👋 Hi, I’m Andre and welcome to my weekly newsletter, Data-driven VC. Every Tuesday, I publish “Insights” to digest the most relevant startup research & reports, and every Thursday, I publish “Essays” that cover hands-on insights about data-driven innovation & AI in VC. Follow along to understand how startup investing becomes more data-driven, why it matters, and what it means for you.

Current subscribers: 18,625, +405 since last week

Brought to you by Affinity - Insights you need to find, manage, and close more deals

Affinity surveyed more than 700 private capital professionals for this comprehensive report on market conditions for the year ahead. Learn why investors are anticipating higher deal volume, how they’re shifting priorities to snap up high-quality deals, how AI is poised to change venture capital—and why some investors are remaining cautious amidst rising optimism.

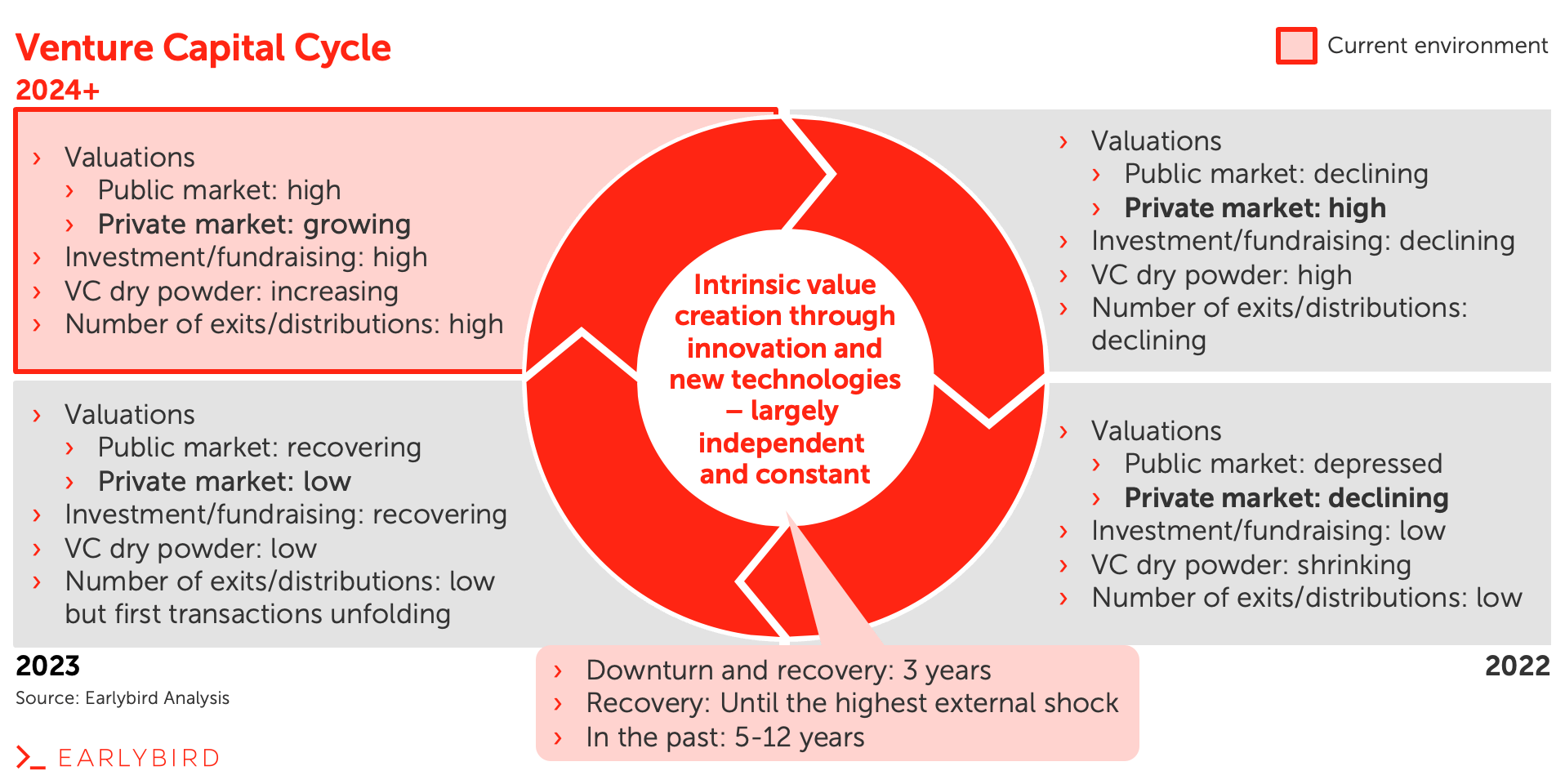

Private Markets Follow Public Markets

One of my recent predictions about The Future of VC centered around the fact that private market cycles follow public markets with some delay, thus expecting we have hit bottom and will see a re-acceleration in startup funding throughout 2024. Public markets serve as a reliable forward-looking indicator for private markets.

Besides the cyclicity, there’s another dimension where public markets serve as a forward-looking indicator for what is likely to happen in private markets: innovation. What can private markets learn from public markets?

The Hedge Fund Industry’s Inflection Point

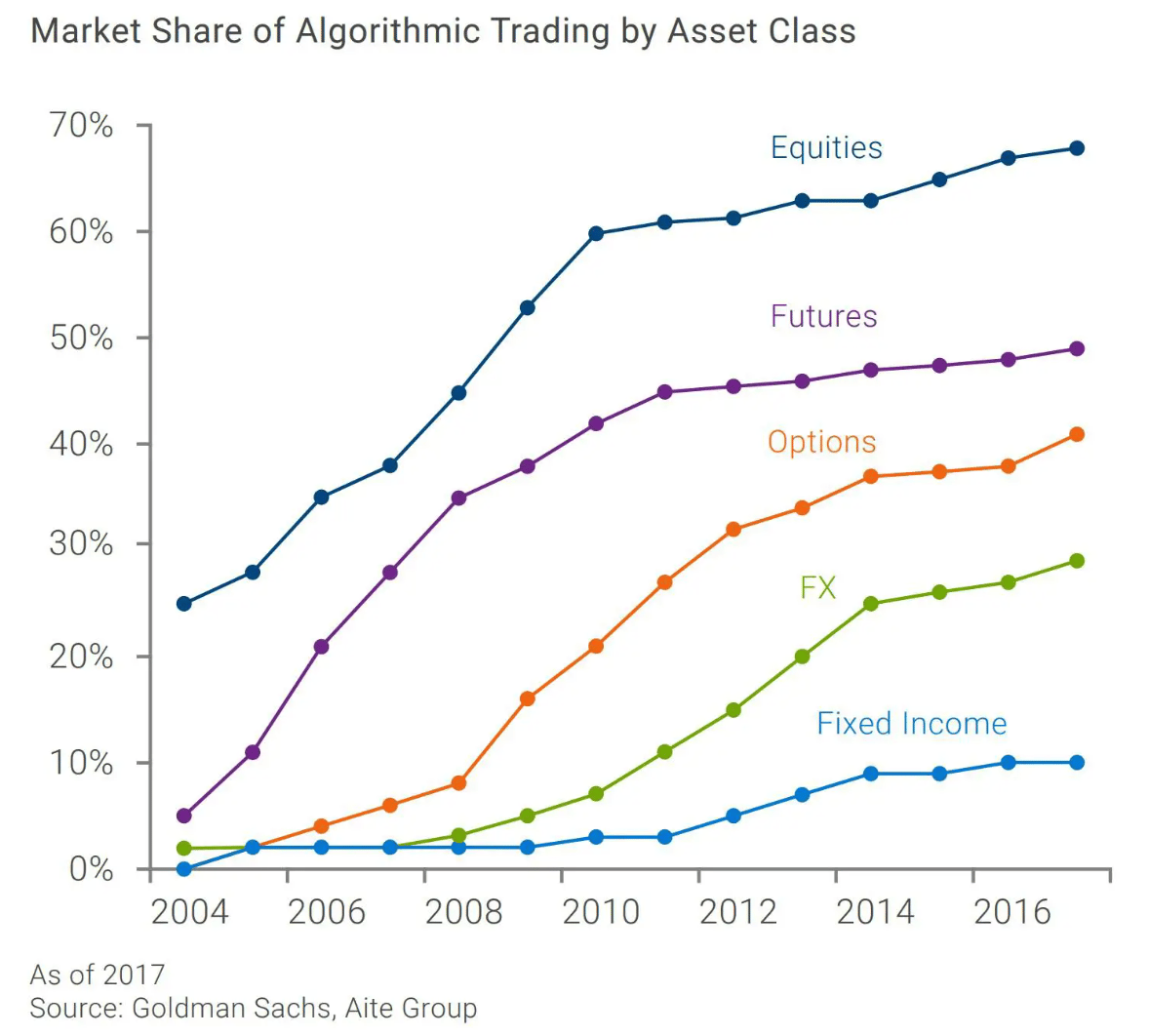

Up until the 1980s, hedge funds were largely run by Wall Street veterans who relied on their instincts and connections to make investment decisions. However, as more data on public companies became available, a new breed of hedge funds emerged that used quantitative models to make data-driven investment decisions and eliminate human cognitive bias in the chase for returns.

When Stephen Cohen, founder of S.A.C. Capital, one of the top hedge funds of the last century, started aggressively hiring quantitative specialists while at the same time cutting his stock-picking team of fund managers by nearly two-thirds, it became clear that “quant” was here to stay.

With pioneers like Cohen leading the algorithmic trading revolution of the hedge fund industry, we saw a range of manifestations on the spectrum of pure quantitative strategies, where mathematical algorithms make all of the asset allocation or stock-picking decisions, to “quantamental” strategies, which combine the traditional stock-picking skills of fund managers with data and computing power.

Today, quant hedge funds (in whatever manifestation) are the most successful and profitable firms in the industry and manual trading has gone extinct. According to recent figures, quant strategies account for 75%+ of total trading and more than $ 1 trillion in assets under management in the public markets.

Subscribe to DDVC to read the rest.

Join the Data Driven VC community to get access to this post and other subscriber-only content.

Join the Community