Data-driven VC #30: Developing for developers: the potential behind B2D companies

Where venture capital and data intersect. Every week.

👋 Hi, I’m Andre and welcome to my weekly newsletter, Data-driven VC. Every Thursday I cover hands-on insights into data-driven innovation in venture capital and connect the dots between the latest research, reviews of novel tools and datasets, deep dives into various VC tech stacks, interviews with experts and the implications for all stakeholders. Follow along to understand how data-driven approaches change the game, why it matters, and what it means for you.

Current subscribers: 7,385+, +202 since last week

Brought to you by Gravity - Your all-in-one platform with billions of data points on founders and startups

Unlike other data providers, Gravity tracks new company launches and all funding events each month while diving deep into the key insights around the founders of these companies in an easy-to-use dashboard that helps you uncover their FounderDNA™ - founder characteristics such as prior exits, past experiences and much more! Sign up for free and take advantage of the 14 day free trial

This post was written by my colleague Laurin Class and me, and was originally published on the Earlybird blog. Following your continuous interest in my previous dev-related posts and the positive feedback on our original Medium post, I am reposting it here for the Data-driven VC community.

At Earlybird, we love developers. We love having developers as part of our investment team for new perspectives. We love having them in our internal engineering team to build our data-driven VC platform, Eagle Eye. And we especially love to invest and partner with them as founders.

With that proximity to the software engineering community, it follows naturally that we closely observe the developer’s tool kit and continuously try to understand its inherent pain points, as well as how to ease productivity blockers and challenge what might come next.

In the past, we invested in developer-oriented companies such as DeepCode (now part of Snyk), Aiven, Seerene, a UK-based Seed company in Stealth, and more – to help put the right tools in the hands of devs and to assist in generating as much high-quality output as possible.

Recently, we witnessed a growing interest in the space and many of its sub-trends, from both the entrepreneur and the investor side. We have noticed certain tendencies: more companies founded to target programmers, raising bigger investment rounds, achieving higher valuations, and overall generating more attention.

This sparked our interest to take a deeper look into what makes these Business-to-Developer (B2D) companies so special. We found that these companies share a number of unique characteristics and that when quantitatively measured, there is a first indication for an outperformance of the segment from a return perspective — compared to wider market benchmarks.

But let us take a step back and first look at what we understand as B2D and what we discern makes them special.

How we define B2D

The term Business-to-Developers (B2D) is not yet widespread and anything but mainstream. What it means to us is that other than for example, more traditional business-to-business (B2B) or even business-to-consumer (B2C) firms, a company primarily, sometimes exclusively, targets their products or services to software developers.

Over time, we actually saw reason to look at things more broadly and also include Data scientists/engineers/analysts as well as Designers (UX/UI focus) in this category; these 3 customer/user personas often work closely together and share a lot in terms of work set-up, tooling, and community-centeredness. For a better reading flow, we’ll still mainly talk about developers in the B2D context.

The model works since typically B2D businesses sell their solution straight to an individual developer/data worker/designer instead of selling top-down to a whole team through a (product) manager or tech lead, detached from the actual engineering work.

The market momentum that catches our attention

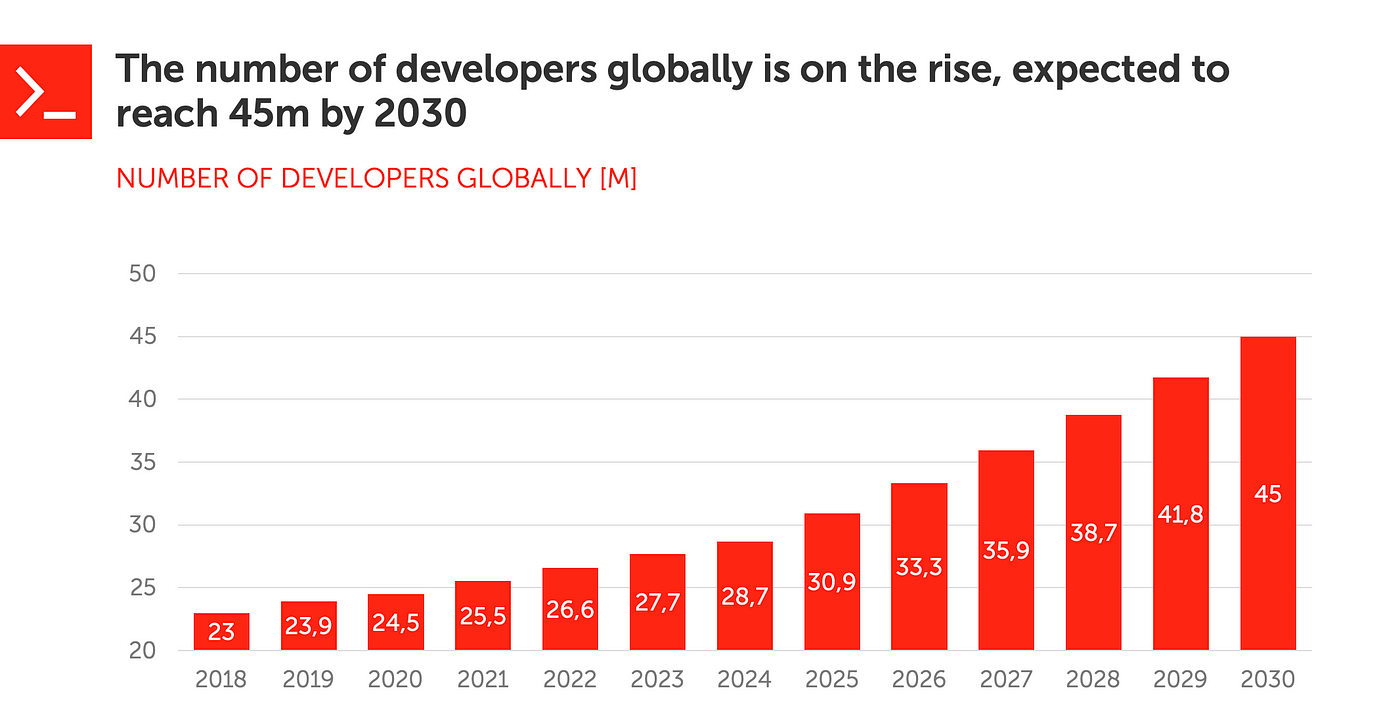

Generally speaking — a lot of macro tailwinds work in favor of this company category. First of all, the number of developers is growing rapidly, from >26m in 2022 to 45m by 2030.

Additionally, first anecdotal indicators point to an increased investment activity targeted towards this segment, further fueled by landmark transactions such as IBM’s RedHat acquisition for $34bn in 2019, the IPO of Elastic at >$2.5bn valuation in 2018, the $20bn acquisition of Figma by Adobe in 2022, and a number of high-profile acquisitions from mainstays like Microsoft.

Some prominent large funding rounds include:

… to name just a few.

But where we see the true magic of B2D is when it comes to the following dynamics in their Go-To-Market:

PLG: With the transition towards consumer-grade UX in enterprise software, more beautiful, powerful, and intuitive, prominent companies such as Slack, Dropbox, or Figma showcased the power of PLG. Though many new startups follow the trend, not every model is made for this particular sales motion. It seems that B2D companies however, almost by nature, are perfect PLG candidates, since developers as a target group want to see proof of the value of a product first and stress-test it in actual live cases before making a purchase decision and upgrading to full functionality tiers.