👋 Hi, I’m Andre and welcome to my newsletter Data-Driven VC which is all about becoming a better investor with Data & AI. Join 28,660 thought leaders from VCs like a16z, Accel, Index, Sequoia, and more to understand how startup investing becomes more data-driven, why it matters, and what it means for you.

Brought to you by Deckmatch - Agentic Workflows and APIs for Data-Driven VCs

Connect your top-of-funnel to Deckmatch and transform pitch decks and URLs into structured and insightful data. Get detailed firmographic and people data, in-depth competitive and market analysis, and personalized investment memo without lifting a finger. The cherry on the cake? It's all seamlessly synced to your preferred tools like Affinity through our API integrations.

Never miss a deal, ditch the donkey work, and build meaningful relationships faster.

Time Between Funding Rounds: Magic Number 18

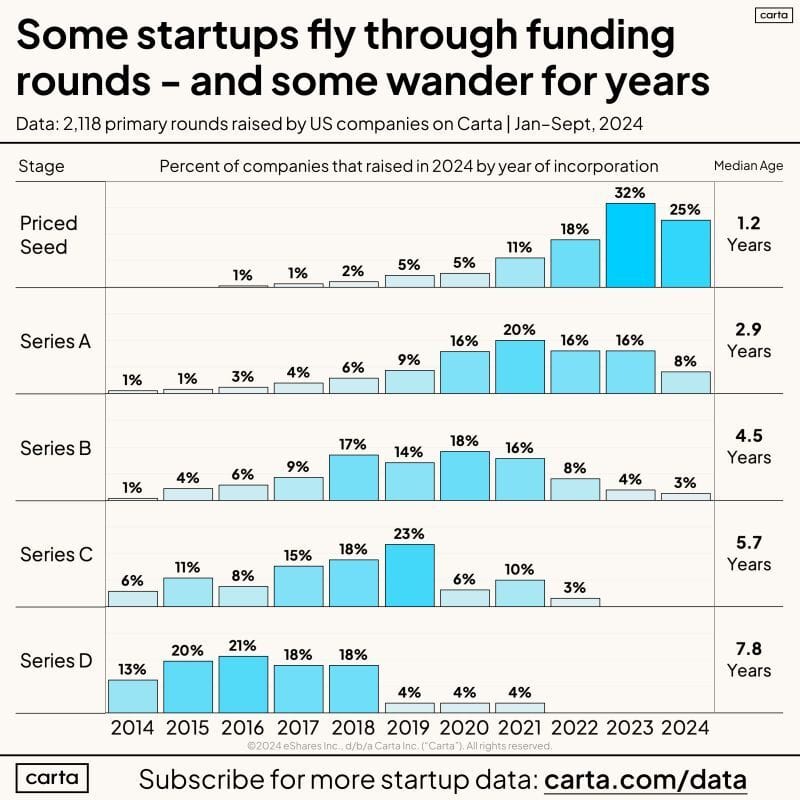

Carta’s latest analysis of funding rounds reveals that startups follow diverse paths when raising funds, with some moving swiftly through the rounds, while others take years to secure capital. Though fast growth is often celebrated, long-term success isn’t always tied to speed, and slower-moving startups may be laying the groundwork for future triumphs.

Seed round movers: In 2024, 32% of startups raising a priced seed round were founded in 2023, but some date back to 2017.

Series B spread: 16% of Series B fundraisers were from 2019 startups, while 4% came from companies founded in 2023.

Older Series D rounds: 18% of Series D fundraisers this year trace back to 2016, showing how the venture landscape supports long-term growth.

✈️ KEY TAKEAWAYS

Startup success isn’t always a sprint. Some companies need time to mature, and although quick funding boosts valuations, slower paths can lead to sustained success too. In short, the median is 1y from incorporation to Seed, 3y to Series A, 4.5y to Series B, and 6y to Series C. Said differently, one round every 18 months seems to be the rule of thumb.

Predicting Success for Seed Startups

An analysis by Adam Shuaib of every seed startup in Europe since 2010 reveals valuable insights about success predictors.

Top talent matters: The ability to hire top talent post-raise is one of the strongest success indicators.

Experience isn’t key: Founders with less than five years of experience were just as likely to raise funds as those with 15+ years.

Speed counts: Startups raising a seed round within one year of incorporation were more than twice as likely to reach Series A/B compared to those that took four or more years.

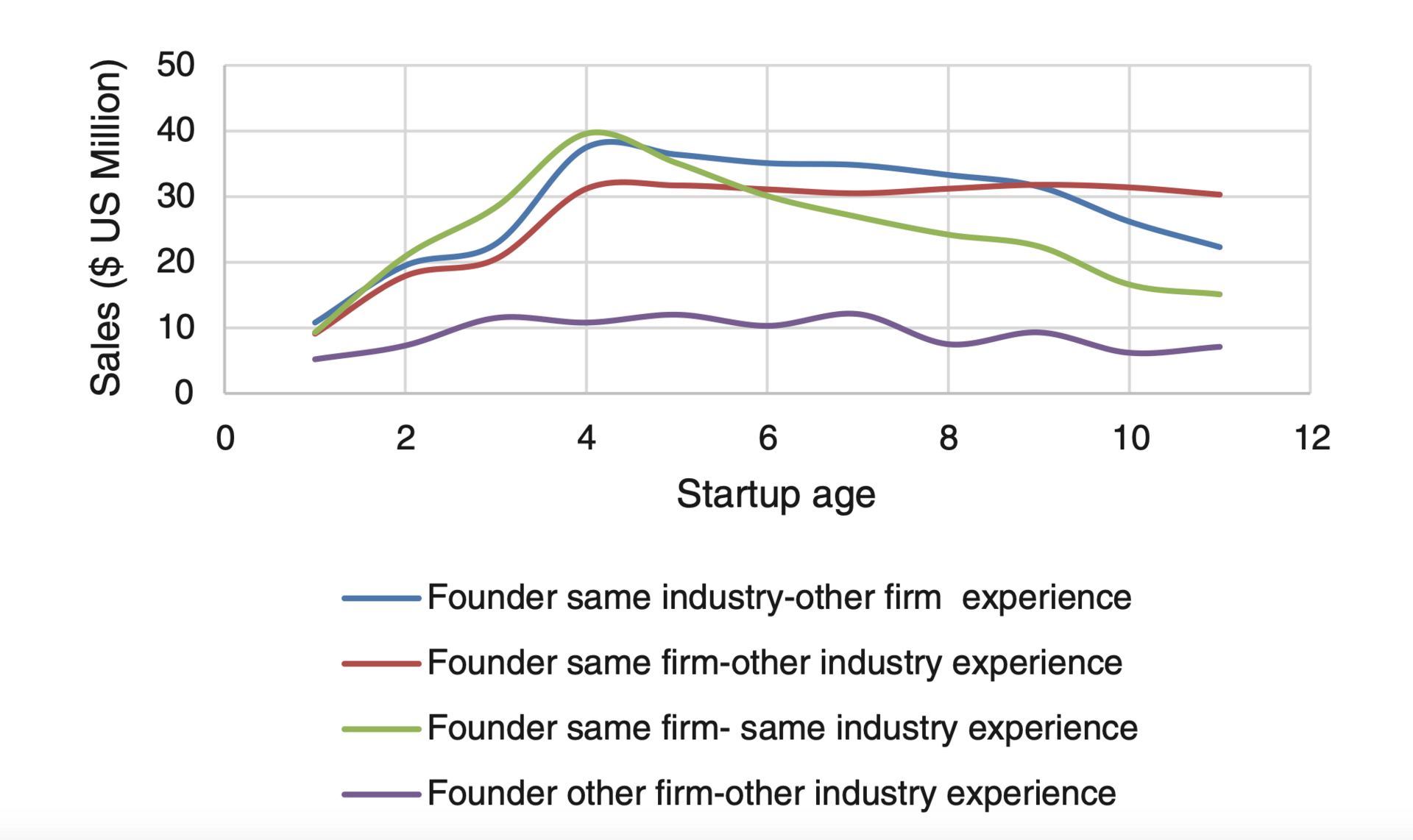

While industry expertise is not the single most deciding factor overall, it correlates somewhat with the founders’ ability to generate revenue, according to Hasai & Zaker (2021)

✈️ KEY TAKEAWAYS

Speed and the ability to hire top talent outshine experience and educational background. Fast action and strong teams seem to be the real predictors of long-term startup success.

Subscribe to DDVC to read the rest.

Join the Data Driven VC community to get access to this post and other subscriber-only content.

Join the Community