👋 Hi, I’m Andre and welcome to my newsletter Data Driven VC which is all about becoming a better investor with Data & AI.

Two highlights for the upcoming week:

Join our live webinar with Atomico, Bain Capital Ventures, and Vestberry this Wednesday to learn how top investors leverage AI for portfolio insights and value creation

Get 20% discount across all our paid subscriptions until Friday night

Welcome to another edition of our Sunday “Resources” stream where we share our most valuable data & resources across four rotating formats:

For 1. and 3., we collaborate with best-in-class partners to ensure you get the highest quality data. For 2. and 4., we leverage our ever-growing product portfolio and share selective snapshots of the most sought-after resources from The Lab.

At the end of this post, you’ll find a unique deep dive on “how to predict startup success with publicly available data” with researchers, product, and data leads from Columbia University, Crunchbase, ex-Greycroft and ex-Balderton.

RESOURCES OVERVIEW🛠️

✅ Evaluating startups with ChatGPT

✅ VC Co-Pilot for deal sourcing

✅ Top 10 Prompts for startup sourcing

✅ Top 10 Prompts for startup screening & due diligence

✅ Top 10 Prompts for deal winning & closing

✅ List of 312 family offices

✅ List of 59 pension funds

✅ List of 1513 angel investors

✅ List of 997 accelerators

Access these and more resources like our 50+ masterclasses, automation templates, Notion templates, copilots, and more via our Annual and Premium subscriptions to The Lab. Get 20% discount across all our subscriptions until Friday night!

What I read this week🤓

78% of you liked this format two weeks ago (thank y’all for participating in the poll!), so I’m happy to continue! Here’s a summary of the best content that I consumed in the previous week…

1) Carta shows that ‘hot deals’ are more likely to raise follow-on funding

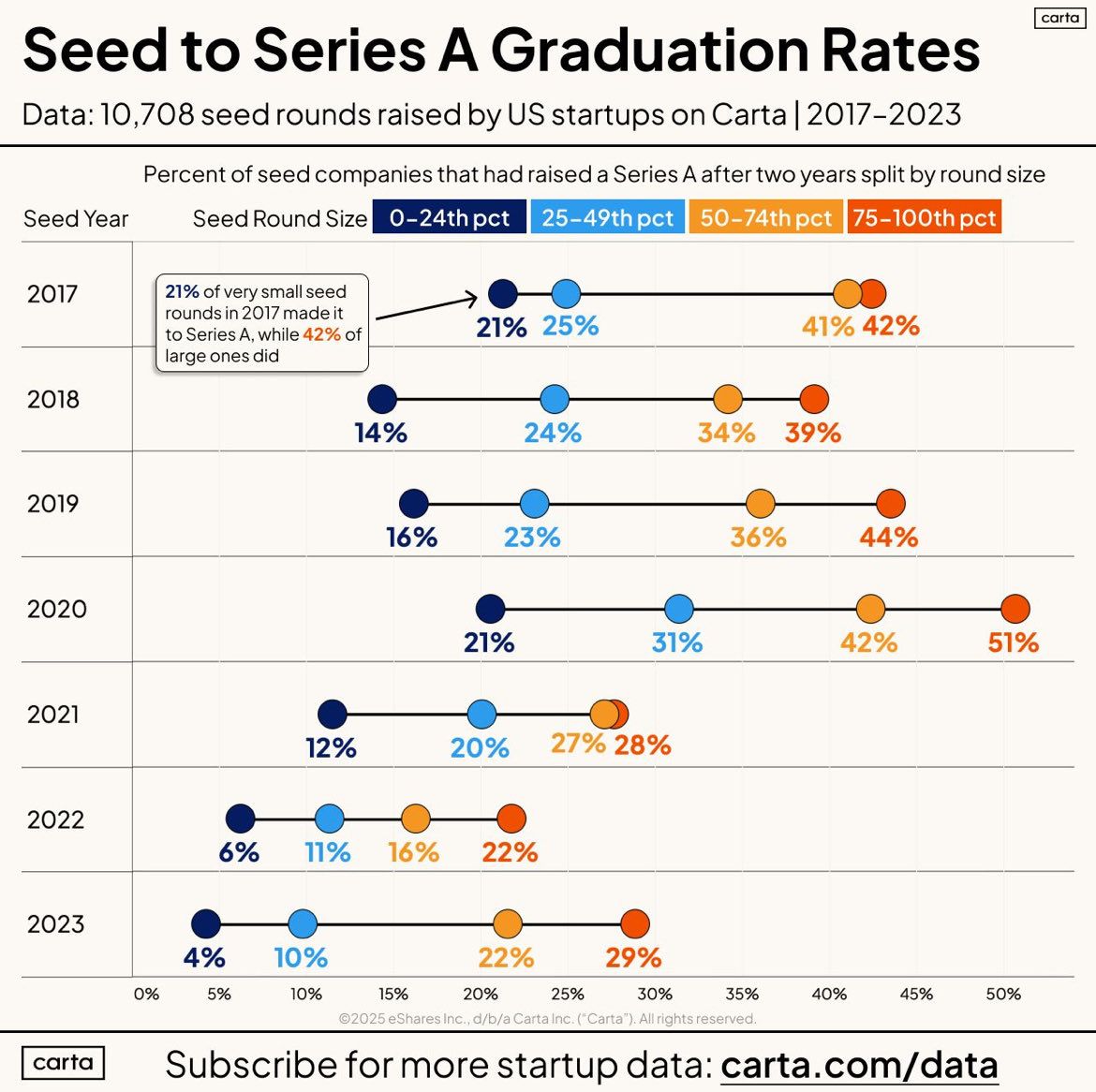

Peter Walker published an analysis showing that companies with large Seed rounds (=75-100 percentile) are twice more likely to raise a Series A than their peers with small Seed rounds (=0-25 percentile), i.e. 42% conversion versus 21%, respectively

Are Sam Lessings words for Seed VCs who are on the outlook for category defining founders - or in his words “patients that present with a very specific set of delusions that result in them wanting to start companies.” Analyze their world view and incentives & then kick some of them over the edge with capital.

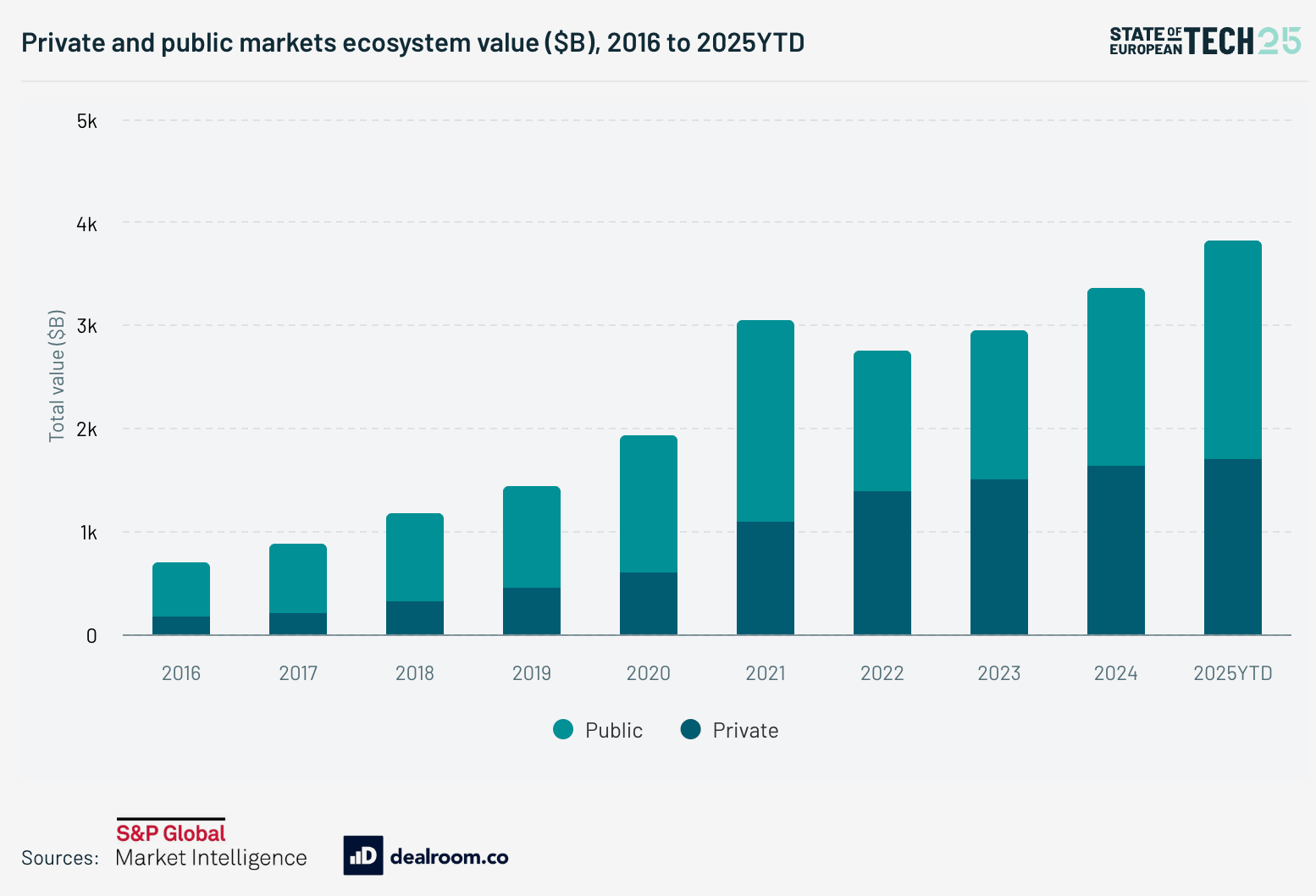

3) Atomico’s annual “State of European Tech Report 2025”

If you don’t have time for 282 pages, here’s the TL;DR: Despite continued growth of private and public markets, strong talent, growing venture activity, and rising optimism, structural barriers - from regulatory fragmentation and limited exit opportunities to brain drain, low risk tolerance, and widening gender gaps - continue to hinder Europe’s ability to compete on eye-level with the US and China. To become a true tech powerhouse, we must modernize our ‘operating system’, embrace bold innovation, and create conditions that keep founders and scaleups on the continent

4) Google launched Gemini 3 models across Search, Gemini, Vertex, and the new agent-centric Antigravity IDE

They set state-of-the-art results on major benchmarks, while confirming a strategic shift to TPU-only training that gives Google a major compute advantage. Alongside this, Google introduced Antigravity for multi-agent development and released Nano Banana Pro, a faster, higher-quality 4K image-generation system powered by optimized TPU processing

5) The beginning of the AI platform war is here

AI model performance is converging, shifting the real competition from raw benchmarks to platform strategy, where distribution, integrations, and ecosystem control become the defining advantages. Google, OpenAI, Anthropic, and Meta are each executing distinct platform plays - bundling AI into operating systems, building superapps, owning trusted enterprise APIs, or open-sourcing the model layer - marking the true beginning of the AI platform wars

Predicting startup success with data

I’m excited to share the recording from one of the most watched recordings in our platform The Lab from a panel with Columbia Professor Sandra Matz, Crunchbase CPO Megh Gautam, and Francesco Corea who was previously with Greycroft and Balderton.

Watch if you want to learn:

Why merging Crunchbase, LinkedIn, X, etc. data is painful but important

How founder and team personality can be inferred from social data

How investors model success via near-term fundraising milestones

Which feature clusters matter most: team, product, market, funding

How biased proxies (e.g., pedigree) become self-fulfilling in models

Different ways to define “startup success” in your algorithms

… and a lot more

Here’s the link to the full panel discussion👇

Subscribe to our premium content to read the rest.

Become a paying subscriber to get access to this post and other resources from the exclusive Data Driven VC community.

UpgradeA subscription gets you:

- Lists of 312 Family Offices + 59 Pension funds + 1513 angels

- Annual ticket for the virtual DDVC Summit

- Access our archive of 300+ articles

- 1 new premium article per week

- Virtual & physical meetups

- Masterclasses & videos

- Access to AI Copilots

- Prompt Database

- ... and lots more