👋 Hi, I’m Andre and welcome to my newsletter Data-driven VC which is all about becoming a better investor with data & AI. Every Tuesday, I publish “Insights” to digest the most relevant startup research & reports. Every Thursday, I publish “Essays” that cover hands-on insights about data-driven innovation & AI in VC, and every Sunday, I publish “Picks” to spotlight the hottest Stealth, Early, and Growth Startups. Follow along to understand how startup investing becomes more data-driven, why it matters, and what it means for you.

Current subscribers: 24,555, +250 since last week

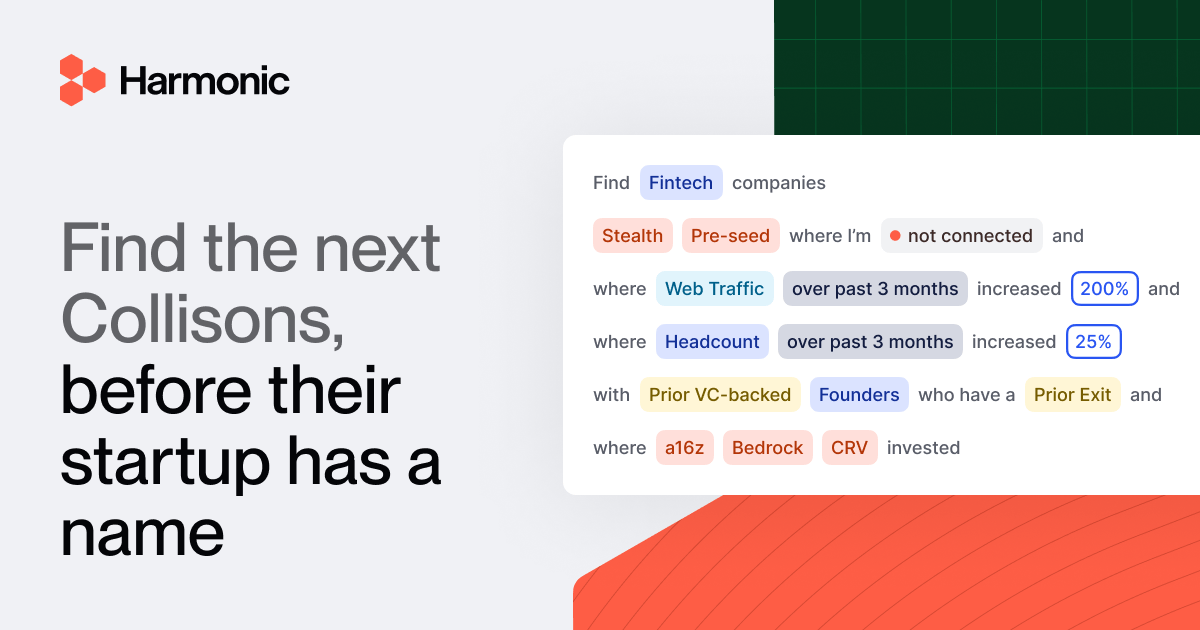

Brought to you by Harmonic - The Startup Discovery Engine

Harmonic identifies visionary entrepreneurs launching companies before any other provider. By analyzing backgrounds, tracking talent movements, monitoring new filings, and keeping tabs on social media updates, we discover startups 6-12 months ahead of the competition.

Today is a special episode as we share one of the most watched sessions from the virtual Data-Driven VC Summit 2024 with you. I was lucky to have Sarah from Atomico, Ben from InReach, Olivier from Red River West, and Max from Harmonic join me to discuss their perspectives on make vs buy, and how VCs can differentiate and gain a competitive edge in the future.

✍️ Key Take Aways

Focus Beyond Sourcing: Move beyond just sourcing to areas like evaluation and portfolio management.

Codify Investment Thesis: Translate the firm’s unique investment thesis into data-driven models.

Leverage Private and Public Data: Use both types of data to identify promising opportunities and generate insights.

Maintaining Trajectory: Push for continuous innovation and alignment with the firm’s goals. Stay agile and keep exploring new ways to leverage data for a competitive edge.

Community Knowledge Sharing: Foster collaboration and knowledge sharing within the community.

Introduction

To kick it off, I asked the panelists for a brief intro and where they position on the spectrum of make vs buy.

Sarah

I'm part of Atomico's Intelligence team. I've been working on data-driven initiatives for the past five years at Atomico, and I'm also the co-author of the “State of European Tech” report, the definitive data-led report on the European tech ecosystem. We've been active across all parts of the investment value chain from sourcing to portfolio value creation to exits. So we have a really good mix of make versus buy. It's been amazing to see the DDVC community grow, and I've enjoyed collaborating with many of you over the years. Thank you so much for having me. I'm very excited about the chat today.

Ben

Hi, I'm Ben, the partner, co-founder, and CTO of InReach Ventures. We've been going for about eight years now, starting with the idea that we could completely change and redesign the investment process of a venture firm by putting technology at the center. We focus on very early-stage companies all over Europe using technology, which wasn't really possible for a fund of our size without technology. In terms of the make versus buy split, because we've been doing it so long, we have mostly had to make. We're very heavily skewed towards engineering and product. But I'm not zealously into making everything myself; I actually quite like buying things from time to time.

Max

I'm the CEO at Harmonic. I was at Google for a long time in various data-related roles. Harmonic is essentially like Google search but for startups. We've built web crawlers that go to any place on the public internet where startup data might be lurking. We've gotten really good at extracting that data at scale, structuring it, merging it into a knowledge graph, indexing it so all that data can be searched, and keeping it fresh in real-time. My position is that firms can get a lot of leverage by buying that core data asset and applying their focus and energy on top of that instead of trying to collect or coerce that data.

Olivier

I'm Olivier, one of the partners at Red River West. We’ve been around since 2017 and are on our second fund now. We invest later-stage, mostly at series B, and only in Europe in companies with the potential to expand to the US. We started our data initiative about five years ago with our internal team, sometimes supplemented by freelancers. We use an algorithmic platform called Ramp for sourcing, screening, and operational efficiency. We're mostly on the make side but do buy at the bottom of the stack, mostly for data collection.

Subscribe to DDVC to read the rest.

Join the Data Driven VC community to get access to this post and other subscriber-only content.

Join the Community