👋 Hi, I’m Andre and welcome to my newsletter Data Driven VC which is all about becoming a better investor with Data & AI. ICYMI, check out some of our most read episodes:

Brought to you by Foresight - Unify and talk to your data

Private market data was disconnected, which made getting a single view of a company, a fund, or a portfolio challenging. Foresight was the first to use AI to connect your data - fund accounting, cap tables, CRM, KPIs and 3rd party - which revolutionized sourcing, diligence, and portfolio management.

Now we’re thrilled to unveil yet another first: letting you talk with your unified data through AI. Learn what you can do here:

Welcome to another Data Driven VC “Insights” episode where we dive deep into a specific topic, cover the most relevant research, and deduct actionable takeaways.

When Ramp launched its new “Bill Pay” feature in late 2021, it saw an immediate retention boost: card customers using Bill Pay churned much less (Not Boring, 2022). This product expansion grew 70% month-over-month with no external marketing, by giving existing customers more reasons to stay engaged.

The lesson echoes industry advice: deepening your product’s value stack “not only improve[s] retention, [but] helped us attract new customers” by giving them more reasons to stay put (Growth Unhinged, 2025).

In short, making a product stickier through additional features or integrations can dramatically raise retention before even touching marketing. And that’s the topic of today’s episode: A deep dive on metrics, strategies, and mechanisms to tackle churn and drive retention in AI products.

✅ TL;DR (5 Key Takeaways)

Early AI churn is unusually high, driven by “AI tourists,” so meaningful retention must be measured from Month 3 onward to reveal true product stickiness.

Strengthening product depth (new features, integrations, “next task” workflows) significantly boosts retention and can drive organic growth before marketing.

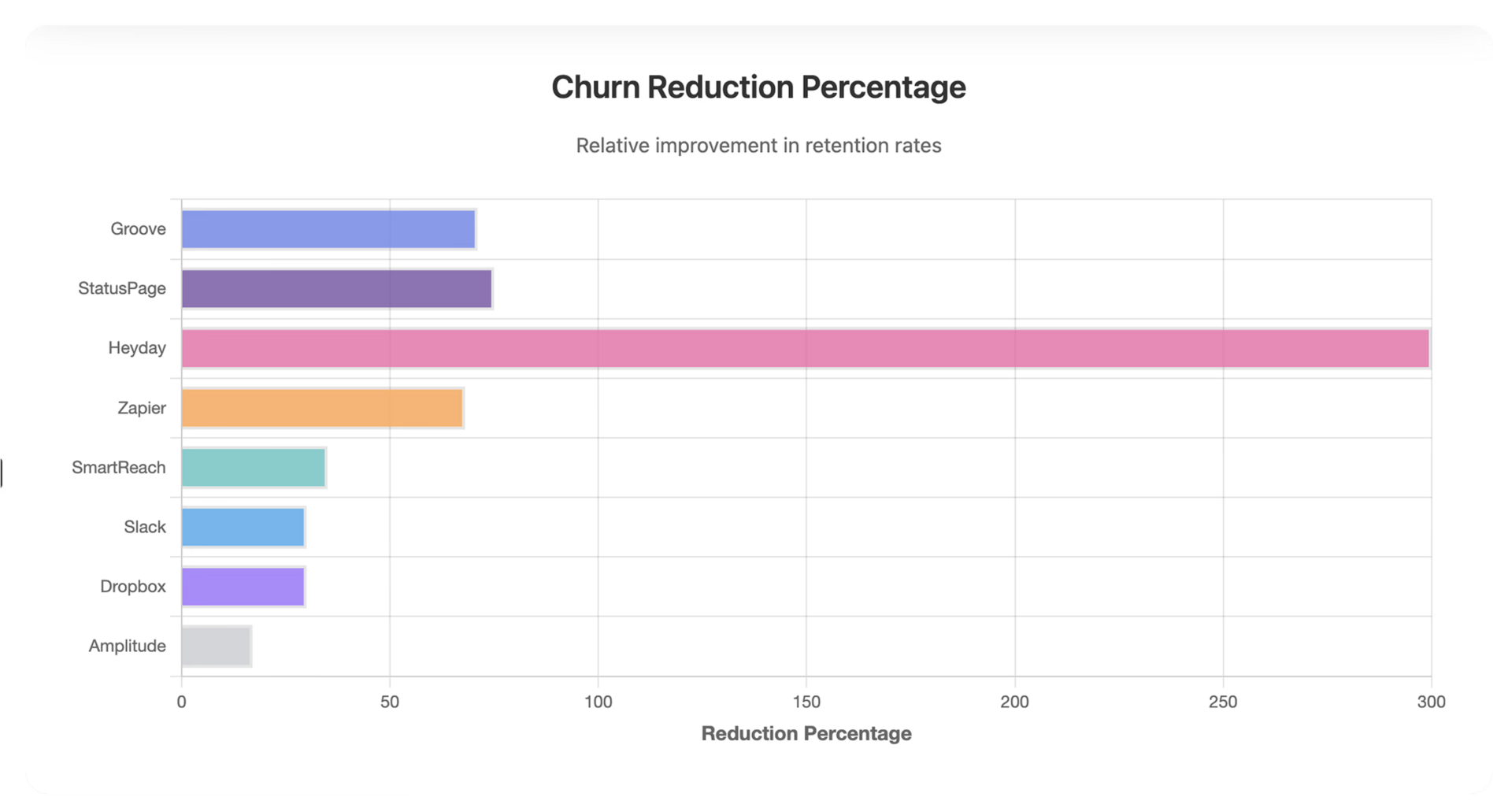

Predictive churn systems work: unifying customer signals and triggering targeted interventions can cut churn dramatically (often 30-70%).

Personalization is a major retention lever: AI-driven experiences (LLM assistants, recommendations) materially increase satisfaction, engagement, and revenue.

Sticky AI products rely on network effects: team-based adoption, referrals, and habit-forming usage loops create >100% NRR and reduce long-term acquisition costs.

Why AI Churn Is Different

AI products are prone to high early churn as casual “AI tourists” try out the product and drop off after initial curiosity (a16z, 2025 a). Because of this, retention usually only stabilizes after a few months, which is why Andreessen Horowitz recommends measuring retention from Month 3 (M3) to assess true engagement (a16z, 2025 a; Mind The Product, 2024). This helps isolate the core users who convert from novelty to long-term value, a pattern a16z describes as the “smiling” retention curve (a16z, 2025 a).

The risk is real: if too many early users churn, AI apps can suffer from the “leaky bucket” problem: growing quickly at the top of the funnel but failing to retain a loyal base long-term (BVP, 2024). For comparison, benchmark data from Vitally shows that average monthly churn for SaaS is roughly 3.5%, comprised of about 2.6% voluntary churn and 0.8% involuntary churn (Vitally, 2025). For AI founders, this means it’s critical to manage the first few months carefully and focus on retention levers that keep the core cohort active beyond M3 (a16z, 2025 a; BVP, 2024; Vitally, 2025).

✈️ KEY INSIGHTS

AI products experience a unique early spike in churn as casual “AI tourists” drop off, which is why retention should be measured from Month 3 onward to understand true product stickiness. After this phase, remaining users often deepen engagement, but many AI apps still face a “leaky bucket” where strong initial growth fails to convert into long-term retention. Founders must design for this early volatility and focus on strengthening habits within the durable core user base.

Churn Prediction Playbook

To forestall churn, companies follow a systematic process. First, gather and unify all relevant customer signals (product usage, support tickets, billing events, survey scores, etc.) and segment users by behavior and value (Paddle, 2025; Pedowitz Group, 2025).

Next, train predictive models on this data: start with logistic regression or boosting models, and consider survival analysis to predict when a user might churn (Paddle, 2025; Pedowitz Group, 2025).

Third, analyze model outputs to surface root causes: modern techniques like SHAP can highlight controllable drivers (e.g. incomplete onboarding or feature non-use) behind each at-risk account (Pedowitz Group, 2025).

Finally, set up automated retention actions for accounts the model marks as high-risk. These can include guided onboarding sessions, personalized offers, or outreach from customer-facing teams. They should be monitored and improved continuously based on performance data (Paddle, 2025; Pedowitz Group, 2025).

In practice, this approach is proven by case studies. For example, Groove (a helpdesk SaaS) built an early-warning system using leading indicators (session duration, daily logins, etc.) and automated emails for flags. This intervention cut monthly churn from 4.5% to 1.3% - a 71% improvement (Saasfactor, 2025). Likewise, Slack identified that small trial workspaces (few members, low message volume) were at risk, so it prompted users to “invite your teammates” or “connect Google Drive” during onboarding. These timely nudges lowered Slack’s 30-day trial churn by about 30% (Saasfactor, 2025).

Such examples show that combining predictive signals with quick tactical fixes - whether automated email campaigns, product walkthroughs, or payment reminders - can generate dramatic retention gains (Saasfactor, 2025; Pedowitzgroup, 2025).

✈️ KEY INSIGHTS

A structured churn-reduction process that unifies customer signals, models risk, identifies root causes, and triggers targeted actions consistently drives results. Cases like Groove’s 71% churn drop and Slack’s roughly 30% trial improvement show how predictive alerts plus timely fixes boost retention. The strongest gains come from pairing data insights with quick and impactful product and customer-team interventions.

Building Sticky AI Products

Beyond reactive interventions, AI-native companies are designing products that naturally lock in users. Recent industry analyses suggest that top AI companies often outperform traditional SaaS on growth and retention, but only when these metrics are measured correctly (a16z, 2025 a; Mind The Product, 2024). In AI’s new paradigm, growth is rapid, but early retention is low, so investors and founders now focus on later-cohort metrics. For instance, a16z recommends using M3-based revenue retention: measure how much a cohort expands from Month 3 to Month 12 relative to its M3 size (a16z, 2025 a).

This reframes retention as a compound metric that reflects product-market fit after the churn of casual users. The result is that many AI companies do end up with >100% net dollar retention, because committed users add more value over time (e.g., through upsells or usage-based spending) (a16z, 2025 a).

Importantly, investors emphasize rapid product velocity and user value. A16z data show that AI startups now frequently exceed the old “$0–$1M ARR” growth bar, reaching multiple millions in ARR within their first year (a16z, 2025 b). However, they caution that by Series A, you must back up that top-line growth with stickiness: “rapid top-line growth won’t be enough to compensate for low engagement or high churn” (a16z, 2025 b).

On the bright side, once AI products convert users to paid plans, their retention can be as good as or better than legacy apps - a16z finds that converted users “retain just as well” as in pre-AI businesses (a16z, 2025 b). In practice, building in habit-forming features, network effects, or “next task” workflows (see Bessemer’s recommendation to embed co-pilots into existing platforms) makes AI apps inherently stickier to their core audience (BVP, 2025; a16z, 2025 b).

The strongest moat emerges from product-driven referral loops that compound acquisition organically. Data shows that referral mechanics power 60% of acquisition for leading platforms, not marketing spend (ProductSchool, 2025). For AI products, peer-group adoption creates exponential stickiness: teams co-adopting tools together (Cursor, Lovable, Perplexity) build switching costs and network effects that lock in retention. Strategic referral incentives like credits, tier upgrades or exclusive features transform individual conversions into team-wide adoption, dramatically lowering CAC and extending LTV runway (ProductSchool, 2025).

Personalization and Scale

AI excels at personalizing experiences at scale, which boosts loyalty. McKinsey reports that advanced AI-driven personalization can increase customer satisfaction by 10-20% and lift revenue 5-8% on average (McKinsey & Company, 2025). By delivering “the next best experience”, sequencing touchpoints and offers for each user, companies both delight customers and reduce attrition.

Generative chatbots and LLM-based assistants exemplify this trend. For instance, ChatGPT (now #1 AI app globally) has extremely high engagement: average sessions are around 14½ minutes with multiple query pages per visit (Index, 2025). Crucially, its retention is strong: roughly 89% of paid ChatGPT users continue after one quarter (Index, 2025).

In other words, a hyper-personalized chatbot can create habitual usage. Embedding similar conversational agents or AI advisors into products - whether it’s a sales Slackbot, an AI tutor in an app, or contextual help built on LLMs - leverages those same effects. Early data hint that applying next-gen personalization (through chatbots, recommendation engines, or predictive content) will markedly improve loyalty: companies report 10-15% higher sales and 10-20% higher satisfaction from AI-based personalization programs (McKinsey & Company, 2025; SuperAGI, 2025).

✈️ KEY INSIGHTS

AI-driven personalization significantly boosts loyalty, with companies reporting sizable gains in satisfaction and revenue. The strong retention seen in highly engaging AI assistants like ChatGPT shows how tailored, conversational experiences create habitual use. Embedding similar AI agents or recommendation systems can replicate these effects and meaningfully improve customer retention.

How to Act On This

Re-base retention metrics to Month 3 (M3) to separate “AI tourists” from true users, and evaluate PMF on post-novelty cohorts. This prevents overreacting to early churn and aligns your metrics with how leading AI companies (per a16z) measure stickiness.

Build a churn-prediction loop early: unify product + billing + support data, apply lightweight ML models, and create automated “save plays” (guided onboarding, targeted prompts, payment recovery). Case studies show this can cut churn by 30-70%.

Design your AI product for habitual use, not one-off novelty. Add high-frequency workflows, integrations, or value-stack features (e.g., Ramp-style “second product”) that increase depth of use and naturally raise retention and expansion.

Leverage AI-driven personalization. LLM assistants, tailored prompts, next-best-action flows: McKinsey data shows it can lift both satisfaction and revenue with measurable retention gains.

Track NRR, activation, and feature-adoption cohorts weekly, not just logo churn. Small improvements in activation and usage lead to disproportionately large revenue effects (Bain: a few churn-point reductions can raise profits ~25%).

✈️ KEY INSIGHTS

AI products typically see quick early growth but also fast initial churn, so meaningful retention shows up only when focusing on later cohorts such as Month-3 onward. Companies that build habit-forming workflows, strong personalization, and value-expanding features tend to create stickier products with >100% net retention. Referral loops and team-based adoption further strengthen loyalty, while targeted activation and churn-reduction strategies help sustain long-term revenue.

Thanks to Lea Winkler for her help with this post.

Stay driven,

Andre