👋 Hi, I’m Andre and welcome to my newsletter Data Driven VC which is all about becoming a better investor with Data & AI. Join 35k+ thought leaders from VCs like a16z, Accel, Index, Sequoia, and more to understand how startup investing becomes more data-driven, why it matters, and what it means for you.

Brought to you by Affinity - Campfire 2025 is coming to London!

Private capital teams are drowning in emails, data, and shifting markets—just as competition for the best deals reaches new heights. On October 28, 2025, Affinity Campfire London will bring together leading investors, dealmakers, and operators to turn that noise into actionable insight.

Join peers for an afternoon of networking and hands-on learning. From smarter sourcing and fundraising to practical AI integration, you’ll take home proven tactics, hands-on demos, and real-world success stories you can deploy immediately.

In the last two weeks, I covered why now is the best time to start leveraging AI for investing and how I would start today if I’d need to build a tech stack for a VC firm all over again - based on 8 years of experience of transforming Earlybird VC.

Last episode, I asked a question:

89% of readers want to see the most prominently used tools by 500+ firms from our VC Tool Finder platform - so here we go.

Today, I’ll share:

What the most common VC tool stack looks like across firms, ranging from solo/micro GPs to early-stage, growth, and multi-stage funds in our unique dataset from VC Tool Finder. If you want to compare your stack to firms similar to yourself in terms of fund size, team size, AUM, etc. - click here.

Recap of my personal tool stack today, including a few words on how I use MCP and workflow automation

Links to other dozens of tool stacks from firms such as as a16z, Hoxton, Point Nine, Ben’s Bites Fund, Craft Ventures, Hustle Fund, 201 Ventures, Chapter One, Awesome People Ventures, AirAngels, Susa Ventures, Ganas Ventures, Forward Deployed VC, Davidovs Venture Collective, Footwork, 81 Collection, Untapped Capital, and many more

Let’s jump in!

1. Most frequently used tools across 500+ firms from VC Tool Finder

Our unique data shows that VC tool stacks follow a rough 80/20 logic: Very few tools (20 or so out of 600+ that we track) like Affinity, Carta, Crunchbase, Harmonic, Notion, and Superhuman are used by a big majority (more than 80%) of all investment firms.

However, the majority of tools are are only used by small subsets of investors. Oftentimes, these investor groups share clear characteristics like fund size, geography or industry focus. For example, firms investing in Europe tend to rely on Dealroom as a data source or funds with larger fund sizes leverage more data sources that are oftentimes redundant and more expensive, such as Pitchbook or CB Insights.

What’s interesting, however, is that the group of “early adopters” who use tools like Granola, WhisprFlow, ArcBrowser, and others cannot be segmented based on characteristics. Said differently, there’s no pattern for early adopters as they come from all fund sizes, all AUM groups, all geographies, all industry focuses, etc.

2. My personal tool stack (today)

First and foremost, my stack continues to simplify as I cannot stand context switching and data siloes that are not in synch anymore.

Within 2 years, I went down from a bit more than 100 tools to roughly 60. So almost halved the number of tools in my stack.

Not only does it save me costs in number of subscriptions, but it also reduces the fragmentation of information and data siloes. Platformization & consolidation is for real and the incentives for using as many products as possible from as few vendors as necessary continue to increase.

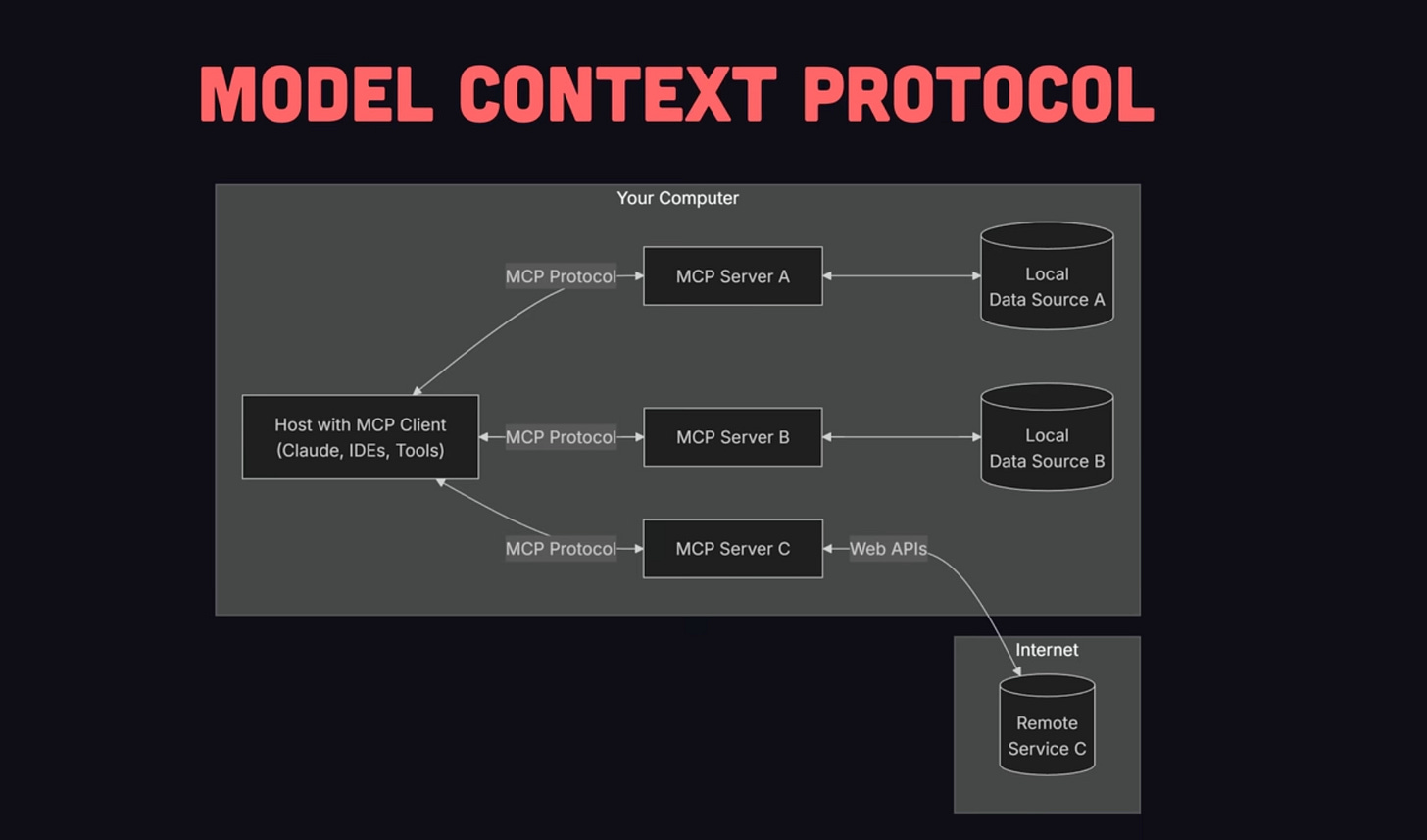

MCP as the connective tissue

Last episode, I highlighted that automation tools like Zapier have been the glue connecting my fragmented stack. Fast forward to today, this is still true but I recently started shifting more and more automation flows to MCP and n8n.

💡What Is an MCP Server?

An MCP Server is a modular software backend that integrates:

Memory — Persistent structured and unstructured data on startups, people, theses, markets, etc.

Context — Dynamic linking of entities (e.g., who introduced this founder, when you met them, how they compare to others).

Persona — A tailored overlay that understands your investment lens, sector preferences, writing style, and workflows.

Put simply, the MCP server allows you to feed in noisy real-world data (emails, PDFs, scraped bios, decks, call notes etc.), and ask high-quality, highly personalized questions like:

“Remind me who introduced me to the founder of Company X and when we last spoke?”

“Which companies in our CRM are similar to this one?”

“Summarize our investment thesis in bio-based carbon capture in less than 200 words.”

It acts like an always-on chief-of-staff, analyst, and memory extension—available 24/7, and only getting smarter over time. Tell me you don’t want this too? ;)

📈Use Cases for VC Investors

Here are some exemplary VC workflows where an MCP Server shines:

1. Sourcing and Scouting

Parse all inbound emails and automatically extract startup names, sectors, stage, traction, and team.

Cross-reference with your CRM or Notion stack to flag if you've seen this before.

Auto-tag warm vs cold intros and route to appropriate internal investors.

2. Due Diligence and Benchmarking

Compare a startup’s metrics to internal portfolio data or market benchmarks.

Ask your MCP server, “How does this company’s growth compare to others at similar stage in AI Infrastructure?”

Generate custom DD checklists based on sector, stage, and geography.

3. Founder Interactions

Summarize past interactions with a founder before a call.

Maintain founder-specific preferences: preferred communication style, fundraising pace, key motivators.

Recommend next steps or intros based on context.

4. Internal Investment Committees

Pull up relevant IC memos, thesis notes, or past deals in a similar category.

Automate early-stage memo drafts that incorporate internal language and structure.

5. Content and Thought Leadership

Turn internal notes or interviews into high-quality blog posts or social content.

Maintain consistency of tone and style that aligns with your personal or firm-level brand.

In short, what was once a simple automation tool like Zapier has become a mix of MCP and n8n: The connective tissue of my VC operations from sourcing to decision making and portfolio value creation.

Where I spend my time

I’ve coded a simple script to track my time across tools. In 2023, my usage was hyper fragmented. Today, it mostly concentrates on 5 pillars:

EagleEye & Affinity: Our internal data intelligence platform and CRM backbone

ChatGPT & Perplexity: Have replaced search and I use them for all research + content generation tasks

Notion: My second brain and knowledge management system

Superhuman, WhatsApp & Slack: Internal and external communication

Zapier, n8n, Claude & Airtable: Automations all around, read + MCP + write

Most of the other tools are task specific, such as TravelPerk for travel management, Personio for HR topics, Payhawk for expenses, or DocuSign for signatures.

3. Links to other tool stacks

a16z Olivia Moore here

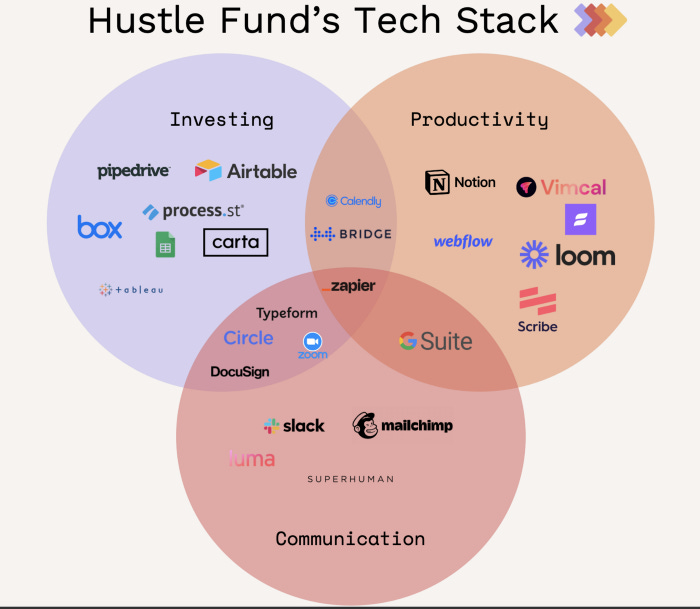

Hustle Fund Tech Stack here

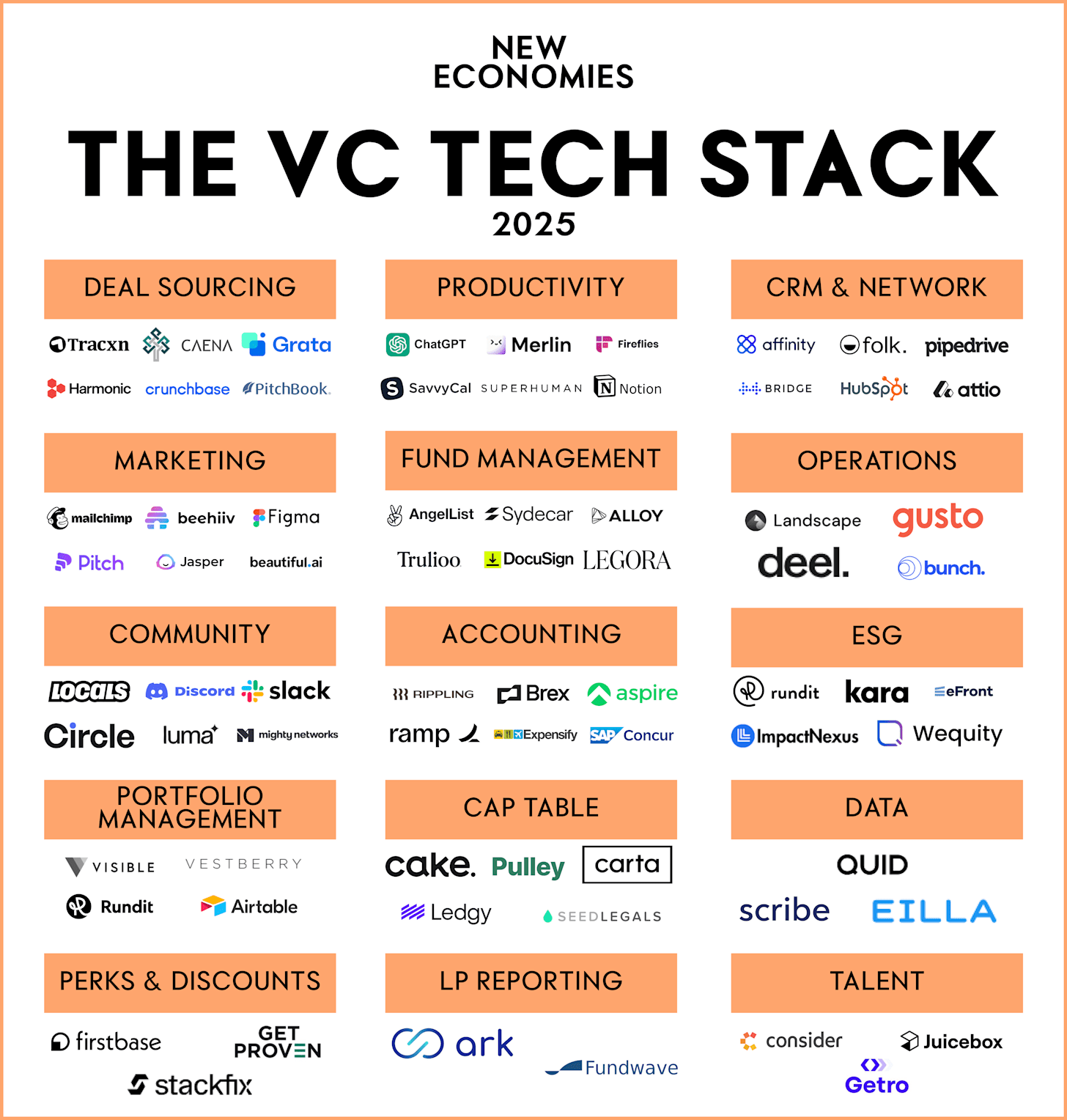

VC Stack Overview by Ollie Forsyth here

And a few other stacks that my friend David Teten has summarized:

OrangeCollective: How Orange Collective Vibe-Coded Their Own VC Operating System

Alpaca VC: Tech Stacks to Scale a VC Fund Efficiently

Ascension.vc: Managing a VC portfolio with Airtable

Precursor Ventures: How to Manage a 80+ Portfolio with a <5 Person Team

Hoxton Ventures Tech Stack

Point Nine Capital: A (Micro) VC’s Tech Stack, and the sequel, Revisiting Point Nine’s tech stack

tiny.vc, Conscience VC, Ben’s Bites Fund, Craft Ventures, Hustle Fund, 201 Ventures, Chapter One, Awesome People Ventures, AirAngels, Susa Ventures, Ganas Ventures, Forward Deployed VC, Davidovs Venture Collective, Footwork, 81 Collection, Untapped Capital: VC Fund Stacks overview

Presidio Ventures: Shares how GPT-4 helped develop ML sourcing models

Red River West: Uses Data & AI to Beat Sellers in Secondary Transactions

Founders Edge: How we quantitatively assess founders’ odds of success

SuperAngel Fund Tech Stack

Jacob Kostecki (angel): The Ultimate Early-Stage Investor’s Tech Stack

Untapped Capital: Tech stack; for details see This VC Is Slowly Automating His Job

That’s it for today. I hope you found some inspiration to test new tools and upgrade your tech stack. If we missed a great tool: hit reply and share it ;)

Stay driven,

Andre

Thank you for reading this episode. If you enjoyed it, leave a like or comment, and share it with your friends. If you don’t like it, you can always update your preferences to reduce the frequency and focus on your preferred DDVC formats. Join our community below and follow me on LinkedIn or Twitter to never miss data-driven VC updates again.