👋 Hi, I’m Andre and welcome to my weekly newsletter, Data-driven VC. Every Tuesday, I publish “Insights” to digest the most relevant startup research & reports, and every Thursday, I publish “Essays” that cover hands-on insights about data-driven innovation & AI in VC. Follow along to understand how startup investing becomes more data-driven, why it matters, and what it means for you.

Current subscribers: 19,060, +435 since last week

Brought to you by Affinity - Insights you need to find, manage, and close more deals

In a survey of 700+ dealmakers, almost 90% predict they’ll do the same or more deals this year. But is this optimism warranted? Get the full picture in Affinity’s new report, including strategies that leading VCs are using to source more deals using their networks and how they’re implementing AI to streamline internal processes.

Why Our Tool Landscape Will Change

Last week, I wrote about Investment Tech as an emerging category. It’s software that facilitates public and private market investing for those firms that cannot afford - or simply don’t want - to develop their software stack in-house.

I received lots of feedback and questions on this post supporting my thesis: Most investors are lost with make vs buy and overwhelmed with the ever-growing spectrum of tools available - that btw all sound the same.

How can you find the right tools for your budget? Why will the 4th wave of tools be different? Is it smart to wait until it unfolds or jump on the train just now?

To answer these questions, I decided to dive into the evolving 4th wave of Investment Tech and highlight how AI-powered tools will be different from anything we know so far. In the end, I’ll also share what I would do as an investor looking to become as data-driven as possible with as few resources as necessary.

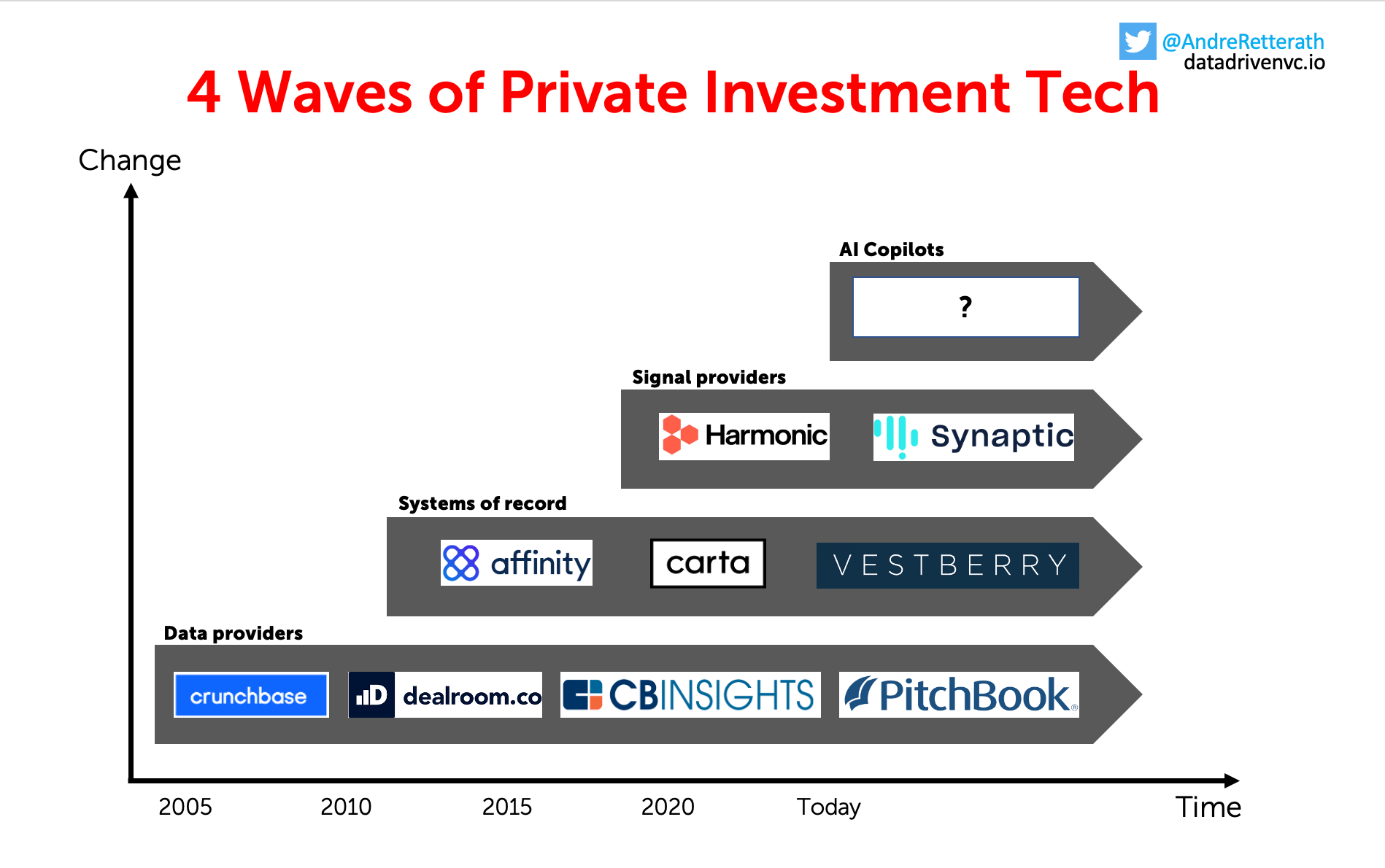

4 Waves of Investment Tech

Quick summary of the four major waves of Investment Tech:

1st wave: Private company and fund data providers like Crunchbase, Dealroom, Pitchbook, Preqin, and others

2nd wave: Systems of record (CRM, portfolio, cap table management) like Affinity, Vestberry, Carta, and others

3rd wave: Signal providers like Harmonic, Synaptic, and others

4th wave: AI Copilots and unified systems like … ?

While the first three waves had a great impact on “what” investors do, they didn’t materially change the “how”. I know that some of you would disagree, but let’s face it: Workflows and the ways how we interact with data are still mostly the same. Manual and inefficient.

Yes, we use commercial databases instead of Google. Yes, we use CRM systems instead of Excel files. Yes, we use signal providers instead of analyzing all data points and extracting the insights ourselves. But all in all, investment processes haven’t materially changed for the past decades. Until now.

Standing on the shoulders of giants (systems of record, data & signal providers), the 4th wave of Investment Tech will finally change the way how investors interact with data. This time it’s less about the what but more about the how.

Subscribe to DDVC to read the rest.

Join the Data Driven VC community to get access to this post and other subscriber-only content.

Join the Community