💥The First Sales Hire: Avoiding Pitfalls, Benchmarks & When to Make a Change

Playbook with Do's and Don'ts

👋 Hi, I’m Andre and welcome to my newsletter Data Driven VC which is all about becoming a better investor with Data & AI. Join 34,890 thought leaders from VCs like a16z, Accel, Index, Sequoia, and more to understand how startup investing becomes more data-driven, why it matters, and what it means for you.

ICYMI, check out our most read episodes:

Learn how top founders build and scale AI companies on autopilot! I’m working on a new project to uncover how next-gen founders ship faster and win with new AI tools, agents, and automation. Here’s what to expect:

✅ Interviews with top founders & operators — deep dives into the tactics, tools, and systems that power winning AI companies.

✅ Customer acquisition playbooks — from community-led growth to organic content, standout branding, paid campaigns, and partnerships.

✅ Pricing & monetization strategies — learn what works (and what doesn’t) to grow viral without churn.

Introduction

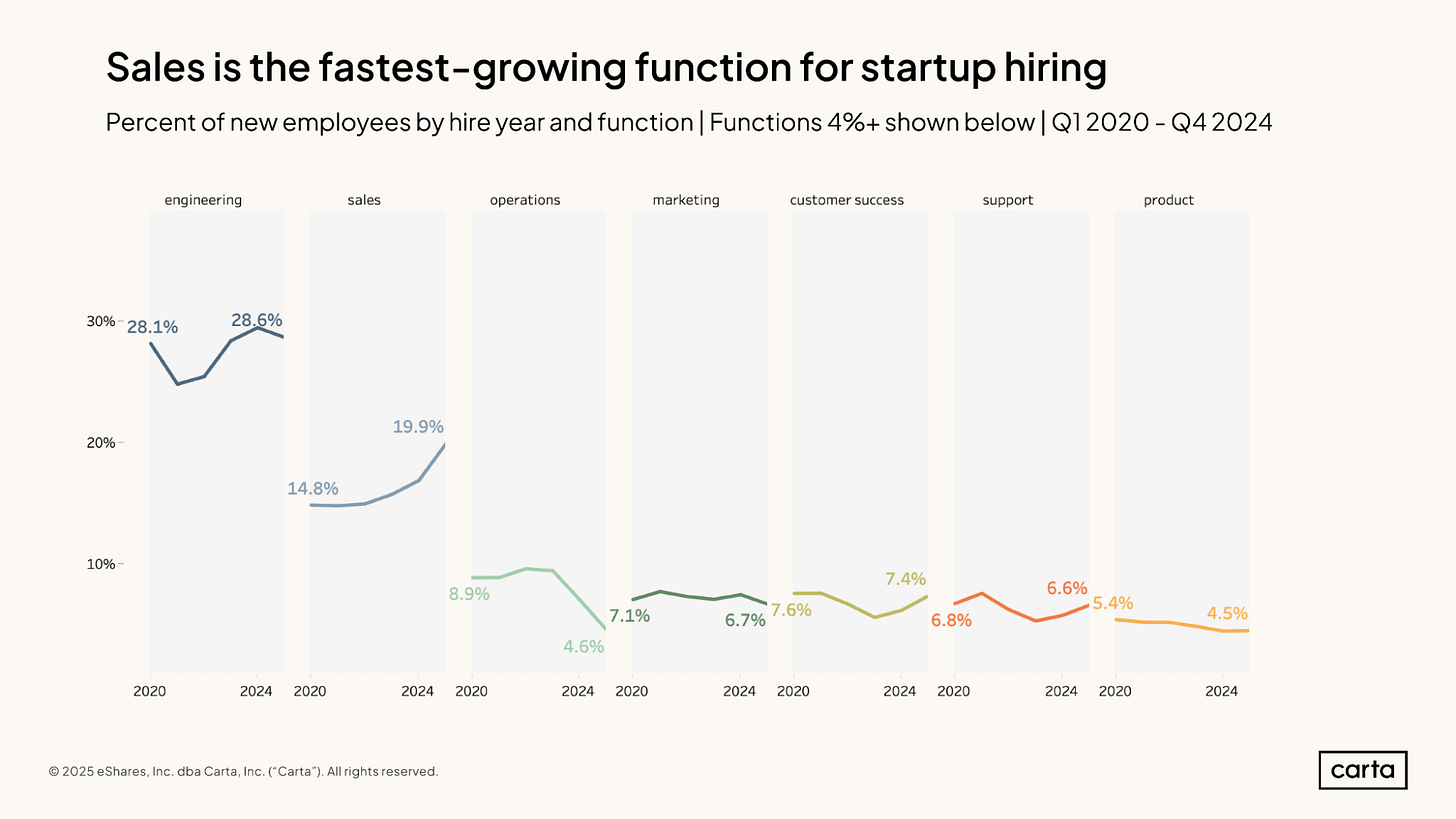

The first sales hire can be make or break for any startup. Get it right and you lay the foundation for revenue growth; get it wrong and you risk months of lost momentum and costly turnover. Unfortunately, many venture-backed startups in their seed to Series A phase stumble here. Studies show the average sales rep’s tenure is only around 18 months (Xactly, 2022), and for startup sales leaders it’s often even shorter. One analysis found the first VP of Sales frequently churns in under a year (OpenView Partners, 2021).

Why is this role so difficult to get right?

In today’s deep dive, we’ll explore common failure modes (and early warning signs) for a startup’s first sales hire, share industry benchmarks on tenure and compensation, and provide a practical checklist for founders deciding whether to replace their first sales hire.

Let’s dive in! 👇

✅ TL;DR (5 Key Takeaways)

Timing is everything: Hiring too early - before PMF or a repeatable sales motion exists - almost guarantees failure. Founders should close the first 10–25 customers themselves and document learnings before handing sales to a new hire.

Profile matters more than pedigree: Big-company VPs or Rolodex hires rarely thrive in early-stage chaos. The ideal first hire is a scrappy, “full-stack” salesperson who can prospect, close, and build process under ambiguity - grit and adaptability beat flashy resumes.

Founder involvement is critical: A founder checking out of sales too soon is a red flag. Early success requires ongoing founder support, joint selling, and careful diagnosis of whether missed deals are due to people, product, or process.

Onboarding and structure drive success: Dropping a rep into chaos without ICPs, playbooks, or onboarding is a silent killer. Clear role expectations, activity-based milestones, and a 50/50 comp split with ~1% equity help set the right foundation.

Know when to cut losses: If after 3–6 months there’s no pipeline momentum, consistent missed targets, or poor cultural fit, it’s usually time to replace. Prolonging a bad hire quickly costs hundreds of thousands in lost time and missed revenue.

Why First Sales Hires Often Fail (and Early Warning Signs)

Hiring too early – before you’re ready – is a top culprit.

Many founders, eager to offload the awkward work of selling, bring in a salesperson prematurely (Firstround Capital, 2023). If you haven’t yet validated that customers truly want your product and established a repeatable sales motion, a new rep will be set up to fail. As one VC observed, hiring a salesperson “in the first five customers” is risky – you likely haven’t deeply validated the problem or buyer yet (Firstround Capital, 2023).

Early warning sign: The sales hire struggles to close deals that the founders were able to win. This often means the product or process wasn’t ready, not necessarily that the person is a bad seller. Founders sometimes misdiagnose this as a “people problem” when it’s actually a product/market fit or process problem (Evans, 2025). Before blaming (or firing) the new rep, check whether you’ve handed them a workable playbook or just chaos.

Hiring the wrong profile is another frequent failure mode. A common mistake is overshooting on seniority – e.g. recruiting a big-company VP Sales with 20 years experience because they have a flashy resume (Firstround Capital, 2023). In practice, early-stage sales is gritty, hands-on work. Those coming from large orgs with armies of support often struggle to “do their own button-clicking” in a startup (Firstround Capital, 2023).

On the flip side, hiring someone too green can be “the blind leading the blind” if neither the founder nor the hire knows how to build a sales process (SaaStr, 2022). Early warning sign: Your new rep keeps asking for resources a big company would have (lead lists, marketing collateral, sales engineers) and seems paralyzed without them.

If they aren’t proactively generating pipeline and experimenting with scrappy tactics, that’s a red flag (Firstround Capital, 2023). As one experienced founder put it, “hiring late-stage, coin-operated people almost never works for early stage” – you need a resourceful hustler over a rigid playbook follower.

Expectation misalignment between founders and the first hire is almost guaranteed. Founders are used to selling with massive advantages – personal passion, product knowledge, and the CEO title that opens doors (Evans, 2025). A new sales hire gets none of those advantages. Yet many founders still expect the newbie to replicate the founder’s win rate or magically “figure out sales.”

This is a setup for disappointment. A related early warning sign is if the hire and founder start pointing fingers at each other. For example, the rep might blame the product or lack of leads, while the founder blames the rep’s technique, indicating a gap in understanding what’s really causing missed deals.

Open communication is critical here: Founders should obsess over the sales process enough to discern whether it’s a people issue or a process issue (Evans, 2025). If you, as CEO aren’t close enough to sales to tell, that itself is a sign of trouble.

Founders “jumping the gun” and checking out of sales entirely is a fatal mistake. If your primary motive for hiring a salesperson is “to get myself out of sales,” pause right there (Evans, 2025). Completely handing off all sales duties at seed stage is often premature – and investors warn it’s a bad sign. As one startup advisor bluntly writes, “If your motivation for hiring a salesperson is to remove yourself from customer acquisition, you don’t deserve to have a business.” That may be extreme, but the core message is valid: a founder who abdicates sales too early both fails to support the new hire and loses touch with the market.

Early warning sign: The founder steps back and provides no guidance or involvement in deals, and the pipeline dries up. It’s no coincidence that many of the best startups still involve founders in sales well into the early years – for example, one enterprise startup didn’t close a single deal without founder involvement for five years (Firstround Capital, 2023). A founder completely “checking out” in quarter one of a new rep’s tenure is usually a recipe for that rep to flame out.

Poor onboarding and processes are silent killers. Even a talented first sales hire can fail if you drop them into chaos. A classic scenario: The founder hasn’t documented any sales learnings from the first few customers – no ideal customer profile, no common objections or trial plan – and expects the hire to create it all from scratch (Morris, 2022).

Mike Molinet, the founder of Branch who learned this the hard way, admits he once gave a new VP Sales “100 things to figure out” – from CRM setup to defining the ICP to building a team – which no single person could succeed at (Firstround Capital, 2023). The result was failure.

Early warning signs of this issue include the new rep asking basic questions constantly (indicating nothing was documented) or them focusing on internal tasks over customer calls. If three months in they still “feel in the dark” about how past deals were won, that points to an onboarding failure on the company’s side (Firstround Capital, 2023).

The fix is to equip them with playbooks and contextfrom founder-led sales. As Figma’s first salesman advised founders: at least jot down notes on how you closed your last 5 deals – “they don’t have to be perfect,” but give your hire some starting roadmap (Firstround Capital, 2023).

Finally, consider cultural and motivational mismatches. Early startup sales is an emotional rollercoaster requiring resilience, creativity, and belief in the product mission. You want a “missionary, not a mercenary” in that seat (Firstround Capital, 2023).

Warning sign: The hire seems primarily motivated by cash and talks more about the OTE and commission structure than the vision. Recruiters caution that a candidate “only motivated by a high cash comp” is a huge red flag for a founding sales role (Primary Capital, 2025).

If your first sales hire isn’t emotionally invested in the problem you solve, they may not push through the tough early days of ambiguous product-market fit. On the other hand, a true believer will exhibit curiosity and proactively gather customer feedback rather than just chasing quick deals (Poyar, 2022).

✈️ KEY INSIGHTS

Most first sales hires fail because they’re brought in before product–market fit or a repeatable sales motion exists.

Early warning signs include: a rep struggling to close deals founders could, reliance on big-company resources, lack of scrappy pipeline generation, or the founder checking out of sales too soon.

To avoid failure, founders should document learnings from the first 5–10 customers, stay actively involved in sales, and hire for grit and mission-alignment over flashy resumes or comp-driven motivation.

When and Who to Hire: Getting the Timing and Profile Right

Choose the right moment to make that first sales hire. Instead of following a rigid ARR or timing rule, look for key signals that you’re ready to scale beyond founder-led selling. One rule of thumb from early-stage experts: Wait until you have on the order of 10–25 paying customers (who aren’t just friends of the founder) as proof that a market exists.

You should also have a repeatable (if imperfect) sales process emerging, not just one-off heroic deals. Have you identified a target customer profile and started to outline a consistent sales playbook? If you “can’t clearly articulate how your last five deals got done, you’re not ready for a sales hire,” warns Molinet (Firstround Capital, 2023).

In short, nail down the ingredients of your sales recipe before hiring, even if the recipe isn’t fully baked. Founders should ideally close a good chunk of initial deals themselves to learn what works and document it. Only then will a new hire have a fighting chance.

On the flip side, don’t wait too long and become a bottleneck – if you’re regularly seeing hot leads “fall on the floor” because you’re too busy to follow up, that’s a strong signal it’s time to bring in help (Firstround Capital, 2023). The sweet spot is when you have more inbound or qualified opportunities than you personally can handle, and a new salesperson could step in to capture that excess demand.

Hire for stage-specific skills and attitude, not just a resume. The ideal first sales hire at a pre-seed/Seed/Series A startup is often a “full-stack” salesperson – a jack-of-all-trades who can prospect, sell, and even help shape go-to-market strategy. In practice, this means they will wear many hats: One day doing cold outreach like a BDR, the next day demoing the product like a sales engineer, and later tweaking pitch decks like a marketer.

As SaaStr’s Jason Lemkin says, your founder may expect you to be “an SDR, a demand gen person, a cold caller, a product marketer, an opener and a closer” all at once (SaaStr, 2022). Therefore, when evaluating candidates, prioritize those with early-stage experience and hustle over those from big-name companies with narrow roles.

Look for evidence that the person has thrived in unstructured environments. One hiring manager’s tip: Ask candidates if they’ve been in a situation with no formal resources and how they succeeded (Primary Capital, 2025). If they only come from environments with BDR teams feeding them leads and well-oiled processes, they might not adapt well to a seed-stage grind. Domain expertise can be helpful but comes second to “motion” expertise (Poyar, 2022).

For instance, if you’re a product-led growth SaaS, someone who has navigated PLG sales motions before will ramp faster than a purely enterprise sales veteran, even if the domain is different (Firstround Capital, 2023). A strong candidate might not have the most impressive title, but perhaps they were a “founding AE” at a startup that grew or a scrappy seller who routinely beat targets with creative tactics.

Don’t over-index on the “Rolodex” factor. Early-stage founders often get enamored with candidates who claim to have a book of contacts in their industry. But hiring someone primarily for their Rolodex is “the lowest thing on the list” you should focus on, warns VP of Growth at Sama, Jacquelyn Goldberg (Firstround Capital, 2023).

At seed stage, there’s no guarantee those contacts will buy an unproven product – and if you pivot your ICP, that Rolodex becomes irrelevant (Poyar, 2022). It’s far more important that your first sales hire is adept at building pipeline from scratch and comfortable with the ambiguity of your go-to-market strategy. A useful heuristic from Stripe’s early team: Consider candidates who may have been “second or third place” at a high-growth startup rather than the top rep at an easy winner (Firstround Capital, 2023).

The theory is that someone who hustled at a tougher sell (or a #2 player in a space) likely had to develop grit and resourcefulness, whereas a salesperson riding a hot product might not have faced as much adversity. The ability to persevere through “no’s” and iterate the sales approach is pure gold in a first hire.

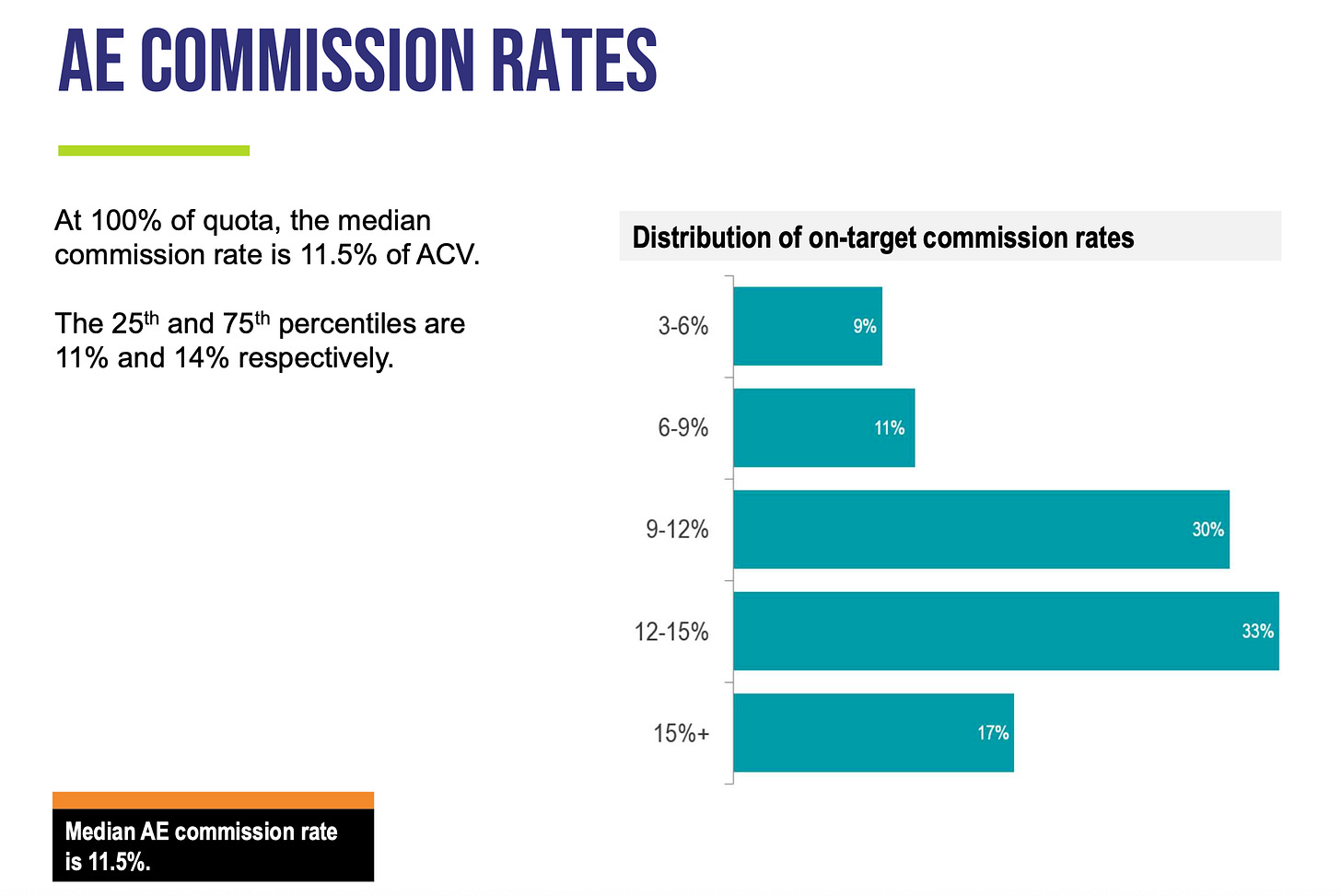

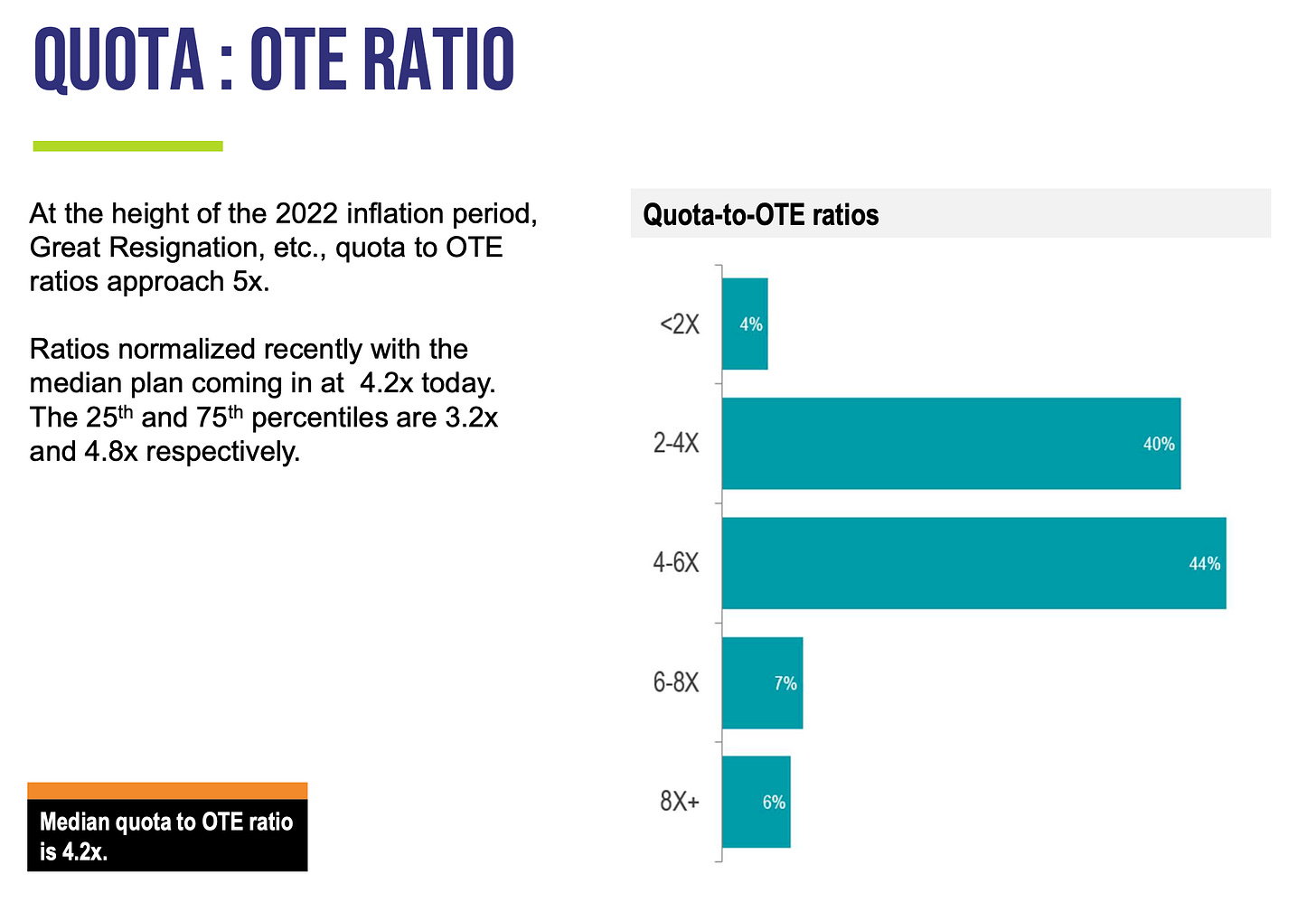

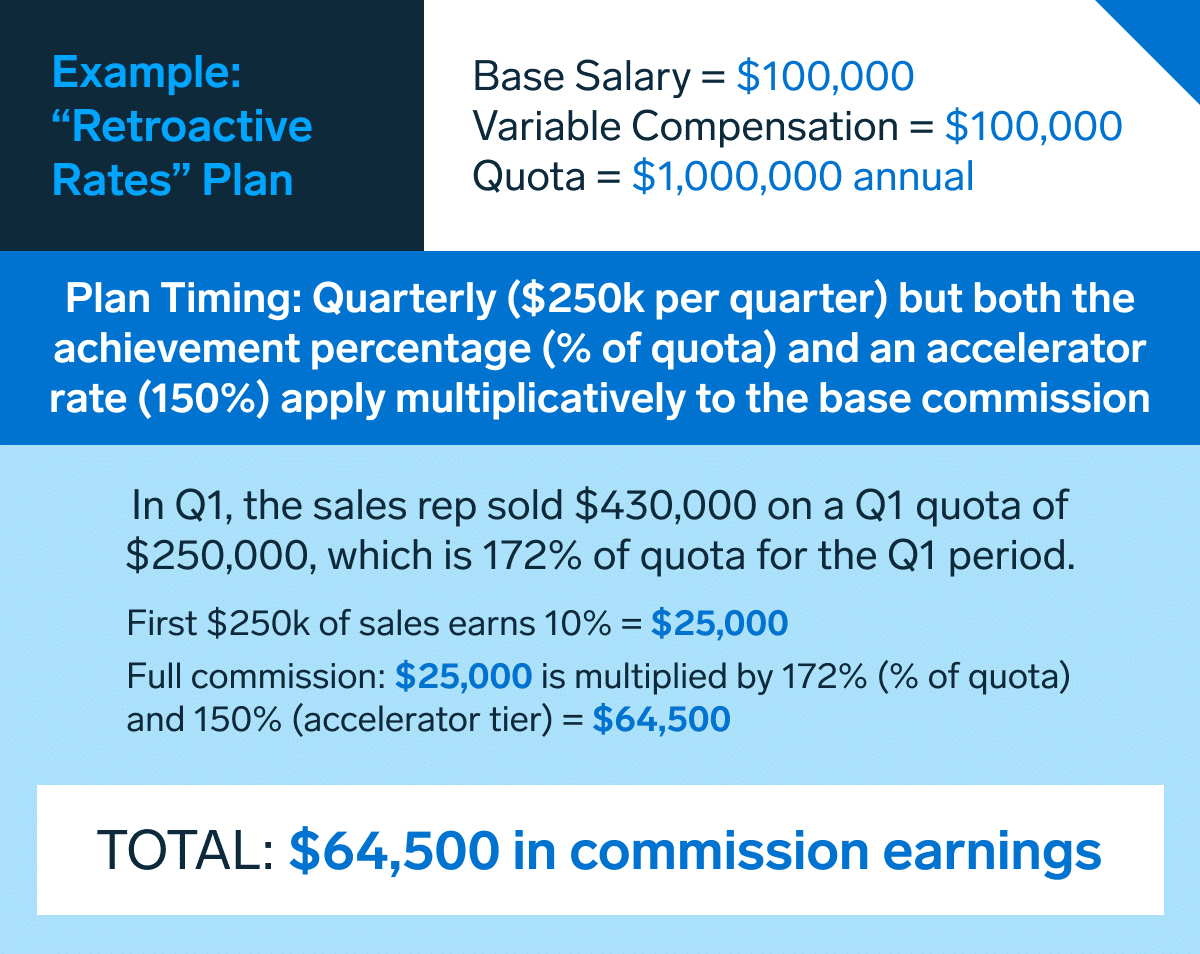

Craft incentives and role structure to fit an early-stage company. Compensation for a first sales hire will typically include a mix of cash and equity, but it should be structured to motivate the right behaviors in a high-ambiguity environment. Industry benchmarks suggest that startups usually offer a 50/50 split between base salary and commission (OTE) for sales roles (Battery Ventures, 2025).

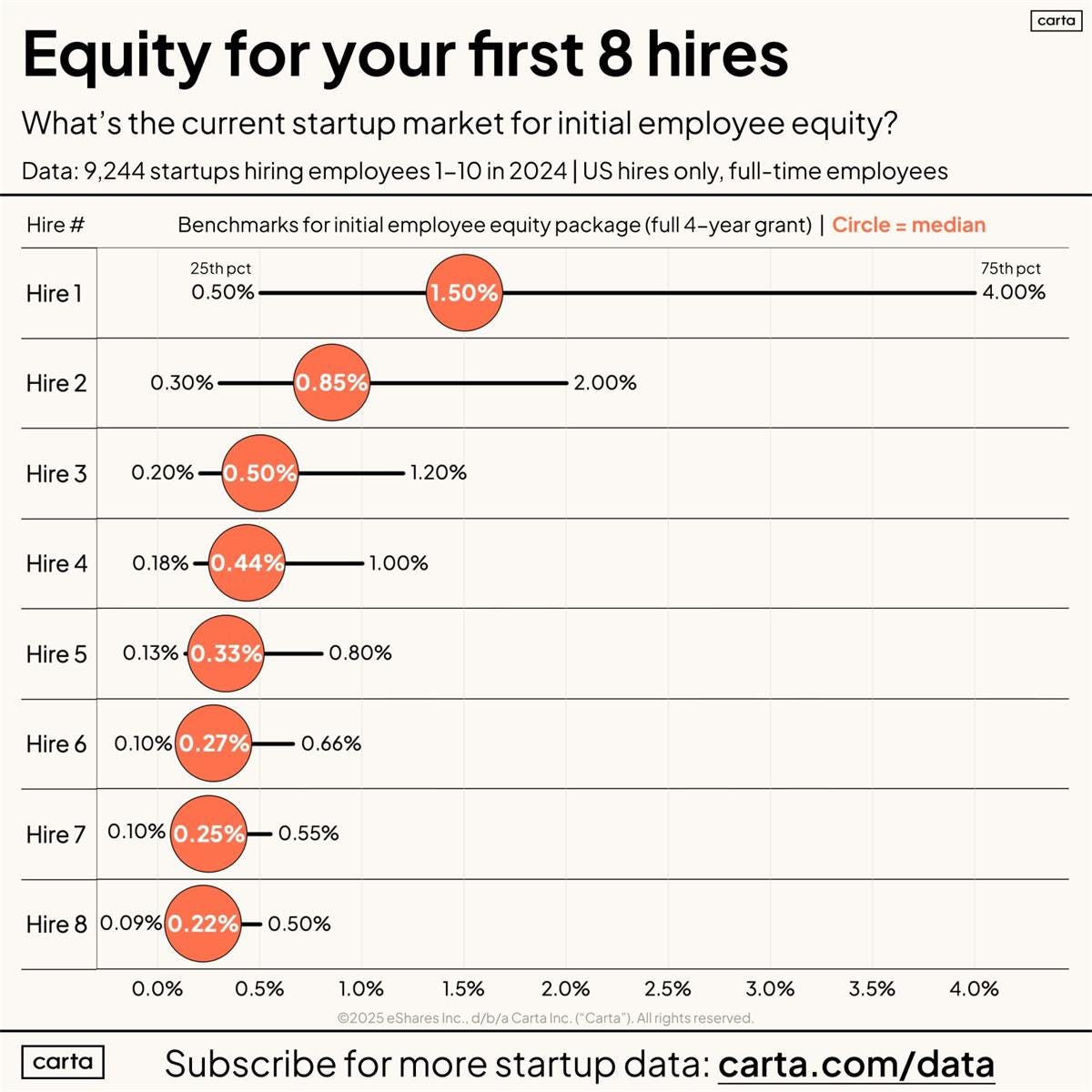

For example, a package might be a $70K base with $70K variable commission at target (i.e. $140K OTE) for an early AE, ensuring the hire has upside but also some stability while ramping. Many startups also provide an equity grant to align the hire with long-term success. Carta’s data shows that the median equity grant for the first non-founder hire is about 1.5% of the company (Carta, 2025).

This can be higher or lower depending on the person’s seniority and the company’s stage. A very seasoned “player-coach” Head of Sales might command up to ~2%+ equity with a title like Director/VP (Primary Capital, 2025), whereas a more junior AE might be under 1%. Creative comp structures are often used to set the first hire up for success. For instance, some product-led startups initially forego strict revenue quotas and instead set activity-based milestones (like “number of customer conversations” or “successful onboardings”) for the first few months (Poyar, 2022).

This gives the new rep time to learn and doesn’t punish them for early uncertainties in pricing or positioning. It’s also common to build in accelerators for above-target performance and even a longer ramp period. Remember, you’re asking this person to both sell and build a repeatable process. Make sure to discuss and document the role expectations clearly: Is this person expected to purely sell as an individual contributor (a “founding AE”), or are they also supposed to create playbooks and eventually hire/team-build (a “Head of Sales” role)?

Many startups opt for a middle ground: Hire a player-coach who can close deals now and grow into a leadership role later. Just be wary of giving a lofty VP title too early; title inflation can backfire if the person isn’t actually operating at a VP level (Cosmic Partners, 2024). It’s often better to bring them in with a director or senior manager title with the understanding they’ll wear multiple hats, and promote them once they’ve proven a scalable model.

Finally, emphasize mission and cultural fit. You want someone who genuinely believes in your product’s value and is hungry to pioneer something new. Early sales hires who succeed often act like extensions of the founding team. They exhibit high ownership, curiosity, and don’t give up easily. During interviews, probe for these traits: Did they voluntarily learn about your industry? Do they ask thoughtful questions about your roadmap? Are they okay with rolling up their sleeves on tasks outside a normal “sales” job description?

As Kyle Parrish (the first salesperson at Figma) noted, you should seek “missionaries” who care about the vision and want equity, not mercenaries just chasing a quota. If you find a candidate who is excited by the challenge of building a sales machine from zero (even if they weren’t a mega-star at a big firm), that mindset is worth its weight in gold at this stage.

✈️ KEY INSIGHTS

The best moment to hire is when you’ve closed ~10–25 paying customers, can clearly explain how those deals happened, and are dropping qualified leads because founder bandwidth is maxed.

The right profile is a “full-stack” hustler who can prospect, sell, and build GTM processes, not a big-company VP or Rolodex hire. Compensation typically lands around $140K OTE with a 50/50 base/commission split plus ~1–2% equity, with early milestones often tied to activity and learning rather than strict quotas.

The Replacement Checklist: When to Consider Letting Your First Sales Hire Go

Even with best efforts, not every first sales hire will work out. The reality is that venture-backed startups often must replace their initial sales hire or VP – it’s so common that one survey found most startups go through multiple sales leaders in the early years (Openview Partners, 2021). As a founder, how do you know when it’s time to cut bait versus coach and give it more time? Below is a checklist of criteria and warning signs to guide your decision on replacing your first sales hire:

No Meaningful Progress After a Reasonable Ramp: Generally, you should allow a ramp-up period (often ~3-6 months for an AE). But by the end of that time, you should see leading indicators of progress – pipeline generation, at least a few deals closed or near closing, and an improving win rate. If after ~6 months your first sales hire has zero or only token sales to show, and more importantly, no growing pipeline, it’s a strong signal the fit isn’t right (Xactly, 2022). Make sure to benchmark against your sales cycle length – e.g., in enterprise, it may take 6+ months to close a deal, but you should still see pipeline build and positive momentum. If instead you see excuses and a persistently empty pipeline, time to rethink the hire.

Ramp time benchmark for AEs in SaaS companies (Bridge Group, 2024) Consistent Missed Targets & Lack of Improvement: Early on, you might set modest targets (or even none in the first quarter). But once targets or OKRs are in place, missing them quarter after quarter is unacceptable if the reasons don’t markedly improve. Maybe they miss in Q1, but you identify issues and give feedback – by Q2, you expect better results or at least a plan that’s working. If the salesperson keeps missing quota with no clear learning curve, you likely have a mismatch. One VC noted that in high-pressure tech sales, even missing a couple of quarters can put a VP on the chopping block (Richards, 2025).

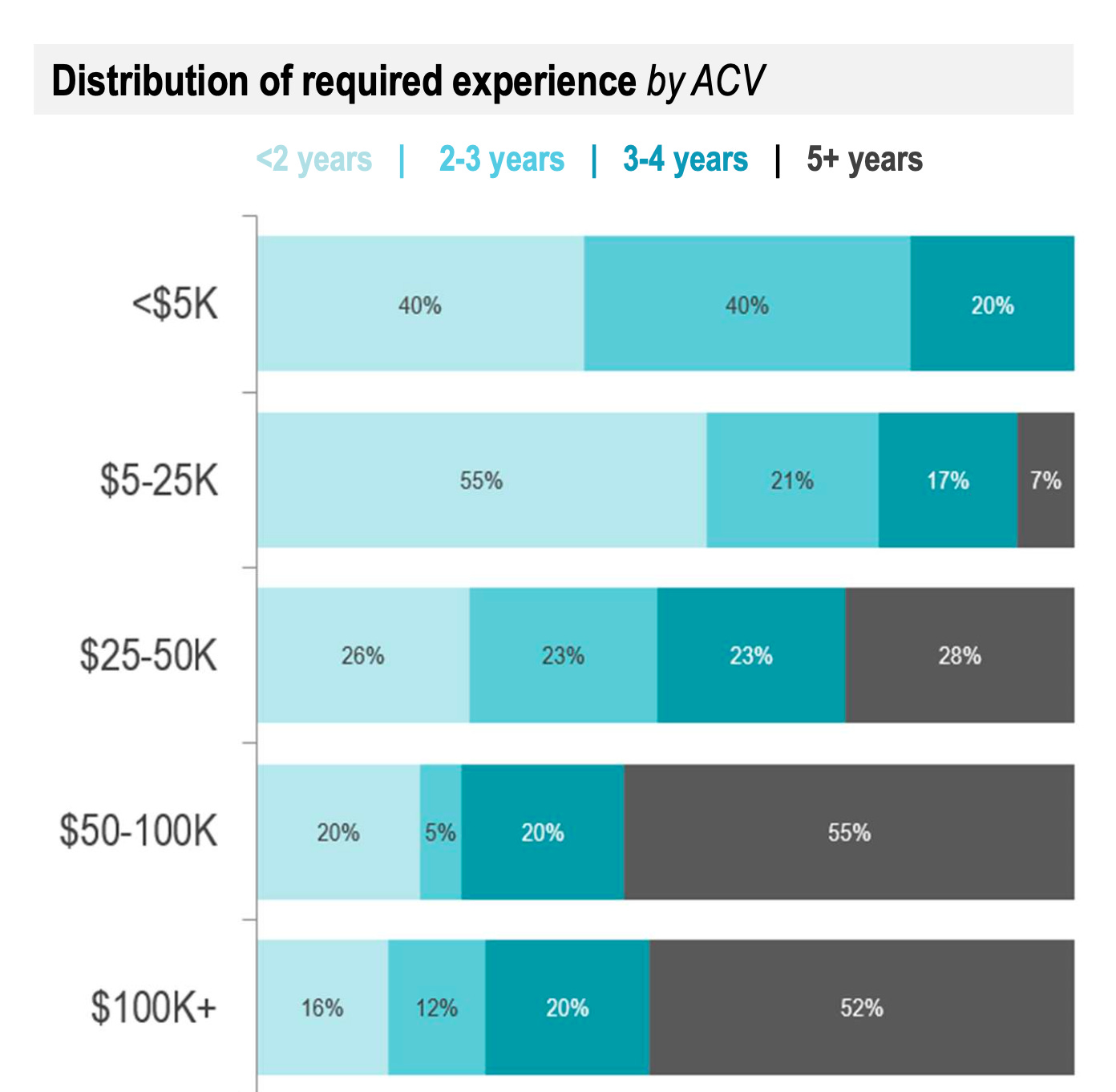

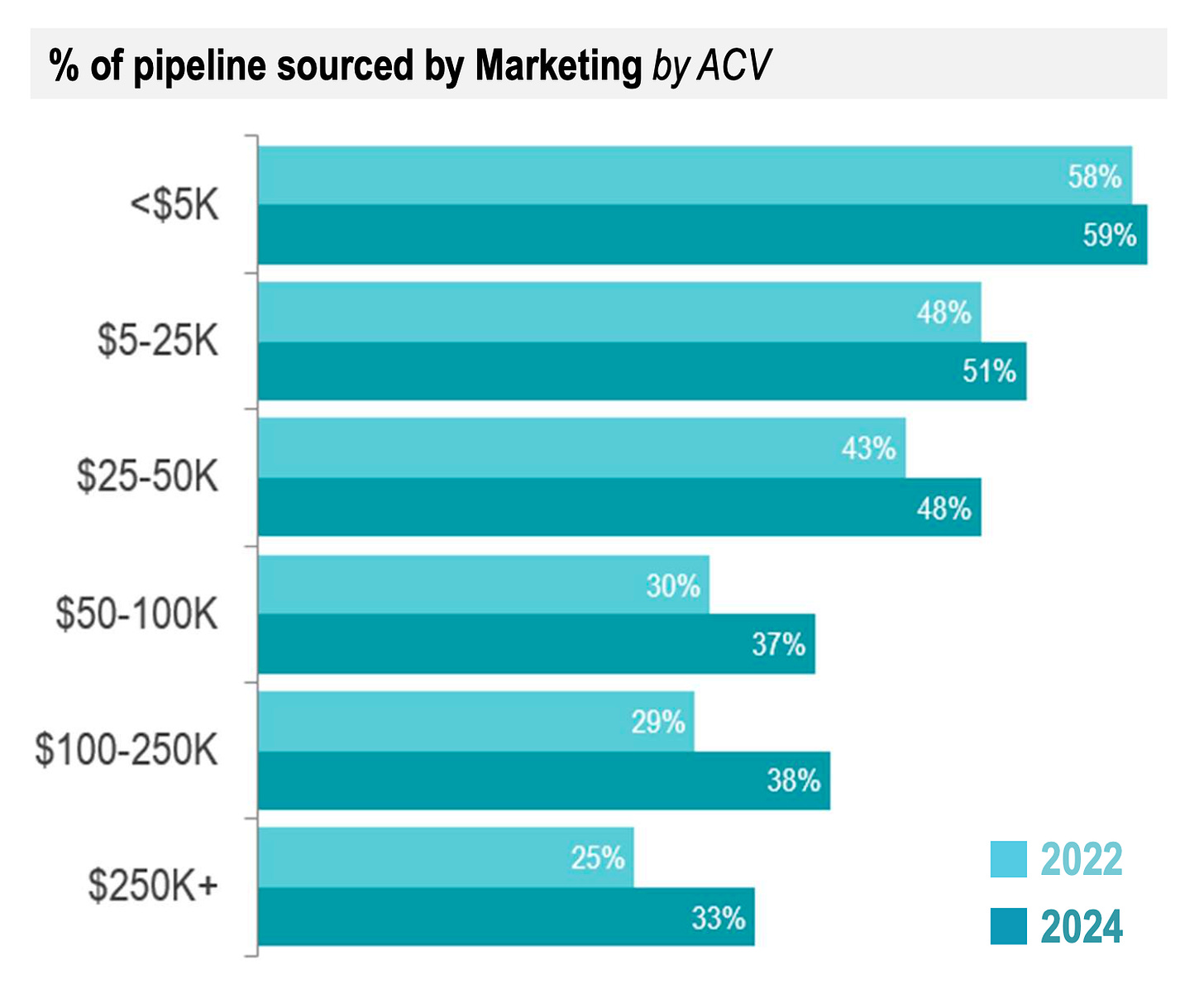

Quotas keep rising in every ACV segment (Bridge Group, 2024) Poor Fit with the Sales Motion or Customer Base: Sometimes, you realize a person’s background just doesn’t translate to your market. For example, if your strategy shifted to enterprise sales and your hire is a pure transactional SaaS rep (or vice versa), they may be a fish out of water. Ask: Do they embrace the way we need to sell? If not – e.g., they struggle with your technical product complexity or won’t prospect into the SME segment you need – you may need someone with a different skill set (Firstround Capital, 2023).

Negative Signals from Customers or Team: Pay attention to qualitative feedback as well. If you start hearing from prospects that the salesperson isn’t delivering value – e.g., they’re unprepared in meetings, can’t answer product questions, or are pushing too hard – that’s damaging to your reputation. Internally, if your other team members (engineers, product, etc.) express concerns that the hire doesn’t collaborate or is “not learning the product,” those are serious flags. Culture fit matters: A first sales hire needs to integrate with a tight-knit early team. If instead they act like an isolated “sales cowboy” or create team tension, consider a replacement who better fits your company’s ethos.

Lack of Coachability and Accountability: In the early stage, no salesperson will have all the answers – what you want to see is coachability and a growth mindset. If your hire becomes defensive at feedback, consistently blames external factors (bad leads, product bugs, “the price is too high”), and fails to take ownership of improving, that’s usually a dead end. The best early salespeople are almost quasi-founders: They take extreme ownership of the mission. If you’ve provided clear feedback and resources, but the rep isn’t adapting or showing self-awareness of their shortfalls, it’s time to move on.

Your Startup Has Evolved Beyond Their Skills: In some cases, a person was the right hire at the time, but 18 months later, your company’s needs have outgrown them. Perhaps they were great at selling your $200/mo product to design teams, but now you’re closing $200K enterprise deals and need a more strategic seller or a true sales leader to build a team. This is a delicate situation – it may not be “failure” so much as a stage transition. If they can’t rise to the new challenge, you might layer someone above them or replace them outright. The tenure data tells us this is common: Many startup sales VPs don’t make it past the stage jump from initial traction to scale-up (Richards, 2025). Ideally, you have this conversation openly – sometimes a great “first sales hire” transitions to another role (like account management) when a bigger gun is brought in for the next phase.

Target personas and ACVs can differ drastically and they can change quickly when a company pivots. Your sales hires might not be the perfect fit that they were 12 months ago (Bridge Group, 2024)

Remember, as the founder, you should first examine your own role in a first sales hire’s struggles. Did you truly give them the tools, clarity, and support to succeed? If not, address those issues in parallel. But if you’ve checked those boxes and the results still aren’t there, trust the data and your gut – it’s better to make a change sooner rather than later.

Replacing a mis-hire is painful, but as one sales expert notes, continuing with a non-performing salesperson costs even more – the average cost of a bad sales hire (in lost time and direct costs) can top $100K (Xactly, 2022), not to mention the opportunity cost of missed revenue.

✈️ KEY INSIGHTS

If after 3–6 months there’s no pipeline momentum, closed deals, or visible improvement, it’s usually time to cut. Consistently missed targets, poor customer/team feedback, or lack of coachability are strong replacement signals.

Tenure data shows most startups swap out early sales leaders as needs evolve—better to act quickly than let a bad hire drain $100K+ in lost time and revenue.

Compensation & Structures (US vs EU) for the First Sales Hire

US AE compensation benchmarks: 2024 Bridge Group benchmarks (170+ B2B SaaS companies): median AE OTE $190k with 53:47 base:variable, and $800k annual quota; quota/OTE ratio centers ~4x–4.2x. Use this as a sanity check when you price early roles (Bridge Group, 2024).

EU context and trend: EU startups paid more conservatively in 2024 as budgets tightened. Ravio’s 2024–25 datasets show lower raise budgets (median annual increases ~4.8%) and generally lower base pay than US peers for “Direct Sales” bands; founders should adjust OTEs downward in many EU markets (and match local social-benefit norms) (Ravio, 2024).

Equity for earliest hires: Carta’s 2024/25 analyses of first-10 hires show median ~1.4–1.5% for hire #1 (four-year vest) with a steep drop-off for hires #2–#5. For a founding AE or player-coach Head of Sales at seed, 1%± can be market, with upside for exceptional candidates (Carta, 2025).

Sales engineering & presales. For technical products, the first GTM “seller” may be an AE+SE hybrid; 2024 industry presales research tracks AE:SE coverage, OTE by geo, and workload—useful if your AE must carry demos and solutions scoping before a dedicated SE hire (Consensus, 2024).

Activity-based ramp for 60–90 days (meetings, discovery depth, POCs started) before strict bookings quotas. This is common in PLG + sales hybrids (Openview Partners, 2021).

Longer ramp times are getting a lot more common (Bridge Group, 2024) Accelerators and low cliffs: Reward early signal (first design partners, first multi-seat land) while you stabilize pricing/packaging. Pair with quarterly SPIFFs, not just annual quota (Bridge Group, 2024).

Title management: Avoid premature “VP” titles and start as Founding AE or Head of Sales (player-coach) with explicit scope growth gates. Job-market scans show founding AE postings expect full-cycle selling + process building (Flowla, 2025).

✈️ KEY INSIGHTS

US first AE comp: ~$190k OTE (53:47 split) with ~$800k quota; EU OTEs are lower. Equity averages ~1% for founding AEs. Effective structures: 60–90 day activity-based ramp, early accelerators/SPIFFs, and avoiding premature VP titles.

Conclusion

Getting your first sales hire right is one of the most leverageable moves in early company building. The data is clear: Hire too soon or the wrong profile, and you lose months of momentum. Hire at the right moment with the right structure, and you create the foundation for repeatable growth. Key is timing (10–25 customers and a repeatable motion), profile (a gritty, full-stack seller, not a big-company VP), structure (OTE ~4x quota, ~1% equity, activity-based ramp), and discipline (replace quickly if there’s no pipeline progress).

Done well, your first sales hire is the catalyst for scaling revenue.

Thanks to Jérôme Jaggi for his help with this post.

Stay driven,

Andre

Thank you for reading this episode. If you enjoyed it, leave a like or comment, and share it with your friends. If you don’t like it, you can always update your preferences to reduce the frequency and focus on your preferred DDVC formats. Subscribe below and follow me on LinkedIn or Twitter to never miss data-driven VC updates again.