👋 Hi, I’m Andre and welcome to my newsletter Data-Driven VC which is all about becoming a better investor with Data & AI. Join 33,080 thought leaders from VCs like a16z, Accel, Index, Sequoia, and more to understand how startup investing becomes more data-driven, why it matters, and what it means for you.

Brought to you by Affinity – Exclusive Dealmaking Benchmarks

What can Affinity data on almost 3,000 VCs from 68 countries reveal about how VCs performed last year and how dealmaking will continue to evolve? Find out in Affinity’s 2025 venture capital benchmark report with exclusive data on deal volume, network activity, and engagement. You’ll learn the traits that set apart top firms and actionable guidance for updating your deal strategies. Get the report.

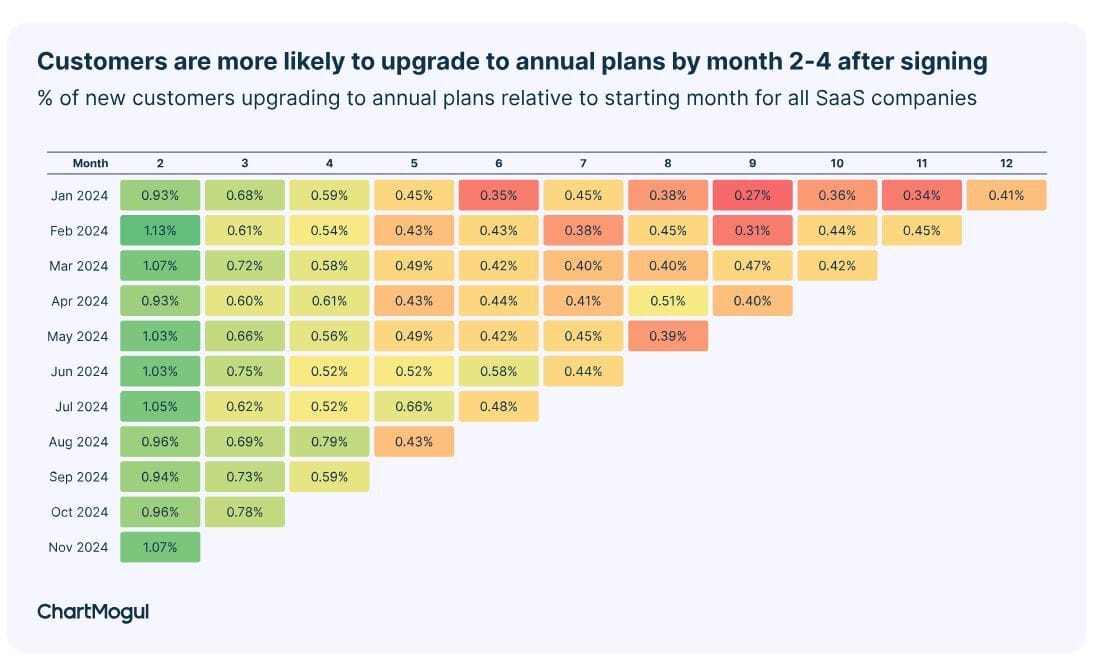

The Right Time to Push Customers for an Upgrade from Monthly to Annual Plans

Kyle Poyar summarizes new data from ChartMogul, analyzing billing behaviour across 2,500+ SaaS companies. Contrary to popular belief, the best time to push for annual upgrades isn’t months down the line but within the first few weeks of onboarding.

Upgrade Timing: Customers are 3–4x more likely to switch to annual plans in month 2 than in month 9, flipping the usual assumptions about upgrade windows.

Revenue Lift: Monthly plan NRR ranges from 43% (<$25 products) to 76% ($250–$500 products). Annual plans clock in 10–20 percentage points higher on average.

Monthly Plan Advantage: SaaS companies with 50%+ of customers on monthly plans tend to grow faster in the $0–$10M ARR stage, suggesting monthly isn’t just a trial step but a growth lever.

✈️ KEY TAKEAWAYS

Don’t wait to ask for the annual commitment. The highest conversion window is within the first month, not after six. And while annual plans drive higher retention, a strong monthly base can be just as critical for early-stage growth.

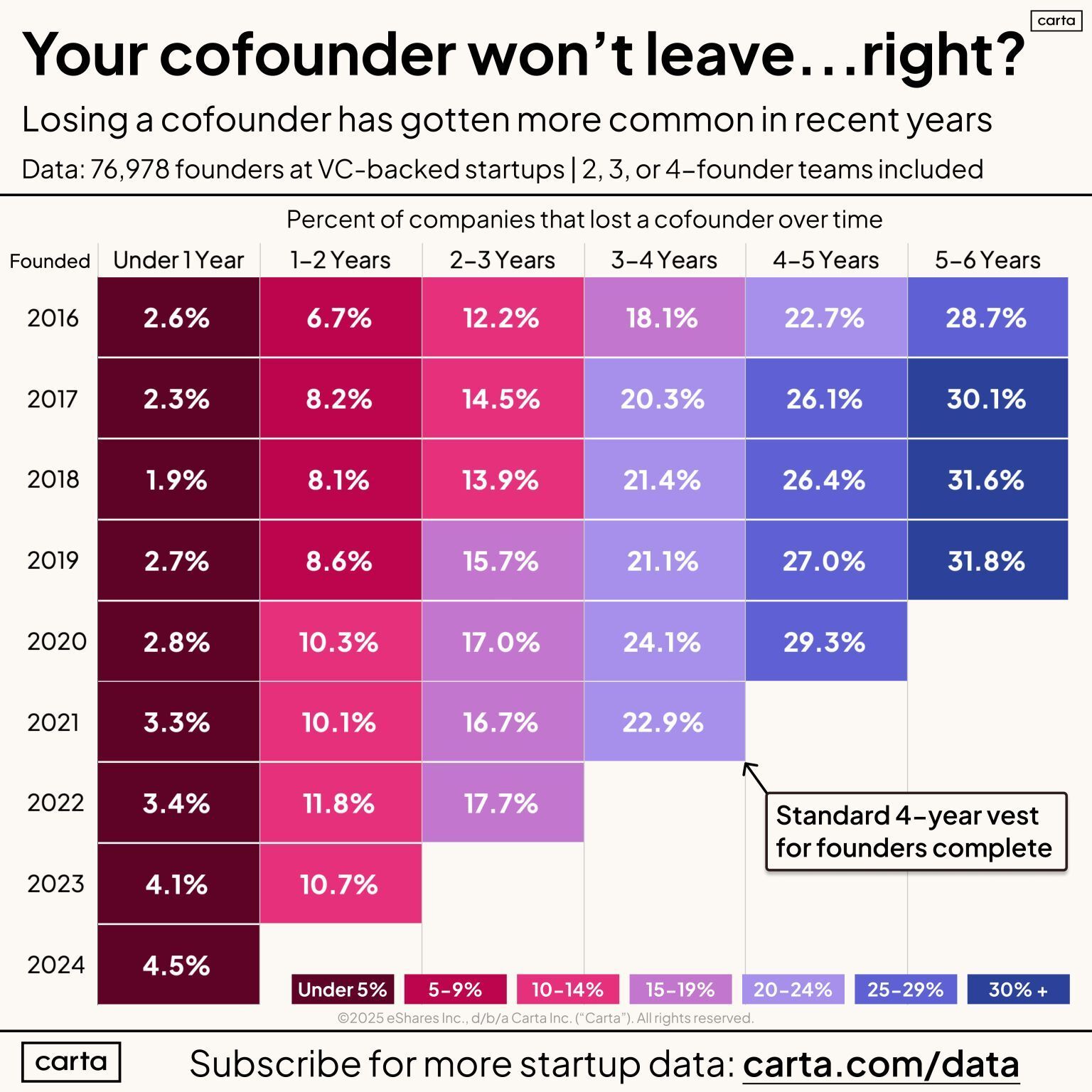

1 of 3 Co-Founders Leaves Within the First 6 Years

Peter Walker from Carta breaks down founder departure data from nearly 77,000 US startups founded between 2016 and 2024. His analysis excludes solo founders and focuses on VC- or angel-backed companies with SAFEs or Notes.

Early Exits Rising: Startups founded in recent years are seeing more cofounder exits in their first 1–3 years, a shift from earlier cohorts.

Year 4 Drop-Off: In the 2017 cohort, 20.3% of companies had lost a founder by year 4, aligning with typical vesting timelines and highlighting a key departure milestone.

Vesting Debates: With longer timelines for building venture-backed companies, there’s growing discussion about whether the standard 4-year founder vest should be extended to 6 years.

✈️ KEY TAKEAWAYS

Cofounder departures are trending upward in early startup years. As founders and investors navigate longer company-building journeys, equity vesting structures may need a rethink to reflect today’s startup reality.

What Sets Unicorn Founders Apart? It’s (Still) the Technical Chops

Subscribe to our premium content to read the rest.

Become a paying subscriber to get access to this post and other resources from the exclusive Data Driven VC community.

UpgradeA subscription gets you:

- Lists of 312 Family Offices + 59 Pension funds + 1513 angels

- Annual ticket for the virtual DDVC Summit

- Access our archive of 300+ articles

- 1 new premium article per week

- Virtual & physical meetups

- Masterclasses & videos

- Access to AI Copilots

- Prompt Database

- ... and lots more