👋 Hi, I’m Andre and welcome to my weekly newsletter, Data-driven VC. Every Tuesday, I publish “Insights” to digest the most relevant startup research & reports, and every Thursday, I publish “Essays” that cover hands-on insights about data-driven innovation & AI in VC. Follow along to understand how startup investing becomes more data-driven, why it matters, and what it means for you.

Compass is the first full-stack OS for investors looking to become data-driven. We help forward-thinking venture funds:

Unlock full market visibility through data-driven sourcing

Drive efficiencies in manual screening workflows

Automate monitoring startups on their watchlist

Join leading global venture funds using Compass today.

This is the third episode of my new “INSIGHTS” series. I’ll publish it every Tuesday and it comes in two alternating formats:

“DIGEST” the most interesting startup research & reports from the previous two weeks. We read all reports, studies, and papers about startups and the wider ecosystem, and condense the most important insights for you. The only source you need to keep up with data-driven startup insights.

“SYNTHESIZE” all available research to create a deep knowledge base for various startup topics such as success criteria, founder backgrounds, hiring playbooks, salary benchmarks, cap table structures, and more. The only source you need to understand any specific startup topic.

Today, we continue with DIGEST#2, summarizing the most relevant research from the past two weeks and highlighting six clear takeaways.

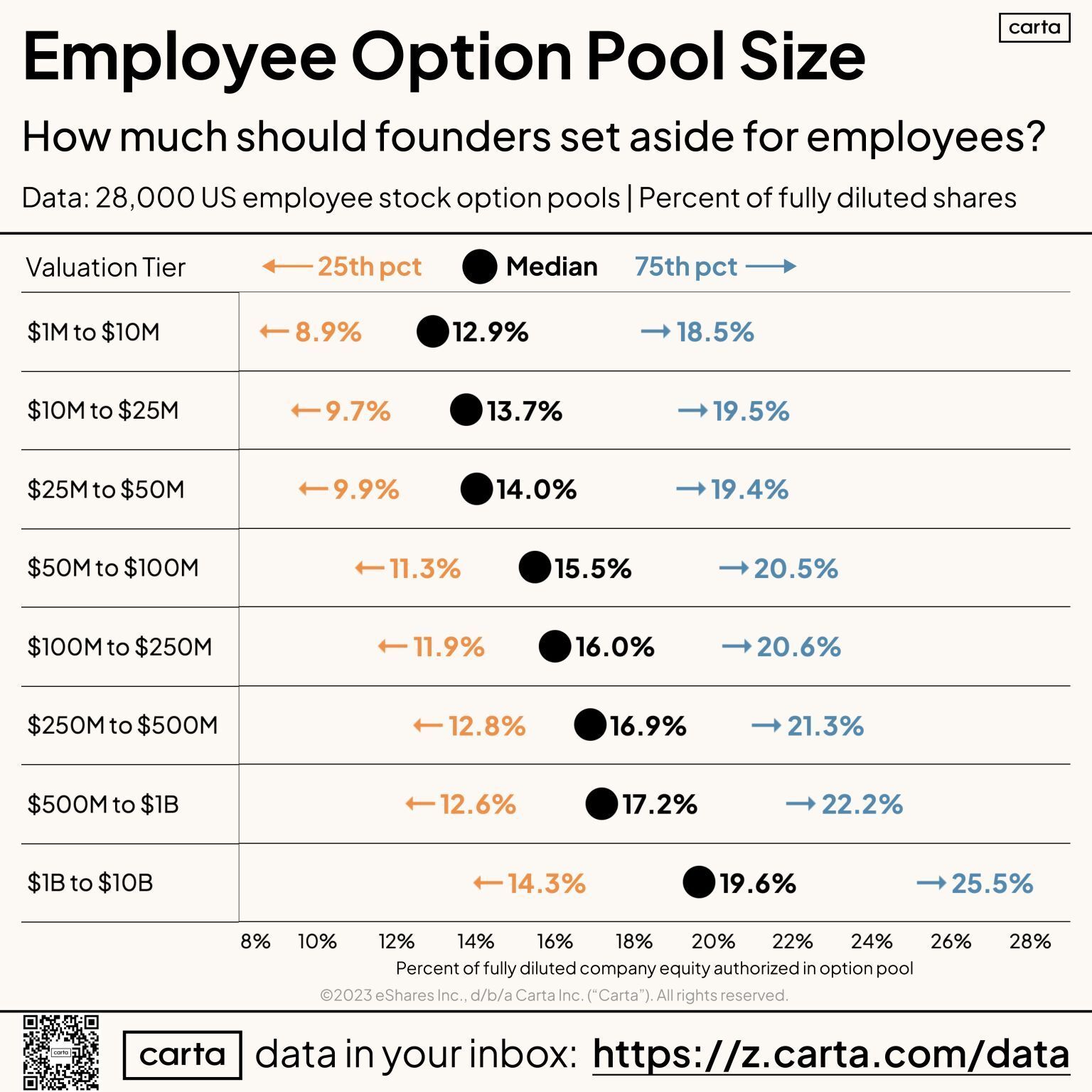

Sizing Employee Stock Option Pools (ESOP) is crucial to attracting and retaining top talent. Yet, founders oftentimes lack the benchmark of what’s market standard and what’s off. Thankfully, Carta ran the numbers for 28k US companies and found:

Negotiation Necessity: ESOP becomes a pivotal point in discussions with VCs, demanding founders to strategically plan their equity distribution to accommodate future hiring needs.

Trend Tracking: An uptick in ESOP utilization reflects the challenges companies face in fundraising, prompting them to extend the life of existing option pools. Interestingly, equity distribution saw a shift, with the first ten hires in recent years receiving more than those in positions 10-100 compared to earlier cohorts.

Vesting Variations: While a 4-year vesting schedule with a one-year cliff remains standard, emerging trends include varied vesting terms and early exercise options.

✈️ KEY TAKEAWAYS

As startups navigate their growth, managing equity burn becomes as critical as cash burn to prevent valuation and ownership dilution. Depending on initial team composition, ESOP starts with around 13% fully diluted at Pre-Seed and Seed and grows to about 20% fully diluted at unicorn valuation. Full analysis here.

Deciphering the "Normal" Burn Rate for Startups

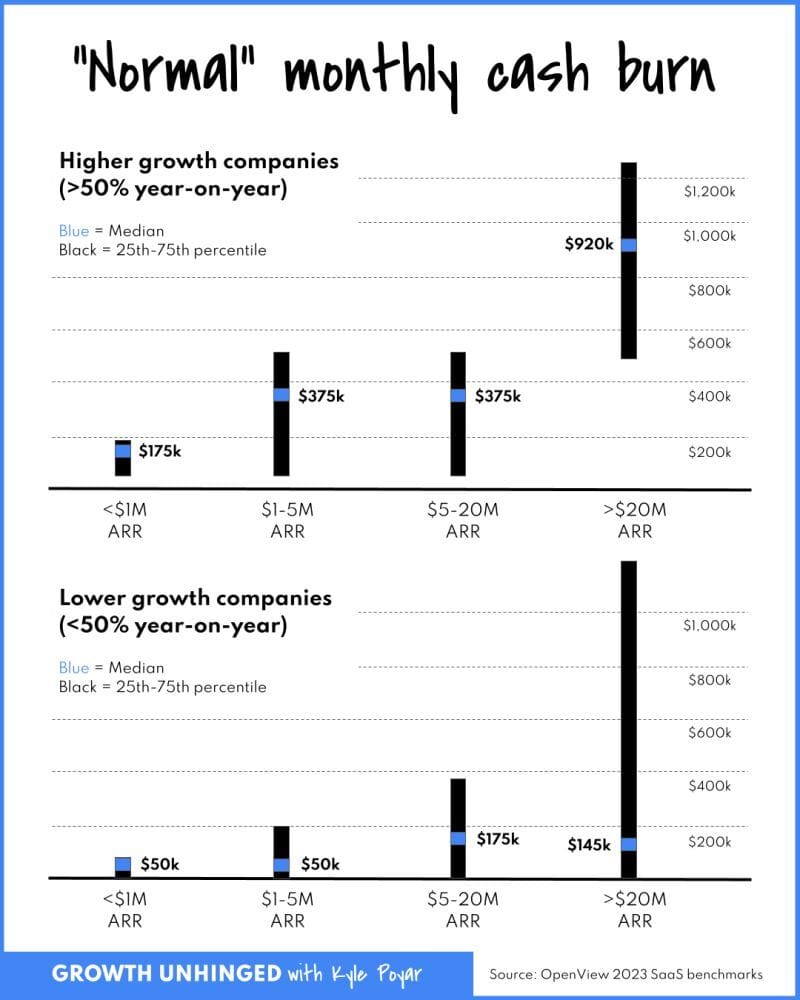

Navigating the financials of a startup, especially understanding burn rates, is more art than science, as evidenced by a recent survey of over 700 SaaS companies. Here's what we've learned about the elusive "normal" burn rate:

No One-Size-Fits-All: The ideal burn rate is a myth. It's highly contextual, depending on a company's cash reserves, investment strategies, and the expected return on those investments.

Shifting Benchmarks: Today's burn rates have plummeted from the highs of 2021/2022. For SaaS ventures in the $20-$50M ARR range, the median monthly burn rate has dramatically decreased from $1.5M in 2022 to just $100-150K in 2023.

Size and Growth Impact: High-growth companies with $20M+ ARR tend to burn around $1M per month, with only a small fraction breaking even or turning a profit. Conversely, lower-growth companies with $1-5M ARR have significantly lower burn rates of about $50K per month, with a quarter achieving breakeven or profitability.

✈️ KEY TAKEAWAYS

The concept of a "normal" burn rate is fluid, deeply influenced by a company's growth phase, market dynamics, and strategic direction. While recent trends show a marked reduction in burn rates, companies must remain agile, prepared for strategic adjustments and potential cost reductions to align burn with growth trajectories. Original post here.

Also relevant in this context: BVP’s recent “Rule of X” concept shows that different from the “Rule of 40”, growth is higher valued than profitability.

Subscribe to DDVC to read the rest.

Join the Data Driven VC community to get access to this post and other subscriber-only content.

Join the Community