👋 Hi, I’m Andre and welcome to my weekly newsletter, Data-driven VC. Every Thursday I cover hands-on insights into data-driven innovation in venture capital and connect the dots between the latest research, reviews of novel tools and datasets, deep dives into various VC tech stacks, interviews with experts, and the implications for all stakeholders. Follow along to understand how data-driven approaches change the game, why it matters, and what it means for you.

Current subscribers: 10,185, +176 since last week

Brought to you by Synaptic - The alternative data & intelligence platform for data-driven investors!

Synaptic is an indispensable tool for leading VCs, PEs, hedge funds, and sovereign funds to unlock the power of alternative data – like app downloads and website traffic, employee and hiring data, product reviews, open-source projects, and more. Our no-code platform unifies 100+ real-time performance metrics on companies around the globe layered with a rich analytics toolkit.

Learn how Synaptic can benefit your sourcing, tracking, and due diligence efforts!

Avid readers of this newsletter know that in the past I focused most of my attention on the sourcing, screening, and portfolio value creation parts of the value chain - just like most other Data-driven VCs out there (check out the “Data-driven VC Landscape 2023” report here to understand more about the leading firms and their focus). Yet, data-driven innovation does not stop here but gradually changes the remaining parts of the value chain too.

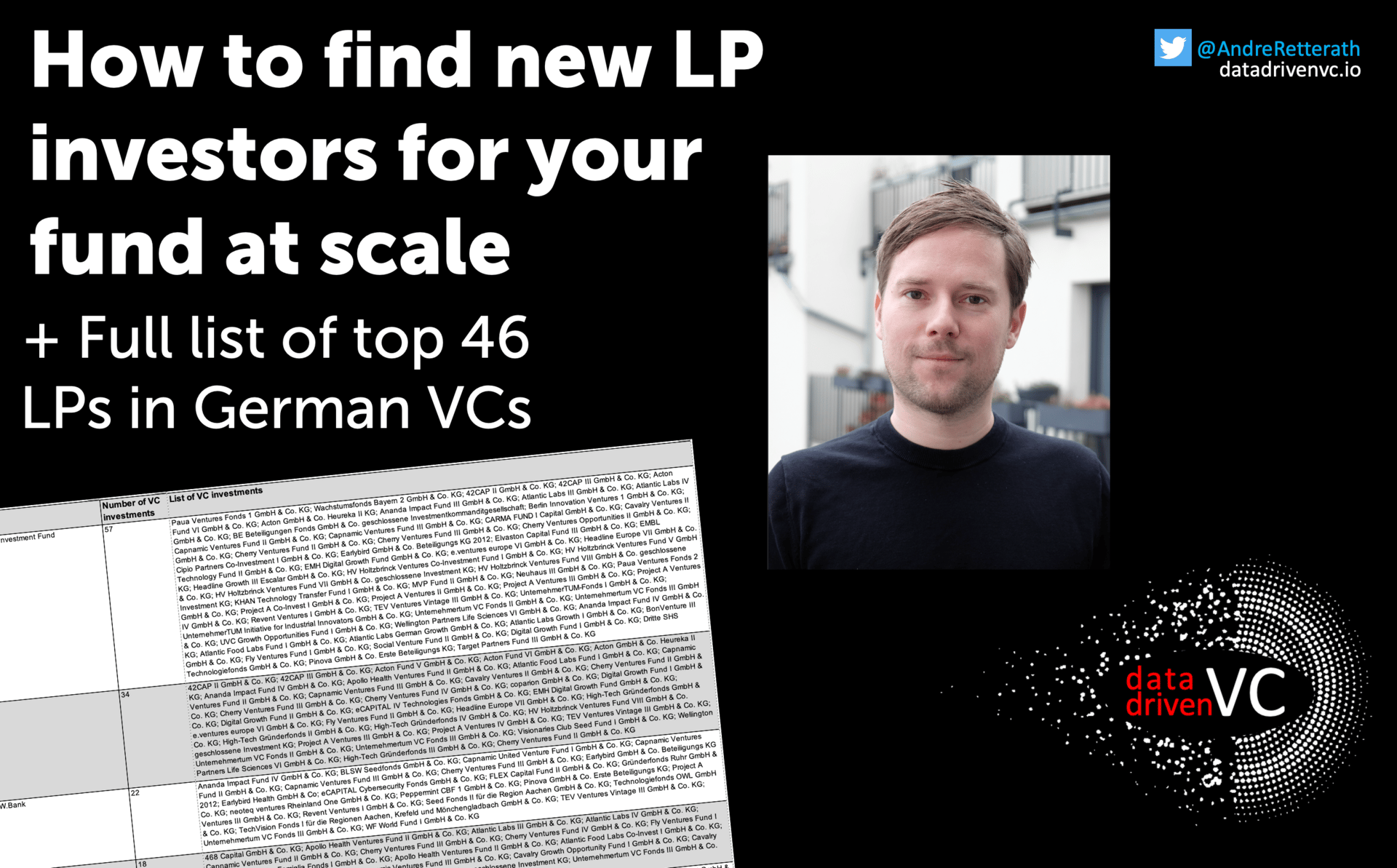

Today, I’m incredibly excited to have Arnas Bräutigam share how his team leverages public register entries to identify potential LP investors for fund managers. He does not only explain his approach in full detail but also reveals the final result, his secret list of the top 46 most active LPs in German VC funds.

Arnas is a co-founder of startupdetector (a data provider for the German startup and investor ecosystem) and AddedVal.io (a platform connecting 1,000+ business angels with suitable pre-seed / seed startups in Germany). Thank you for sharing your valuable insights below, Arnas! 🙏🏻

Raising a venture capital fund is hard. Well, not that I would know anything about it personally, having neither worked in VC let alone raised a fund myself. But at least, that’s what I hear a lot.

Before you finish your thought “Well, why is this guy then talking about fundraising for VCs?” - let me explain.

startupdetector is a specialist in German commercial register data. Initially, we only provided data on newly incorporated startups (hence the name), but later expanded into startup investors and very recently into fund investor data.

As part of this push, we identified more than 3,800 LPs from more than 320 German VC funds which we compiled into a top 46 list of the most active LPs in Germany (full list at the end of this article - but don’t scroll down, yet!).

In this guest post, I will reveal the exact process that we used for you to replicate and apply across public registers. Strap in.