👋 Hi, I’m Andre and welcome to my newsletter Data-Driven VC which is all about becoming a better investor with Data & AI. Join 26,752 thought leaders from VCs like a16z, Accel, Index, Sequoia, and more to understand how startup investing becomes more data-driven, why it matters, and what it means for you.

Brought to you by Harmonic — The Startup Discovery Engine

Have you already met your next fund returner? See everyone your team has ever emailed, met, or connected with on LinkedIn in Harmonic. Get alerted when the founder you spoke to 18 months ago starts gaining traction.

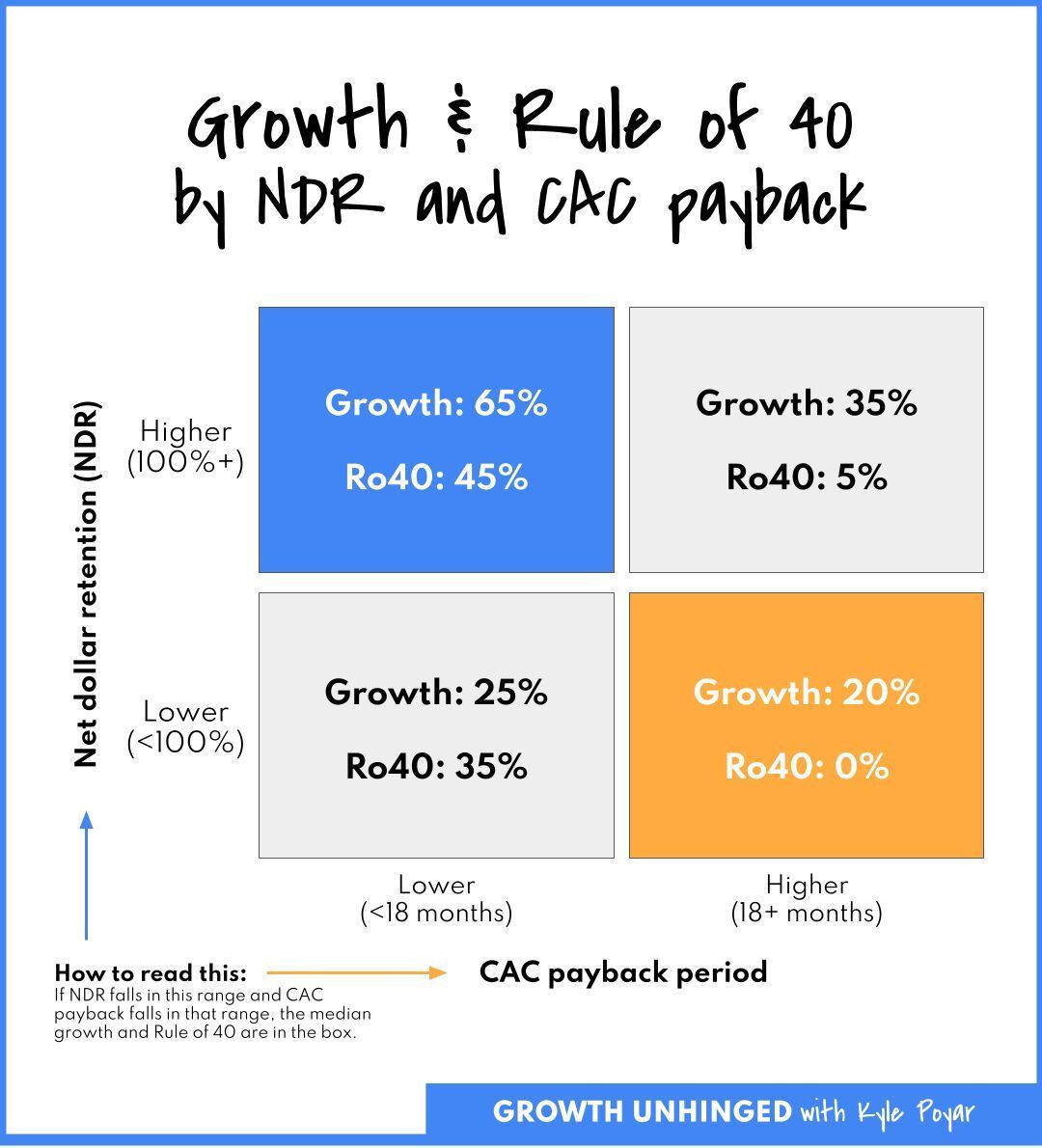

Predictors of SaaS Growth: CAC Payback Period & NDR

The one and only from explores in a recent post how combining CAC payback period with net dollar retention (NDR) offers strong insights into SaaS growth efficiency:

Top performers: Companies with high NDR (100%+) and a low CAC payback period (<18 months) show a median growth of 65% YoY and a Rule of 40 at 45%.

Enterprise focus: High NDR but a longer CAC payback period (18+ months) yields 35% YoY growth, but the Rule of 40 drops to 5%.

PLG model: Low NDR and a short CAC payback period correlate with 25% YoY growth and a Rule of 40 at 35%.

✈️ KEY TAKEAWAYS

Pairing NDR and CAC helps identify growth efficiency, especially across different business models like PLG and enterprise SaaS.

Time to Unicorn Status Varies Widely

A recent Stanford study finds that while the median time for a startup to achieve unicorn status is 7 years, the journey varies greatly across companies.

Speedsters: Altos Labs became a unicorn in less than a year, one of the fastest ever.

Slow and steady: Companies like Quizlet and Cytek took 15 and 28 years, respectively, to reach the $1 billion valuation.

Majority range: 75% of unicorns reached this status within 9 years of founding, but outliers remain.

✈️ KEY TAKEAWAYS

The path to unicorn status is highly individualized, with both rapid ascents and long hauls proving successful. A good estimate seems to be just below a decade.

Subscribe to DDVC to read the rest.

Join the Data Driven VC community to get access to this post and other subscriber-only content.

Join the Community