👋 Hi, I’m Andre and welcome to my newsletter Data Driven VC which is all about becoming a better investor with Data & AI. Join 34,890 thought leaders from VCs like a16z, Accel, Index, Sequoia, and more to understand how startup investing becomes more data-driven, why it matters, and what it means for you.

ICYMI, check out our most read episodes:

Learn how top founders build and scale AI companies on autopilot! I’m working on a new project to uncover how next-gen founders ship faster and win with new AI tools, agents, and automation. Here’s what to expect:

✅ Interviews with top founders & operators — deep dives into the tactics, tools, and systems that power winning AI companies.

✅ Customer acquisition playbooks — from community-led growth to organic content, standout branding, paid campaigns, and partnerships.

✅ Pricing & monetization strategies — learn what works (and what doesn’t) to grow viral without churn.

Introduction

The first sales hire can be make or break for any startup. Get it right and you lay the foundation for revenue growth; get it wrong and you risk months of lost momentum and costly turnover. Unfortunately, many venture-backed startups in their seed to Series A phase stumble here. Studies show the average sales rep’s tenure is only around 18 months (Xactly, 2022), and for startup sales leaders it’s often even shorter. One analysis found the first VP of Sales frequently churns in under a year (OpenView Partners, 2021).

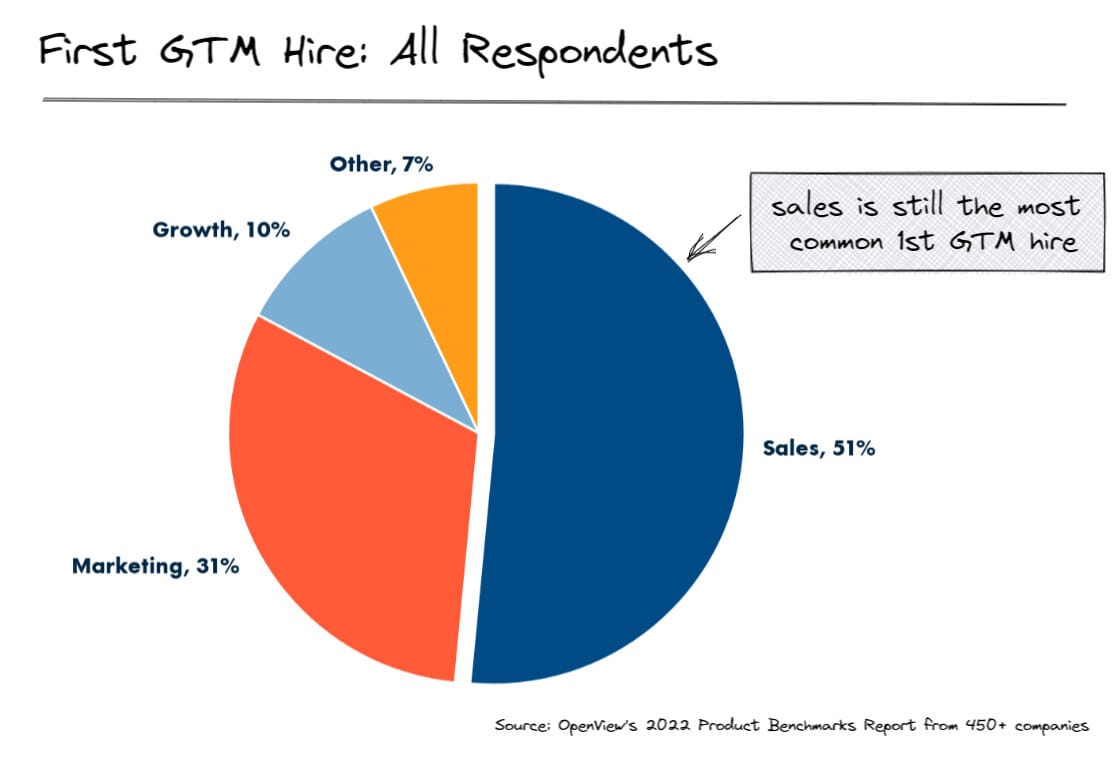

The first pure GTM hire is usually a salesperson - so how do you get this right (Poyar, 2022)?

Why is this role so difficult to get right?

In today’s deep dive, we’ll explore common failure modes (and early warning signs) for a startup’s first sales hire, share industry benchmarks on tenure and compensation, and provide a practical checklist for founders deciding whether to replace their first sales hire.

Let’s dive in! 👇

✅ TL;DR (5 Key Takeaways)

Timing is everything: Hiring too early - before PMF or a repeatable sales motion exists - almost guarantees failure. Founders should close the first 10–25 customers themselves and document learnings before handing sales to a new hire.

Profile matters more than pedigree: Big-company VPs or Rolodex hires rarely thrive in early-stage chaos. The ideal first hire is a scrappy, “full-stack” salesperson who can prospect, close, and build process under ambiguity - grit and adaptability beat flashy resumes.

Founder involvement is critical: A founder checking out of sales too soon is a red flag. Early success requires ongoing founder support, joint selling, and careful diagnosis of whether missed deals are due to people, product, or process.

Onboarding and structure drive success: Dropping a rep into chaos without ICPs, playbooks, or onboarding is a silent killer. Clear role expectations, activity-based milestones, and a 50/50 comp split with ~1% equity help set the right foundation.

Know when to cut losses: If after 3–6 months there’s no pipeline momentum, consistent missed targets, or poor cultural fit, it’s usually time to replace. Prolonging a bad hire quickly costs hundreds of thousands in lost time and missed revenue.

Why First Sales Hires Often Fail (and Early Warning Signs)

Hiring too early – before you’re ready – is a top culprit.

Many founders, eager to offload the awkward work of selling, bring in a salesperson prematurely (Firstround Capital, 2023). If you haven’t yet validated that customers truly want your product and established a repeatable sales motion, a new rep will be set up to fail. As one VC observed, hiring a salesperson “in the first five customers” is risky – you likely haven’t deeply validated the problem or buyer yet (Firstround Capital, 2023).

Product experience of the first sales hire matters (Poyar, 2022)

Early warning sign: The sales hire struggles to close deals that the founders were able to win. This often means the product or process wasn’t ready, not necessarily that the person is a bad seller. Founders sometimes misdiagnose this as a “people problem” when it’s actually a product/market fit or process problem (Evans, 2025). Before blaming (or firing) the new rep, check whether you’ve handed them a workable playbook or just chaos.

Hiring the wrong profile is another frequent failure mode. A common mistake is overshooting on seniority – e.g. recruiting a big-company VP Sales with 20 years experience because they have a flashy resume (Firstround Capital, 2023). In practice, early-stage sales is gritty, hands-on work. Those coming from large orgs with armies of support often struggle to “do their own button-clicking” in a startup (Firstround Capital, 2023).

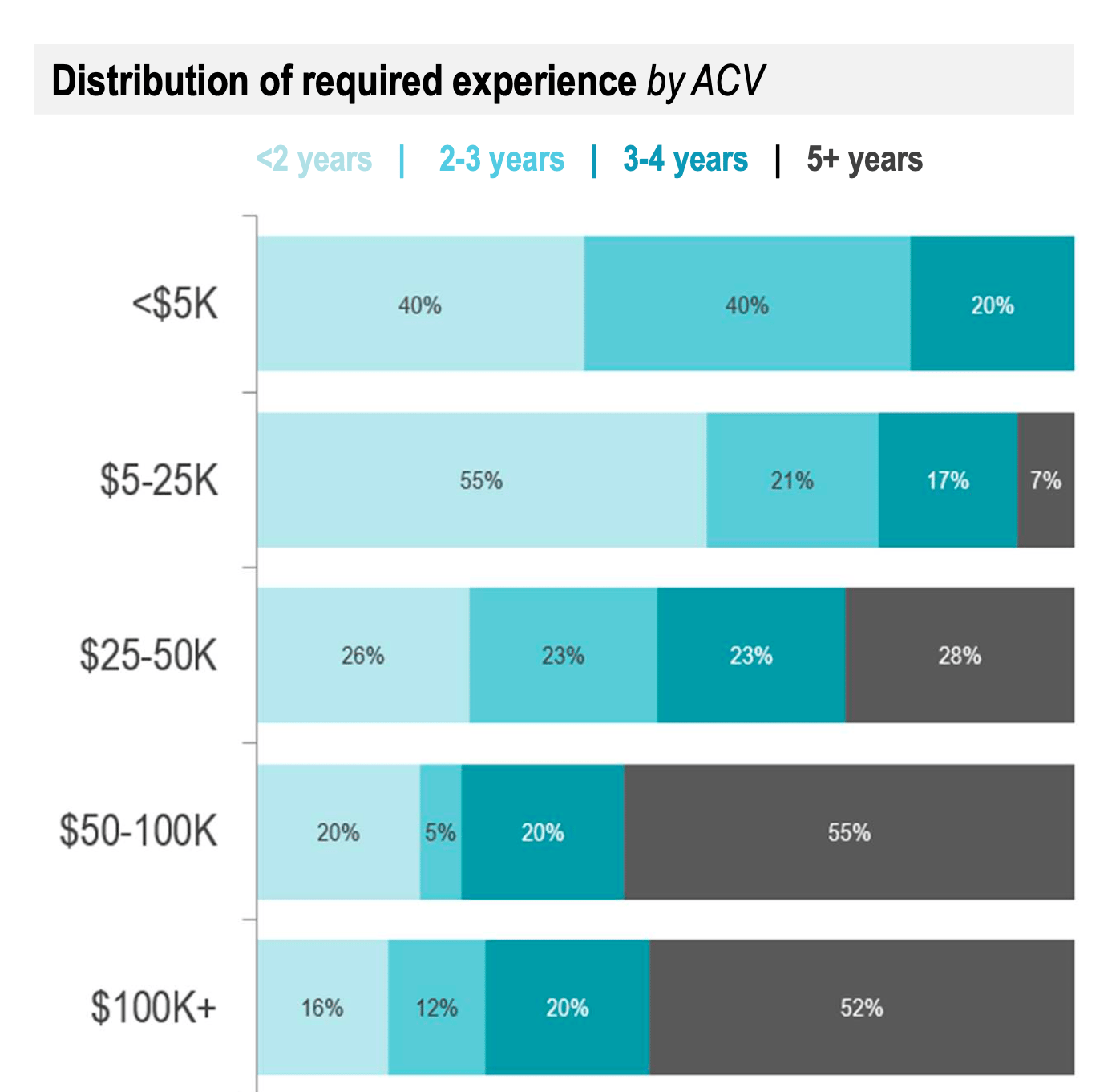

Bridge Group (2024)

On the flip side, hiring someone too green can be “the blind leading the blind” if neither the founder nor the hire knows how to build a sales process (SaaStr, 2022). Early warning sign: Your new rep keeps asking for resources a big company would have (lead lists, marketing collateral, sales engineers) and seems paralyzed without them.

If they aren’t proactively generating pipeline and experimenting with scrappy tactics, that’s a red flag (Firstround Capital, 2023). As one experienced founder put it, “hiring late-stage, coin-operated people almost never works for early stage” – you need a resourceful hustler over a rigid playbook follower.

Expectation misalignment between founders and the first hire is almost guaranteed. Founders are used to selling with massive advantages – personal passion, product knowledge, and the CEO title that opens doors (Evans, 2025). A new sales hire gets none of those advantages. Yet many founders still expect the newbie to replicate the founder’s win rate or magically “figure out sales.”

This is a setup for disappointment. A related early warning sign is if the hire and founder start pointing fingers at each other. For example, the rep might blame the product or lack of leads, while the founder blames the rep’s technique, indicating a gap in understanding what’s really causing missed deals.

Open communication is critical here: Founders should obsess over the sales process enough to discern whether it’s a people issue or a process issue (Evans, 2025). If you, as CEO aren’t close enough to sales to tell, that itself is a sign of trouble.

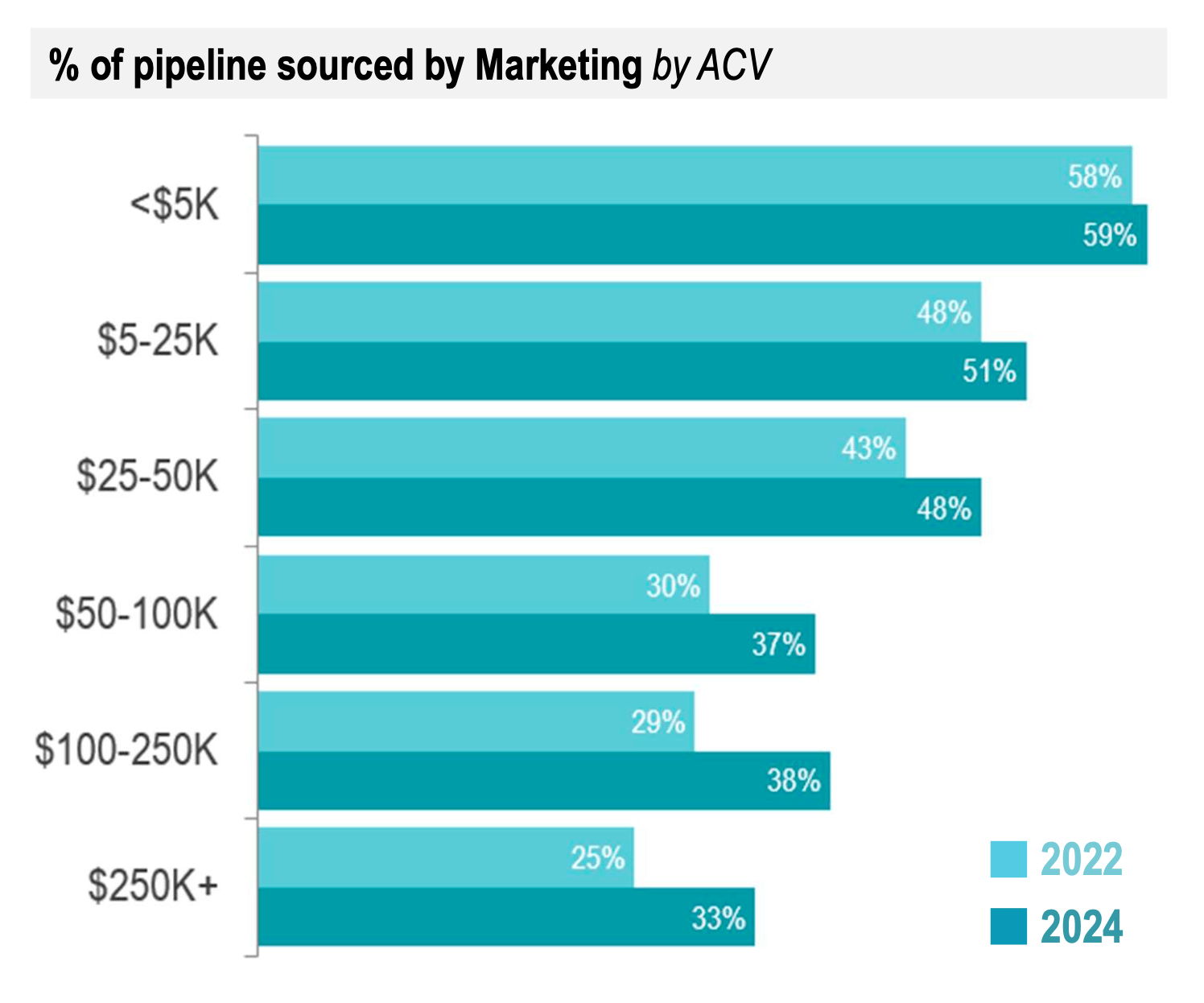

Marketing generates a large and increasing part of an AE’s pipeline (Bridge Group, 2024)

Founders “jumping the gun” and checking out of sales entirely is a fatal mistake. If your primary motive for hiring a salesperson is “to get myself out of sales,” pause right there (Evans, 2025). Completely handing off all sales duties at seed stage is often premature – and investors warn it’s a bad sign. As one startup advisor bluntly writes, “If your motivation for hiring a salesperson is to remove yourself from customer acquisition, you don’t deserve to have a business.” That may be extreme, but the core message is valid: a founder who abdicates sales too early both fails to support the new hire and loses touch with the market.

Early warning sign: The founder steps back and provides no guidance or involvement in deals, and the pipeline dries up. It’s no coincidence that many of the best startups still involve founders in sales well into the early years – for example, one enterprise startup didn’t close a single deal without founder involvement for five years (Firstround Capital, 2023). A founder completely “checking out” in quarter one of a new rep’s tenure is usually a recipe for that rep to flame out.

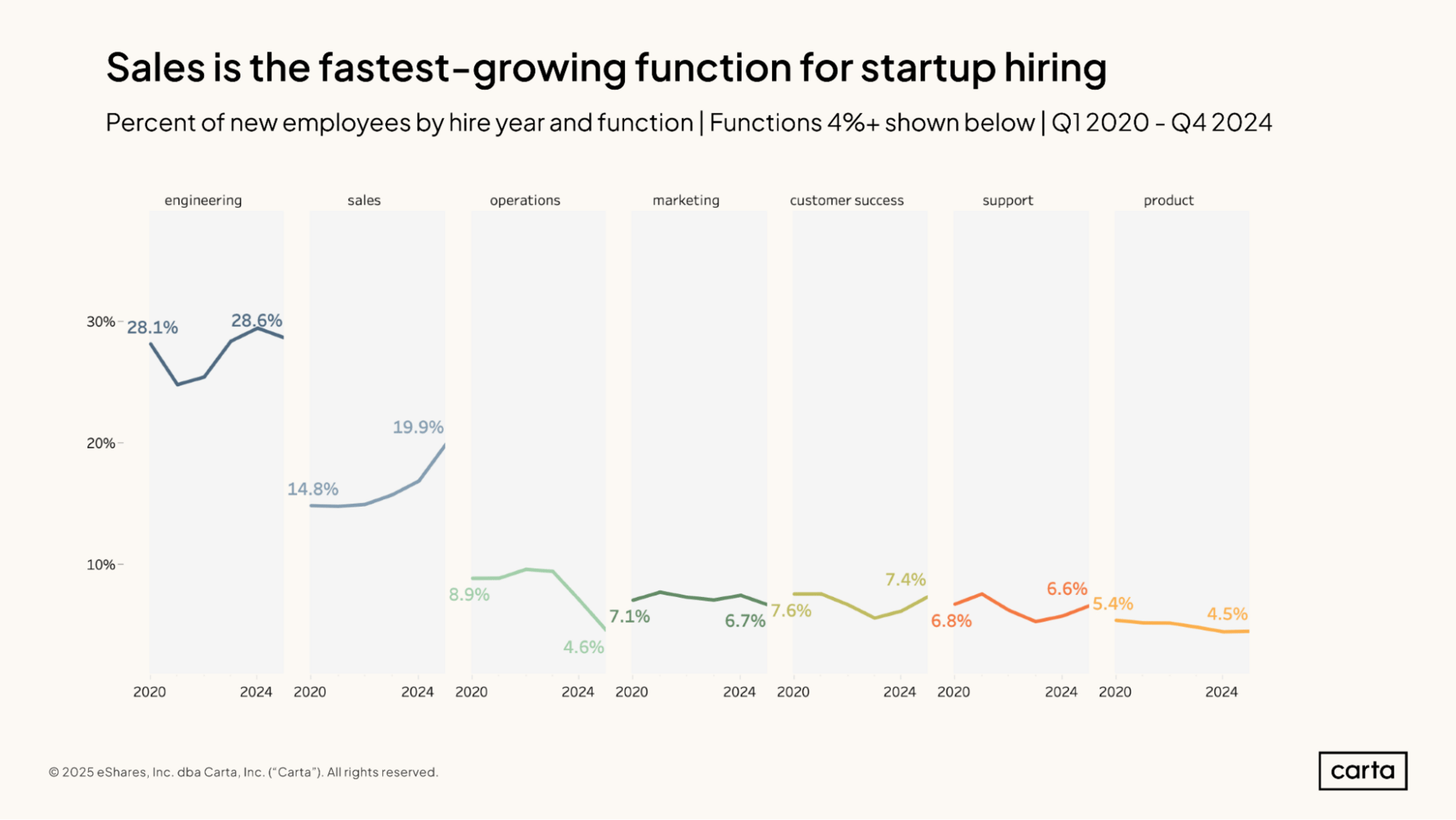

Sales tenure can be tricky, but at least companies are hiring sales people faster than any other function (Carta, 2025)

Poor onboarding and processes are silent killers. Even a talented first sales hire can fail if you drop them into chaos. A classic scenario: The founder hasn’t documented any sales learnings from the first few customers – no ideal customer profile, no common objections or trial plan – and expects the hire to create it all from scratch (Morris, 2022).

Mike Molinet, the founder of Branch who learned this the hard way, admits he once gave a new VP Sales “100 things to figure out” – from CRM setup to defining the ICP to building a team – which no single person could succeed at (Firstround Capital, 2023). The result was failure.

Early warning signs of this issue include the new rep asking basic questions constantly (indicating nothing was documented) or them focusing on internal tasks over customer calls. If three months in they still “feel in the dark” about how past deals were won, that points to an onboarding failure on the company’s side (Firstround Capital, 2023).

The fix is to equip them with playbooks and context from founder-led sales. As Figma’s first salesman advised founders: at least jot down notes on how you closed your last 5 deals – “they don’t have to be perfect,” but give your hire some starting roadmap (Firstround Capital, 2023).

Finally, consider cultural and motivational mismatches. Early startup sales is an emotional rollercoaster requiring resilience, creativity, and belief in the product mission. You want a “missionary, not a mercenary” in that seat (Firstround Capital, 2023).

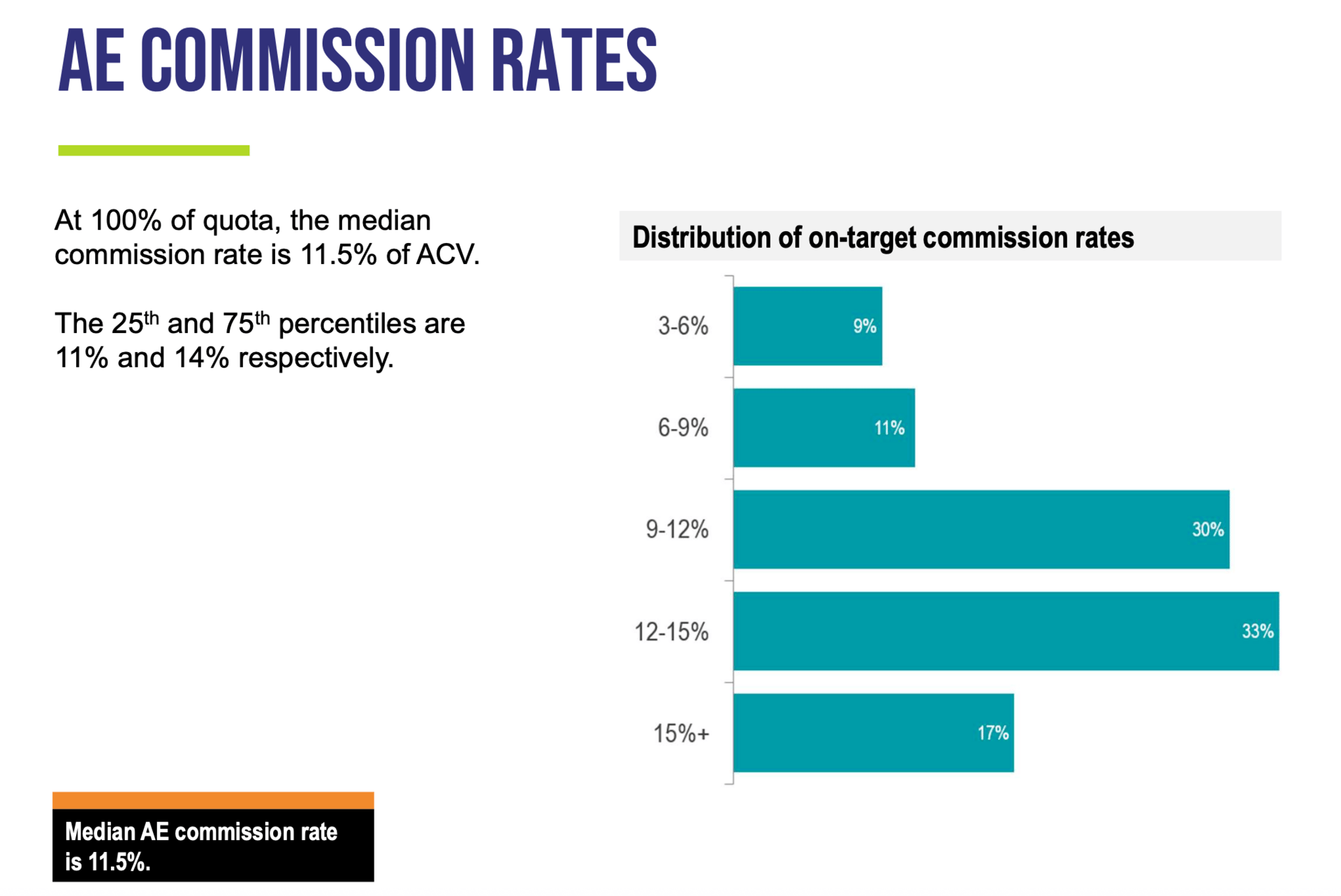

Warning sign: The hire seems primarily motivated by cash and talks more about the OTE and commission structure than the vision. Recruiters caution that a candidate “only motivated by a high cash comp” is a huge red flag for a founding sales role (Primary Capital, 2025).

Bridge Group (2024)

If your first sales hire isn’t emotionally invested in the problem you solve, they may not push through the tough early days of ambiguous product-market fit. On the other hand, a true believer will exhibit curiosity and proactively gather customer feedback rather than just chasing quick deals (Poyar, 2022).

Subscribe to DDVC to read the rest.

Join the Data Driven VC community to get access to this post and other exclusive subscriber-only content.

Join the CommunityA subscription gets you:

- 1 paid weekly newsletter

- Access our archive of 300+ articles

- Annual ticket for the virtual DDVC Summit

- Exclusive DDVC Slack group

- Discounts to productivity tools

- Database Benchmarking Report

- Virtual & physical meetups

- Masterclasses & videos

- Access to AI Copilots