👋 Hi, I’m Andre and welcome to my newsletter Data Driven VC which is all about becoming a better investor with Data & AI. ICYMI, check out some of our most read episodes:

Brought to you by LIMITEDPARTNERLIST.COM

Access our exclusive list of 2500+ LPs across family offices, fund-of-funds, wealth managers, endowments, governments, and pension funds that actively invest across venture capital, growth, and private equity. As a bonus, you can download fundraising materials and pitch decks of funds like Seedcamp, Weekend Fund, SuSa Ventures, and more.

Welcome to another Data Driven VC “Insights” episode where we cover the most interesting startup research & reports from the past two weeks.

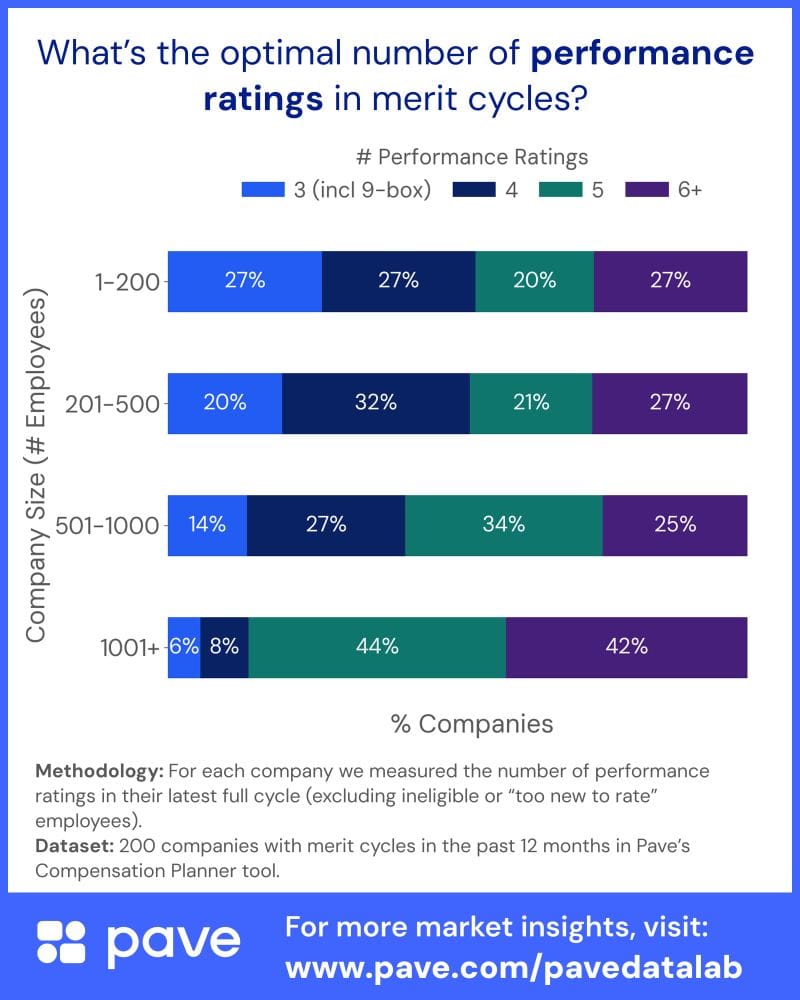

What Is the Right Scale for Employee Performance Ratings?

Matt Schulman examines how companies of different sizes structure their performance rating systems. He explains how organizations shift from simple to more granular models as they scale and refine their pay-for-performance approach.

Rating Systems by Company Size: Companies with 1 to 200 employees show an even split across 3 (below expectations, meets expectations, exceeds expectations), 4 (no neutral box), 5 (like 3 but more granular), and 6-plus rating systems. Between 201 and 500 employees, 4-rating systems become the most common, while 501 to 1,000 employees see 5-rating systems take the lead. At more than 1,001 employees, 3-rating systems decline in popularity as 5 and 6-plus systems dominate.

Granularity vs. Simplicity: The post outlines how 3-rating systems encourage clarity, 4-rating systems remove neutral options, 5-rating systems aim for balance, and 6-plus systems offer high precision for specialized organizations.

Beyond Ratings: Schulman notes that some large enterprises and pre-IPO companies choose to use no ratings at all and instead give managers broader discretion during merit cycles.

✈️ KEY TAKEAWAYS

As companies grow, they tend to adopt more detailed performance rating systems. The choice ultimately depends on how much granularity an organization needs to support fair performance assessments and compensation decisions without adding unnecessary complexity.

Free Tool & Cloud Credits for Startups

The article published by “The VC Corner” provides a comprehensive overview of both general cloud credits and AI-specific credits available to early-stage startups. It highlights how founders can stack these programs to reduce operational costs, speed up development, and experiment with multiple AI providers.

Cloud Infrastructure Credits: AWS, Google Cloud, and Azure offer sizable credit packages for compute, databases, and hosting, helping founders operate core infrastructure with minimal early cash burn.

AI Model and API Credits: LLM vendors such as OpenAI, Anthropic, Mistral, and Cohere provide usage credits that let startups test model performance, run pilots, and validate AI features without cost pressure.

Bundled Startup Programs: Ecosystem partners and accelerators combine cloud and AI credits with customer introductions, tooling discounts, and technical support, creating a broader lift for teams building across the stack.

✈️ KEY TAKEAWAYS

Startups save the most when they combine general cloud credits with AI-specific usage credits, allowing them to build infrastructure cheaply while experimenting with multiple AI providers.

Upgrade your subscription to access our premium content & join the Data Driven VC community

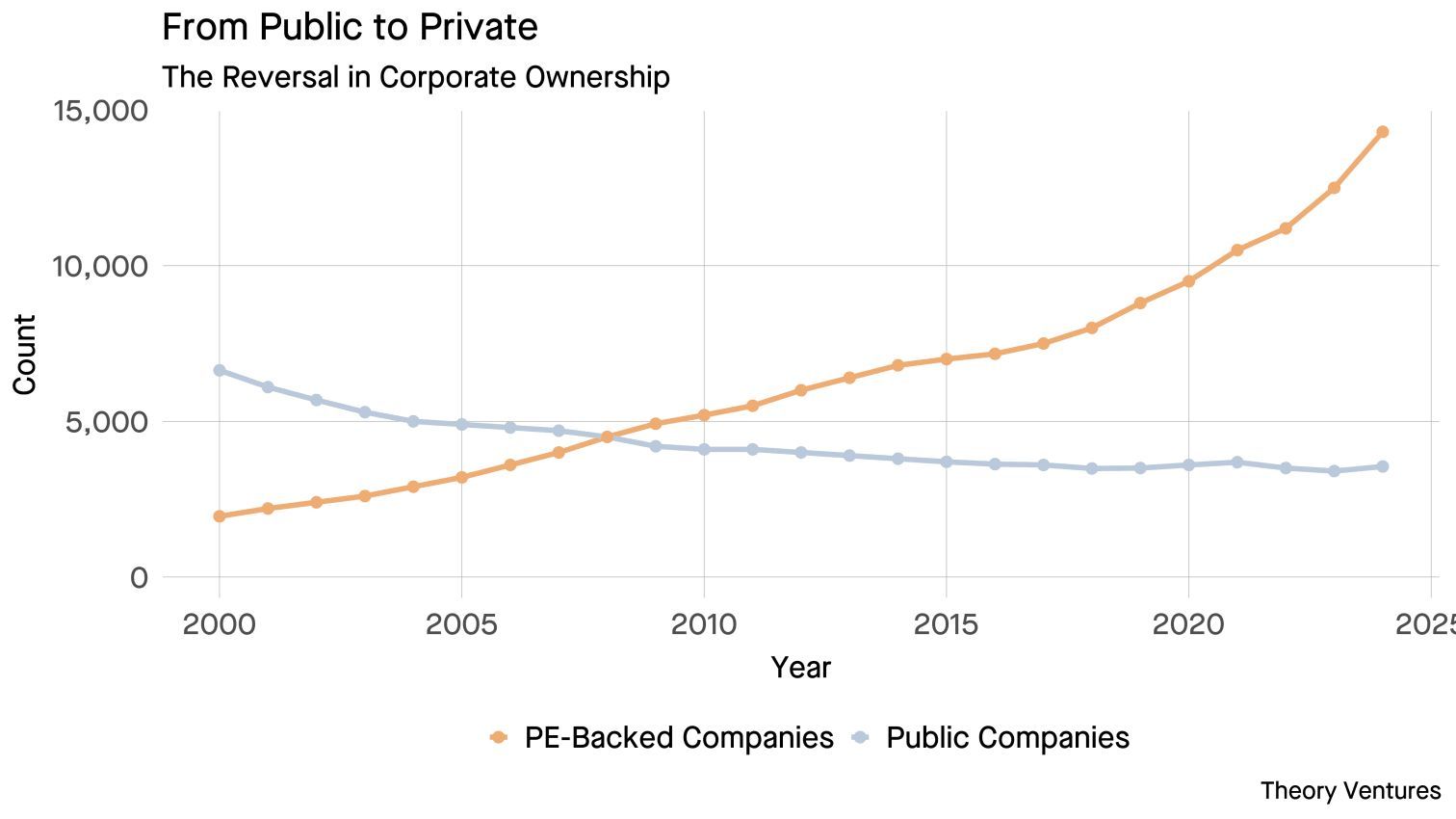

Private Equity Is Becoming a Major GTM Channel for AI Startups

According to an analysis shared by Tomasz Tunguz, private equity is becoming an unexpected but highly effective distribution path for AI startups. The rapid expansion of PE-owned companies in the US has created a large, centrally controlled customer base that is highly motivated to adopt tools that cut costs and improve operational efficiency.

Growth of PE Portfolios: Public companies dropped from 6,639 in 2000 to 3,550 in 2024, while PE-owned firms grew from 1,950 to 14,300. The crossover happened in 2009, and PE-backed companies now outnumber publics by roughly 4:1.

Mid-Market Fit: Most PE-owned companies operate in the mid-market, which gives AI startups shorter sales cycles and stronger alignment with cost-focused buyers.

Portfolio Deployment: A PE firm owning 25 companies can validate an AI tool in one or two businesses, then roll it out across the entire portfolio. Control enables fast scaling and efficient cross-sell.

✈️ KEY TAKEAWAYS

Private equity portfolios now represent a major distribution channel for AI startups. The combination of large controlled buyer networks, strong incentives to improve margins, and faster mid-market sales cycles creates a GTM path that bypasses the friction of traditional enterprise selling.

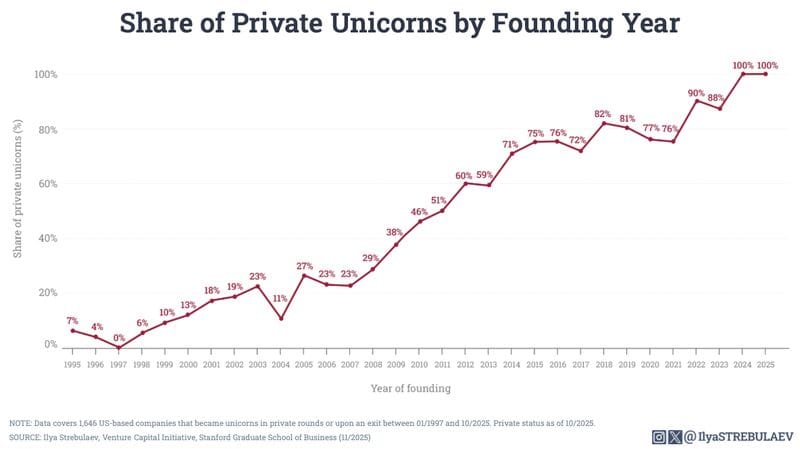

Ilya Strebulaev analyzes how long unicorns remain private and shows that many companies delay exits far longer than expected. The data indicates how private capital availability and market conditions shape the timeline from founding to IPO or acquisition.

2011 Cohort at 51 Percent: Half of the unicorns founded in 2011 are still private, demonstrating that even mature companies often stay outside the public markets for more than a decade.

2021 Cohort at 77 Percent: For the 2021 vintage, 77 percent of unicorns remain private, which reflects the slow path to liquidity for more recent high-growth companies.

Twenty-Year-Old Unicorns at 27 Percent: Even among companies founded in 2004, 27 percent have yet to exit. The data shows that private capital allows some firms to postpone going public indefinitely.

✈️ KEY TAKEAWAYS

A significant share of unicorns remain private for many years. Liquidity in private markets enables companies across multiple founding years to delay traditional exits, making the public markets less central to a startup’s long-term trajectory.

Join our free Slack group as we automate our VC job end-to-end with AI. Live experiment. Full transparency.

The GTM Skills Companies Will Prioritize in 2026

This article by Maja Voje outlines five GTM capabilities expected to be most valuable in 2026 based on hiring patterns and interviews with GTM leaders. The author highlights how technical workflows, creativity, experimentation, human connection, and operational range are becoming core differentiators.

GTM Engineering Growth: The article notes a 205% year-over-year increase in GTM engineer roles and points to rising demand for people who can build technical outbound systems such as signal-based automation, webhook flows, and AI-driven workflows.

Brand Differentiation Pressure: The author explains how AI saturation makes brand, design, and positioning significantly more important and argues that unique creative expression will be a key competitive advantage as AI-generated content becomes more uniform.

End-to-End Operators: The analysis describes a shift toward specialists who can own full funnels, from email execution to concept validation, and emphasizes the importance of being able to ship independently without large teams.

✈️ KEY TAKEAWAYS

Companies are preparing for a more technical, creative, and self-sufficient GTM environment. Skills that blend engineering literacy, brand differentiation, rapid experimentation, strong relationships, and end-to-end ownership are becoming core expectations for high-performing GTM teams.

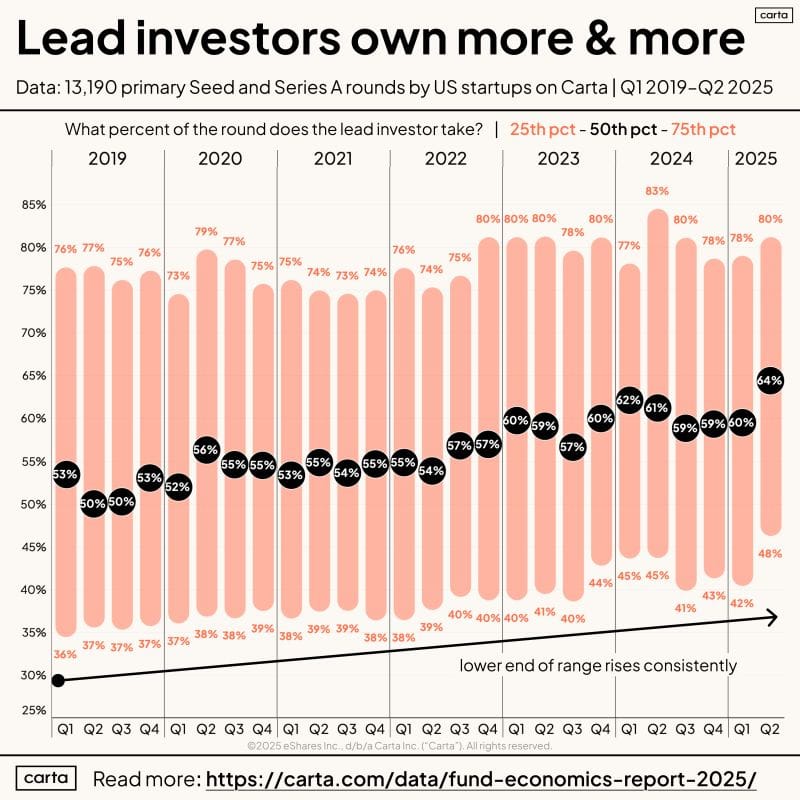

Who Else Is Investing? Why the Most Annoying VC Question Still Matters

Peter Walker examines why founders dislike being asked who else is investing, and why the question still plays an important role in early-stage fundraising. The article explains how cap table composition, lead investor dynamics, and shifting market conditions shape this tension.

Fewer Leads in the Market: The number of funds actually leading Seed or Series A rounds on Carta has declined, even though more funds participate in those rounds overall. This makes identifying the lead more consequential for everyone involved.

Leads Taking 75 Percent of Rounds: Lead investors are now taking a larger share of the total round size. Small check investors depend heavily on knowing which fund or GP is absorbing most of that allocation.

Signal Risk in Follow-On Funding: Questions about whether a lead can support pro rata or lead a future round matter for both founders and smaller investors. The absence of continued support sends a strong signal about a company’s trajectory.

✈️ KEY TAKEAWAYS

The article argues that while the question can frustrate founders, knowing the identity and strength of the lead investor is a rational concern. With fewer leads and higher concentration in rounds, the dynamics around who else is investing have become more strategically important for startups and investors alike.

Thanks to Lea Winkler for her help with this post.

Stay driven,

Andre

PS: Access the list of 2500+ LP contacts via LIMITEDPARTNERLIST.COM