👋 Hi, I’m Andre and welcome to my newsletter Data Driven VC which is all about becoming a better investor with Data & AI. ICYMI, check out some of our most read episodes:

Brought to you by FORESIGHT - The End-to-End Data Platform for Investors

You had the best intentions when you bought all those data sources like Crunchbase, Dealroom, Pitchbook, and Harmonic. You thought everything gets logged with that powerful CRM called Affinity. You wanted to connect it all to ChatGPT and start asking questions.

But then you realized that you’re missing the middle layer between your data and your LLM that connects the data siloes, eliminates the duplicates, and normalizes the data swamp.

This is why you need an “entity resolution” data infrastructure, aka the glue. But do you build it or buy it?

Welcome to another Data Driven VC “Insights” episode where we cover the most interesting research & reports about startups and VC from the past week.

How Lovable and Cursor Turn Their Entire Team Into a Branding and Distribution System

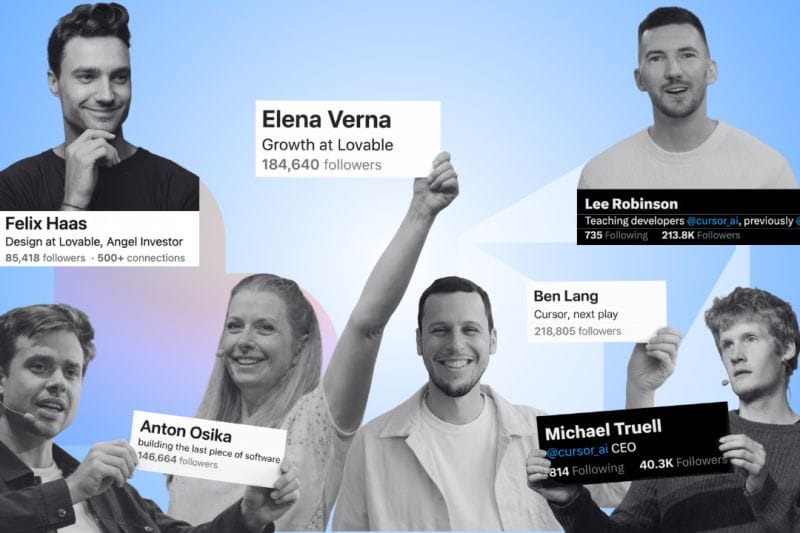

The post by Robin Lopes highlights how companies like Lovable and Cursor are approaching social distribution by design, not by accident. Instead of relying only on founders, they build teams where multiple operators actively create content and attract demand.

Founders Plus 5+ Operator Voices: Both Lovable and Cursor feature visible founders alongside operators across growth, product, design, dev education, and community. The author points to individuals like Anton Osika, Elena Verna, and Felix Haas at Lovable, and Michael T., Ben Lang, and Lee Robinson around Cursor as examples of this layered presence.

Every Hire as a New Distribution Surface: By hiring operators with existing audiences, each new team member becomes an additional content node. This creates multiple sources of trust and discovery rather than a single centralized brand voice.

Demand Generated Across Multiple Platforms: With posts coming from different roles and perspectives, awareness and demand emerge from many corners of the internet. Distribution shifts from a single channel strategy to a coordinated team-wide motion.

✈️ KEY TAKEAWAYS

The article reframes social media from a founder-led activity into an organizational capability. Startups that intentionally hire and empower operators with distribution can compound reach, credibility, and demand far faster than those relying on one or two visible voices.

What 2025 Data Reveals About Raising VC Funding in 2026

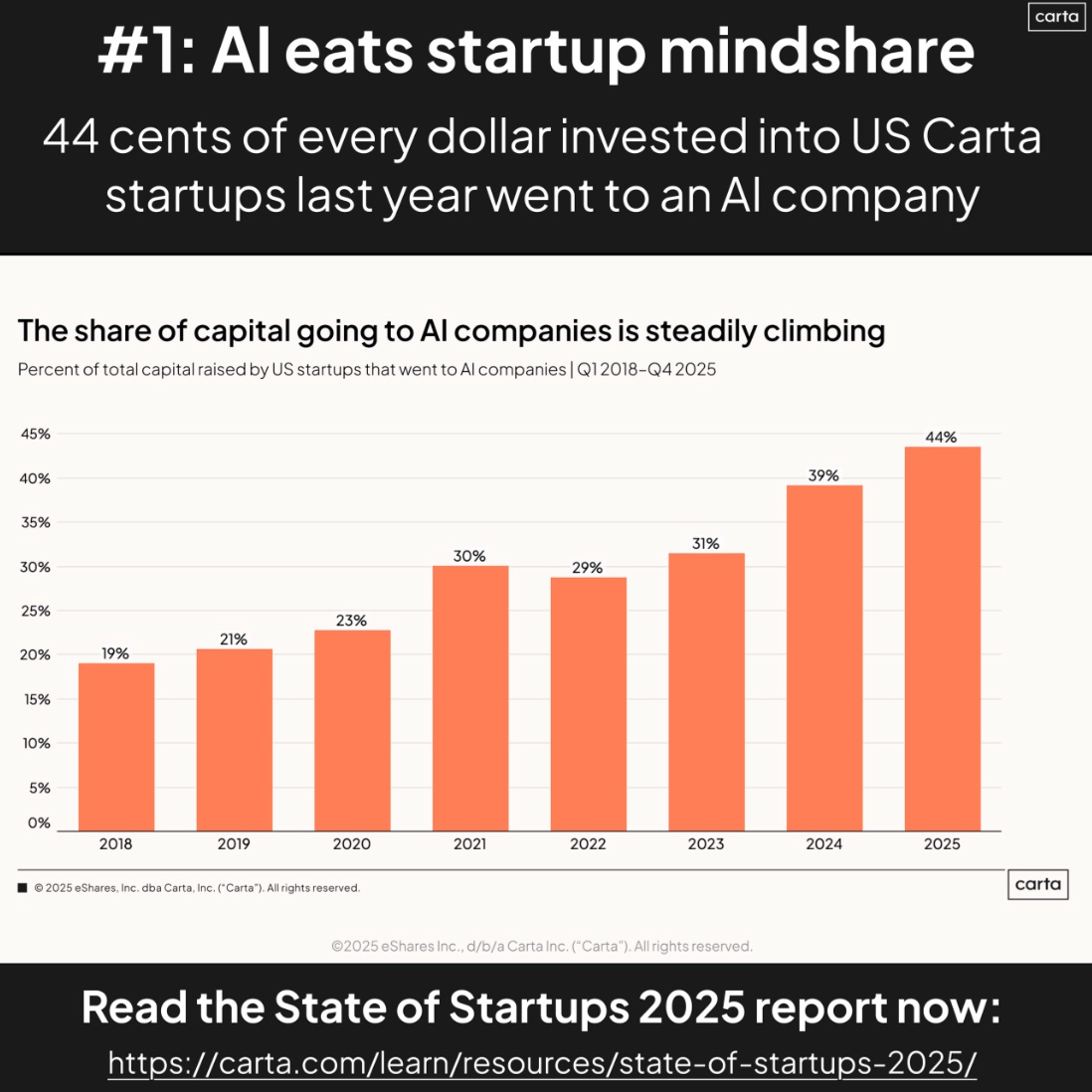

Peter Walker summarizes key findings from Carta data to explain how venture fundraising dynamics shifted in 2025 and what founders should expect heading into 2026. The analysis focuses on concentration of capital, valuation dispersion, and structural advantages tied to AI and geography.

44% of Capital Going to AI Startups: Peter notes that 44% of capital invested into startups went to AI companies, making AI the dominant investment theme. For software companies without an AI angle, the default investor question has shifted toward why AI is not part of the product or roadmap.

More Capital Deployed but Fewer Funded Companies: Early-stage investment dollars increased overall, but the number of companies receiving funding declined. VCs concentrated capital into fewer bets they had high conviction in, often at higher prices, leading to a more selective funding environment.

2.6% Unicorn Rate and a Widening Valuation Gap: An analysis of 5,700 seed rounds from 2016 to 2020 shows that only 2.6% ever reached a $1B valuation, with significantly higher success rates for companies in the top 25% of seed valuations. The gap between median valuations and the top 5% has never been wider, and top-end valuations are heavily concentrated in SF compared to other markets.

✈️ KEY TAKEAWAYS

The data points to a funding market where capital is abundant but increasingly concentrated around AI-native companies, top-tier valuations, and specific geographies. Founders raising in 2026 should expect sharper differentiation, more scrutiny, and outcomes that diverge quickly between the top of the market and everyone else.

Upgrade your subscription to access our premium content & join the Data Driven VC community

What It Means to Build a GTM Engine That Pulls Growth

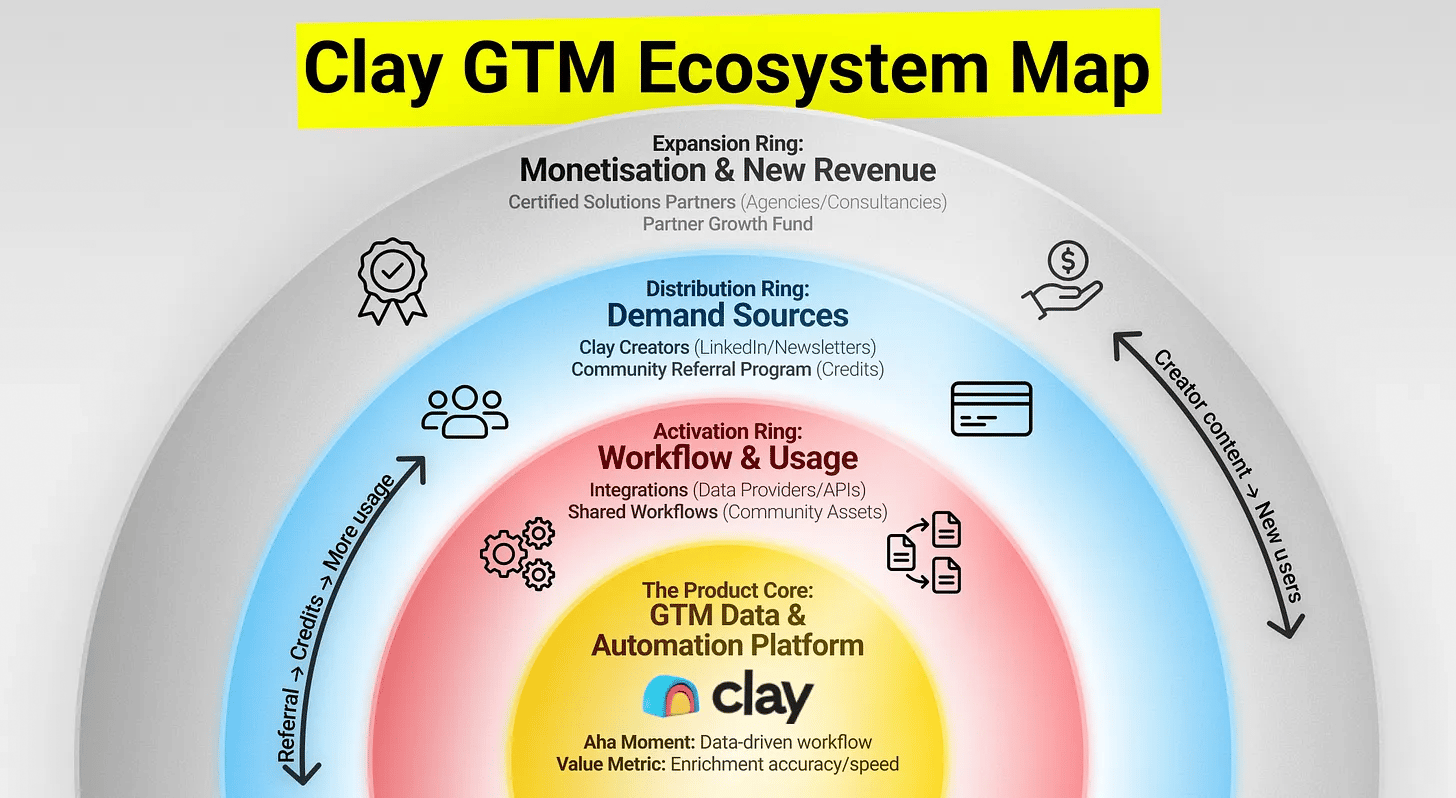

In a recent blog post, Maja Voje argues that the fastest-growing AI-native companies are not scaling through more campaigns or headcount, but by designing GTM ecosystems embedded into their business models. Using examples like Clay, Lovable, and Cursor, she reframes GTM as a system of aligned external actors rather than a set of tactics.

$100M+ ARR Growth Driven by External Actors: The author highlights companies such as Clay at $100M ARR and Lovable reaching $200M ARR in eight months to show how growth increasingly comes from creators, partners, platforms, and communities. The core idea is that leverage comes from aligning incentives so others create and distribute value alongside the product.

4-Part GTM Ecosystem Model Across the Customer Journey: The framework breaks GTM into four layers: product core, activation ring, distribution ring, and expansion ring, connected by compounding growth loops. Each layer maps to specific roles like usage, demand creation, and monetization, positioning GTM as a system tied to business model design rather than marketing execution.

150+ Integrations and a 30K Community Powering Clay: Clay is used as a concrete example, with over 150 integrations, AI agents like Claygent and Sculptor, a 30K+ community, global events, and solution partners driving adoption and expansion. The ecosystem extends into agencies, educators, and partners that monetize services and data through the platform itself.

✈️ KEY TAKEAWAYS

The article reframes GTM from a linear funnel into a compounding ecosystem where growth is pulled by aligned stakeholders. Companies that embed distribution, activation, and monetization into their product and partner networks can scale faster and more defensibly than those relying on traditional GTM motions alone.

Equity Benchmark for First Team Members and Advisors

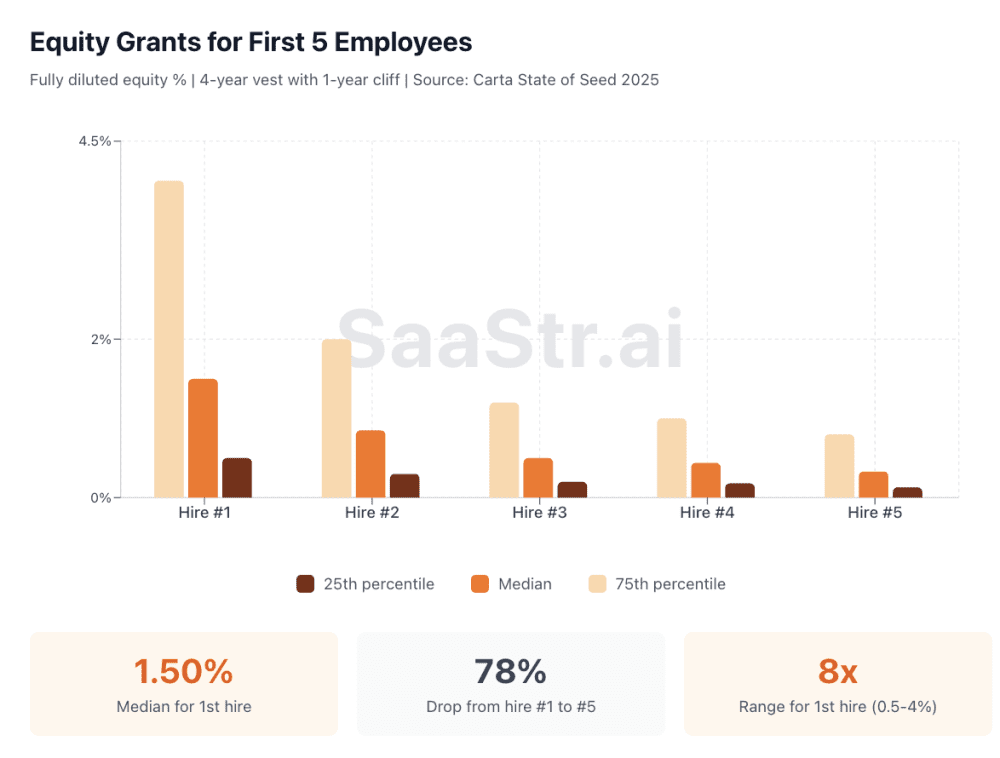

The article by Jason Lemkin (SaaStr) breaks down equity benchmarks for early hires and advisors using data from tens of thousands of startups. It focuses on how quickly equity grants decline with each hire and where founders commonly over-allocate.

1.50% Median Equity for Hire #1: The data shows the first non-founder hire receives a median of 1.50% fully diluted equity, with a wide range from 0.50% at the 25th percentile to 4.00% at the 75th percentile. Lemkin highlights that this role carries the most risk and is treated very differently from subsequent hires.

0.33% Median Equity by Hire #5: Equity drops sharply after the first hire, falling to 0.85% for hire #2 and below 1% by hire #3. By the fifth hire, the median grant is 0.33%, roughly one fifth of what the first employee receives.

0.12% Median Equity for Seed Advisors: Advisor equity is far lower than many founders expect, with a median of 0.12% at seed and only the top 10% exceeding 0.5%. The article argues that grants above 1% are rare and should be reserved for advisors delivering outsized, tangible value.

✈️ KEY TAKEAWAYS

The data shows that equity allocation follows a steep curve, with the first hire commanding a disproportionate share and advisors receiving far less than anecdotal norms suggest. Founders who align grants with market benchmarks preserve flexibility for future senior hires while still remaining competitive early on.

Join our free Slack group as we automate our VC job end-to-end with AI. Live experiment. Full transparency.

The New B2B CMO & GTM Playbook

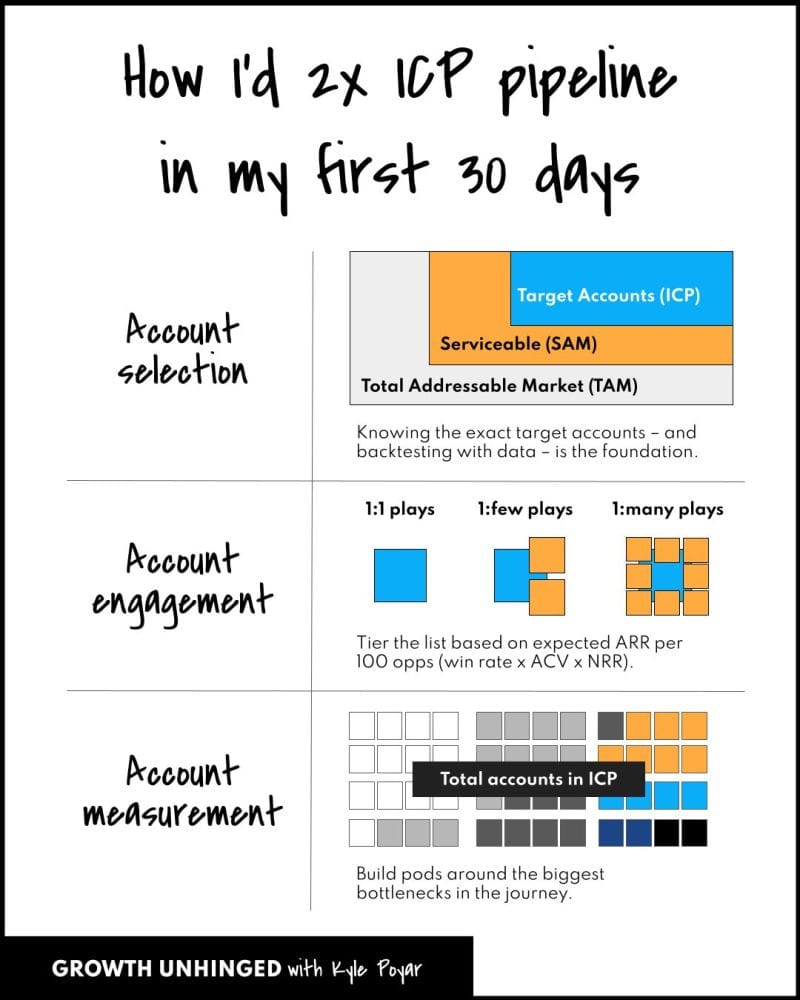

Kyle Poyar outlines a hypothetical 30-day plan for a new CMO joining a $10M ARR B2B company, with the explicit goal of doubling ICP pipeline heading into 2026. He focuses on tight ICP definition, rapid experimentation, and early alignment with sales to surface bottlenecks fast.

$10M ARR and 18-Month Deal Analysis: The plan starts by defining every ICP account using qualitative input from sales and CS, combined with an analysis of all won and lost deals from the past 18 months. Expected ARR per 100 opportunities is calculated using win rate, ACV, NRR, and volume, then enriched with industry, company size, geo, tech stack, and hiring signals.

1,000 ICP Accounts Mapped to Buying Stages:

Kyle Poyar proposes mapping all ICP accounts across awareness, interest, and consideration stages using behavioral signals like site visits, ad engagement, demos, trials, and pipeline status. This makes gaps visible, such as how many accounts are unidentified, unengaged, or stuck before reaching sales.10+ Tests in Week One Around the Biggest Bottleneck: Once the main constraint is identified, a dedicated pod is formed to run more than 10 experiments in the first week. Variables include account signals, messaging, channels, offers, and personalization depth, with early focus on converting aware or interested accounts into pipeline through tactics like warm outbound and personalized LinkedIn video.

✈️ KEY TAKEAWAYS

The plan emphasizes speed, focus, and leverage by narrowing in on best-fit accounts, quantifying where revenue friction exists, and attacking the biggest constraint with aggressive testing. By grounding strategy in data and early execution, the approach aims to earn credibility quickly while creating momentum across marketing and sales.

Why Profitability Alone Is Not Enough in SaaS

Jason Lemkin from SaaStr argues that reaching profitability is an important milestone, but not a long-term strategy in today’s SaaS market. Using public market data and company examples, it shows how growth rate, not margins, is the primary driver of valuation.

44% vs 8% Growth Equals a 4.3x Multiple Gap: Public SaaS data shows that companies growing around 44% trade at roughly 4.3x higher multiples than those growing closer to 8%. Jason Lemkin frames this as the difference between mid-range outcomes and multi-billion-dollar outcomes on the same ARR base.

$500M ARR at 2x vs 25x for High-Growth Peers: PagerDuty and SEMrush are used as case studies of profitable companies with slowing growth, trading at roughly 2x to 4x ARR despite strong margins and scale. In contrast, high-growth peers trade near 25x ARR with average market caps around $100B.

NRR Falling from 107% to 100% Over 5 Quarters: A five-quarter decline in NRR from 107% to 100% is highlighted as the inflection point where compounding breaks. At 100% NRR, all growth must come from new logos, increasing costs and limiting upside.

✈️ KEY TAKEAWAYS

The article makes the case that efficiency is a prerequisite, not the end goal, and that sustained valuation upside comes from reaccelerating growth. Companies that stop investing once they reach profitability risk trading durable businesses for permanently lower outcomes in a market that continues to reward growth above all else.

Thanks to Lea Winkler for her help with this post.

Stay driven,

Andre

PS: If you want to automate your investor job, make sure to join our free Slack community here