👋 Hi, I’m Andre and welcome to my newsletter Data-Driven VC which is all about becoming a better investor with Data & AI. Join 34,010 thought leaders from VCs like a16z, Accel, Index, Sequoia, and more to understand how startup investing becomes more data-driven, why it matters, and what it means for you.

Brought to you by Affinity – The Leading CRM for VC

Affinity is a relationship intelligence platform that empowers dealmakers in relationship-driven industries to find and win better deals, faster.

With industry-leading automated relationship insights and technology, Affinity frees dealmakers from manual data entry and equips teams to act with confidence—knowing the full context and history of every relationship.

Trusted by over 3,000 organizations worldwide, Affinity is your partner for smarter dealmaking.

Welcome to our monthly wrap-up episode where we cover May’s most relevant content at the intersection of startups, VC, data & AI.

We read it all so you don’t need to - here we go👇

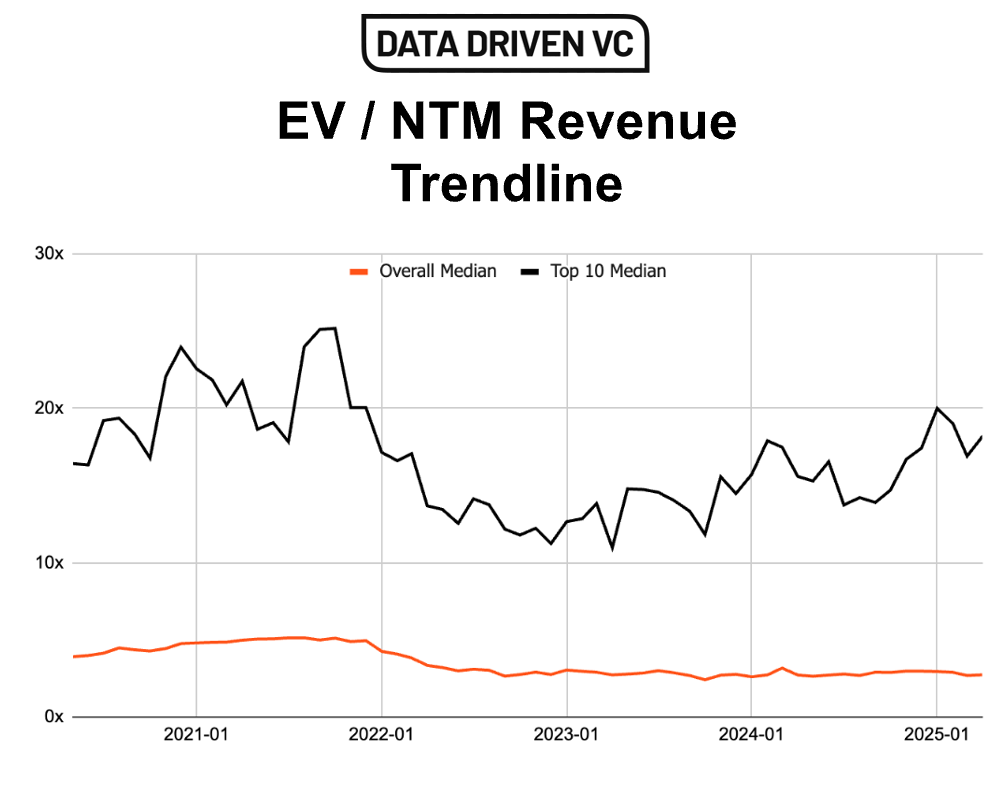

MULTIPLES SNAPSHOT📸

As part of our Sunday Resources format, we started to compile an extensive monthly “State of the Market” episode with deep dives into macro, markets & multiples. Here are 3 key charts as a snapshot for you. Full episode of May here.

Data Source: Multiples.vc

Data Source: Multiples.vc

Data Source: Multiples.vc

Should I keep the Multiples Snapshot in the next Monthly Wrap Up?

INTERESTING RESEARCH & REPORTS📈

The State of Pre-Seed

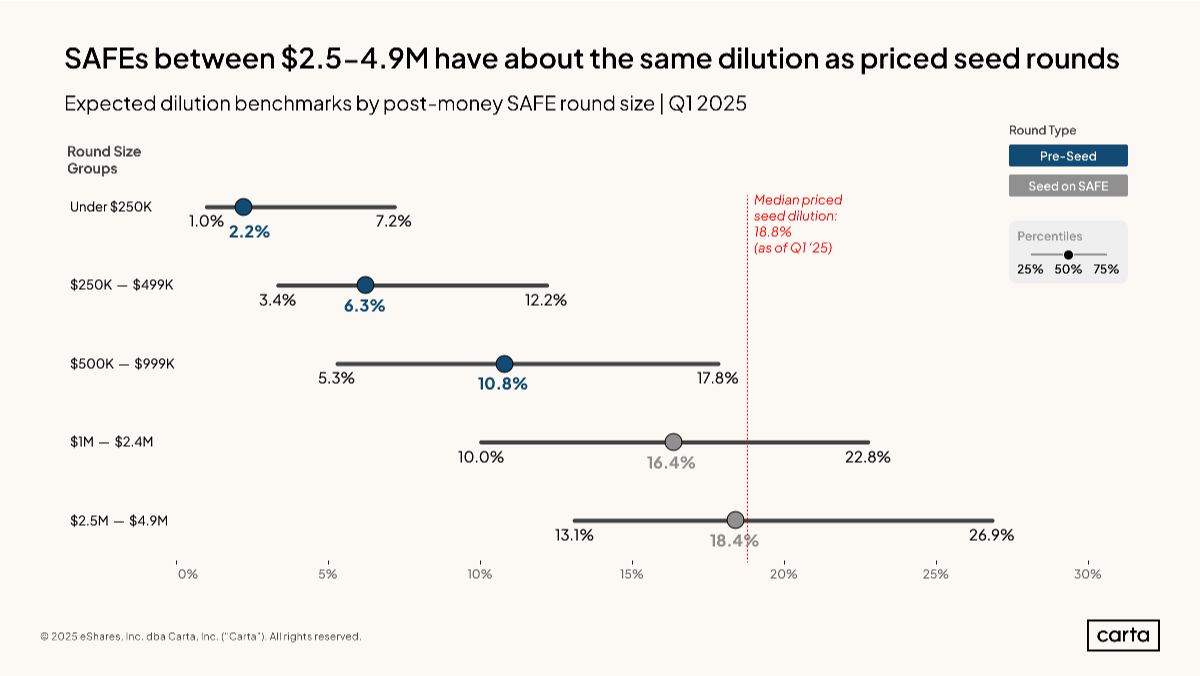

Carta just published their State of Pre-Seed Report for Q1-2025 here, revealing major pre-seed trends on dilution, discount percentages, industry comparisons, and more. Key findings include:

Continued decline in pre-seed activity: For the third consecutive quarter, pre-seed investment declined, in terms of both total cash raised and count of instruments. Q1 saw a total of $737 million invested, down 20% from Q4’s $923 million.

Increasing valuation caps: For post-money SAFE rounds above $500,000, valuation caps rose slightly in Q1 2025 compared to Q4 2024.

Steady interest rates: The median interest rate on convertible notes held steady at 7% in Q1 2025, down from a high of 8% in Q2 2024.

✈️ KEY TAKEAWAYS

While overall pre-seed activity continues to decline in volume of deals as well as overall cash invested, we see a concentration of capital on fewer high profile deals that drive valuation caps up.

What Makes a Fundable Founder?

Adam Shuaib of Episode 1 Ventures shared findings from analyzing tens of thousands of seed founders and pitch decks. The results shed light on surprising traits that correlate with fundraising success or failure.

Personality Impacts Outcomes: Extroverted founders were 2x more likely to raise. Meanwhile, high neuroticism halved the chances of advancing past Seed.

Unusual Signals Win: Multilingual upbringing, obscure hobbies like base jumping, and early academic achievements were strong fundraising predictors.

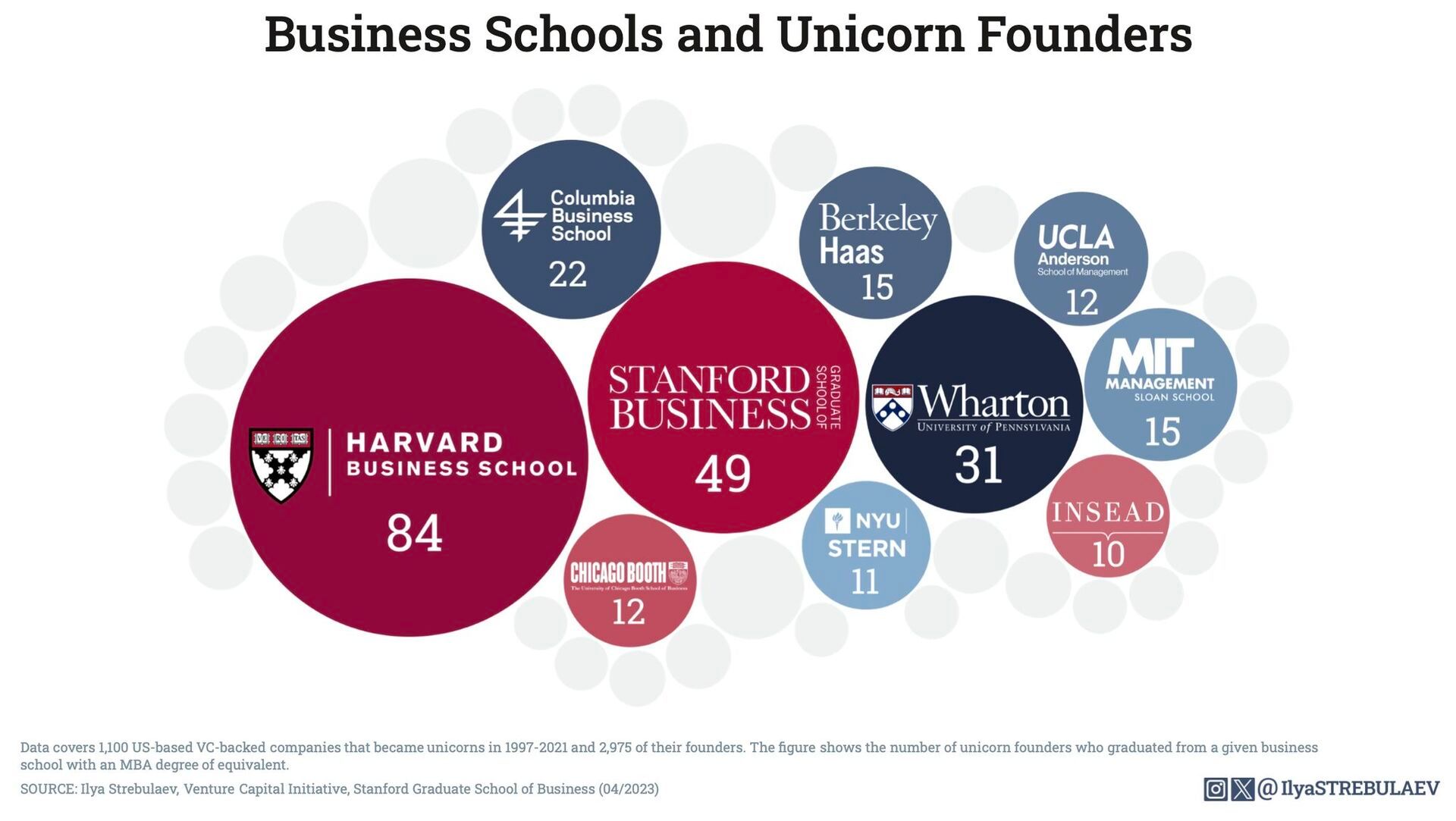

PhD > MBA: Having a PhD (especially in AI) boosted fundraising odds significantly. An MBA showed no measurable impact.

While statistically not increasing fundraising chances, MBAs still produce a substantial number of unicorn founders (Strebulaev, 2025)

✈️ KEY TAKEAWAYS

Investors are favouring founders with emotional stability, international experiences, and quirky high-risk hobbies while MBAs may no longer give you an edge.

INSPIRING TECH IN VC CONTENT💡

VC Tech Stack 2025

Subscribe to our premium content to read the rest.

Become a paying subscriber to get access to this post and other resources from the exclusive Data Driven VC community.

UpgradeA subscription gets you:

- Lists of 312 Family Offices + 59 Pension funds + 1513 angels

- Annual ticket for the virtual DDVC Summit

- Access our archive of 300+ articles

- 1 new premium article per week

- Virtual & physical meetups

- Masterclasses & videos

- Access to AI Copilots

- Prompt Database

- ... and lots more