Data-driven VC #24: An Emerging VC's Tech Stack

🔥Inside Hustle Fund’s data-driven VC journey

👋 Hi, I’m Andre and welcome to my weekly newsletter, Data-driven VC. Every Thursday I cover hands-on insights into data-driven innovation in venture capital and connect the dots between the latest research, reviews of novel tools and datasets, deep dives into various VC tech stacks, interviews with experts and the implications for all stakeholders. Follow along to understand how data-driven approaches change the game, why it matters, and what it means for you.

Current subscribers: 6,110+, +140 since last week

I ended last week’s “If you can’t measure it, you can’t improve it” episode with the following summary:

“Conclusions will be different for every fund and so should the prioritization of your initiatives. Next episode, we’ll dive into various avenues to become more data-driven based on different starting points.”

To explore these different avenues as tangible as possible, I decided to finally incorporate your feedback and meet your wishes by launching a series of guest posts. Thankfully, there are incredibly kind VCs in our community who are willing to share their story and learnings from different starting points across the VC Digitization Journey.

One of them is Will Bricker from Hustle Fund, a pre-seed venture capital firm investing in software and service companies in the United States, Canada, and Southeast Asia. It’s the perfect example of an Emerging VC firm that has very limited resources but runs on a highly effective and modern tech stack. Relating to my “VC Digitization Journey” episode, I’d classify Hustle Fund as a “Productivity VC” on the verge to becoming a “Data-driven VC” via automated deal assessments and more. Thank you, Will, for sharing your journey with us in the guest post below 🙏🏻

VC Tech Stack Approaches

When it comes to building your VC tech stack, there are two available options:

The choice of which approach to take will depend on preference and requirements. Some factors include:

How unique are the features you require?

How much do you want to pay?

What resources do you have to run your platform?

Keeping all this in mind, let’s talk about Hustle Fund’s setup.

The Hustle Approach

When designing our platform, we went with the bespoke approach from day 1. A couple of factors went into our decision:

Who we are: our partners are entrepreneurs at heart — the desire to stay lean, learn and iterate is in their DNA

How we started: as a small fund ($11m), we didn’t have much money to spend on big-time software

How we invest: we see a lot of deals and write a lot of checks. Without the ability to automate what we do, the only way to scale is by adding salaries

For some additional context, let’s get specific on that last point:

We see ~700 deals a month

We write ~15 checks a month

We have ~400 Portfolio Companies across three funds

We have written ~550 Checks

Our companies have had ~800 investment rounds

In short, we are a high-volume firm: we see many deals and write many checks. The high volume presents a core challenge in balancing efficiency and effectiveness in getting, synthesizing, and acting on information when investing and supporting our portfolio companies. We believe a bespoke platform is the best approach to tackle this challenge. I say that because it enables us to create and apply logic and automation that

Helps us identify whether or not we think a deal is a good fit based on the information they have provided

Enables us to have all the information for our portfolio companies across platforms, including their live value

Allows us to automate our most common actions across platforms

Provides flexibility that facilitates us iterating and evolving our platform as we grow

Ok, enough setup. Let’s talk about our stack.

Our Tech Stack: App Overview

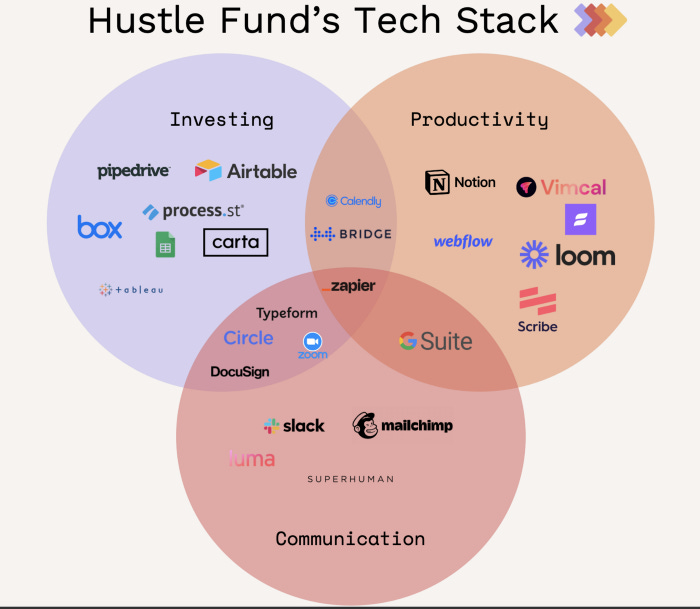

There are a lot of apps we use as a team — depending on personal preference, role, etc. However, below are our most universally used and adopted apps (apps that MORE than two people use):

Our Tech Stack: Investment Stack Design

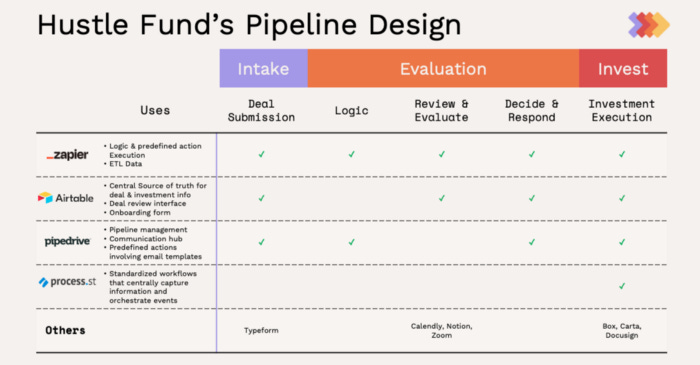

Generally, when I read these pieces, I always wonder, “ok, I know what you use, but how do you use it?” So, I am providing some simple diagrams to show the outlines of our platform for our deal pipeline and portfolio management. The idea is to show you where and how we use each piece to make and monitor investments.

In brief, I would argue that the core of our platform has three layers:

DB

Airtable — as our central source of truth for information about all investing entities (companies, investments, etc.) and operations info (actors, status, actions, etc.)

Glue

Zapier — to connect our apps, run our logic, and execute predefined events via triggers

UIs

Airtable: to view information about deals and investments & intake data

Pipedrive: to author and review communication

Process street: as our investment execution workflow (central/standard data intake + event orchestration)

With these three layers, we can build a set of features that fulfills our needs and bolt on other platforms (Carta + Box, Typeform, DocuSign) as we see fit. Below you can see in a little more detail how and where we use these pieces to invest and manage our portfolio.

Our Tech Stack: Investment Stack App Breakdown

In this section, I want to provide an overview of how we use each app and my thoughts on how satisfied we are with it currently (on a 1–5 scale, with 5 being the best) and how well we think it will scale with us going forward (using the same scale).

The Big Pieces

Database: Airtable

CRM: Pipedrive