👋 Hi, I’m Andre and welcome to my weekly newsletter, Data-driven VC. Every Tuesday, I publish “Insights” to digest the most relevant startup research & reports, and every Thursday, I publish “Essays” that cover hands-on insights about data-driven innovation & AI in VC. Follow along to understand how startup investing becomes more data-driven, why it matters, and what it means for you.

Brought to you by Invyo - Accelerate Your Business, Leverage Your Data

Invyo´s solutions enable investors like you to grow and enrich your dealflow by 2.5 times, and add over 150 data points per company while reducing your data costs. It seamlessly integrates with various data sources including M&A DB (Crunchbase, Pitchbook, Dealroom, etc.), LinkedIn, Glassdoor, Github, Product Hunt, patents and multiple others.

Join leading investors such as Supernova, Hélios, RRW, Blackfin, Creas or New Alpha AM! In just 30 minutes, we'll assess your needs and explore how to implement a data-driven strategy within your fund.

Welcome to the last of three “founder origins” Insights episodes where we've been unpacking the backgrounds of those brave souls launching startups. In our previous episodes, we explored how a founder's academic credentials and previous work experience play into their startup's success. Today, we close our series with a look at repeat founders—those who've been in the startup trenches more than once.

While we've seen value in understanding a founder's work and academic history, stepping back into the startup arena brings its own set of advantages. It's not just about having experience; it's about the kind of experience that hones decision-making, risk assessment, and resilience. Repeat founders likely have a network of contacts, insights into effective strategies, and, importantly, lessons from past failures.

It’s clear that the journey of a founder is as diverse as it is challenging. Repeat founders, with their unique blend of experience and resilience, offer compelling insights into what it might take to succeed in the startup world.

Let's explore why they might just have the edge in turning visionary ideas into reality.

Serial Entrepreneurs: Their Wins and Challenges

This study sheds light on the significant advantages repeat founders hold in attracting venture capital funding. It emphasizes that the experience and lessons learned from previous ventures, successful or unsuccessful, enhance a founder's appeal to investors.

This unique perspective grants them greater credibility, a more substantial negotiating stance, and a richer network of potential investors and partners. Crucially, it positions them as more seasoned and committed entrepreneurs with a realistic vision, aligning closely with what investors seek.

It turns out that repeat founders not only attract capital more easily, they also negotiate more favorable VC contracts than novice founders, with this trend holding true for those with both successful and unsuccessful past ventures.

Studies suggest that these advantages include retaining CEO positions, greater board control, and experiencing less equity dilution. Interestingly, startups led by serial entrepreneurs, particularly those with past successes, are valued higher at VC funding stages. This indicates that venture capitalists probably overindex on the judgment and experience of serial entrepreneurs.

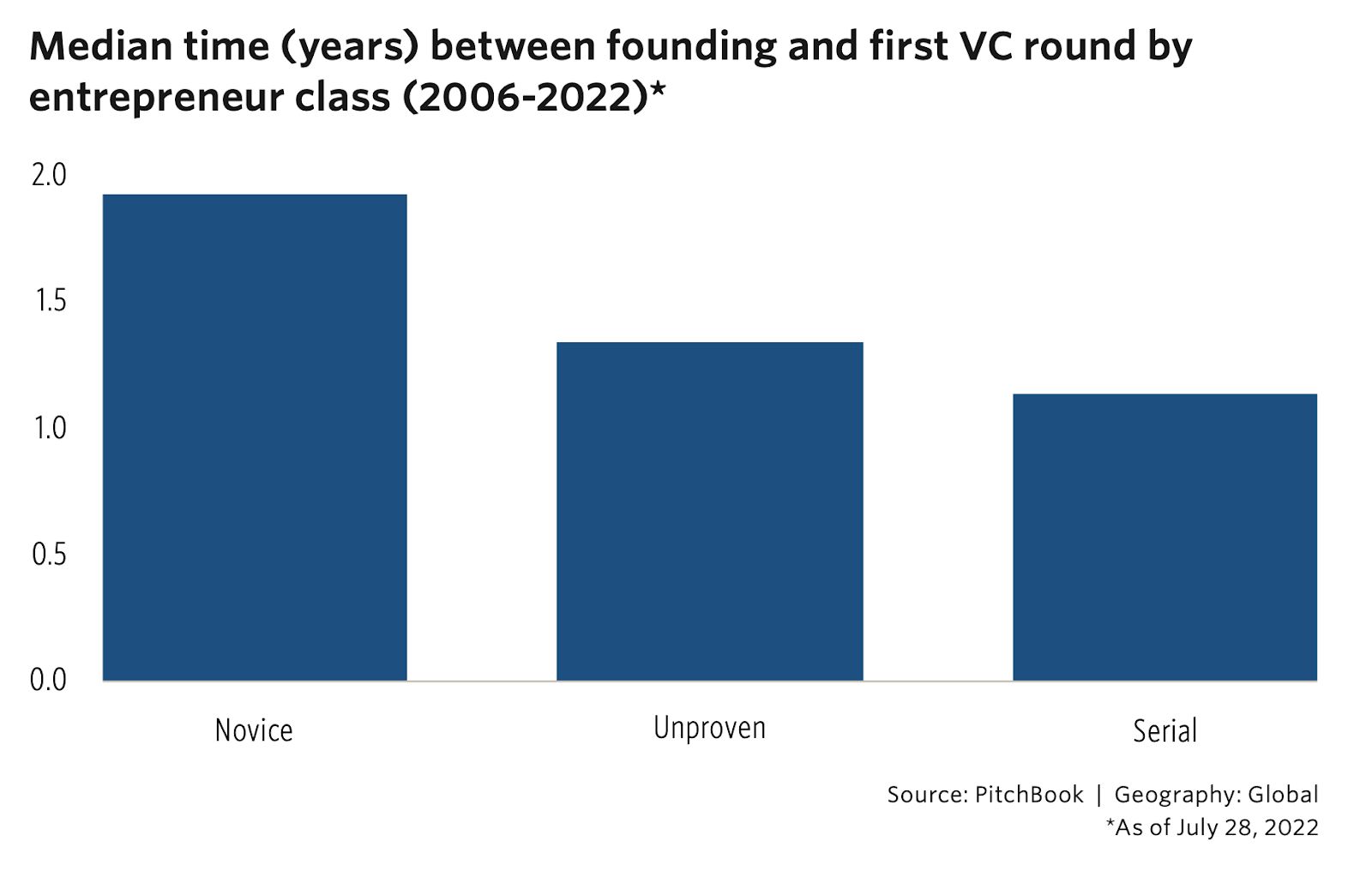

Only a matter of time: Novice founders take almost 2 years to attract first funding for a new venture, while unproven (repeat but no exit) founders fare almost as well as serial founders with a previous successful exit.

Interesstingly, while repeat founders seem to have it easier to start e new venture, they fare much worse than average in the job market. A study reveals a hiring bias against former founders, who receive 43% fewer callbacks than non-founders.

Notably, successful founders face even greater hurdles, with a 33% lower callback rate compared to those whose ventures failed. This founder penalty, particularly acute in older firms, suggests that concerns over fit and commitment overshadow the value of entrepreneurial experience.

✈️ KEY TAKEAWAY

Serial entrepreneurs stand out in the startup world, attracting venture capital more easily and negotiating better terms thanks to their experience and resilience, yet face unexpected challenges in the traditional job market due to perceived overqualification or commitment concerns.

Subscribe to DDVC to read the rest.

Join the Data Driven VC community to get access to this post and other subscriber-only content.

Join the Community