👋 Hi, I’m Andre and welcome to my weekly newsletter, Data-driven VC. Every Tuesday, I publish “Insights” to digest the most relevant startup research & reports, and every Thursday, I publish “Essays” that cover hands-on insights about data-driven innovation & AI in VC. Follow along to understand how startup investing becomes more data-driven, why it matters, and what it means for you.

Brought to you by Tegus - Quality Content Led by Top Investment Firms

Did you know that over 50% of VC firms on the prestigious Midas List conduct their expert calls through Tegus? This isn't just any transcript library; it's a goldmine of high-quality insights fueled by the world’s top investors.

Tegus is the only platform that allows you to delve into prominent VCs' minds and explore what they care most about when evaluating real investment opportunities.

Different Investors Have Different Philosophies. Find the One That Fits Your Needs

As entrepreneurs navigate the lifecycle of a startup from pre-seed to exit, the decision of which investor to partner with is more akin to a long-term marriage than a simple monetary transaction. This week, we aim to add a scientific foundation to the age-old debate about the actual value investors bring to the table—a discussion often mired in strong opinions and anecdotal evidence.

Different venture capital firms offer varying philosophies and strategies: From "kingmaker" firms like Tiger or Coatue, who deploy extensive amounts of capital to gradually dry out competitors, to more hands-on boutique firms like Benchmark or USV, who help with advise, facetime, and extensive networks.

We'll explore three key aspects of investor choice that can significantly impact a startup's path: the negotiation terms between VC and entrepreneur, the real impact of an investor's added value, and how to pick the right investor.

While we delve into how these factors can shape a startup's future, it's crucial to remember that the ultimate success of a business mostly rests on the founders - their vision, background, and execution - as we showed in our past few episodes on startup success and failure.

1) Investment Terms

A paper by Ewens et al. (2021) analyzes 8,100 first-round VC financings from 2002 to 2015, making it one of the largest datasets studied for such analysis to date. They were specifically interested in how negotiating terms between VCs and founders impact startup success.

Optimal Equity Share: The average startup’s value increases with the lead investor’s equity share up to an ownership stake (upon conversion) of 15%. Any further increase in the VC’s share decreases firm value.

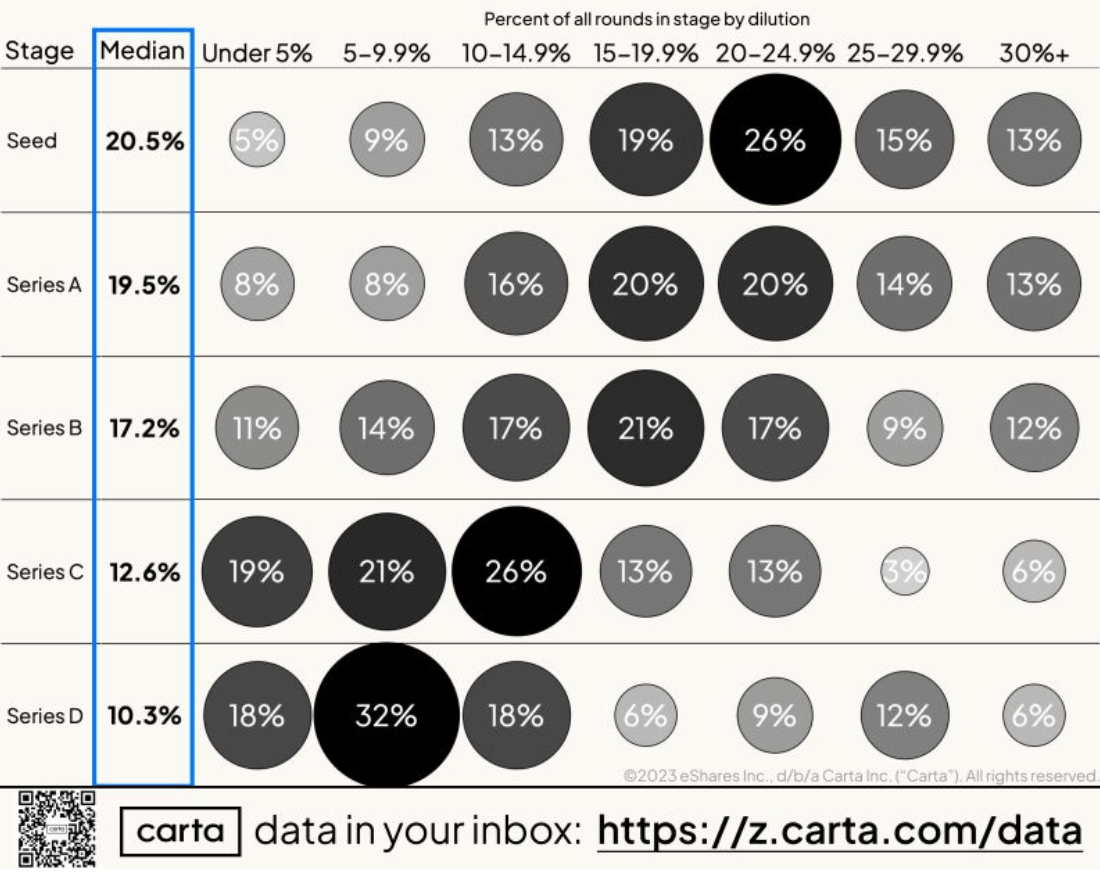

2023 data from Carta shows median round dilutions of 20% for Seed & Series A, 17% for Series B, 13% for Series C, and 10% for Series D. It’s all about finding the right balance between investor equity stake to create sufficient buy-in and keeping founder dilution reasonable to keep them motivated, with sufficient skin in the game.

Carta data showing 2023 dilution by funding round

The above-mentioned study also analyses other contract terms which we combined with findings from Amore & Conti (2023) and Hong et al. (2020) to yield the following rundown of the most common deal terms and their impact on the startups:

VC Board Seats: These can diminish firm value by reducing entrepreneur control, though they may be very beneficial in deals with high-quality VCs.

Participation Rights: Often called “pro-rata” rights, they generally have a neutral effect on the likelihood of startup success while increasing the VC's share of the firm's value.

Pay-to-Play Provisions: Shift value towards the entrepreneur and can enhance firm value by penalizing VCs who don't reinvest in future rounds, thus facilitating the next fundraise. They can be somewhat of a double-edged sword though, as they might preclude top-tier funds from investing altogether.

✈️ KEY INSIGHTS: Founders should not sell more than 20% of their equity in the first priced round and be very careful which investors they onboard. VC board seats can make a big difference, but only if the board member has an exceedingly relevant background and/or network.

Subscribe to DDVC to read the rest.

Join the Data Driven VC community to get access to this post and other subscriber-only content.

Join the Community