👋 Hi, I’m Andre and welcome to my newsletter Data Driven VC which is all about becoming a better investor with Data & AI.

📣 Secure one of the last 33% discounted SUPER EARLY BIRD tickets for our Virtual DDVC Summit 23-25th March here to learn how leading investment firms transform their operations with alternative data, AI, and automation

Welcome to another Data Driven VC “Insights” episode where we cover the most interesting research & reports about startups and VC from the past week.

Pricing in the Era of AI Is About Outcomes, Not Access

Bessemer Venture Partners outline how AI monetization differs fundamentally from SaaS because inference and support costs create real COGS, forcing pricing to align tightly with delivered value. It presents a framework of models, charge metrics, and operational disciplines that help founders design scalable, value-based pricing.

50-60% vs. 80-90% Gross Margins: AI businesses operate with materially lower gross margins due to compute and human-in-the-loop costs, which makes early unit economics and value-based pricing non-negotiable.

3 AI Models and 3 Core Charge Metrics: Copilots lean toward seat or consumption pricing, Agents toward ROI or outcome pricing, and AI-enabled services toward per-output models, while the main charge metrics span consumption, workflow, and outcome with increasing value alignment and cost risk.

$0.99 per Resolution and Hybrid Pricing Formulas: Outcome pricing examples like per-ticket resolution and hybrid structures such as platform fees plus outcome credits show how companies balance predictable revenue with expansion upside.

✈️ KEY TAKEAWAYS

AI pricing is becoming a strategic product and GTM decision where companies that tie monetization to measurable work, enforce early unit-economics discipline, and use hybrid models to manage cost variability are best positioned to capture long-term value.

Wealth Advisers Rewrite the Playbook: Global Diversification, AI and Private Markets

MSCI Wealth published their Wealth Trends 2026: How Advisers Are Repositioning for a Volatile World report, surveying 250 wealth management professionals across the Americas, Europe and Asia on how they are navigating geopolitical instability, AI disruption and shifting client expectations.

86% Report Heightened Client Concern Over Global Uncertainty: Wealth managers say their clients are deeply worried about tariffs and geopolitical risk, with most advisers indicating high concern levels being far more likely to decrease U.S. equity allocations. Only 31% expect to increase U.S. equity exposure, compared to 61% planning to increase allocations to developed non-U.S. markets and 48% to emerging markets.

95% Plan to Increase AI Investment, Yet 44% Believe Wealth Lags Broader Industry: Nearly all firms plan to boost AI spending over the next three years, and 68% view AI as vital to competitiveness. However, wealth managers see their segment behind other financial services in adoption, with top AI priorities centering on portfolio management, proposal generation, risk management and due diligence rather than client-facing applications.

71% Expect to Increase Private and Alternative Allocations, 83% Say Private Assets Are Now Essential: Private credit, private equity, digital assets and other alternatives are expected to see the largest allocation growth. A 15% allocation to private assets may increase expected returns by 40 basis points annually while maintaining similar risk levels. ETFs are simultaneously surging (73% expect them to become more common) as advisers pair liquid instruments with illiquid long-term holdings.

✈️ KEY TAKEAWAYS

Wealth managers are structurally rotating away from U.S. equities into private markets and global diversification, creating strong tailwinds for startups building private market access platforms and AI-powered portfolio tools. With 98% of new HNW portfolios now customized yet 44% citing fragmented data as the key AI bottleneck, the biggest opportunity sits in infrastructure that makes scalable personalization actually work.

Join 900+ investors in our free Slack group as we automate our VC job end-to-end with AI. Live experiment. Full transparency.

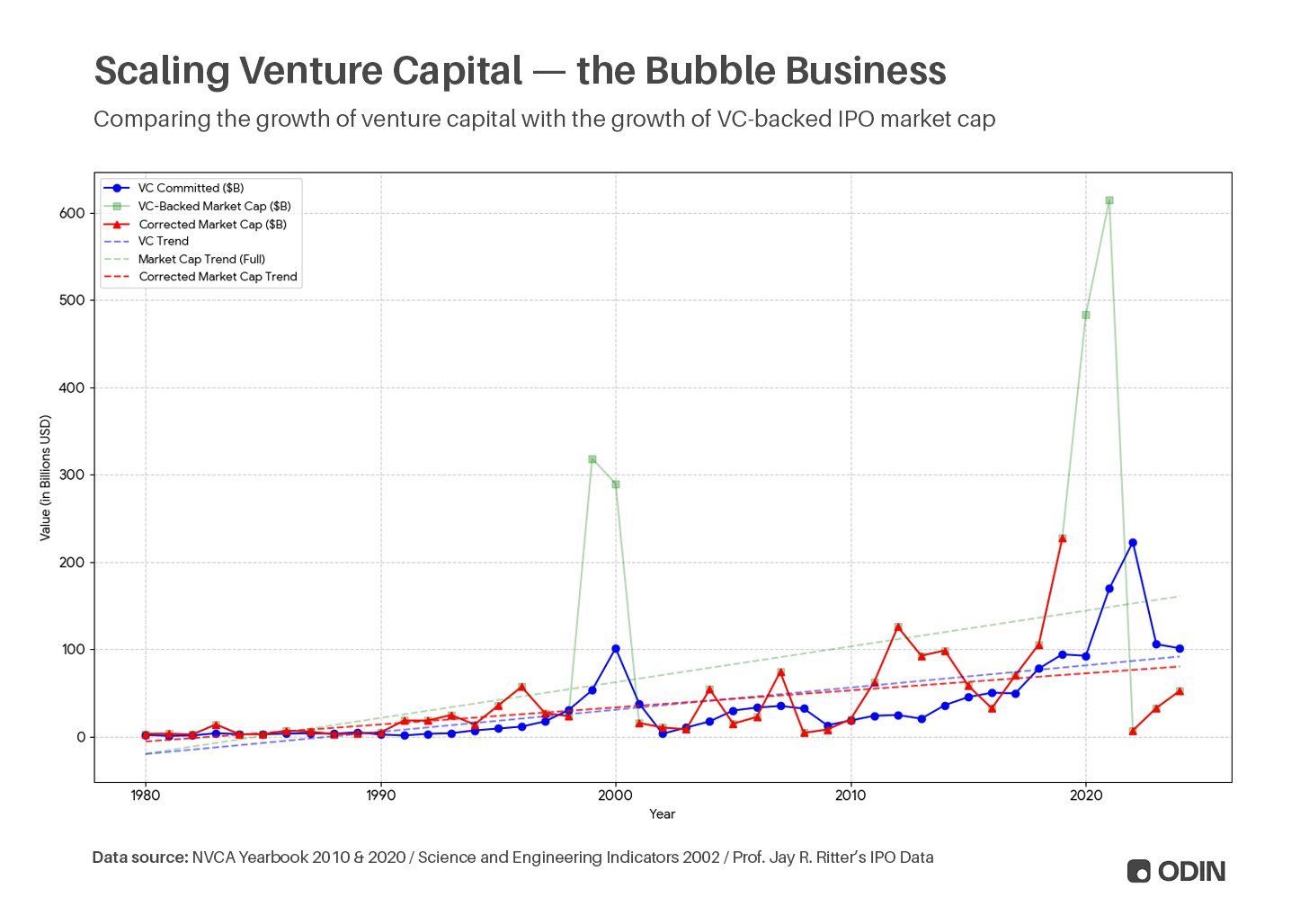

Can Venture Capital Scale?

Dan Gray from Odin argues in a sharp X thread that the VC industry's scaling problem is not about deploying more capital but about fixing the interface between capital and talent, getting companies public sooner, and properly capitalizing innovation economy-wide.

VC allocation has grown significantly relative to the market cap of venture-backed IPOs, but whether the industry is outgrowing its opportunity set hinges entirely on four anomalous years: 1999/00 and 2020/21. Both periods generated massive liquidity but ended in disaster, and both are unlikely to repeat due to post-Enron regulation and the unique conditions of pandemic-era zero rates. Excluding those years, the trend suggests VC may already be oversized relative to its exit capacity.

The real scaling opportunity is at the base, not the top: expanding the network of independent managers to surface more novel companies, then getting them public around year 8 instead of year 15. Trading public market growth for extended private timelines is actively degrading company health. Private capital is expensive, incentives misalign with long-term value creation, and companies that IPO sooner show better growth, stronger profitability, lower risk at listing, and superior long-run returns.

Scaled VC funds face a math problem (larger multiples get harder), scaled VC firms face a systematic problem (consensus decision-making, market distortion, distance from founders), but the deeper question is whether VC as an asset class is properly sized relative to actual innovation output. The goal should not be inflating venture capital or IPO market caps but increasing the total proper capitalization of innovation, public and private combined.

✈️ KEY TAKEAWAYS

The strongest structural opportunity is in early-stage infrastructure that widens the funnel: tools enabling distributed independent managers to source, evaluate, and support companies more efficiently, paired with platforms that make the path to public markets shorter and healthier. Think GP enablement, not more megafunds.

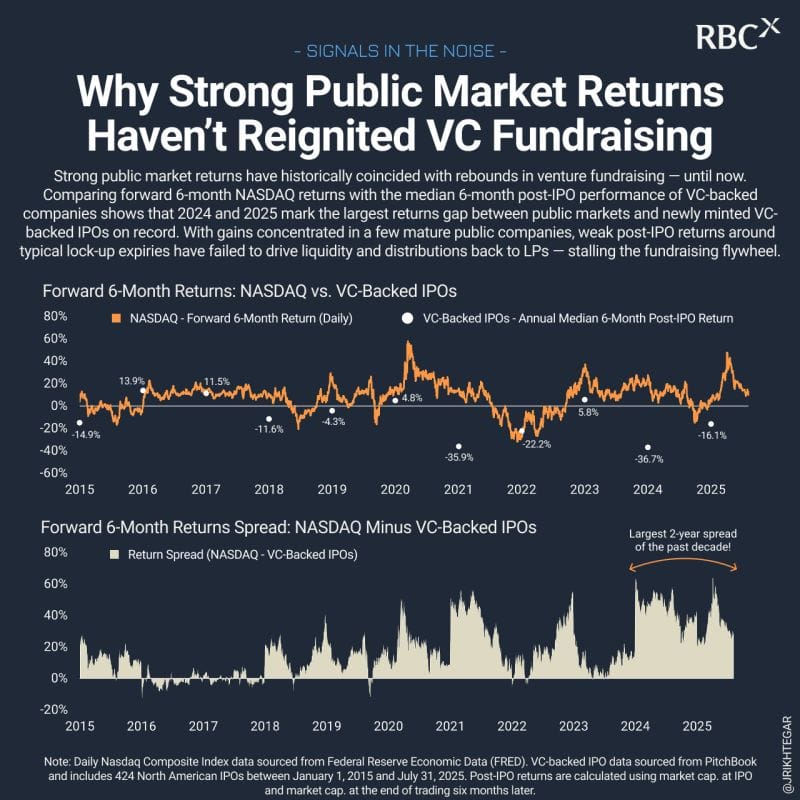

Public Market Gains vs. Weak VC Liquidity

A recent post by John Rikhtegar analyzes why North American VC fundraising in 2024 and 2025 fell far below model-implied levels despite strong public market performance. By comparing forward 6-month NASDAQ returns with median post-IPO performance of VC-backed companies, the piece shows that the usual feedback loop between exits, DPI, and new commitments has broken.

Record 2-Year Return Spread Between NASDAQ and VC-Backed IPOs: The analysis highlights the widest gap in more than a decade between strong forward NASDAQ returns and some of the weakest median post-IPO results for venture-backed companies at the 6-month lock-up expiry window.

Public Market Performance Concentrated in a Few Mega-Caps: Recent index gains are shown to be driven by a small group of large incumbents that sit outside venture portfolios, which means the rally does not generate liquidity or distributions for VC LPs.

Fundraising Undershooting 30-Year Model Levels in 2024-2025: Current fundraising totals are described as the largest deviation from historically correlated public market returns and venture capital formation in three decades.

✈️ KEY TAKEAWAYS

The post argues that venture fundraising depends on realized liquidity rather than headline public market strength. Without strong post-IPO performance that converts into DPI, LP capital is not recycled into new funds, breaking the historical cycle between public market rallies and VC fundraising.

AI Reshapes Support Hiring With a 65% Drop in 2 Years

Jason Lemkin shows a sharp contraction in Customer Support hiring and explains how AI is changing role design rather than eliminating the function. The piece highlights a shift toward higher-skilled human roles and predicts similar patterns across other GTM and product functions.

8.30% → 2.88% New Hire Share (Q4 ’23-Q3 ’25): Across 386,500 hires, the share going into support fell by roughly 65%, with nearly half of that decline occurring in the last three quarters, indicating an accelerating adoption curve.

20+ → 3 Humans, +47% YoY Revenue: One example shows a transition from more than 20 support staff to three humans supported by AI agents, while revenue moved from -19% to +47% YoY as AI handled most inbound volume.

$50K Generalists → $100K+ Technical Hybrid Roles: Tier 1 work is increasingly automated, leaving fewer entry-level ticket handlers and more specialized escalation and CS-style roles as AI deflects 40-60%+ of requests.

✈️ KEY TAKEAWAYS

Support is becoming the first clear proof point that AI changes hiring mix, not customer focus. As Tier 1 volume is automated, headcount shifts toward higher-leverage, technical, and revenue-oriented roles, and the same 40-60% automation threshold is likely to reshape SDR, marketing, and QA next.

Seed-to-Series A Graduation Speed

Peter Walker’s analysis highlights how quickly startups move from Seed to Series A and why that timing is closely watched by investors. While founders often focus on growth milestones, the pace of graduation also serves as a signal to LPs about fund performance and portfolio health.

Early Graduations: About 10% of startups make the jump to Series A in under 12 months, and another 15.6% do so between 12-24 months. By the end of Year 3, roughly 80% of startups that will ever graduate have already done so.

Investor Signals: Graduation rate acts as a baseline for "markup rate," helping LPs evaluate fund managers long before cash returns are realized. It informs early judgments about fund performance in a decade-long venture cycle.

Bridges and Extensions: Relying on bridge rounds or extensions is discouraged, as it can misalign incentives between founders and investors. Startups should plan funding rounds strategically to avoid signaling delays in growth or maturity.

✈️ KEY TAKEAWAYS

The pace at which a startup moves from Seed to Series A is more than a timing metric: it shapes investor perception and fund evaluations. Understanding graduation rates helps founders align their fundraising strategy with the expectations of LPs and avoid missteps like over-relying on bridge rounds.

Thanks to Lea Winkler for her help with this post.

Stay driven,

Andre

PS: Reserve your seat for our Virtual DDVC Summit 2026 where 30+ expert speakers will share their workflows, tool stacks, and discuss the latest insights about AI for VC