How to Not Miss the AI Train: Essentials You Need to Know

DDVC #55: Where venture capital and data intersect. Every week.

👋 Hi, I’m Andre and welcome to my weekly newsletter, Data-driven VC. Every Thursday I cover hands-on insights into data-driven innovation in venture capital and connect the dots between the latest research, reviews of novel tools and datasets, deep dives into various VC tech stacks, interviews with experts, and the implications for all stakeholders. Follow along to understand how data-driven approaches change the game, why it matters, and what it means for you.

Current subscribers: 13,713, +157 since last week

Brought to you by VESTBERRY - The Portfolio Intelligence Platform for Data-driven VCs

We are opening early access to our Affinity Integration! What value does it bring to VCs? In short, it allows you to become more data-driven by combining your relationship and portfolio data to discover hidden connections and insights. For example, you can easily identify influential stakeholders within your portfolio to discuss secondaries, explore co-investment opportunities, or share investment plans. And there's more to uncover! Early stage has limited spots, so be among the first to sign up.

TL;DR

Perfect AI storm due to “magic triangle” of intelligent algorithms, powerful compute, and large-scale availability of data

I share 2 frameworks to assess AI: 1) Onion framework to understand terminology and 2) value chain framework to understand different propositions as well as full-stack/verticalized versus horizontal

AI will reduce the cost of experimentation, more specifically the marginal cost of generation, and thus allow companies to achieve more with less

Reduced entry barriers will increase new startup creation, eventually increasing cash demand more broadly across the startup ecosystem

Increased capital demand together with current cash shortage led to strong buyer’s market but will hopefully bounce back to more balanced dynamic

Companies need to access the potential of AI for 1) their workforce and 2) their own product, a simple framework below

Digitization of VC is still at day 0, providing a huge opportunity for first-movers leveraging data & AI to generate alpha, more details via

—

Last week, I was invited to give two keynotes at Bits & Pretzels, one of the leading startup conferences in Europe. My Sunday session was all about “The Future of Startups & VC: Augmenting Humans with AI”, a topic that’s close to my heart and the essence of this newsletter. Subsequently, the Monday session “How to Not Miss the AI Train: Essentials You Need to Know” was intended to double-click on the previous day and provide a more comprehensive rundown of the recent AI hype, frameworks to properly access AI opportunities as well as a perspective on the impact of AI on our economy, startups, and us as VC investors.

Unfortunately, I needed to cancel the Monday session on short notice due to my very own Earlybird 🐣🤩 surprise. I appreciate that many of you were at the stage when it was canceled (thanks for your kind messages), so I’m happy to share the presentation with you today. Below, you’ll find the most relevant slides including key talking points.

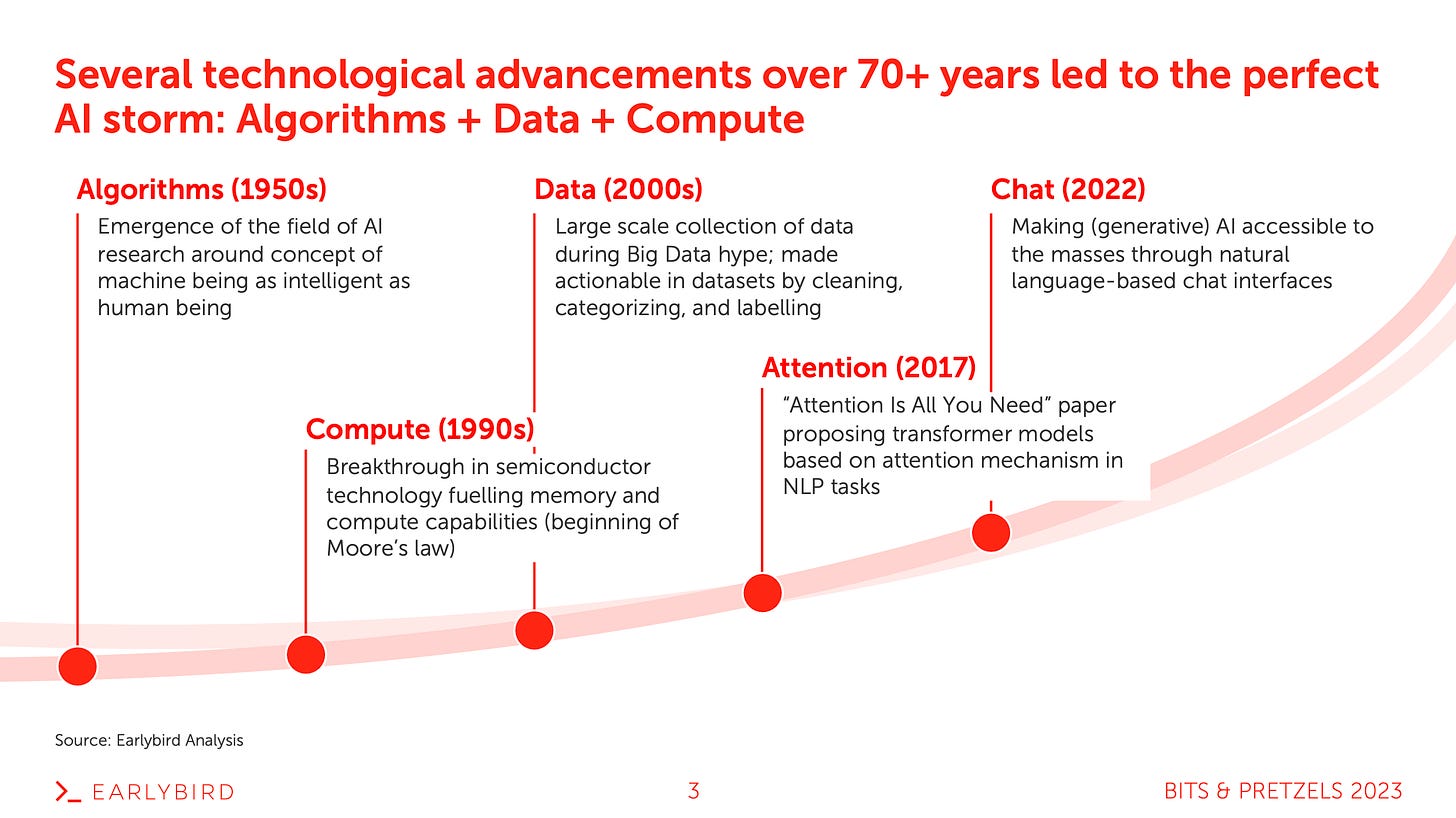

“Magic Triangle of AI”: Algorithms + Compute + Data

It feels that the perfect AI storm has just begun, yet in reality, it has been 70+ years in the making. Only with intelligent algorithms (starting in the 50s), powerful computing (starting in the 90s but waiting for its breakthrough in the 2010s via parallel computing and GPUs), and broad availability of data (“data is the new oil”); the so-called “Magic Triangle of AI”; AI started to become reality.

While the actual epicenter of the AI boom was probably the discovery of attention mechanisms via the “Attention is all you need” paper in 2017, I’m convinced that 2022 will be remembered as the year of breakthrough in AI due to the launch of ChatGPT. ChatGPT and its ability to prompt LLMs via natural language (instead of code) removed significant friction and led to widespread adoption across prosumers.

How to make sense of AI in a structured way – 2 helpful frameworks

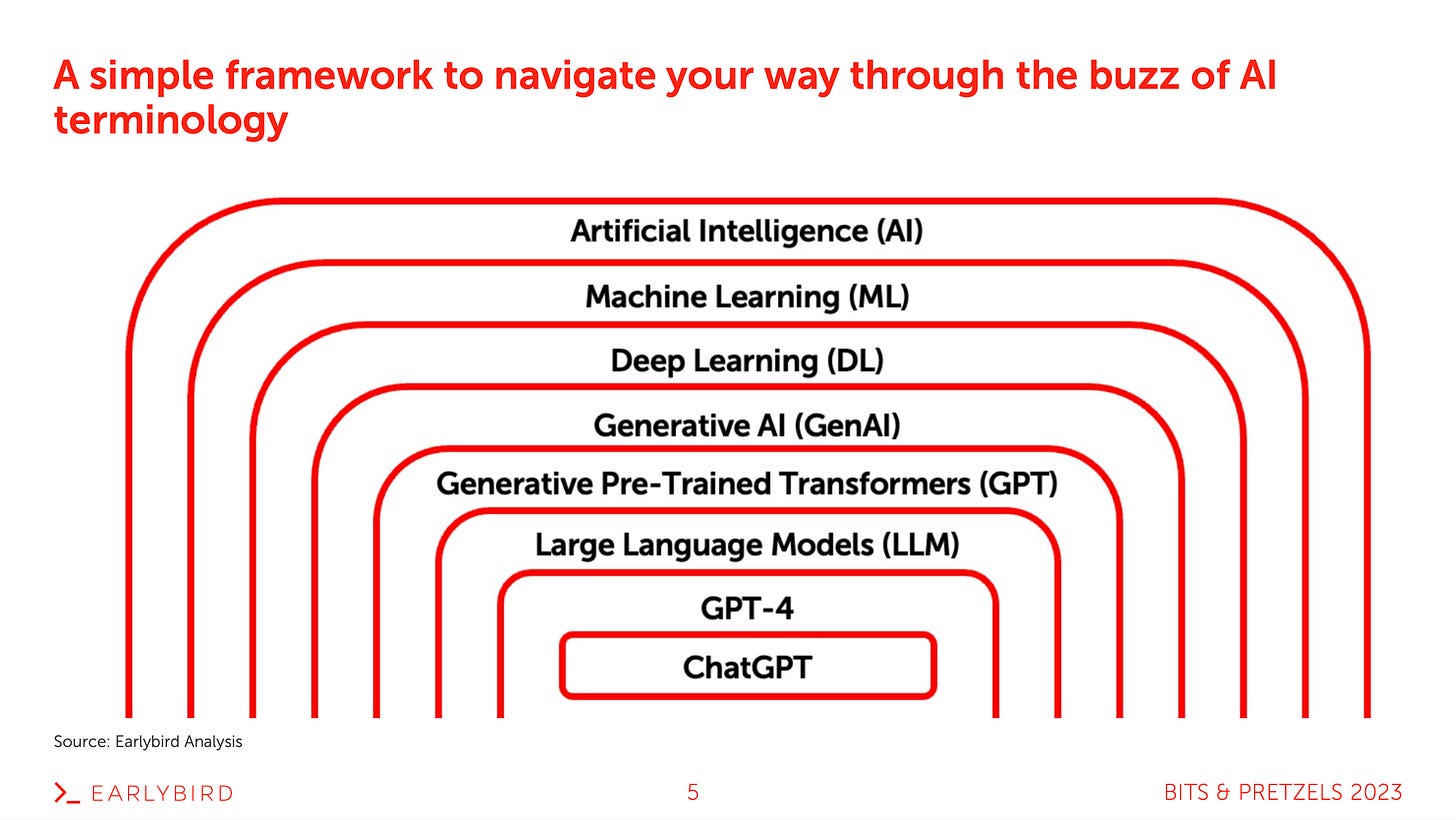

Following the craze of the past year and engaging in a variety of conversations around AI, I couldn't help but notice a common trend—many people seem to confuse the fundamentals and mix up various concepts regarding AI. It became evident that amidst the excitement and buzz surrounding AI, there is a need for clear and simple frameworks to help demystify this complex field.

As described in this “AI Cheat Sheet” post, I’m a big believer in simplifying frameworks to make sure we speak the same language. My two favorites are below.

The “Onion Framework” for terminology

The “Value Chain Framework” for different propositions

What’s holding us back now?

By now it’s pretty obvious that compute infrastructure is the key bottleneck to scale AI. Seemingly unlimited demand faces restricted supply. The result? Nvidia as the leading AI-GPU provider became one of the most valuable companies after posting year-over-year sales growth of 101%, to $13.5 billion for the three months that ended in July — a new record for the company. Of course, this also engages geo-political attention.

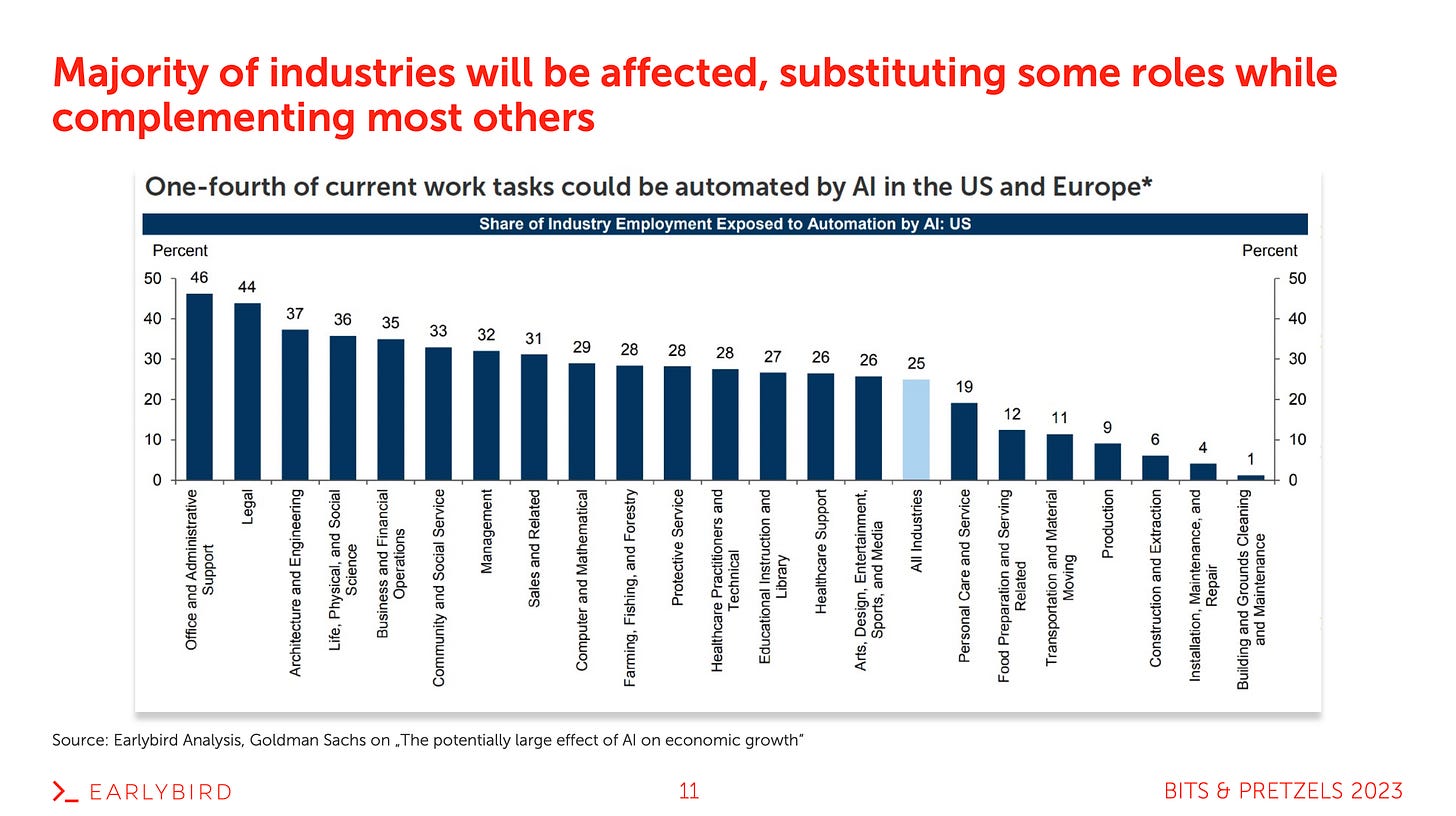

The impact of AI on our economy, the startups we invest in, as well as ourselves as VCs

What’s ahead?

It’s very much a crystal ball but I strongly believe that Amara’s law will hold true for AI as for other technological shifts in the past:

“We tend to overestimate the effect of a technology in the short run and underestimate the effect in the long run.” - Roy Charles Amara

Those are obviously just a few of many predictions that I anticipate as an impact of AI. I’m particularly excited about the cost of experimentation though. Let’s look at this in a bit more detail.