👋 Hi, I’m Andre and welcome to my weekly newsletter, Data-driven VC. Every Thursday I cover hands-on insights into data-driven innovation in venture capital and connect the dots between the latest research, reviews of novel tools and datasets, deep dives into various VC tech stacks, interviews with experts and the implications for all stakeholders. Follow along to understand how data-driven approaches change the game, why it matters, and what it means for you.

Current subscribers: 3,120, +103 since last week

Big shout-out to everyone who submitted their input to the “Data-driven VC Landscape 2023”. 100+ nominations and counting. Make sure to submit your perspective and share the link with everyone who could potentially contribute. You will be the first to receive the full landscape and report including insights into different tech stacks, tools used, thought leaders, content to follow etc.

This episode is intended to answer three reader questions that came up so many times that I decided to finally write the answers down 👨🏻💻

Why are you talking so transparently about your learnings and ideas?

Surprisingly, I feel that the VC industry is still at day one in terms of digitization and data-driven innovation. Most firms today use CRMs (although nobody seems really happy and teams jump across solutions), one or two commercial database providers like Crunchbase, Dealroom or Pitchbook (which become increasingly redundant and hard to differentiate) and simple productivity tools like Calendly, Mixmax or Superhuman. Their approach to data-driven sourcing, screening or even portfolio value creation, however, is in most cases either non-existing or depends on external solutions like Specter or SourceScrub.

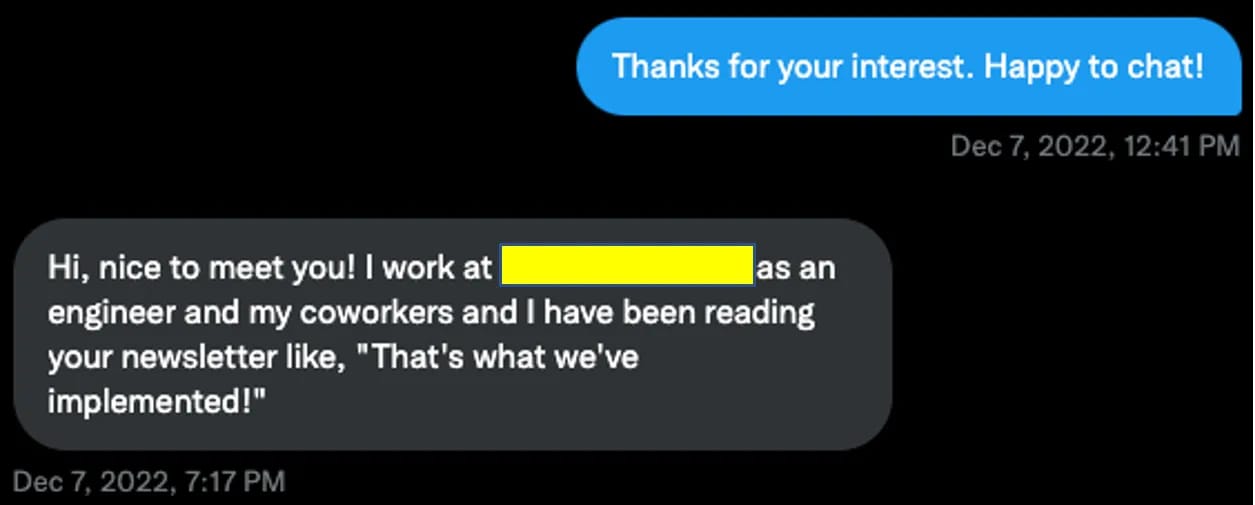

Very few funds actually have the means (=management fee), the commitment in the leadership, someone who bridges the gap between the investment and the engineering world as well as access to world-class engineering talent to really do something innovative with data. As a result, the majority of readers are actually not in a position to act upon most of the shared content but rather perceive it as an inspiration and a rough idea of what is possible. It eventually informs their decision to start becoming more data-driven and helps them avoid stupid mistakes. For everyone else, those who are in the position to build something in-house, the majority of content is probably “Hey, that’s exactly what we do”!

In reality, 80% of the stuff is trial and error and in retrospect very straightforward. Not difficult to get right if you really want to get it right and have the right people. These “straightforward insights” are mainly the learnings I share here, but it’s far from the secret sauce we have developed at Earlybird ;)

What is the secret sauce in data-driven VC?

Short-term: If you do something, you’re already ahead of the majority.

Mid-term: Creativity with respect to identification sources becomes key. Commercial data providers become increasingly redundant and a “creativity race” has been started to be among the first to find novel identification sources. For example, one or two years back it was highly innovative to leverage LinkedIn sales navigator to search for and crawl profiles of professionals who changed their title from whatever to “Starting something new” or “Stealth mode”. In many cases, this approach helped us identify new startups even before they got officially registered. It certainly kept us ahead for some time, but is really no rocket science to replicate once the secret - in this case just a website/source and a search term - is out.

Long-term: This answer is two-fold.

Subscribe to DDVC to read the rest.

Join the Data Driven VC community to get access to this post and other exclusive subscriber-only content.

Join the CommunityA subscription gets you:

- 1 paid weekly newsletter

- Access our archive of 300+ articles

- Annual ticket for the virtual DDVC Summit

- Discounts to productivity tools

- Database Benchmarking Report

- Virtual & physical meetups

- Masterclasses & videos

- Access to AI Copilots