of a solopreneur selling his AI-enabled product Base44 to Wix for $80M just six months after inception.

The Impact of Vibe-Coding & AI on Venture Capital as an Asset Class

This prompts a fundamental question: What does this mean for venture capital as an asset class? Here’s my take:

Subscribe to our premium content to read the rest.

Become a paying subscriber to get access to this post and other resources from the exclusive Data Driven VC community.

UpgradeA subscription gets you:

- Lists of 312 Family Offices + 59 Pension funds + 1513 angels

- Annual ticket for the virtual DDVC Summit

- Access our archive of 300+ articles

- 1 new premium article per week

- Virtual & physical meetups

- Masterclasses & videos

- Access to AI Copilots

- Prompt Database

- ... and lots more