👋 Hi, I’m Andre and welcome to my weekly newsletter, Data-driven VC. Every Thursday I cover hands-on insights into data-driven innovation in venture capital and connect the dots between the latest research, reviews of novel tools and datasets, deep dives into various VC tech stacks, interviews with experts and the implications for all stakeholders. Follow along to understand how data-driven approaches change the game, why it matters, and what it means for you.

Current subscribers: 3,431, +91 since last week

The days between Christmas and New Year are perfect to reflect. To zoom out, look in the rearview, celebrate progress and critically plan ahead. Typically I prefer to do it in private by myself. But as I decided to write this newsletter and share my learnings more publicly, I take this episode as an open reflection.

2022 in Review

As stated in my first episode on “what to expect from this newsletter” published on 11th Sept 2022 “Together with an ever-growing group of like-minded people, I made it my mission to push VC to the next level through real innovation. To overcome shortcomings from inaccessibility for underrepresented founders over biased, inefficient and manual decision-making processes to non-scalable, sometimes very limited value-add. I strongly believe that technology in general, but data more specifically, is here to disrupt VC as it did/does with any other industry.”

So the “what” is clear, but what about the “how”? Referring to episode 14 on “how VCs can learn from each other”: “Very few people are actually in the position to share hands-on learnings, what works well, what doesn’t work and where they get their information from. And those who do, are oftentimes not willing to share their perspectives because they’re afraid to lose their edge. As a result, the ecosystem is not only very early but also highly fragmented with a strong reluctance to share learnings. This is also why most researchers struggle. They lack the hands-on insights from practitioners who are in the trenches. Therefore, a close researcher-VC relationship is key to generate useful studies. This newsletter is here to change this dynamic and provide a platform for like-minded people.”

Building in public

VC is a privileged and intransparent industry where not only returns (=output) follow a Power-law distribution but also the allocation (=input). A few hundred to a thousand Partners globally decide, oftentimes behind closed doors, how hundreds of billions of $$ get allocated. It's the minority of the people moving around the majority of the money.

While some VCs share their decision-making processes and selection criteria publicly, the majority still keep their inner workings to themselves and build in the dark. As a result, opacity perpetuates. Opposing this trend, I decided not only to openly speak about and create a platform for data-driven VCs and everyone who’s interested in its implications but also to build this platform in public by sharing all the ups and downs associated with it.

Every newsletter starts with the recent number of subscribers and the growth within the prior week. Moreover, I take specific milestones to include learnings on the process of writing this newsletter and growing the community. Just like this episode.

The community

I’ve been actively writing and sharing professional content for about six years. On the content creation side, I wrote 3 academic papers with about 6k downloads and 12 Medium blog posts with about 70k reads before I joined Substack for more structured writing in September this year.

Before joining Substack, my writing process was event-driven (triggered for example by new investments, deep dives etc.) and thus pretty inconsistent. Sometimes I had several topics within a few weeks, sometimes nothing for months. No ideation process whatsoever. This inconsistency made it difficult for me to empower and facilitate valuable conversations except for very few conference panels and one or two living-dead Slack groups.

Peer learning, sparring and collaboration among VCs and researchers were very, very slow. I explain in episode #12 how I imagined this newsletter to solve this problem and become the go-to place for everyone interested in digitization in VC and its impact for all stakeholders.

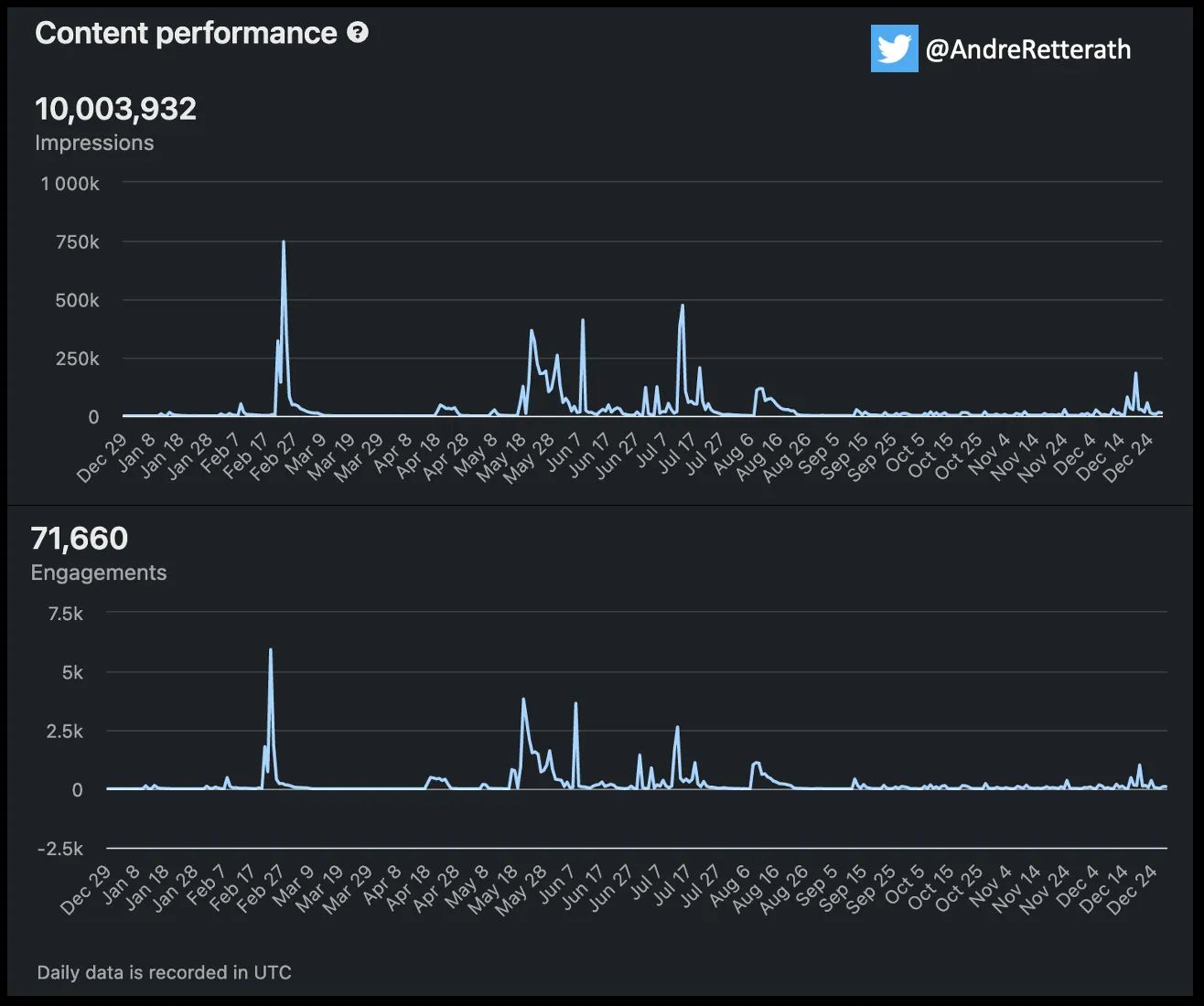

On the distribution side, I joined LinkedIn in July 2016 and have grown my audience to about 25k followers with 10M+ annual post views and 70k+ annual engagements in 2022. One interesting learning I’d like to share: Up until August 2022, I shared mostly external content for a broader audience (tech, VC, startups, productivity) and insights from my day-to-day that I found potentially useful to others. Starting in September, I strictly narrowed my focus to AI and data-driven VC, and shifted from mostly external to mostly my own content.

The LinkedIn content performance chart below reveals that this shift significantly reduced the likelihood of viral posts (until the end of August almost binary picture with few crazy spikes but also many close-to-zero periods) but increased the consistency of engagement (many tiny spikes after August with no close-to-zero periods anymore). So if you consider creating your own content, it might be helpful to leverage external content to create virality and build an audience before you start writing and distributing your own publication. Of course, many roads lead to Rome and you can also do both in parallel. Sharing only your own content from day one without an existing community might not be the best way though.

Subscribe to DDVC to read the rest.

Join the Data Driven VC community to get access to this post and other exclusive subscriber-only content.

Join the CommunityA subscription gets you:

- 1 paid weekly newsletter

- Access our archive of 300+ articles

- Annual ticket for the virtual DDVC Summit

- Discounts to productivity tools

- Database Benchmarking Report

- Virtual & physical meetups

- Masterclasses & videos

- Access to AI Copilots