👋 Hi, I’m Andre and welcome to my weekly newsletter, Data-driven VC. Every Thursday I cover hands-on insights into data-driven innovation in venture capital and connect the dots between the latest research, reviews of novel tools and datasets, deep dives into various VC tech stacks, interviews with experts, and the implications for all stakeholders. Follow along to understand how data-driven approaches change the game, why it matters, and what it means for you.

Current subscribers: 15,430, +300 since last week

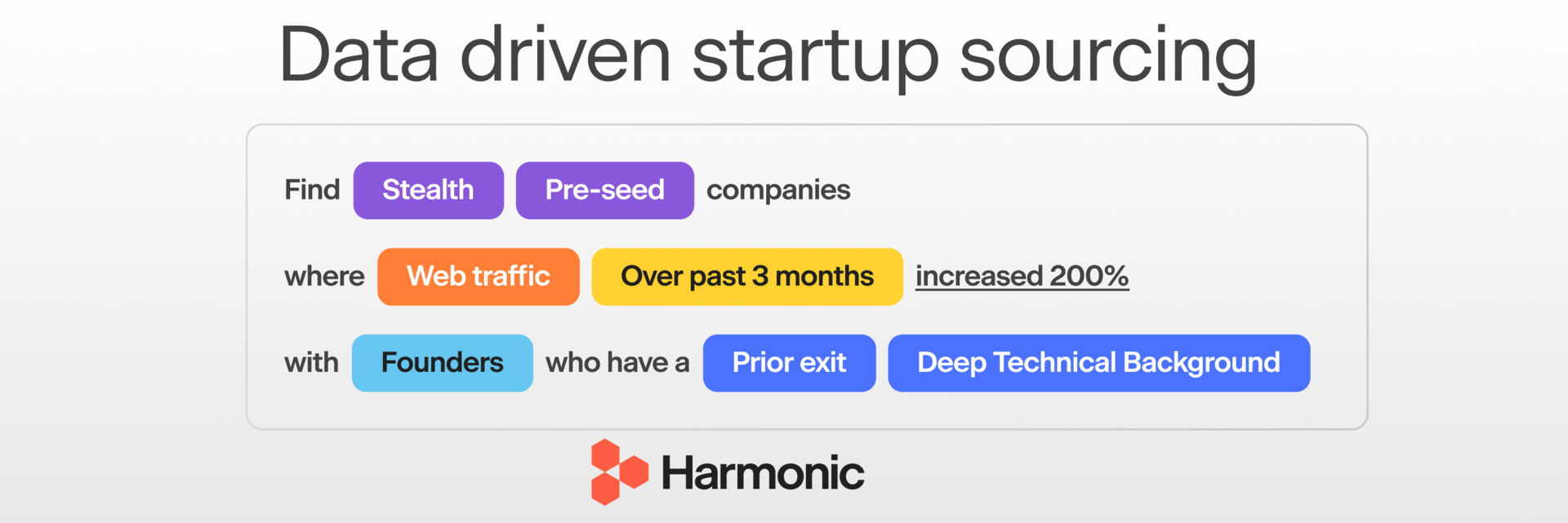

Brought to you by Harmonic - The Sourcing Tool for Data-driven VCs

Harmonic is the startup discovery tool trusted by VCs and sales teams in search of breakout companies. Accel, YC, Brex, and hundreds more use Harmonic to:

Discover new startups in any sector, geography, or stage including stealth

Track companies’ performance with insights on fundraising, hiring, web traffic, and more

Monitor their networks for the next generation of foundersFind Your Next Deal With Harmonic

This post was written by my partner Hendrik Brandis and me, and was recently published via Tech.EU here. We explore how Earlybird, as an established venture capital firm with more than 26 years of history shifted towards an Augmented VC approach, and how leveraging data & AI allowed us to identify Aleph Alpha, among other promising startups. Following the positive feedback on the original post, I am reposting it here for the Data-driven VC community. Looking forward to hearing your thoughts!

Innovation champions of the future create jobs, prevent the emigration of skilled workers, and thus ensure prosperity. To be able to identify and promote champion companies early on, artificial intelligence and data-driven approaches have become indispensable — but the difference is still made by humans.

EagleEye

When we first became aware of Aleph Alpha at the beginning of 2021, their description in the commercial register did not yet read like that of a future AI champion. The vision for technology sovereignty was recognisable and great, but at the time, the approach and structure of the startup still resembled more of an academic chair for artificial intelligence than a commercially oriented company. Certainly highly exciting, but still a long way from concrete applications.

In the absence of a meaningful company website, we would probably never have discovered Aleph Alpha so early if the commercial register entry had not been enriched with further data and appeared on the result list of our proprietary AI-powered platform, "EagleEye".

To better understand the idea behind Aleph Alpha, we therefore contacted Jonas Andrulis, co-founder and CEO of the startup. The serial entrepreneur and former AI manager at Apple had a convincing answer to every one of our questions and strong hypotheses about AI as a future platform technology.

Europe's OpenAI

The rest is quickly told: In July 2021, Earlybird led Aleph Alpha's Series A financing round, followed by groundbreaking research successes around trustworthy and explainable AI applications as well as strategic partnerships with industry giants such as SAP, Bosch, Hewlett-Packard Enterprises (HPE), BCG, and many more.

In addition to these operational partnerships and customer relationships, some of the named companies also participated in the $500 million financing round led by Innovation Park AI (Ipai), Robert Bosch Venture Capital (RBVC), and the Schwarz Group. Aleph Alpha has long been considered one of the biggest tech hopes of recent years and the European answer to ChatGPT developer OpenAI from the USA.

Subscribe to DDVC to read the rest.

Join the Data Driven VC community to get access to this post and other subscriber-only content.

Join the Community