Patterns of Successful Startups, Co-Founder Yes or No, Advisor Equity Benchmark & More

Digesting Insights From the Data

👋 Hi, I’m Andre and welcome to my weekly newsletter, Data-driven VC. Every Tuesday, I publish “Insights” to digest the most relevant startup research & reports, and every Thursday, I publish “Essays” that cover hands-on insights about data-driven innovation & AI in VC. Follow along to understand how startup investing becomes more data-driven, why it matters, and what it means for you.

Brought to you by Pitchreview.ai - Delivering instant, actionable pitch deck analysis to founders

Pitchreview.ai is a self-serve tool that provides bespoke investor-centric feedback to founders on their pitch deck. Embed our tool to effortlessly create goodwill with every founder and publicly exhibit your commitment to cutting-edge AI-driven tech solutions. Secure a competitive advantage with higher quality and complete pitch deck submissions.

Even veteran founders are full of praise for our insightful feedback from an investor's perspective. Improve pitch deck quality and add value to prospective founders. Integrate our technology and access our top 1% of pre-qualified deal flow.

This is the first episode of my new “INSIGHTS” series. I’ll publish it every Tuesday and it comes in two alternating formats:

“DIGEST” the most interesting startup research & reports from the previous two weeks. We read all reports, studies, and papers about startups and the wider ecosystem, and condense the most important insights for you. The only source you need to keep up with data-driven startup insights.

“SYNTHESIZE” all available research to create a deep knowledge base for various startup topics such as success criteria, founder backgrounds, hiring playbooks, salary benchmarks, cap table structures, and more. The only source you need to understand any specific startup topic.

Today, we start with DIGEST#1, summarizing the most relevant research from the past weeks and highlighting six clear takeaways.

What Are the Patterns of Successful Startups?

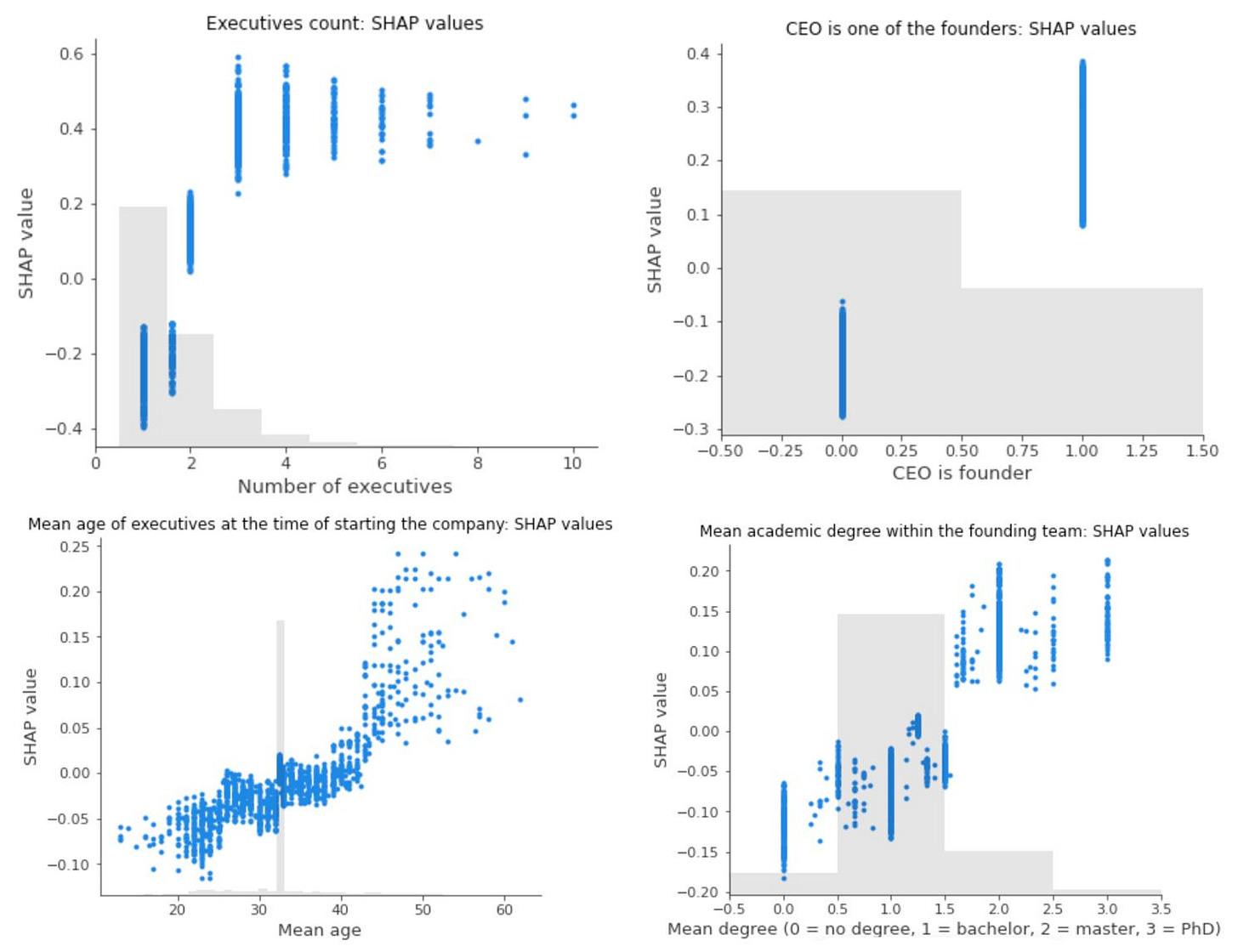

We ran the numbers on 25k+ startups to predict the impact of various team characteristics on the likelihood of raising a follow-on funding round.

Number of executives: 3-6 is best, single founder is worst

CEO: Important to be founder, external CEO is bad

Age: Teams with higher age are more successful; little difference between 25 to early 40s

Education: Master and PhD similarly good, Bachelors and no degree both bad

✈️ KEY TAKEAWAY

Important to differentiate correlation and causation, of course, yet interesting to keep these patterns in mind: Founder CEO, 40+ years old, Master or PhD with 3-6 execs (founders or non-founders) has the highest likelihood of raising follow-on funding. Full study here.

Solo vs. Team: The Startup Founder Debate

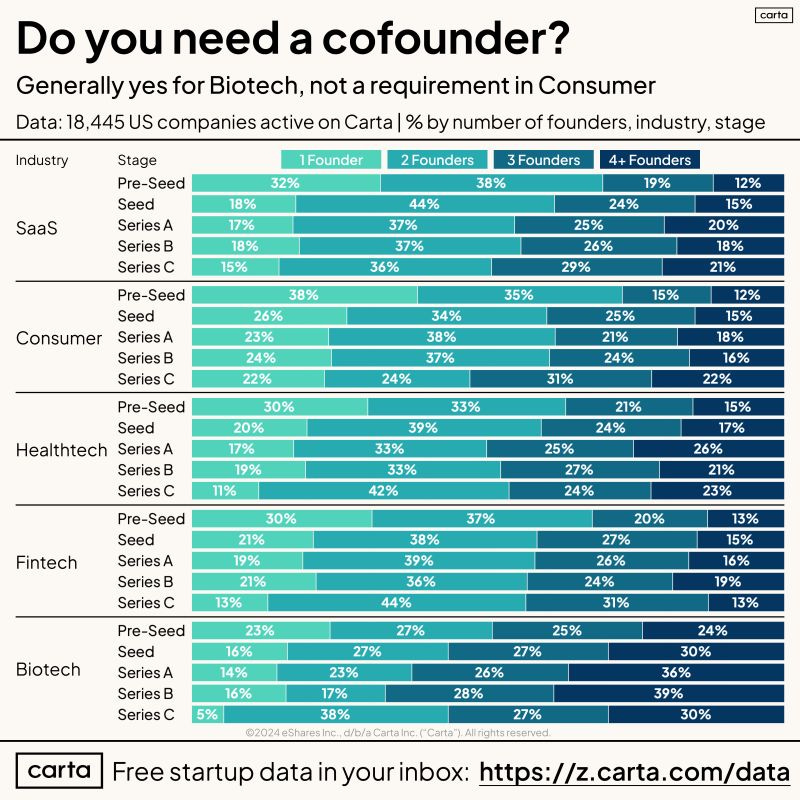

In the startup world, the necessity of having a cofounder is often debated. A recent study of 18k+ companies on Carta sheds light on this topic:

Solo founders are more common than you think: They run about 27% of all companies, with a higher prevalence in the Consumer sector. However, this percentage decreases slightly beyond the pre-seed stage.

The biotech industry favors larger teams: Contrary to other sectors, biotech startups tend to have founding teams of three or more members.

Solo founders persist even at advanced stages: Even at the Series D level, 15% of companies are led by solo founders, indicating that single-founder companies can and do thrive long-term.

✈️ KEY TAKEAWAY

This data reveals that success in startups isn't strictly tied to the number of founders, but rather varies across industries and stages. Full analysis here.

Value Capture in Startup Markets: The Missing Middle

A recent study sheds light on a critical "missing middle" – a gap in value capture for startups facing both technological and commercialization challenges: