💥Where to Start a Company, When Founders Should Quit, How Much $$ It Takes to Build a Unicorn, ROI & AI Adoption Across Industries & More

Digesting Insights From the Data

👋 Hi, I’m Andre and welcome to my newsletter Data Driven VC which is all about becoming a better investor with Data & AI. Join 34,920 thought leaders from VCs like a16z, Accel, Index, Sequoia, and more to understand how startup investing becomes more data-driven, why it matters, and what it means for you.

ICYMI, check out our most read episodes:

Join our exclusive DDVC community breakfast 30th September in Munich that we co-host together with our friends at HSBC Innovation Banking - just one day after our Investor Summit at Bits & Pretzels on 29th September with 1500+ GPs & 300+ LPs.

When Should Founders Quit? Carta Data on Early-Stage Survival

Peter Walker from Carta analyzed 12,731 startups that last raised a Seed or Series A round. The data shows how many are still active on Carta, depending on when they last raised, raising questions about how long founders should push before reassessing.

2025 – 2023 Still on Track: Startups that raised between 2023 and 2025 remain largely active, with more than 500 companies per quarter still live on Carta.

2022 Entering Uncertainty: For companies that last raised in 2022, 3.5 years have now passed. Survival numbers are still solid, but questions arise on whether new capital or a pivot is overdue.

2021 and Earlier, Stagnation Risk: By 2021, 1,276 companies are technically still alive, but many have been waiting 4.5 years or longer since their last raise. From 2020 and before, survival falls to a few hundred companies per year, with many likely stuck or failing quietly.

✈️ KEY TAKEAWAYS

The data suggests that if startups have not found traction or raised again within 3–4 years, their chances of breaking out decline sharply. Persistence is important, but founders may need to distinguish between real progress and being stuck in place.

How Much Capital Does It Take to Build a Unicorn?

An analysis by Ilya Strebulaev of unicorn funding patterns shows how much equity capital companies typically raise before surpassing the $1B valuation threshold. The data highlights both the median journey and the outliers that require extraordinary levels of investment.

Average and Median Funding: Unicorns raise an average of $340M and a median of $250M before their unicorn round, showing most need substantial funding to reach scale.

Most Common Range: The largest cluster is in the $200–300M range, with 367 companies, including Peloton. Another 347 companies, such as Snap, fall into the $100–200M bracket.

Big Outliers: 54 companies raised more than $1B before hitting unicorn status. Examples include Kabbage and Relay Therapeutics, compared with only 186 companies that achieved the mark with under $100M.

✈️ KEY TAKEAWAYS

The path to unicorn status typically requires hundreds of millions in equity funding, with $200–300M as the most common range. A minority of companies achieve it with less than $100M, while a smaller but notable group needs $1B+ to cross the threshold.

Global Ecosystem Analysis

Startup Genome’s Global Startup Ecosystem Report 2025 covers data from over 5 million startups across 350+ ecosystems. It highlights a 31% global decline in Ecosystem Value alongside a sharp rise in AI as the defining force of the next decade.

Top Ecosystems and Shifts: Silicon Valley, New York, and London remain the top three, while Beijing, Los Angeles, and Tokyo are among the few with positive growth. Paris rose to #12 with a 7% increase in $50M+ exits.

AI’s Growing Dominance: AI and Big Data now attract 40% of VC investment, up from 26% in 2021. While 90% of funding is concentrated in the US and China, cities like Paris, Delhi, Istanbul, and San Diego have more than doubled their AI-native startup count since 2021.

Emerging Hubs to Watch: Wuxi climbed to #1 among emerging ecosystems, Jakarta reached #2, and Istanbul jumped 10 places to #3. Other notable movers include Nanjing, Phoenix, Riyadh, and Las Vegas.

✈️ KEY TAKEAWAYS

Global startup ecosystems are under pressure, but AI is fueling a redistribution of innovation. Established hubs like Silicon Valley and NY retain their lead, yet rapid growth in emerging ecosystems suggests a more diversified future for global entrepreneurship.

Equity Grants Are Getting Shorter & Benchmarks Can Be Misleading

Recent data by Matt Schulmann shows that equity vesting durations have shifted significantly over the past five years, making 4-year grants no longer the universal standard. Companies relying on benchmarks without adjusting for grant length risk skewed comparisons and inflated stock-based compensation.

New Hire Grants: Private companies increased average new hire grants from 3.2 to 4.0 years between 2020 and 2025. Public companies, in contrast, shortened them from 3.4 to 3.0 years.

Ongoing Grants: Private company refresh grants remained steady for around 3.5 years. Public companies dropped from 3.6 to 2.9 years over the same period.

Key Benchmarking Risk: Mixing 2, 3, and 4-year grants in one benchmark sample can distort total grant size comparisons. Annualized benchmarks are a more accurate basis for designing equity programs.

✈️ KEY TAKEAWAYS

Equity grant durations vary widely across markets, with public companies leaning shorter and private new hire grants stabilizing at 4 years. To avoid misaligned compensation plans, companies should benchmark on an annualized basis rather than total grant size.

AI Adoption Trends in Reality

Ramp’s AI Index (Summer 2025), as reported by Jackie DiMonte, tracks paid subscriptions to AI models, platforms, and tools across sectors. While adoption is accelerating, the data shows significant variation between industries.

Technology Leads, But Not Fully: 70% of technology companies pay for AI tools, leaving 30% still outside the wave despite being the sector most directly aligned with AI.

Finance and Manufacturing Rising: Finance follows at 57%. Manufacturing doubled adoption within a year, reaching 41%. This can be seen as evidence of AI moving into more traditional industries.

Lagging Sectors: Retail stands at 33%, healthcare at 29%, construction at 26%, and accommodation/food services at just 21%. These areas present the biggest gap and the strongest future growth opportunities.

✈️ KEY TAKEAWAYS

AI adoption is uneven. Technology and finance are leading, but sectors like construction, healthcare, and services are still far behind. With unstructured data and efficiency gains on the table, these lagging industries may represent the next wave of AI-driven transformation.

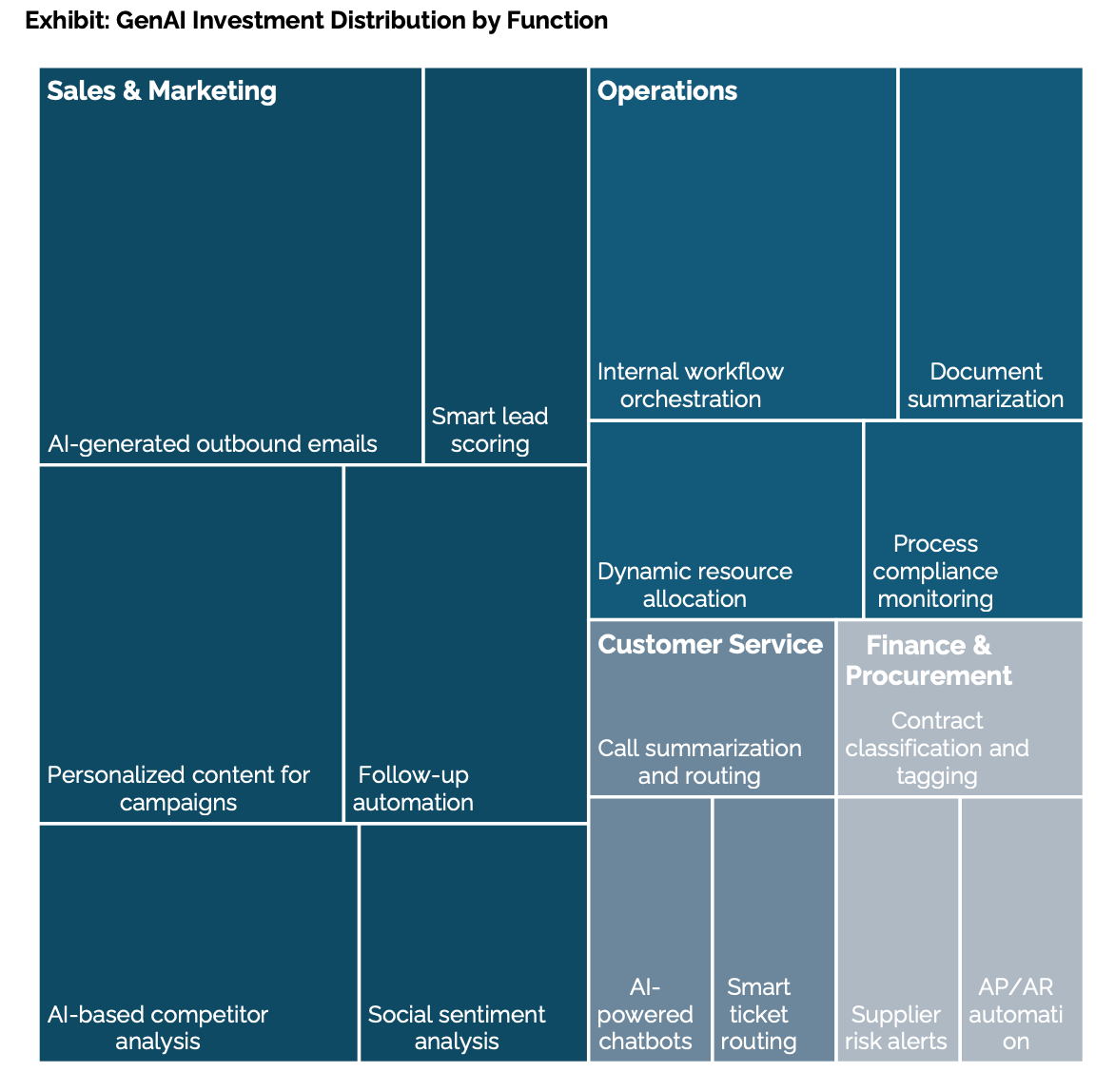

Beyond Adoption, Who Sees ROI From AI?

MIT’s NANDA initiative delivers a sobering analysis of enterprise GenAI pilots through 150 executive interviews, a survey of 350 employees, and an assessment of 300 real-world deployments. The findings expose a stark divide between hype and impact: only 5 % of pilots achieve rapid revenue gains, while the vast majority fail to make a measurable dent in P&L.

Caveat: The criteria for success in the report are quite strict, so take it with a grain of salt.

Targeted Execution Wins: Startups and enterprises that succeed do so by picking one strategic pain point and executing precisely—in partnership with vendors who can tailor solutions to their workflows.

Budget Misalignments: Despite over half of GenAI budgets directed at sales and marketing, the highest ROI is found in back-office automation—streamlining operations, reducing outsourcing, and cutting agency costs.

Buy Over Build Pays Off: Deployments using external vendor tools succeed approximately 67 % of the time, while internally built systems succeed at only about a third of the rate. Nonetheless, many regulated-sector firms still attempt in-house builds, often with disappointing results.

✈️ KEY TAKEAWAYS

Enterprise AI success depends less on model quality and more on integration, focus, and adoption strategy. The highest returns come from automation and vendor partnerships, while most internal builds and broad pilots fail to deliver measurable business impact.

Thanks to Jérôme Jaggi for his help with this post.

Stay driven,

Andre

Thank you for reading this episode. If you enjoyed it, leave a like or comment, and share it with your friends. If you don’t like it, you can always update your preferences to reduce the frequency and focus on your preferred DDVC formats. Join our community below and follow me on LinkedIn or Twitter to never miss data-driven VC updates again.