👋 Hi, I’m Andre and welcome to my newsletter Data Driven VC which is all about becoming a better investor with Data & AI. ICYMI, check out some of our most read episodes:

Brought to you by Coresignal - 1B+ Web Records in One Place

Smart investors and entrepreneurs power their ventures with fresh data signals.

Use multi-source company, employee, and jobs records to develop AI platforms, fill your investment pipeline, or enrich your sales funnel.

Your exclusive 15% discount is waiting for you until the 10th of December. Visit Coresignal's self-service and use the code DATADRIVEN15 at checkout.*

* The discount applies to first-time clients on their initial purchase of either a monthly or yearly plan.

Welcome back to another “Essays” episode. Today is a very special one as it marks the beginning of my live experiment series “Automating my VC investor job with AI”.

Everyone talks AI, few actually use it.

We wrote about “usage vs ROI of AI for professional tasks” earlier this week and what’s true for enterprises, SMBs, and startups, is equally (or more) true for investors. Searching the signal in the noise, the three most frequent questions I get are:

Where should I start to upgrade my stack and automate workflows?

Which are the best AI tools?

What budget should I plan for?

I’ve tested 500+ tools over the years and assume to have a rather advanced productivity stack today. However, I noticed that I have become more reactive over time and that my stack looks more like a best-of-breed patchwork.

In preparation for 2026, the hopefully most productive year ever, I thought to start a live experiment where I list all my VC investor tasks, revisit the status quo, and automate my stack end-to-end. To make it as transparent and useful as possible for you, I decided to publish a weekly update via this newsletter and invite you for brainstorming and co-experimentation via a Slack group.

✅ Join 45k+ readers and subscribe to this newsletter

✅ Join our free “DDVC Automation Experiment” Slack group (only 400 people can join via the link - first come first serve)

Step 1: List All Tasks and Review Where I Spend My Time

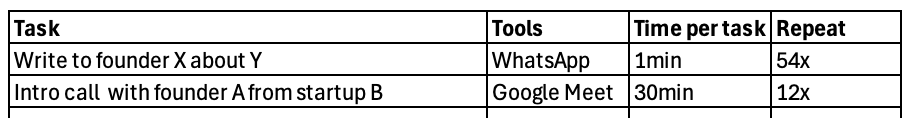

First off, I want to understand where I spend my time. For the past two weeks, I’ve tracked every single task and tool. Like really. Every. Single. Task.

Above is the structure I use that helps me track specific task, tools involved, time per task, and how often it repeated in a given period of time.

As I’m writing this article, the list has 542 rows, includes 34 tools, ranging from 30 seconds to 1 hour, and 1 to 54x repetitions. Related note: I wrote about my ultimate VC Tech Stack Overview (2025) in summer, including the 60 tools I’ve used back then.

Upgrade your subscription to access our premium content & join the Data Driven VC community

Step 2: Categorizing Tasks

The initial list is big mess as it’s very detailed and thus too many entries, making it hard to decide where to start automating. Therefore, I decided to categorize the list.

But how?

We could categorize by:

Value chain (Sourcing, Screening, DD, IC, Deal Winning, Confirmatory DD, etc.)

Stakeholders (Founders, LPs, Co-Investors, Follow-on Investors, Team, etc.)

Tools (Mail, WhatsApp, Slack, Notion, Granola, etc.)

…

The most intuitive way for me, however, seems to be based on process type (Research, Communication, Documentation, etc.). So I took my list and asked ChatGPT to “Cluster this task list MECE and by process type. Make sure to retain all content and only where suitable merge or summarize items.”

The result? Fairly underwhelming. Neither MECE nor actually useful.

So I sat down and created my own structure. Hereof, I asked ChatGPT again to “Map the detailed list of items to my structure below. Make sure to retain all content and only where suitable merge or summarize items.”

That worked! The final list is unfortunately too long for this newsletter episode, but you can download it for free here. A brief snapshot below.

1. Research (Read)

Thesis Building & Market Research

People & Company Research / Sourcing (“Stakeholders”)

Startup Screening & Due Diligence

2. Communication with “Stakeholders” (Read & Write)

Synchronous / Online & Offline Meetings & Events

Asynchronous / Email, Slack, WhatsApp

Socials (Publishing & Engagement)

3. Decisions (Between Read & Write)

Market & Investment Decisions

Deal Flow (Individual & Team)

Investment Committee

Deal Making

Portfolio & Board Work

Internal People & Firm Strategy Decisions

4. Content Creation, Documentation & Knowledge Management (Write)

Create

Synchronize (CRM, Docs, Reporting)

5. Admin, Operations & Execution

Travel & Logistics

Expenses

Process Management

Tool, Data & Automation Management

Employee Lifecycle (On/Offboarding)

Step 3: Prioritization & Where to Start

I’ll prioritize the list based on potential time savings but will consider your feedback in the Slack group where you can upvote specific items and share ideas. Next week, we’ll start with our first automations!

Stay driven,

Andre

PS: Check out Coresignal for 1B+ web data records on startups, people, jobs, and more, and claim your 15% discount until 10th Dec