👋 Hi, I’m Andre and welcome to my newsletter Data-Driven VC which is all about becoming a better investor with Data & AI. Join 33,380 thought leaders from VCs like a16z, Accel, Index, Sequoia, and more to understand how startup investing becomes more data-driven, why it matters, and what it means for you.

Brought to you by Affinity – Navigating 2025’s Investment Landscape

Market consolidation is reshaping venture capital, with fewer firms capturing the lion’s share of deals. How can investors adapt their dealmaking strategies to stay ahead?

Join Mercedes Bent, Venture Partner at Lightspeed, and Brian Murphy, Lead Data Scientist at Salesforce Ventures on May 8 for key insights on evolving dealmaking trends, the behaviors of top-performing firms, and the strategies investors are using to thrive in a competitive market.

The Pricing Dilemma

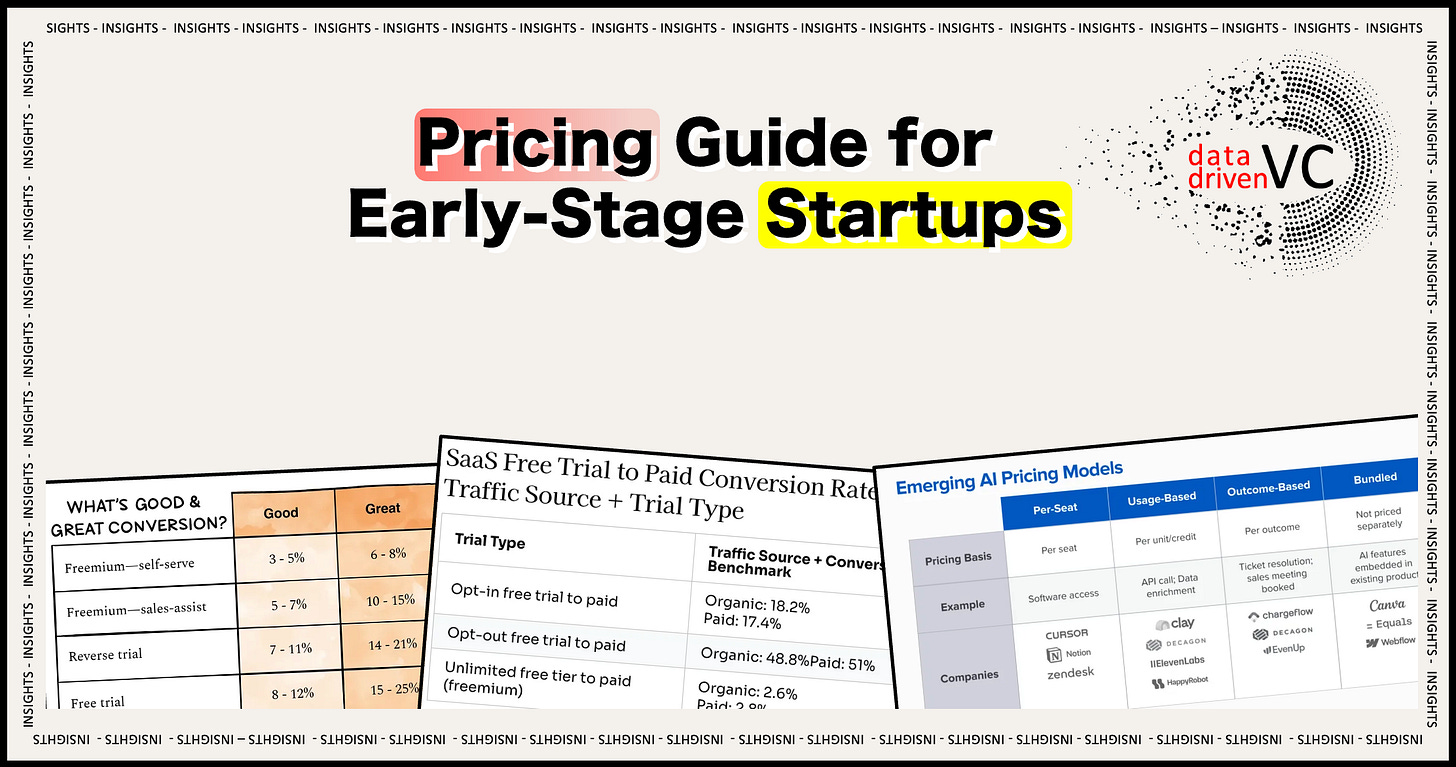

Tech startups in their pre-product-market fit (PMF) phase often experiment with pricing to find a sustainable business model. In the US and Europe, early-stage SaaS and data-driven companies have tried a range of pricing strategies from giving the product away for free to charging premium prices upfront.

This episode examines common pricing models used before achieving PMF, the strategic risks and rewards of setting prices early, conversion data from early monetization experiments, and case studies illustrating key approaches. The goal is to provide a structured look at how young startups price their products when the primary objective is learning and user adoption rather than immediate profit.

Let’s jump in👇

Common Pre-PMF Pricing Models and Strategies

Before achieving PMF, startups favor simple or experimental pricing schemes that maximize learning or user adoption. Here’s a brief summary of the 8 most common approaches.