🚨 We just announced our physical Investor Summit 2025 with speakers from Accel, IVP, KKR, Lightspeed, MEAG and more here

👋 Hi, I’m Andre and welcome to my newsletter Data Driven VC which is all about becoming a better investor with Data & AI. Join 33,480 thought leaders from VCs like a16z, Accel, Index, Sequoia, and more to understand how startup investing becomes more data-driven, why it matters, and what it means for you.

Brought to you by Affinity — 3 data-backed deal sourcing strategies

Get Affinity’s latest deal sourcing guide to see how leading VCs are adapting their strategies for 2025, with insights from firms that source up to 88% of their deals by managing their networks strategically. And with almost 95% of dealmakers incorporating AI into their processes, learn how to build a data-driven sourcing engine that supports both inbound and outbound sourcing.

Linear Vesting Still Dominates…For Now

Matt Schulman digs into whether companies are shifting away from the classic 4-year linear equity vesting schedule in favor of more frontweighted structures. His analysis shows that the trend is not as widespread as the current discussion might have you think.

Private Companies Stick to Basics: Among Pave’s private company customers, linear grants remain the standard. The “frontweighted” buzz seems mostly limited to a few vocal pre-IPO players.

Public Companies Testing Waters: In 2025, 24% of public company new hire grants were frontweighted, up from just 9% in 2021. But 65% of them still issue linear grants.

Pressure from Public Markets: Public firms face real-time stock price volatility and external scrutiny over equity burn, pushing them to experiment more with how equity is structured.

✈️ KEY TAKEAWAYS

Despite headlines, most companies (especially private ones) aren’t overhauling equity structures. Public companies are exploring frontweighted grants, but linear remains the dominant model.

What Makes a Fundable Founder?

Adam Shuaib of Episode 1 Ventures shared findings from analyzing tens of thousands of seed founders and pitch decks. The results shed light on surprising traits that correlate with fundraising success or failure.

Personality Impacts Outcomes: Extroverted founders were 2x more likely to raise. Meanwhile, high neuroticism halved the chances of advancing past Seed.

Unusual Signals Win: Multilingual upbringing, obscure hobbies like base jumping, and early academic achievements were strong fundraising predictors.

PhD > MBA: Having a PhD (especially in AI) boosted fundraising odds significantly. An MBA showed no measurable impact.

While statistically not increasing fundraising chances, MBAs still produce a substantial number of unicorn founders (Strebulaev, 2025)

✈️ KEY TAKEAWAYS

Investors are favoring founders with emotional stability, international experiences, and quirky high-risk hobbies while MBAs may no longer give you an edge.

Why Bigger SaaS Companies Prefer Monthly Billing

ChartMogul reveals a surprising billing trend in SaaS in their latest SaaS Billing Report: larger companies shift away from annual contracts as they scale. Monthly billing becomes dominant past a certain ARR threshold.

Billing Peaks Then Dips: Annual billing dominates at $3M–$8M ARR but drops sharply after. At $15M–$30M ARR, only 28% of revenue comes from annual plans.

Growth = Flexibility: Larger SaaS firms lean into monthly billing to reduce friction, unlock expansion, and adapt to customer preferences.

Market-Driven Shifts: In a cautious economic climate, monthly plans help reduce buyer hesitation, giving SaaS businesses a flexible path to upsell later.

✈️ KEY TAKEAWAYS

While annual plans are key in early growth stages, mature SaaS companies pivot to (or are driven to by customer demand) monthly billing to balance flexibility, customer acquisition, and long-term expansion.

Going Global Means Going Stateside

New research from Ilya Strebulaev suggests relocating to the US dramatically increases a startup’s odds of hitting unicorn status, especially for founders from Israel, India, and the UK.

Israel’s 9x Boost: 29 Israeli startups that moved to the US became unicorns, compared to just 3 that stayed. That’s a ninefold increase.

India and the UK Gain Too: After relocating, Indian startups were 6.5x more likely to become unicorns, while UK companies saw a 2.5x increase.

Why the US?: The American market offers greater access to capital, customer base, and network effects, making it a magnet for ambitious international startups.

✈️ KEY TAKEAWAYS

For many international startups, relocating to the US isn’t just a strategic option, it’s a game-changer with an outsized impact on the path to unicorn status.

Share this article with others who might benefit.

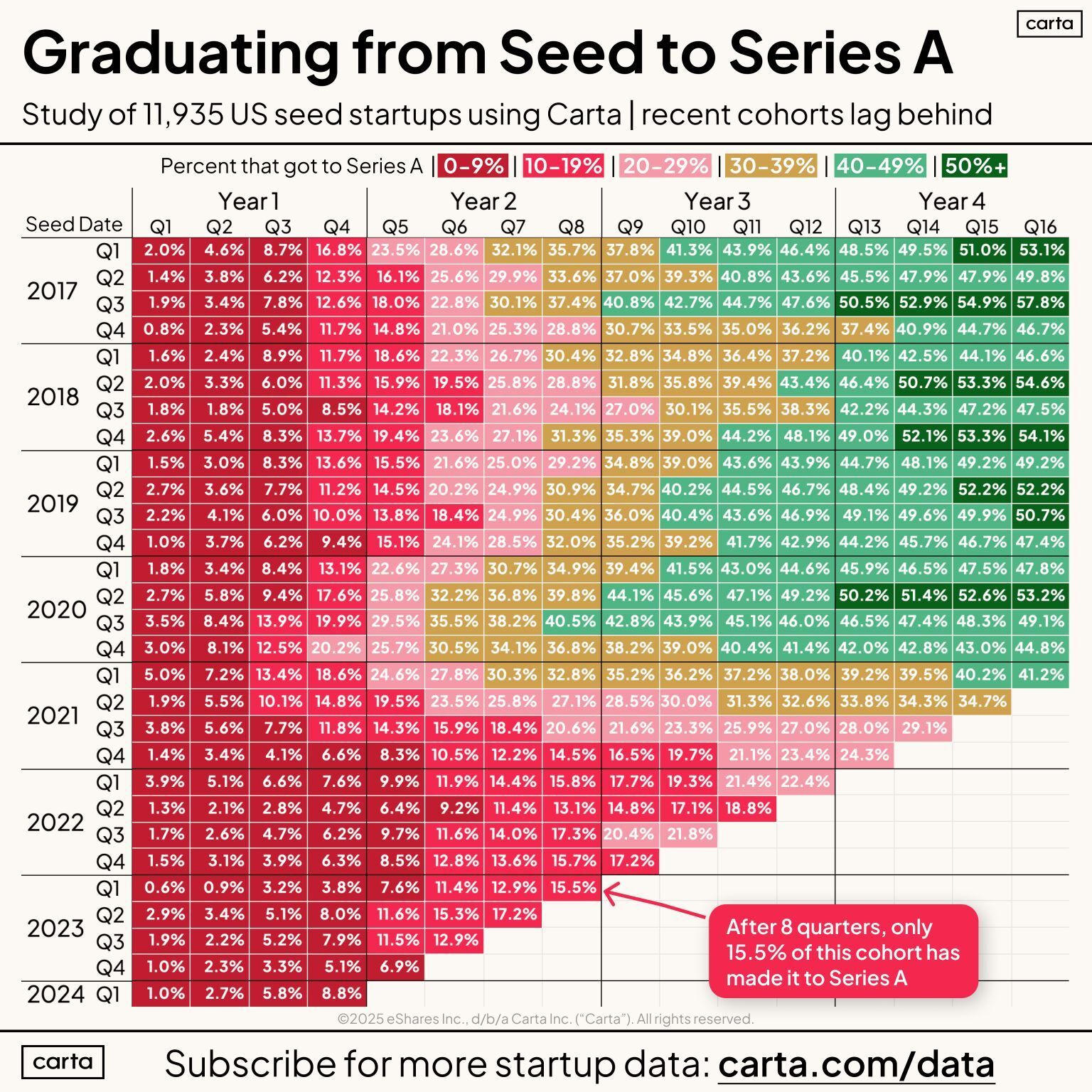

The Series A Bottleneck Is Real

Peter Walker of Carta highlights a sobering trend: Fewer startups are making the leap from Seed to Series A, with conversion rates declining steadily since 2021, regardless of sector or region.

From 38% to Less: Only 38% of startups that raised Seed in Q1 2021 reached Series A in three years. Newer cohorts are tracking even lower.

Metrics Got Harder: Series A benchmarks have quietly shifted upward. “Nice” traction doesn’t cut it anymore unless you’re a repeat founder or an AI outlier.

Seed Round Stalemate: More founders are either stuck raising bridge rounds or trying to avoid further fundraising altogether, fueling an oversupply of seed-stage startups.

✈️ KEY TAKEAWAYS

It’s harder than ever to graduate from Seed to Series A. With rising expectations and investor caution, even strong traction may not be enough to unlock that next check.

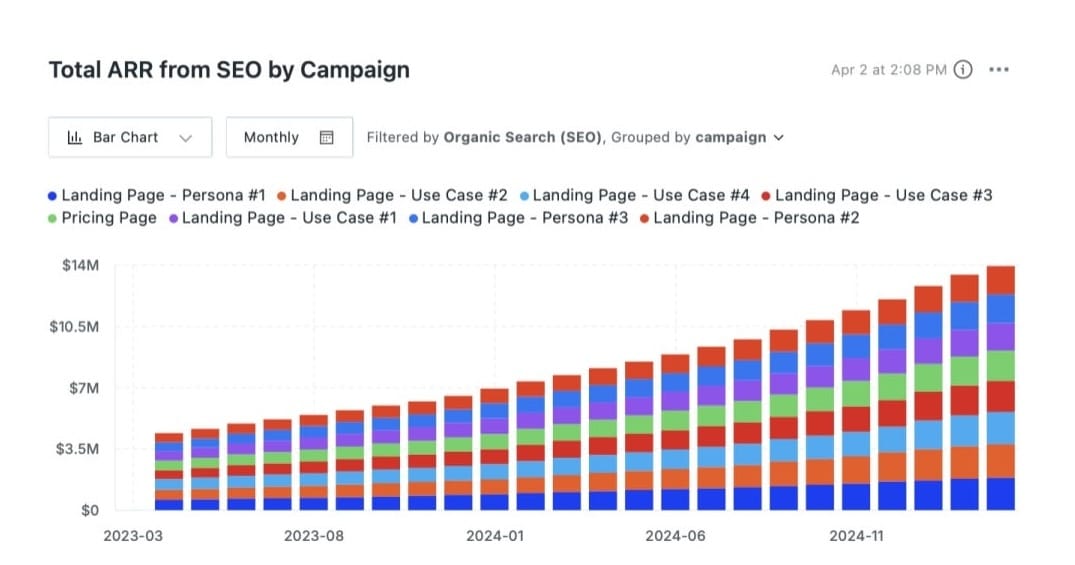

Why Campaign-Level Attribution Matters More Than You Think

Growth Unhinged’s deep dive into marketing attribution (featuring insights from Tim Dalrymple, who brings experience from WebFlow and Notion) argues that campaign-level tracking is essential for scaling growth efficiently.

Attribution = Budget Control: Without campaign-level attribution, companies risk wasting 15–25% of their marketing spend due to misallocated efforts.

SaaS Leaders Do It: The majority of $100M+ ARR SaaS companies have detailed attribution systems in place to inform where to double down.

Build the Full Stack: Dalrymple recommends a multi-tool approach including CRM tracking, web analytics, UTM rigor, and a central reporting layer to properly track CAC and pipeline.

✈️ KEY TAKEAWAYS

Marketing teams that invest in campaign-level attribution are better equipped to scale efficiently, control CAC, and make smarter, faster growth decisions.

Thanks to Jérôme Jaggi for his help with this post.

Stay driven,

Andre

PS: Learn more about our physical Investor Summit 2025 here

Thank you for reading this episode. If you enjoyed it, leave a like or comment, and share it with your friends. If you don’t like it, you can always update your preferences to reduce the frequency and focus on your preferred DDVC formats. Join our community below and follow me on LinkedIn or Twitter to never miss data-driven VC updates again.