👋 Hi, I’m Andre and welcome to my newsletter Data Driven VC which is all about becoming a better investor with Data & AI. ICYMI, check out some of our most read episodes:

Brought to you by Affinity - Private Capital Predictions

The private capital industry is navigating its most challenging environment in over a decade. Unpredictable IPO windows, selective M&A activity, and valuation pressures are extending holding periods while LPs demand liquidity and fundraising becomes increasingly difficult.

Join leaders from Northwestern Mutual, Armira and Crunchbase for Affinity’s 2026 Private Capital Predictions webinar on Dec 11 to explore how firms are adapting sourcing strategies, managing portfolio performance, and using AI as a key value driver to thrive in 2026.

👋🏻 Welcome to our monthly wrap-up episode where we cover November’s most relevant content at the intersection of startups, VC, data & AI👇

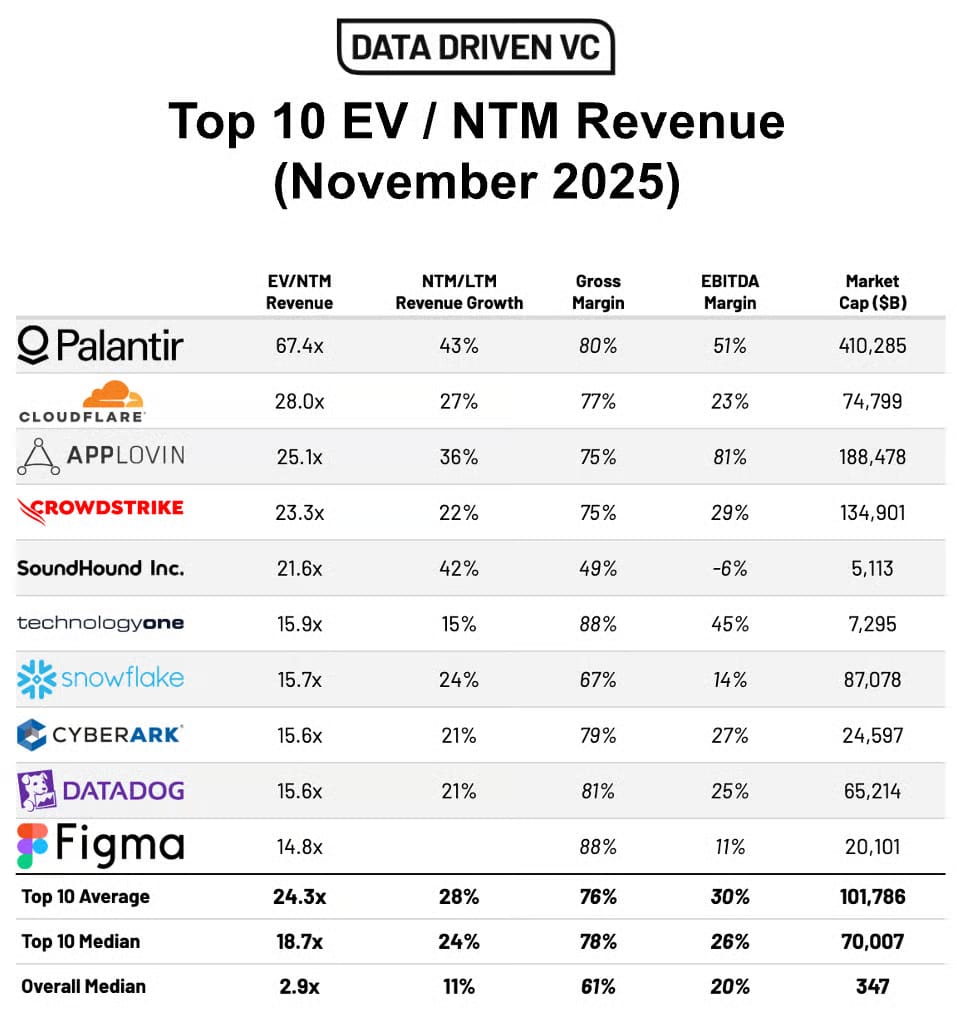

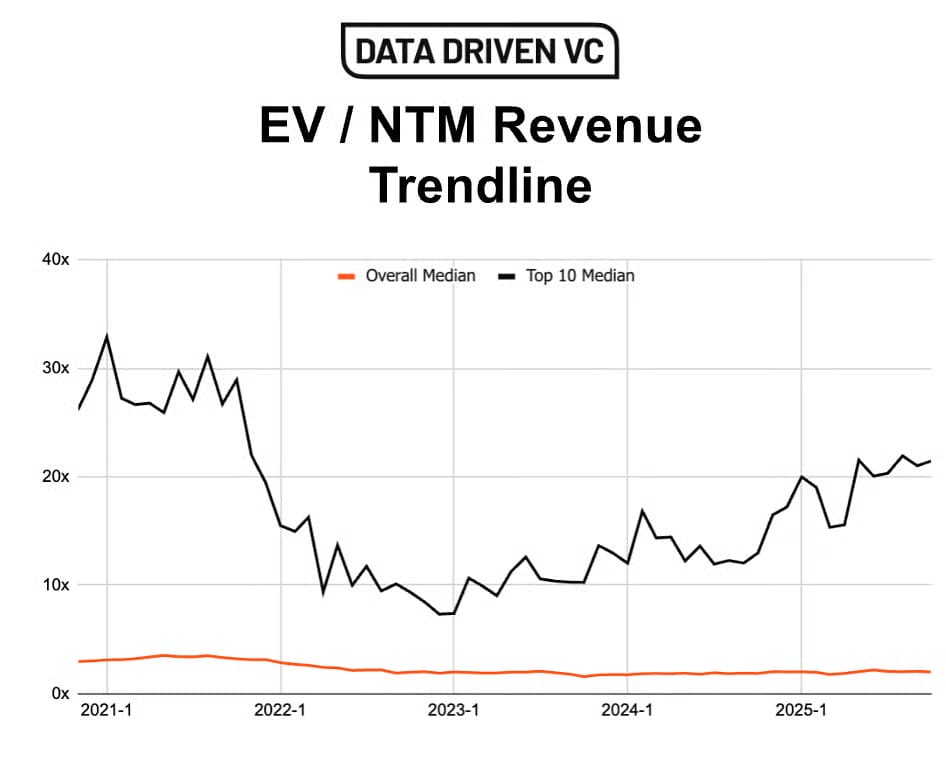

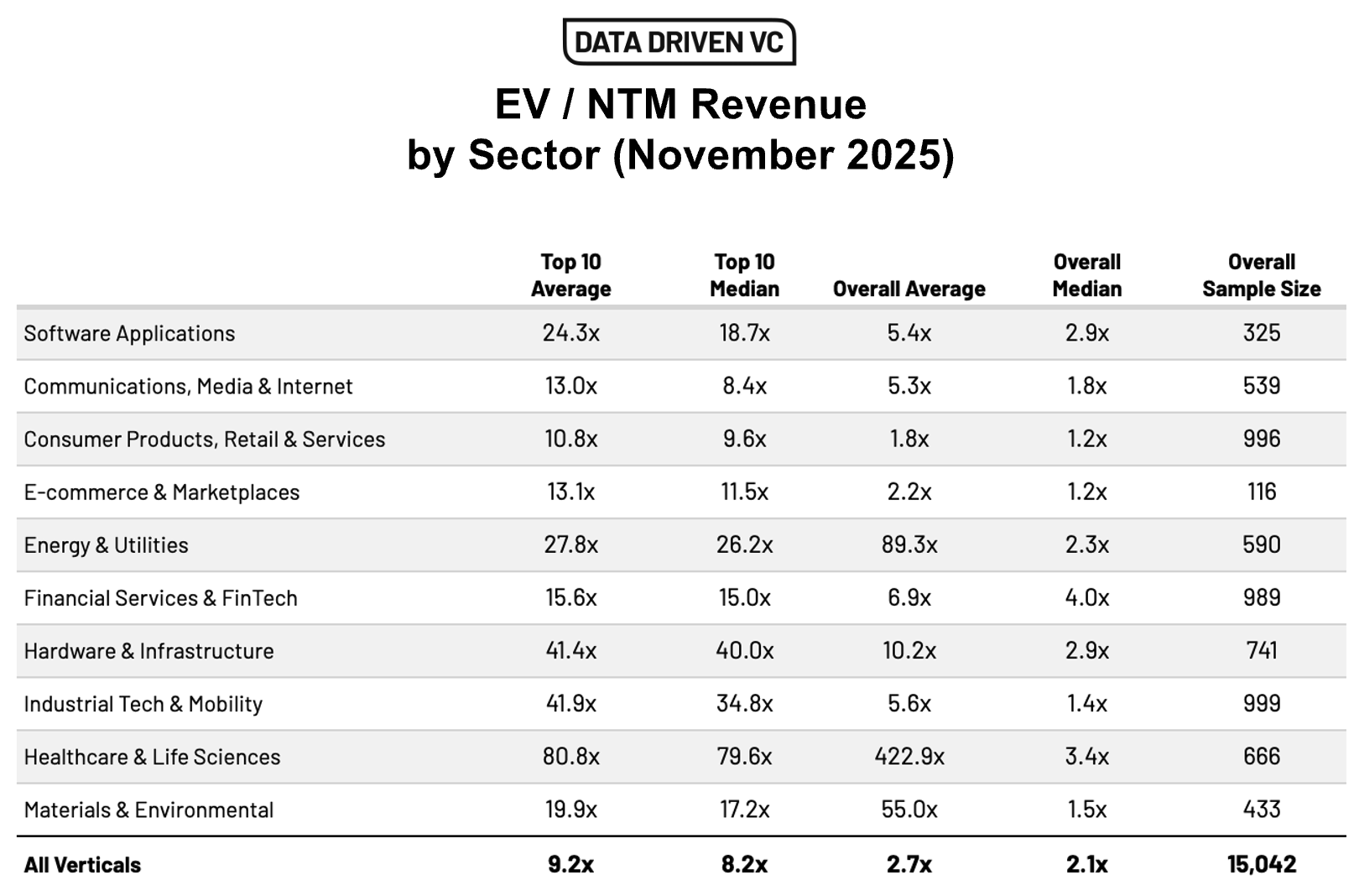

MULTIPLES SNAPSHOT📸

Here’s the state of the market in three simple charts. Full episode with all tables and deep dives here.

INTERESTING RESEARCH & REPORTS📈

Kyle Poyar analyzed data from 6,525 software companies in ChartMogul’s SaaS benchmark report to uncover what separates the 3.5% of startups that grow to $20M ARR from the rest. The surprising finding: success is less about how companies start and more about how they improve over time.

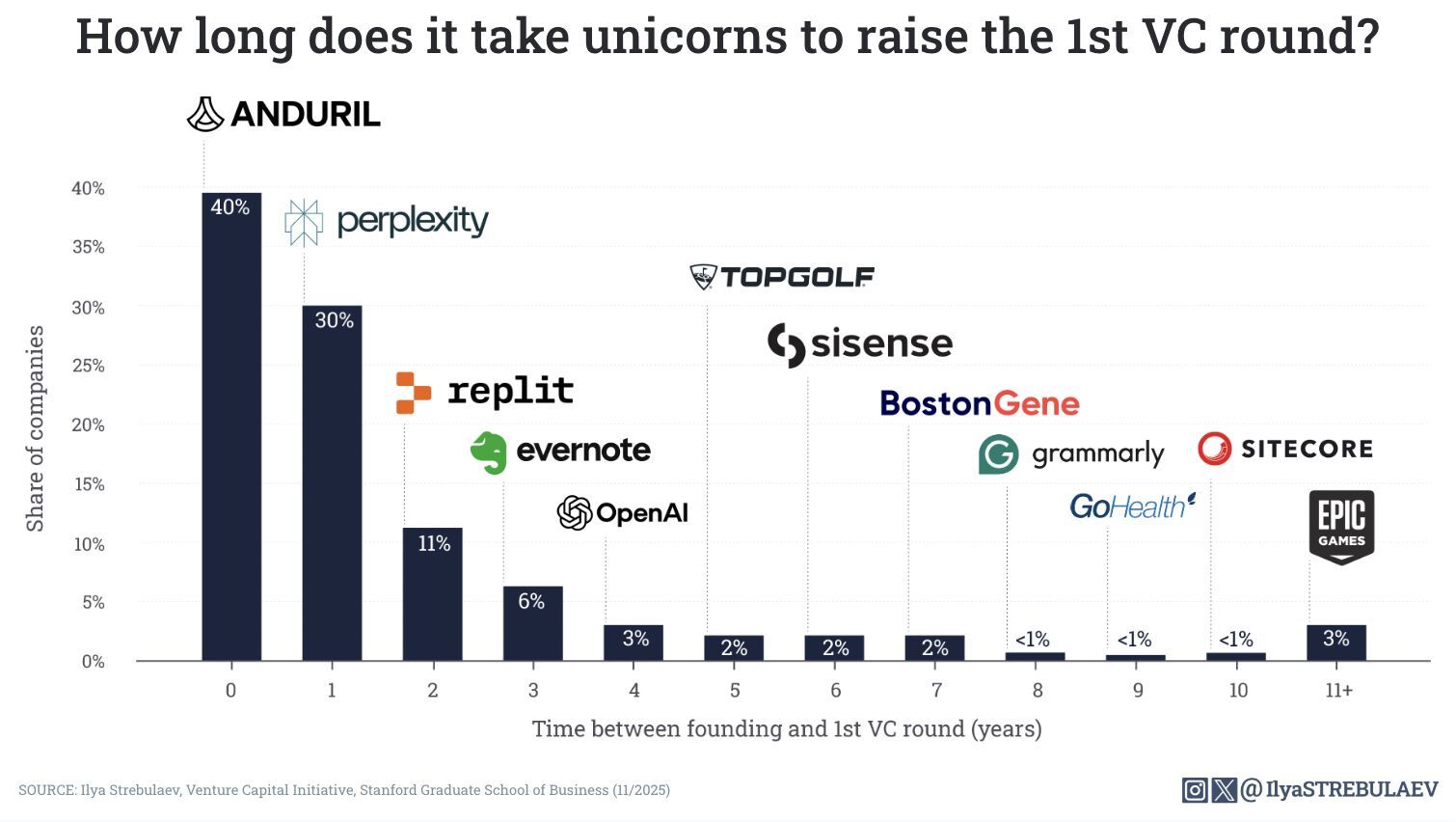

Stanford’s new research of unicorn funding timelines reveals that 70% of companies that achieve unicorn status secure their first VC round within one year of founding, with 40% raising capital in Year 0 (founding year) and 30% in Year 1, demonstrating that raising quickly is the dominant path and suggesting that for the majority of unicorns, there is no prolonged bootstrapping phase.

Nevertheless, the data includes a "long tail" of highly successful companies, such as Replit (Year 2), OpenAI (Year 4), Grammarly (Year 8), and Waymo (Year 11+), which waited several years before taking institutional capital. Despite covering an expanded dataset, the overall distribution remains remarkably stable, confirming that the vast majority of future unicorns are funded within 24 months.

INSPIRING TECH IN VC CONTENT💡

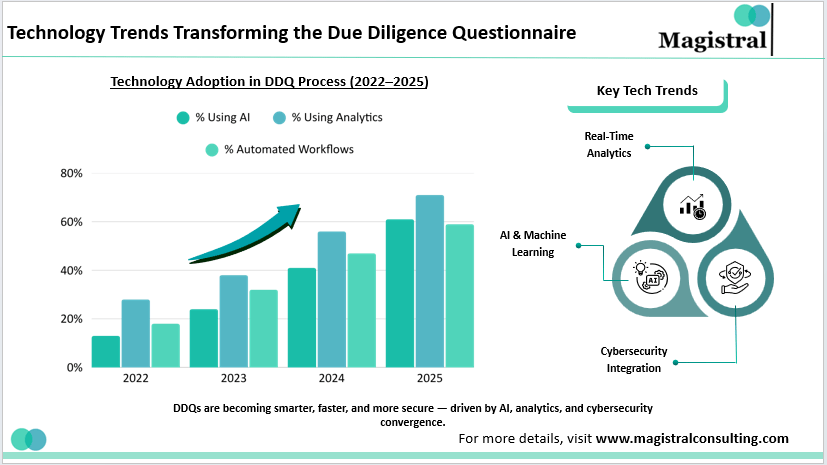

The article details specific GenAI tools such as AlphaSense, Fiscal, Hebbiar, and more - all designed for investor DD processes with features such as Generative Search (to extract insights from premium content) and Generative Grid (to organize and summarize findings from multiple documents into a table format)

The author discusses the transformation of the DD process through AI and analytics platforms, explaining how they automate the review of due diligence questionnaires (DDQs), score risk, and identify inconsistencies to expedite the process.

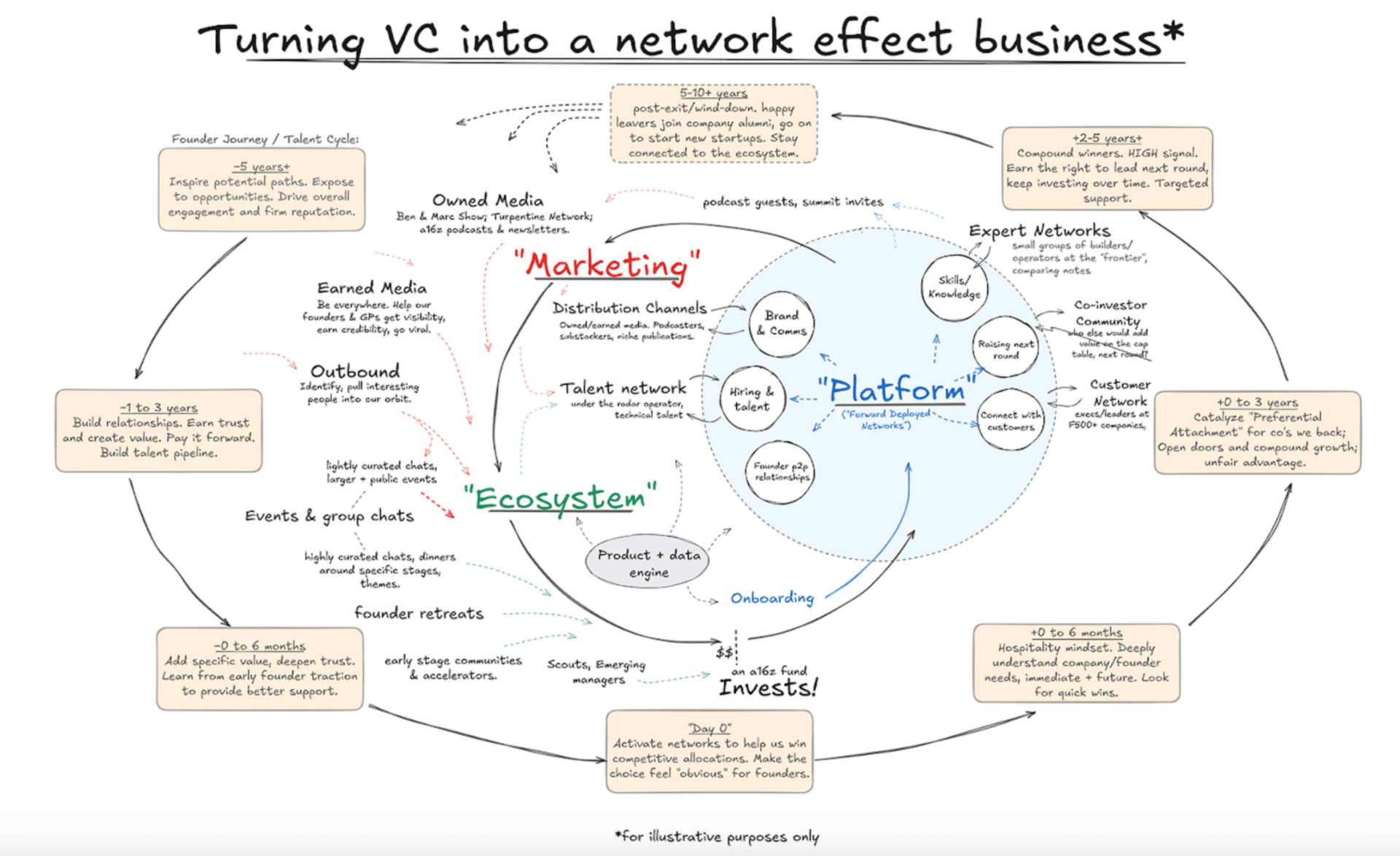

a16z’s new media strategy is a central component of their platform model, aiming to establish the firm as the indispensable authority and ecosystem builder for the tech industry, not just a capital provider.

They nicely visualized the strategy in a compounding feedback loop centered on content creation and ecosystem building designed to establish the firm as the dominant thought leader and talent magnet in tech. The cycle works as follows:

1) Create High-Signal Content: The in-house "New Media" team produces daily, high-quality content (podcasts, blogs, social posts) to shape the narrative and provide value to the tech community.

2) Attract Talent and Founders: This valuable content draws top-tier founders, operators, and high-signal talent to the a16z ecosystem, establishing trust and legitimacy.

3) Drive Portfolio Success (Momentum): The firm then uses this content and media expertise—including "Forward Deployed New Media" embedded with portfolio companies—to execute "timeline takeovers" and secure maximum branding and launch momentum for its investments.

4) Generate New Stories and Deal Flow: The success of the portfolio companies (the wins, new insights, and industry trends) creates the raw material for the next generation of content, which reinforces the firm's authority and attracts more new talent and deal flow, restarting and accelerating the flywheel.

Most importantly, at the center of this flywheel, there’s a unified data layer.

RESOURCES OVERVIEW🛠️

✅ Evaluating startups with ChatGPT

✅ VC Co-Pilot for deal sourcing

✅ Top 10 Prompts for startup sourcing

✅ Top 10 Prompts for startup screening & due diligence

✅ Top 10 Prompts for deal winning & closing

✅ List of 312 family offices

✅ List of 59 pension funds

✅ List of 1513 angel investors

✅ List of 997 accelerators

Access these and more resources like our 50+ masterclasses, automation templates, Notion templates, copilots, and more via our community platform “The Lab”.

“TECH IN VC” JOBS👩💻

🔥Unique chance to join our growing Engineering team at Earlybird:

Senior Typescript Engineer @Earlybird in Berlin here

Other open positions:

Analytics Engineer @Dawn Capital in London here

Senior Data Engineer @Dawn Capital in London here

Fullstack Software Eng @Equation Cap in Munich here

Senior Data Engineer @Growth Equity Firm in the Bay Area here

Engineering Fellow @Pear VC in Austin here

AI Lead @USV in NYC here

Data & Reporting Manager @VSquared in Munich here

If you’re recruiting tech in VC jobs, just hit reply with the URL to your job posting and we’ll include it in our next monthly wrap-up episode + share via VCSTACK.COM

THIS MONTH’S DATA DRIVEN VC EPISODES⏮️

Essays

Insights (from the data)

Resources

Stay driven,

Andre