👋 Hi, I’m Andre and welcome to my newsletter Data Driven VC which is all about becoming a better investor with Data & AI.

📣 Secure one (or more) of hundred SUPER EARLY BIRD tickets for our Virtual DDVC Summit 23-25th March here if you want to learn how leading investment firms transform their operations with alternative data, AI, and automation

Welcome to another edition of our Sunday “Resources” stream where we share our most valuable data & resources across four rotating formats:

For 1. and 3., we collaborate with best-in-class partners to ensure you get the highest quality data. For 2. and 4., we leverage our ever-growing product portfolio and share selective snapshots of the most sought-after resources from The Lab.

At the end of this post, you’ll find a unique deep dive on “Should Seed Investors Follow On” with Abe Othman, Head of Research at AngelList.

RESOURCES OVERVIEW🛠️

✅ Summarize 50+ newsletters with ChatGPT

✅ Evaluating startups with ChatGPT

✅ VC Co-Pilot for deal sourcing

✅ Top 10 Prompts for startup sourcing

✅ Top 10 Prompts for startup screening & due diligence

✅ Top 10 Prompts for deal winning & closing

✅ List of 312 family offices

✅ List of 59 pension funds

✅ List of 1513 angel investors

✅ List of 997 accelerators

Access these and more resources like our 100+ masterclasses, automation templates, Notion templates, copilots, and more via our Annual and Premium subscriptions to The Lab below👇

What I read this week🤓

Here’s a summary of the best content that I consumed in the previous week…

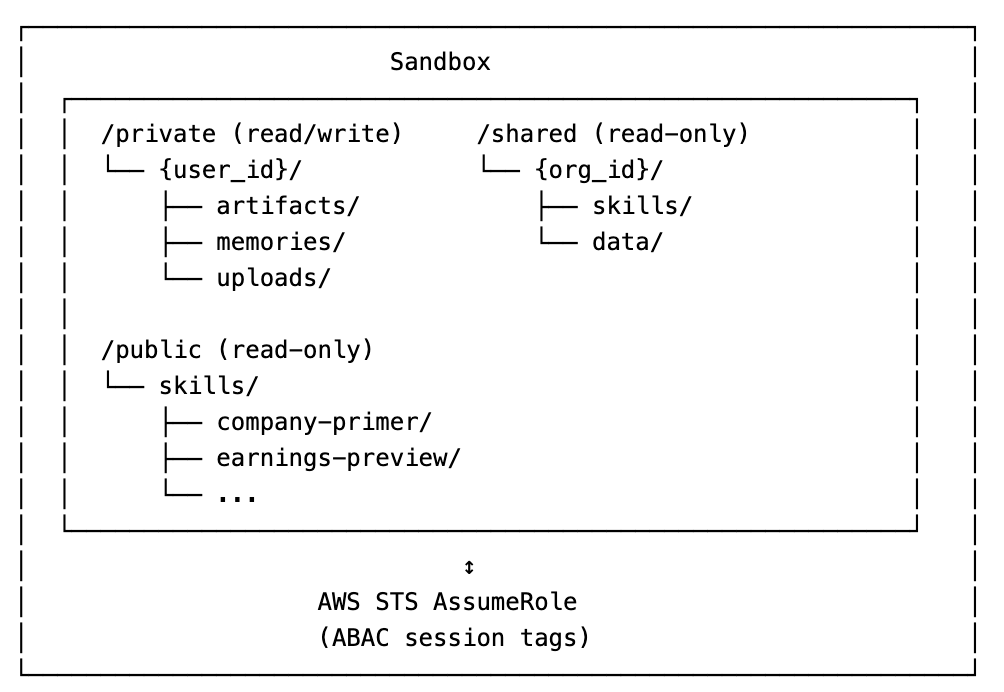

After two years of building AI agents for financial services, the author Nicolas Bustamante argues that the hard part isn’t the model, it’s everything around it. In a domain where a single wrong number can destroy trust, success comes from paranoid attention to detail: sandboxed execution environments, filesystem-first agents, normalized financial data, rigorous parsing of data rooms, and domain-specific evaluation.

Financial AI must handle messy, adversarial data, long-running workflows, and impatient power users, all while being correct, auditable, and fast.

The core insight: the model is not the product. Skills (markdown-based, human-readable instructions), clean context, real-time streaming UX, and production-grade reliability are the real moat. As models improve, they will “eat” today’s scaffolding, so architectures must be designed for obsolescence.

The winners won’t be those with the best LLM, but those who build durable systems, data layers, and workflows that professional investors can actually trust.

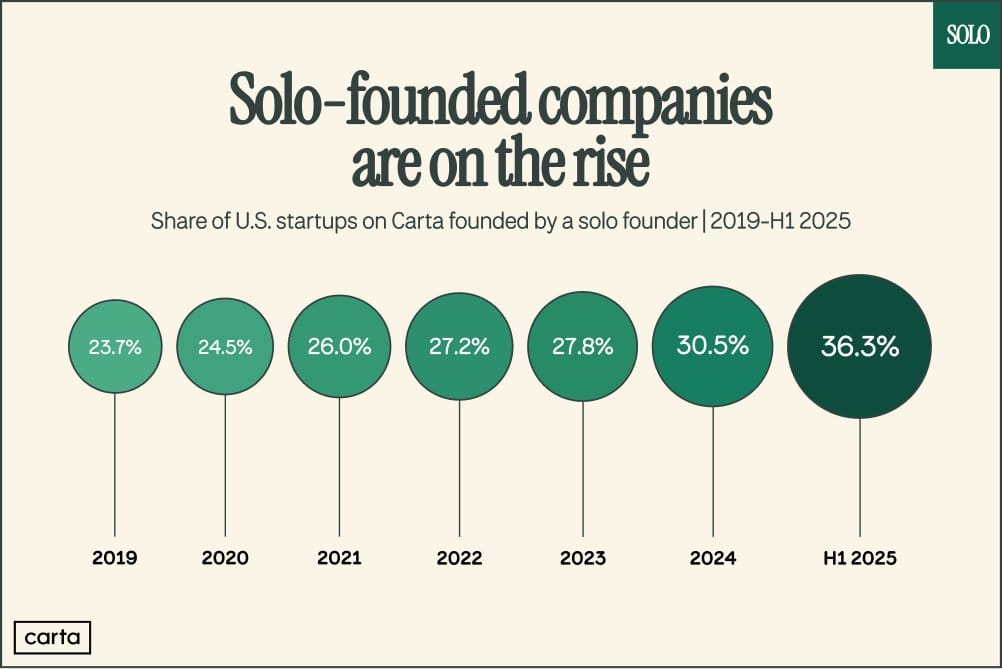

Solo founders were long seen as a red flag. The data now says the opposite. New figures from Carta show that 36.3 percent of new startups are founded by a single founder, the highest share in more than 50 years and a sharp rise from less than a quarter in 2019.

This is not an anomaly but a structural shift. AI is the key driver, not just by speeding up work, but by allowing one person to build product, write code, market, and operate at a level that once required an entire team.

A single founder can move faster, maintain a coherent vision, and avoid cofounder conflict, one of the most common startup killers. Solo founding is not replacing cofounding, but it is becoming an equally valid default.

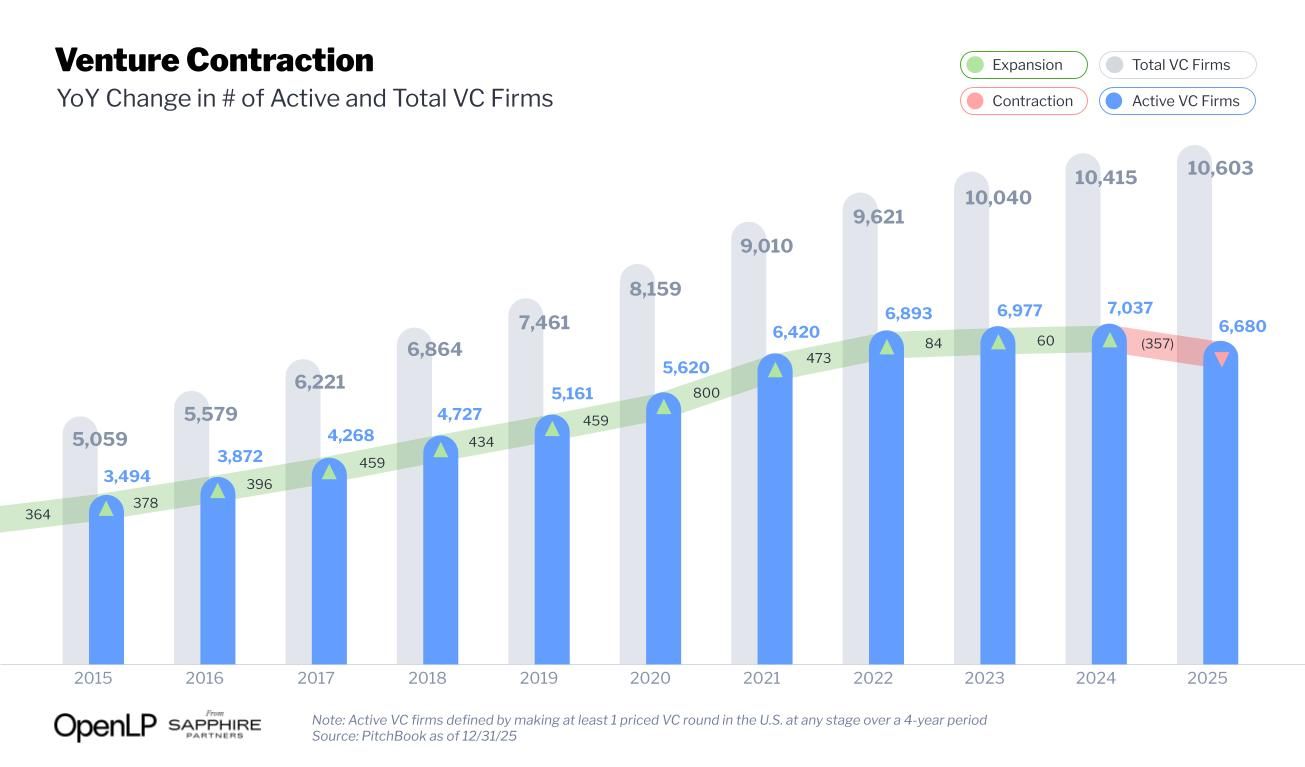

VC is entering its first true industry wide contraction since the dot com era. Despite more than 10,000 venture firms existing on paper in the US, fewer than half are actively investing. The rest are effectively inactive, creating the illusion of a large market while real capital deployment shrinks to its smallest active investor base in over 25 years.

Only about half of first time funds ever raise a second fund, roughly 17 percent reach Fund IV, and fewer than 5 percent become enduring franchises. These outcomes worsen in downturns. After the dot com crash, the GFC, and now the post 2021 correction, LPs consistently pull back to established managers, slowing new fund formation and sharply increasing attrition among emerging funds.

Together with the increase in total funds raised YoY ($100bn+ in 2022 down to $60bn in 2024, rebounding to $70bn+ in 2025), this underscores the increasing concentration, where very few VC firms raise majority of the capital across the industry.

Power-law is everywhere.

Should Seed Investors Follow On?

I’m excited to share one of the most watched recordings in our platform The Lab from a deep dive session with Abe Othman, Head of Research at AngelList (spoiler: he will speak again at this year’s Virtual DDVC Summit in March)

Watch if you want to learn:

Results from AngelList data and a simulation of 10k+ follow-on funding rounds

How does “never follow on” vs “always follow on” compare in performance

The right balance between initial and follow-on reserves in your fund

How many Seed rounds grant “legal pro-rata rights” for subsequent rounds

Concentration vs diversification, volatility, and its impact on performance

… and a lot more

Here’s the link to the full panel discussion👇

Subscribe to our premium content to read the rest.

Become a paying subscriber to get access to this post and other resources from our exclusive Data Driven VC community.

UpgradeA subscription gets you:

- Products like automation templates, prompt libraries, AI copilots

- 100+ masterclasses with experts from leading funds

- Access to our exclusive Slack community

- ... and lots more