👋 Hi, I’m Andre and welcome to my newsletter Data Driven VC which is all about becoming a better investor with Data & AI.

📣Half of our SUPER EARLY BIRD tickets for the Virtual DDVC Summit 23-25 March are taken, secure your seat at 33% discount now to learn how leading firms leverage Claude Code, OpenClaw, n8n, Codex & more to automate their investment work

Brought to you by Kruncher - The AI Platform for Private Market Investors

Kruncher AI powers the entire deal lifecycle with intelligent data that drives better decisions with:

Automated deal screening with 10× more data points and 90% less noise

Auto-generated company reports featuring 300+ configurable signals

Investment memos created in under 2 hours instead of 3 days

Continuous monitoring of the growth and KPIs of your watchlist and portfolio companies

All of this in a single source of truth

Welcome to another Data Driven VC “Insights” episode where we cover the most interesting research & reports about startups and VC from the past week.

How Investors Break Down Startup Risk per Stage

The VC Corner breaks down how investors evaluate startups as bundles of risk rather than linear growth stories. Using the Onion Theory popularized by Andy Rachleff and Marc Andreessen, Ruben Dominguez explains how valuation, fundraising, and execution all hinge on systematically removing uncertainty.

Five Core Risk Layers: The framework outlines five investor risk buckets: People, Product, Market, Economic, and Contextual risk. Each layer represents a category investors expect founders to de-risk with concrete evidence over time.

Risk Removal Drives Valuation Math: Investors implicitly discount valuation based on unresolved risk. As layers are peeled through proof like retention data, unit economics, or compliance milestones, the perceived discount rate drops and pricing improves.

Capital Maps to Risk Retirement by Stage: Seed capital is used to prove team and product viability, Series A focuses on PMF signals, and later rounds target scalability and predictability. The article shows how strong founders align each round to retiring specific layers.

✈️ KEY TAKEAWAYS

The Onion Theory reframes startups as risk-reduction engines where progress, valuation, and fundraising are all functions of how efficiently uncertainty is converted into evidence across clearly defined layers.

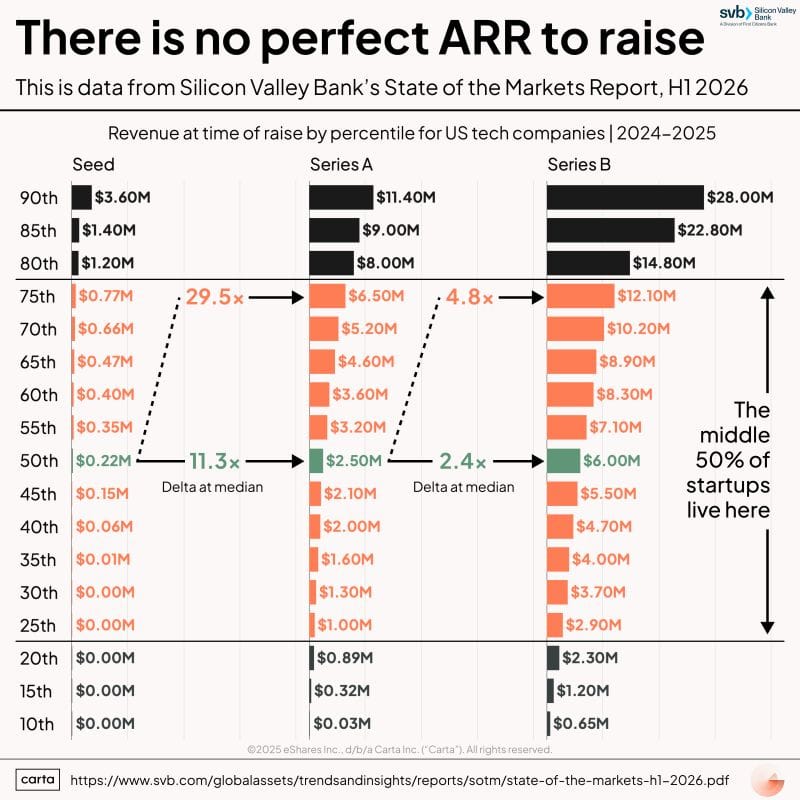

How Much ARR You Need to Raise in 2026

This post from Peter Walker summarizes new SVB data showing how widely revenue levels vary when companies raise seed rounds. Walker uses percentile and median comparisons to explain why ARR benchmarks are a poor predictor of fundraising outcomes.

$0.0M to $3.6M ARR at Seed: The data shows seed rounds closing anywhere from zero revenue to roughly $3.6M ARR. A meaningful share of seed financings still happen with marginal or no revenue, particularly among AI-first companies.

11.3x Median Jump From Seed to Series A: Median revenue increases by 11.3x between seed and Series A, then slows significantly from A to B. This highlights where investors expect the biggest execution leap to occur.

29.5x Jump From Median Seed to Top-Quartile Series A: Reaching top-quartile Series A revenue requires nearly a 30x increase from median seed levels. The post notes this acceleration point is moving earlier, making round-to-round catching up harder.

✈️ KEY TAKEAWAYS

The SVB data reinforces that there is no single ARR threshold for raising a seed round, and that extreme revenue outcomes get attention because they are outliers, not because they represent the typical fundraising path.

Why Repeat Founders Outperform

In this article, Ruben analyzes why founders with prior startup experience tend to outperform first-timers across fundraising, hiring, and long-term outcomes. Drawing on academic research and real-world examples, the piece explains how experience rewires decision-making rather than guaranteeing success.

21% vs 30% Success Rates by Founder Experience: The article highlights Harvard Business School data showing first-time founders succeed about 21% of the time, previously unsuccessful founders about 22%, and previously successful founders around 30%. That gap illustrates how experience materially shifts outcomes, even in a high-failure environment.

Faster Fundraising and Higher Capital Access: Dominguez explains how second-time founders are perceived as lower risk, which shortens time-to-funding and improves access to capital. Prior wins or even prior failures act as credibility signals that influence investor behavior early.

From 3 to 10,000+ Customers in 6 Years: Case studies like HubSpot and Meraki to Samsara show how repeat founders apply sharper GTM instincts, better hiring judgment, and cleaner execution to scale faster. The article emphasizes distribution focus and operational discipline as repeatable advantages.

✈️ KEY TAKEAWAYS

Second-time founders outperform not because of status, but because experience improves pattern recognition, speed, and prioritization. The data suggests that learning how to make decisions under uncertainty is one of the strongest compounding advantages in startups.

Free-to-Paid Conversion Benchmarks in 2026

In a Growth Unhinged analysis, Kyle Poyar reviews new benchmark data on free-to-paid conversion across 200 B2B software products. Partnering with ChartMogul and ProductLed, the article examines how trial types, credit card requirements, and AI-era cost dynamics shape conversion outcomes.

200 Products, 8% Median Conversion: The study covers 200 products surveyed in January 2026, with a median free-to-paid conversion rate of 8%. The distribution is wide, with a 10x gap between the top and bottom quintiles, showing that averages rarely reflect reality.

57% Free Trials vs 26% Freemium: Free trials are the dominant entry model, used by 57% of products, compared to 26% using freemium and 7% reverse trials. The most common trial length is 14 days, and 20% of trials require a credit card upfront.

30% Conversion With Credit Card Trials: Free trials that require a credit card convert at roughly 30%, more than 5x higher than trials without one. When signup rates are factored in, freemium and free trials produce similar numbers of paying customers, while credit-card trials generate the highest yield per visitor.

✈️ KEY TAKEAWAYS

The data shows there is no universally optimal free model, only tradeoffs between adoption and conversion. Teams need to align trials, freemium access, and friction with where users reach value and what free usage actually costs.

Join 800+ investors in our free Slack group as we automate our VC job end-to-end with AI. Live experiment. Full transparency.

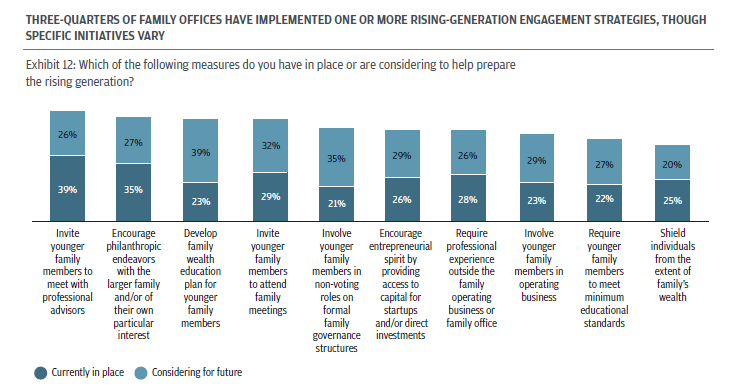

How Family Offices Manage Generational Transition

Mr Family Office summarizes findings from the JP Morgan Global Family Office Report 2026 on how family offices are preparing rising generations for future responsibility. The data highlights broad adoption of engagement strategies, but with meaningful variation in how deeply families involve younger members.

75% Have at Least One Rising-Gen Strategy: The report shows that roughly three-quarters of family offices have implemented or are considering at least one initiative to prepare the next generation. Adoption is widespread, but no single approach dominates across respondents.

39% Focus on Wealth Education Plans: Developing formal wealth education programs for younger family members is one of the most common strategies, cited by 39% of respondents. This reflects a preference for structured financial literacy over informal learning.

26% to 35% Use Governance and Advisor Exposure: Between 26% and 35% of family offices involve younger members through advisor meetings, family meetings, or non-voting governance roles. These mechanisms aim to build familiarity with decision-making without transferring control too early.

✈️ KEY TAKEAWAYS

Family offices are clearly prioritizing next-generation readiness, but approaches vary widely in formality and depth. The data suggests a shift toward education and exposure first, with governance and capital access layered in more selectively.

Hold or Sell After IPO?

A recent paper published in the Strategic Entrepreneurship Journal analyzes why VC firms retain equity after a portfolio company goes public instead of exiting immediately. The article reframes post-IPO ownership as a strategic choice shaped by uncertainty and private information rather than just signaling or liquidity needs.

One-Year and Two-Year Post-IPO Holding Patterns: Using data from 777 VC–venture pairs, the study shows that a significant share of VCs still hold equity one year after lockup expiration, and many continue holding for up to two years.

26 Industries and Market-Level Uncertainty Measures: The authors measure uncertainty using stock market volatility across 26 industries, finding that higher industry uncertainty increases the likelihood that VCs delay exit.

Patent Applications and Positive Market Surprises: VCs are more likely to retain equity when ventures have more pending patent applications and when industries experience positive return surprises, both proxies for positive private information.

✈️ KEY TAKEAWAYS

The article argues that post-IPO VC exit decisions are driven by the option value of waiting, especially when uncertainty is high and VCs believe the market has not yet fully priced in a venture’s upside.

Thanks to Lea Winkler for her help with this post.

Stay driven,

Andre

PS: Reserve your seat for our Virtual DDVC Summit 2026 where 30+ expert speakers will share their workflows, tool stacks, and discuss the latest insights about AI for VC