👋 Hi, I’m Andre and welcome to my weekly newsletter, Data-driven VC. Every Thursday I cover hands-on insights into data-driven innovation in venture capital and connect the dots between the latest research, reviews of novel tools and datasets, deep dives into various VC tech stacks, interviews with experts and the implications for all stakeholders. Follow along to understand how data-driven approaches change the game, why it matters, and what it means for you.

First off, I’d like to thank all of you for your crazy support and interest in this project. I’m still blown away that more than 830 of you subscribed to this newsletter within 24 hours after the initial launch on Monday. BIG THANK YOU! And now let’s jump right in..

The status quo in VC

I always appreciate great structure, so let’s start with a simple framework to understand the status quo of our industry: the VC value chain. On the highest level, GPs must first collect money from LPs, then invest and help their portfolio grow before ultimately divesting and returning the initial commitment plus returns to their LPs. Simple and straightforward.

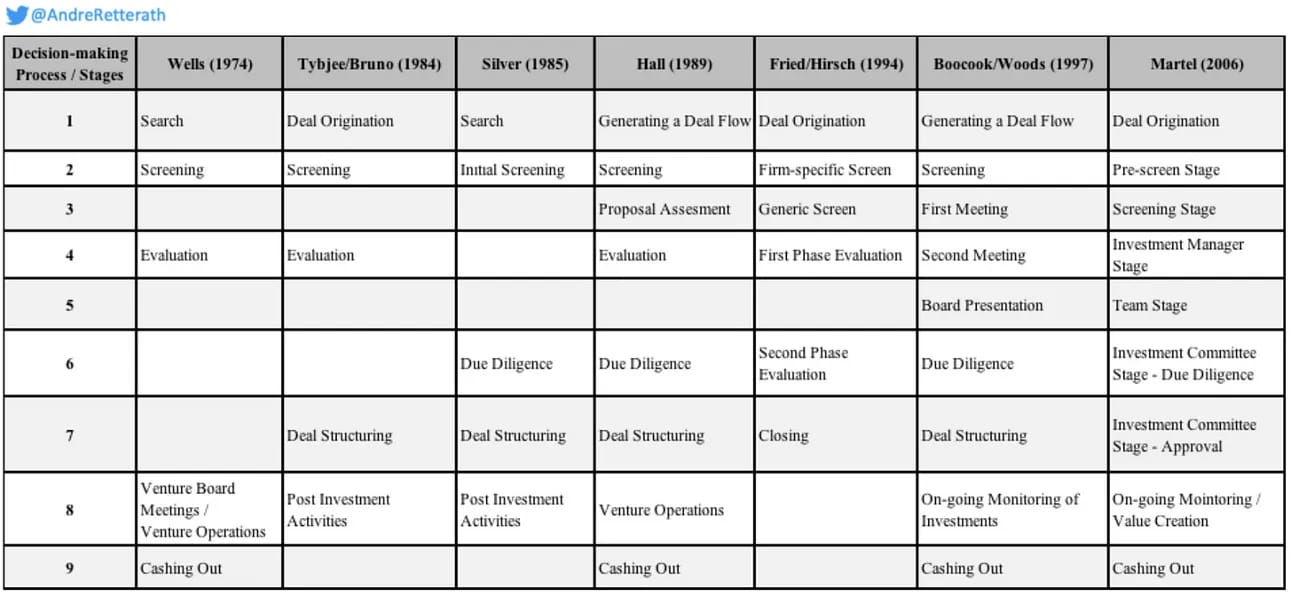

But where do VCs create actual value? Well, for this question we can easily cut the first (money in from LPs) and the latter part (money out to LPs) to remain with the core, the so-called “investment/decision-making process”. Yes, we do create value for our LPs beyond money too, but this is secondary as the primary job of a financially oriented VC is to deliver returns. Outstanding returns. To better understand the levers of this part, let’s focus on the core value creation. Below you can find a table summarizing major frameworks depicting the different stages of the investment/decision-making process.

Overview of VC investment/decision-making frameworks (by Andre Retterath)

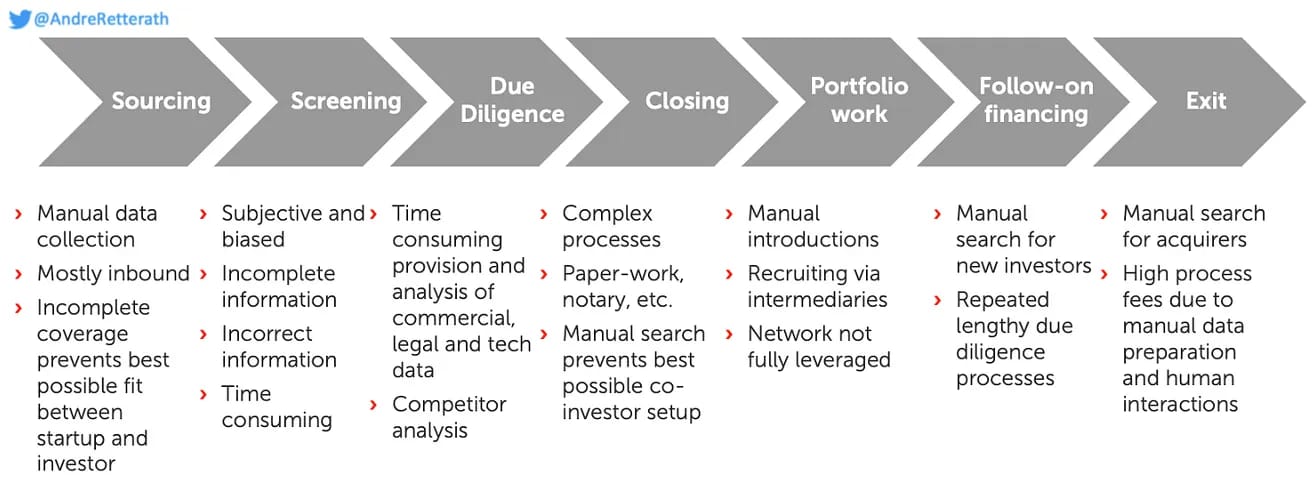

For simplification, I distilled the major steps into a streamlined 7-staged process described in the figure below. Hereof, I highlighted the most obvious shortcomings and bottlenecks in the respective stages. Certainly, this is far from being exhaustive, but sufficient for our purpose.

7-staged VC investment process and list of shortcomings (by Andre Retterath)

In a nutshell, the VC investment/decision-making process is manual, inefficient, non-inclusive, subjective and biased which leads not only to a huge waste of resources but more importantly to sub-optimal outcomes and missed opportunities.

But wait.. hasn’t it actually worked OK until now?

Well, yes. But competition among VCs has exploded in recent years and some early movers among them have started to innovate 👋🏻 To understand this trend in a bit more detail, I’d like to lean on the Supply and Demand Law and adapt it to the VC world: supply (startups) and demand (capital to be invested).

Subscribe to DDVC to read the rest.

Join the Data Driven VC community to get access to this post and other exclusive subscriber-only content.

Join the CommunityA subscription gets you:

- 1 paid weekly newsletter

- Access our archive of 300+ articles

- Annual ticket for the virtual DDVC Summit

- Exclusive DDVC Slack group

- Discounts to productivity tools

- Database Benchmarking Report

- Virtual & physical meetups

- Masterclasses & videos

- Access to AI Copilots