👋 Hi, I’m Andre and welcome to my newsletter Data Driven VC which is all about becoming a better investor with Data & AI.

📣We just opened limited SUPER EARLY BIRD ticket sales for our Virtual DDVC Summit 23-25th March here - secure your ticket before prices increase

Brought to you by VESTBERRY - Portfolio Intelligence Platform for data-driven VCs

Tired of chasing portfolio companies for half-empty reports? You're not alone. Working with hundreds of funds, we've learned the best teams track just 10-15 KPIs. This guide gives you the essential metrics for each industry so you get complete portfolio visibility without the constant back-and-forth.

Welcome to another Data Driven VC “Insights” episode where we cover the most interesting research & reports about startups and VC from the past week.

2025 Was the Rebound Year - What Can We Expect for 2026?

Dealroom’s snapshot frames 2025 as a rebound year for venture and enterprise value creation after the 2022-23 correction. Activity returned disproportionately to later-stage leaders, while discipline persisted at early stage and exits reopened mainly via M&A.

VC Investment Rebound: VC invested hit $434B, up 27% YoY, signaling renewed momentum but still below the 2021 peak. Capital concentrated heavily in frontier AI and large-scale platforms.

Value Creation Concentrated: Global tech enterprise value jumped 29% to $55T, adding $12.3T. Decacorns and $100M-revenue companies benefited most, while early-stage remained selective.

Exits via M&A: $131B in VC-backed M&A exits surpassed the prior five years combined as IPO windows stayed narrow and acquirers stepped in.

✈️ KEY TAKEAWAYS

The rebound was uneven. Scale, revenue maturity, and AI gravity dictated outcomes in 2025, with late-stage leaders and strategic M&A driving most of the recovery while early-stage capital stayed disciplined.

How VC-Backed Companies Evolve Their Executive Equity Plans

A recent post from Dylan Hughes analyzes executive new-hire equity grants at VC-backed private companies and shows how stock options and RSUs shift as organizations scale. The chart highlights clear patterns in substitution behavior rather than stacking multiple equity instruments.

Options-Only at Small Scale: Smaller companies predominantly grant stock options as their sole incentive vehicle, positioning them as the default choice in early organizational stages.

RSU-Only at Larger Scale: As headcount grows, RSU-only grants become materially more common and begin to replace options rather than get layered on top.

Hybrid Structures Remain Rare: Even at 500+ employees, very few companies combine stock options and RSUs in a single executive package, signaling that substitution is more normalized than mixed designs.

✈️ KEY TAKEAWAYS

Equity vehicle choice follows a scale-driven pattern, with companies shifting from options to RSUs as they mature and rarely mixing both. For VCs, the signal lies in identifying when portfolio companies diverge from this pattern and whether that deviation indicates strategic or compensation-driven inflection points.

Upgrade your subscription to access our premium content & join the Data Driven VC community

Are Series A Rounds Overpriced?

In his post, Peter Walker reacts to Harry Stebbings’s claim that Series A is the toughest place to invest right now. The author compares valuation jumps from seed to Series A and questions whether the market dynamics justify the premium.

3x vs 6x Valuation Jumps: Seed to Series A typically increases valuations by roughly 3x. Moving from median seed to top-decile Series A jumps closer to 6x.

High Multiples Persist: Many Series A rounds still clear under 150x ARR, indicating elevated but not universally extreme pricing.

Seed Never Corrected: Seed valuations did not materially reset from the 2021 peak. As a result, both seed and Series A look expensive rather than Series A being an isolated anomaly.

✈️ KEY TAKEAWAYS

The data suggests Series A pricing is rich but so is Seed. For investors, the tradeoff becomes paying up at A or going earlier, while founders benefit from a valuation stack that has remained high through the cycle.

Cap Table Rules Founders Ignore Until It’s Too Late

Ruben Dominguez (The VC Corner) outlines eight cap table rules that founders often learn only after dilution hits. The article frames cap tables as strategic tools rather than documents, emphasizing modeling, clarity, and long-term thinking.

Build Early and Model Forward: Dominguez highlights that cap tables should exist from incorporation and must forecast scenarios like SAFE conversions, option pool expansions, and future rounds. The point is that current ownership alone tells an incomplete story.

SAFEs, Pools, and Dilution Math: SAFEs are treated as dilution before conversion, and option pools are assumed to expand more than once. These two mechanics meaningfully shape the outcome of Series A and B ownership and should be modeled well in advance.

Governance and Single Source of Truth: Clean legal names, one consistent cap table, and pre-modeled equity grants reduce friction in diligence. Dilution is framed as a choice and not something that happens randomly.

✈️ KEY TAKEAWAYS

Cap tables reflect future incentives and outcomes, not just today’s ownership. Founders who model dilution, SAFEs, and option pools early avoid messy surprises later and enter fundraises with clearer expectations and stronger negotiating footing.

Join our free Slack group as we automate our VC job end-to-end with AI. Live experiment. Full transparency.

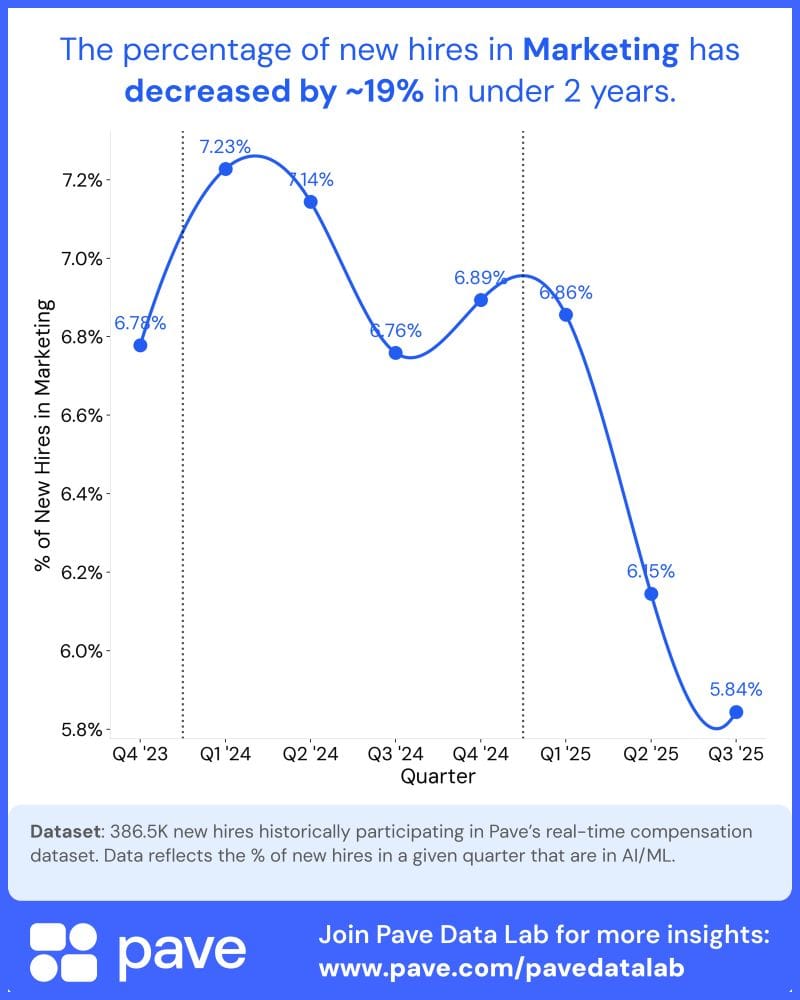

Marketing Hiring Under Pressure in the AI Era

Matt Schulman references Pave research on hiring activity across 8,600+ VC-backed companies to determine whether marketing headcount is under pressure from AI tools. The data shows a noticeable shift in how companies staff marketing teams and raises questions about whether productivity gains could later reverse the trend.

Marketing Hiring Drops 19 Percent: The share of new hires in marketing roles fell from 7.23% in Q1 2024 to 5.84% in Q3 2025, which is roughly a 19% decline in under two years.

Two Drivers of Decline: AI tooling accelerated content creation productivity and a tighter macro environment increased pressure on marketing efficiency and headcount.

Future Paradox: Schulman draws a parallel to software engineering hiring in early 2025, proposing that if marketing ROI exceeds the SaaS Magic Number threshold, companies could eventually re-expand teams to capture productivity gains.

✈️ KEY TAKEAWAYS

AI is compressing marketing headcount today, but the long-term equilibrium is unclear. Pave’s data suggests efficiency pressures are dominant in the near term, while Schulman highlights a scenario where productivity-enhanced marketing performance could eventually drive renewed hiring.

Using Deep Research for GTM Projects

A recent episode of Growth Unhinged breaks down how Deep Research tooling can support complex GTM tasks. The piece focuses on practical workflows, prompt structure, research planning and tool selection for non-engineering work.

Time Savings: The author argues Deep Research can compress 10 or more hours of work into minutes. It can plan, gather context and synthesize outputs end to end.

Prompt Structure: A detailed prompt format is presented, including goal, context, style, sources and instructions. The structure helps produce actionable and customized deliverables.

Source Quality: They emphasize source selection and transparency. The guidance includes prioritizing primary sources, creating source lists and using in-text citations.

✈️ KEY TAKEAWAYS

Deep Research can accelerate GTM analysis, but quality depends heavily on structured prompts, clear context and stronger source curation.

Thanks to Lea Winkler for her help with this post.

Stay driven,

Andre

PS: Reserve your seat for our Virtual DDVC Summit 2026 where expert speakers will share their workflows, tool stacks, and discuss the latest insights about AI for VC