👋 Hi, I’m Andre and welcome to my newsletter Data-Driven VC which is all about becoming a better investor with Data & AI. Join 30,010 thought leaders from VCs like a16z, Accel, Index, Sequoia, and more to understand how startup investing becomes more data-driven, why it matters, and what it means for you.

Brought to you by Deckmatch - Agentic Workflows and APIs for Data-Driven VCs

Connect your top-of-funnel to Deckmatch and transform pitch decks and URLs into structured and insightful data. Get detailed firmographic and people data, in-depth competitive and market analysis, and personalized investment memo without lifting a finger. The cherry on the cake? It's all seamlessly synced to your preferred tools like Affinity through our API integrations.

Never miss a deal, ditch the donkey work, and build meaningful relationships faster.

Welcome to our monthly wrap-up episode where we cover November’s most relevant content at the intersection of startups, VC, data & AI.

We read it all so you don’t need to - here we go👇

INTERESTING RESEARCH & REPORTS📈

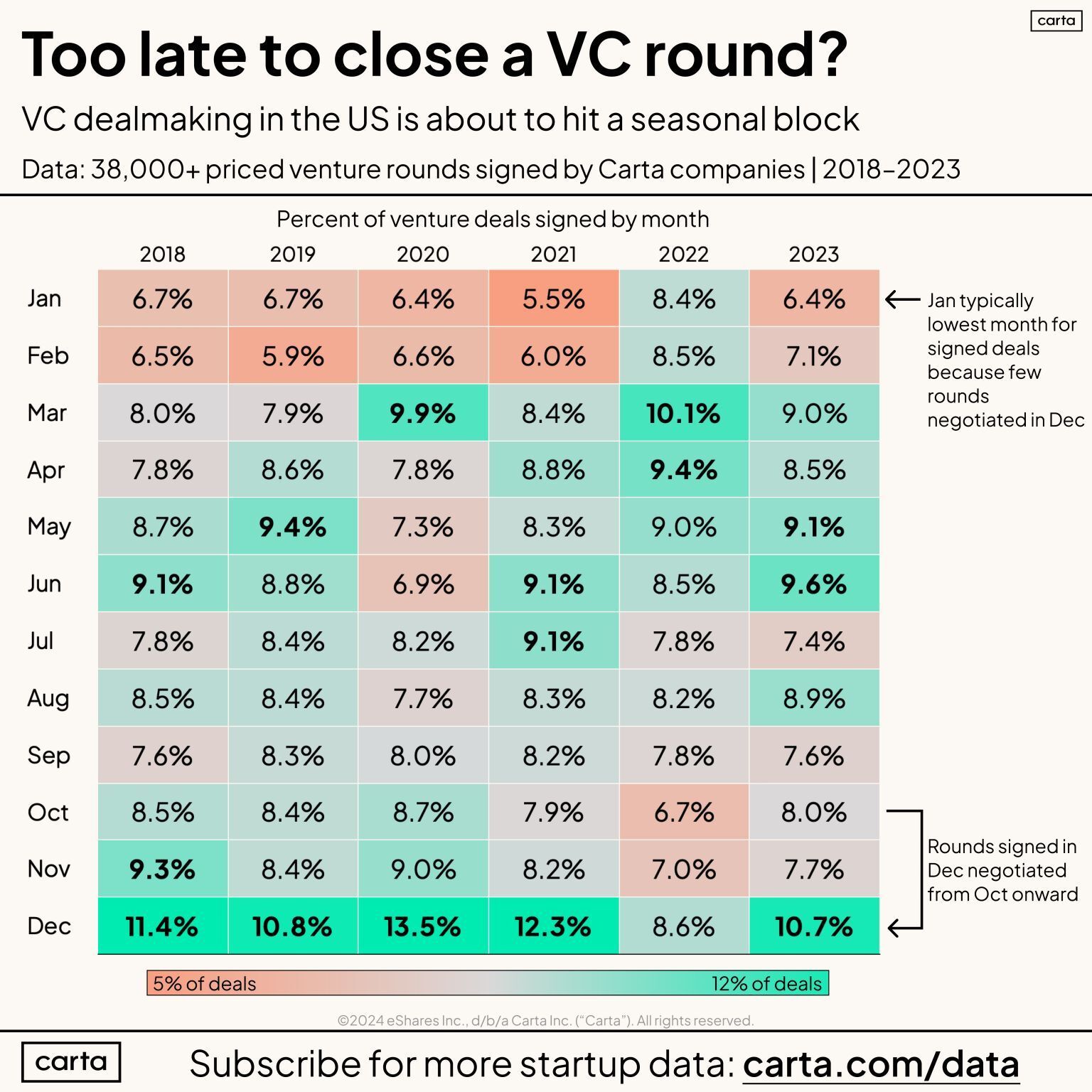

Venture Deals to Hit the Brakes After December

While December typically sees a surge in venture deal closures, the pipeline slows down dramatically heading into the new year. Founders looking to start negotiations post-Thanksgiving may face delays, as January and February are historically the slowest months for finalizing deals. Peter Walker from Carta has the data and insights on what to do about it:

Maximize prep time: Use the upcoming lull to perfect your investor list, refine outreach emails, and secure warm introductions for the next round.

Product focus: Fundraising may pause, but there’s no reason your product development can’t accelerate to impress investors when talks pick up again.

Study trends: Analyze recent deal patterns and market behavior to gain a better understanding of what investors will prioritize in 2024.

✈️ KEY TAKEAWAYS

Founders can use the slower deal season to plan strategically, focus on product growth, and stay informed about market trends to position themselves for success in 2024.

What Seed Pitch Decks Need (and Don’t Need)

Episode 1 Ventures analyzed ~7,000 pitch decks to uncover patterns that increase a startup’s likelihood of raising funds at the seed stage. Their findings highlight certain do’s and don’ts for founders crafting their decks.

LTV and Unit Economics: Decks that mention customer Lifetime Value (LTV) and unit economics have a higher chance of success, showing investors the company understands its value drivers.

Avoid ROI and Milestones: Surprisingly, including terms like “ROI” and “milestones” was linked to lower raise success, suggesting these may sound overly generic or too early-stage for seed rounds.

Market Size Matters: Explicitly discussing market size and recent industry changes can enhance raise chances, as investors often look for clear opportunities and adaptability to shifts.

✈️ KEY TAKEAWAYS

To boost fundraising odds, focus on metrics like LTV and unit economics, highlight market size, and avoid vague terms like “ROI” that don’t provide specific insights.

Subscribe to DDVC to read the rest.

Join the Data Driven VC community to get access to this post and other subscriber-only content.

Join the Community