👋 Hi, I’m Andre and welcome to my weekly newsletter, Data-driven VC. Every Tuesday, I publish “Insights” to digest the most relevant startup research & reports, and every Thursday, I publish “Essays” that cover hands-on insights about data-driven innovation and AI in venture capital. Follow along to understand how startup investing becomes more data-driven, why it matters, and what it means for you.

Current subscribers: 18,220, +505 since last week

Brought to you by VESTBERRY - Portfolio Intelligence Platform for data-driven VCs

Data Engineering is no longer just a backstage player but is taking center stage in the VC space. It is about constructing and maintaining the architectures (think databases, large-scale processing systems) that allow for data availability—a cornerstone for insightful analysis and well-informed decisions. Turning raw data into usable outputs and insights has great use cases for deal sourcing, due diligence, or portfolio monitoring. Dive deeper into this video, where we break down the impact of data engineering on the VC industry.

The importance of technology and AI in VC cannot be underestimated. Our industry is undergoing a massive transformation and by now, every investor should know. 2017, when I got into VC, few people thought about this topic. And certainly, nobody openly spoke about it.

Times have changed, and over the past 6 to 7 years I’m lucky to be part of a growing Data-driven VC community where we exchange thoughts and learnings in small trusted groups. Behind closed doors.

What databases do you use? How can you spot stealth founders? Deduplication? Entity resolution? Which CRM is the best? Make vs buy? What profile to hire as your first engineer? How can you differentiate if every fund has access to the same data?

These and many more questions have been on the agenda. Last Thursday, we decided to open doors for one of these groups, and on Francesco Petricarari and Ralph King’s initiative, we ran an online panel.

650+ signups, 400+ participants, and tons of content for 1 hour time. Today, I’m happy to share the recording and key takeaways.

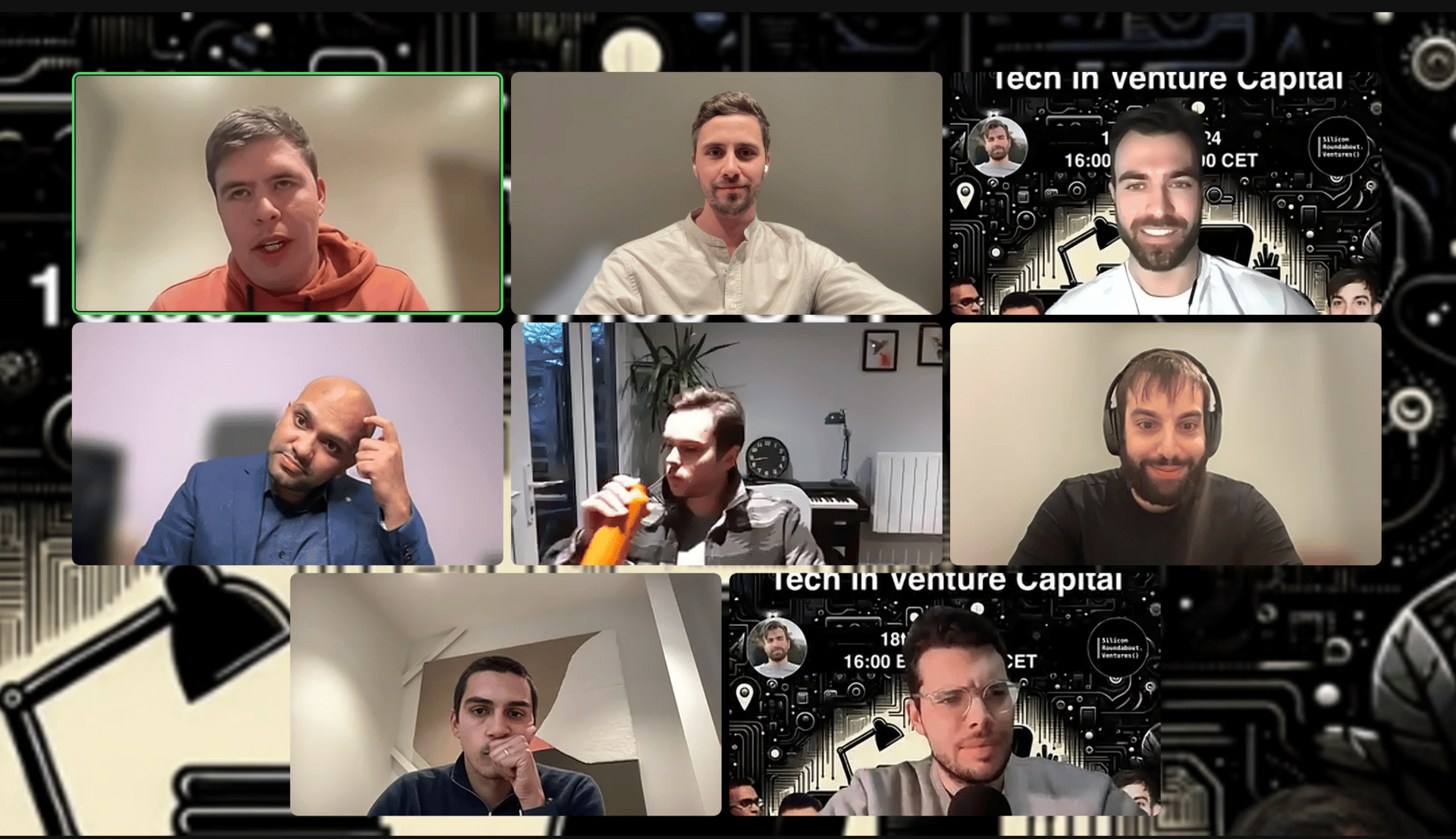

Participants

Mike Arpaia - Moonfire (middle right)

Francesco Corea - Greycroft (bottom left)

Stephane Nasser - OpenVC (bottom right)

Philipp Omenitsch - Sequel (top left)

Danish Abdullah - hive.one (middle left)

Ralph King - Silicon Roundabout Ventures (center)

MC: Francesco Perticarari - Silicon Roundabout Ventures (top right)

… and myself 👋🏻

VC Will Never Be Fully Automated - Will It?

Fra kicked off with a spicy thesis: VC will never be fully automated. Ever. It’s technically unfeasible to automate everything end-to-end. I couldn’t resist but challenge it. I feel that it depends on the setup of the fund. Certainly, it’s true for funds with a lead investor strategy. Someone needs to set the terms, negotiate, do all this human-to-human stuff. Moreover, founders don’t want an algorithm on their board. Sure, I get it.

But what about follower funds? I’m convinced we’ll soon see a cohort of pure quant funds following human-led or augmented VC firms. We can already predict the likelihood of success for private companies and by cutting the wheat from the chaff, algorithms might be able to generate alpha. Even more obvious, a tier1 fund leading the round might increase confidence in the positive trajectory of the company.

The big question for pure quant funds however becomes access? Easy money, but what else? Why should the best founders take your money? This is a question that surely the quant funds will find an answer to.

Philipp adds another dimension: the state of the company. He expects a correlation between the degree of automation and the maturity of the target company. The more mature the startup, the more quantitative data is available, the more work can be automated.

AI Will Bring the “Tinder Moment” to VC

Stephane expects a dating-like situation where all VCs have access to the same data but will eventually get different matches, based on their individual preferences. And not to forget: Someone needs to still go have the date. This will remain all human.

Danish describes the human-algorithm relationship as a second brain. Data-driven capabilities will allow humans to do what they already do, just better and on steroids. Mike adds that DDVC will quickly become a commodity where the human expertise to properly assess opportunities and eventually access competitive deals will be key.

While I agree that access to data might not be a long-term differentiator, I tried to remind everyone that only 1% of all VC firms have internal initiatives to become more data-driven (referring to findings from the Data-driven VC Landscape 2023; survey for 2024 edition open here).

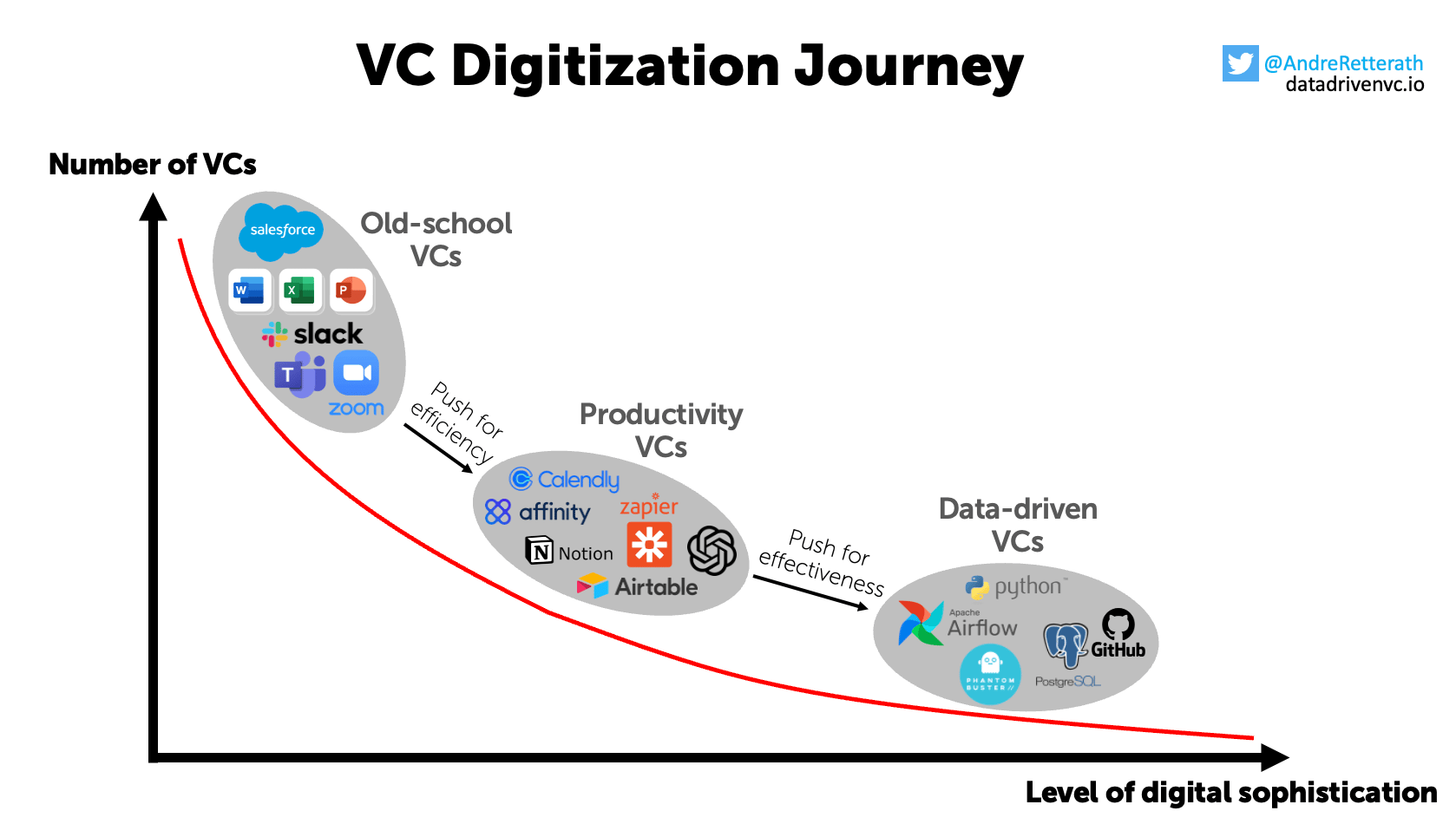

Everyone in this group is part of a tiny bubble and the majority of investors are still stuck in the “Old school” or “Productivity” stages of the VC Digitization journey.

Although I agree that access to data will eventually become a commodity, the time until this happens is probably longer than most of us anticipate. And once we hit this point, differentiation is still possible through proprietary screening algorithms and “taste”, confirming the Tinder analogy made earlier.

Beyond these aspects, differentiation and access is also possible via unique firm brands, personal brands, track records, personal relationships, and more.

Subscribe to DDVC to read the rest.

Join the Data Driven VC community to get access to this post and other subscriber-only content.

Join the Community