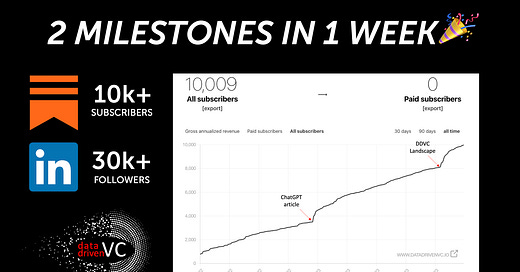

How I reached 30k+ LinkedIn followers and 10k+ newsletter subscribers - and what I would do differently today

DDVC #38: Where venture capital and data intersect. Every week.

👋 Hi, I’m Andre and welcome to my weekly newsletter, Data-driven VC. Every Thursday I cover hands-on insights into data-driven innovation in venture capital and connect the dots between the latest research, reviews of novel tools and datasets, deep dives into various VC tech stacks, interviews with experts and the implications for all stakeholders. Follow along to understand how data-driven approaches change the game, why it matters, and what it means for you.

Current subscribers: 10,009, +249 since last week

Brought to you by Synaptic - The alternative data & intelligence platform for data-driven investors!

Get early signals on high-growth companies with Synaptic! Our platform unifies 100+ company performance metrics from alternative datasets like website traffic, app downloads, employee and hiring data, product reviews, open-source projects, and many others, and layers it with AI-driven analytics on a single pane of glass!

We help you source more deals, prioritize your pipeline, conduct deep diligence, monitor your portfolio, and benchmark performance with competitors!

What an incredible week: Firstly, the Data-driven VC community has grown to 10k+ subscribers in less than 9 months (262 days to be precise🤓), and, secondly, my LinkedIn account crossed 30k+ followers. Thank you so much for your continued support via likes, comments, shares, DMs, guest posts, features, podcast/keynote/panel invites, and so much more.

Looking back at a bumpy 7+ year professional online journey, I learned all content creation, audience building, and personal branding lessons the hard way and got increasingly frustrated that none of the role models in our industry shared their insights publicly. It feels that while everyone knows about the importance of establishing a personal brand, few leaders openly speak about it as they seemingly want their activities to come across “more naturally” and “less intentionally”.

But let’s be honest: Who posts on LinkedIn just for fun? Who writes a blog post for themselves? Nobody. It’s all about engagement, feedback, leads, deal flow, and the resulting discussions with like-minded people. Clearly, all of this is intentional.

Celebrating this week’s milestones and following my “building in public” mantra, I’d like to answer a bunch of questions that I have received in the past months by sharing my personal content creation journey, major learnings, and what I would do differently today. My journey in 5 phases:

Phase 1: Starting as a passive observer

Year#1: I joined LinkedIn in July 2016, almost 7 years ago, mostly to grow my professional network, keep in touch with relevant people, and passively follow their content. I probably logged in every other week or so, mostly to send and accept connection requests. No interaction with content whatsoever and I only published one post for the full first year (which received an incredible 2 likes). As for most beginners, this was a share of external third-party content.

LEARNING#1: It’s easy to sit and watch from the sidelines but takes courage to play the game on the field. Don’t waste time observing but become active from day 1.

Year#2: In the second year, I became slightly more active and posted a mind-boggling 8 times.. OK, tbh not much more than in the first year but it felt like I’m already spamming the world, ofc again, with all third-party content or reshares from other posts which achieved 2-26 likes per post. Topic-wise, the first two years were super random with content about people or companies that I had a direct relation to.

LEARNING#2: Every beginning is difficult but everyone started somewhere. Keep going, it will eventually pay off.

Phase 2: Posting more actively, expanding focus, and adding my own content to the mix

Year#3: In the third year, I published a total of 28 posts on LinkedIn which received 1-79 likes per post. While I continued to post third-party content, I started adding a personal touch to the mix by sharing photos (like here on a Munich Founder vs. Investors Hockey night or here for a CPO meetup).

Moreover, I wrote my first article on Medium “Why we invested in DeepCode” to share the results of our investment research and conviction for ML-based coding (ahead of the Copilot wave 👋🏻). Medium was a great home for my write-up, yet the “platform” did really badly in distribution (at least for me). Therefore, I took my Medium post and distributed it via LinkedIn and Twitter.

LEARNING#3: Content creation and distribution are two different but equally important parts of the equation.

Year#4: Following the activity ramp-up in the previous year, the fourth year was mostly a continuation of what I’ve done before with a total of 21 posts that received 8-1,173 likes per post. Besides my “related people/companies” and personal touch posts, I started to post a lot about AI, data-driven innovation, and productivity - both third-party content and also my own write-ups like “Deconstructing the AI Landscape”. Seeing my first post go viral (at least for my standards) with more than 1k likes and my follower counts hitting the magic “500+” on LinkedIn was the first time I saw the compound effect of my activities.

LEARNING#4: We tend to overestimate the impact of our activities in the short term but underestimate their compound effect in the long term.

Phase 3: Higher farther faster - diluting myself

Year#5: After finishing my Ph.D. on “Machine Learning and the Value of Data in VC” and having spent several years in VC, I asked myself what the future of VC might eventually look like and what it would take to become successful. I posted my thoughts in a Medium article “The Future of VC: Augmenting Humans with AI” and received incredibly positive feedback. As part of this article, I also came to the conclusion that the personal brands of individual investors will become highly important.

As the VC industry becomes more efficient, two “access components” will become core: capital availability (which VC is able to pay the highest valuation) and VC brand (firm brand + personal brand of the individual investor) — besides personal fit (which will remain key)!

As part of this thought process, I started to analyze my own personal brand and tried to understand all contributing factors. I split it into different components like my investment track record, original content, media features, podcasts, keynotes, panels, and a lot more. It became clear that online content in all its forms was the easiest short-term lever for me, thus I thoroughly analyzed the data points that I had previously collected via my online activities.