👋 Hi, I’m Andre and welcome to my weekly newsletter, Data-driven VC. Every Tuesday, I publish “Insights” to digest the most relevant startup research & reports, and every Thursday, I publish “Essays” that cover hands-on insights about data-driven innovation & AI in VC. Follow along to understand how startup investing becomes more data-driven, why it matters, and what it means for you.

Current subscribers: 24,135, +200 since last week

Brought to you by Deckmatch - Agentic Workflows and APIs for Data Driven VCs

Connect your top-of-funnel to Deckmatch and transform pitch decks and URLs into structured and insightful data. Get detailed firmographic and people data, in-depth competitive and market analysis, and personalized investment memo without lifting a finger. The cherry on the cake? It's all seamlessly synced to your preferred tools like Affinity through our API integrations.

Never miss a deal, ditch the donkey work, and build meaningful relationships faster.

Will Quant Investors Rule the World?

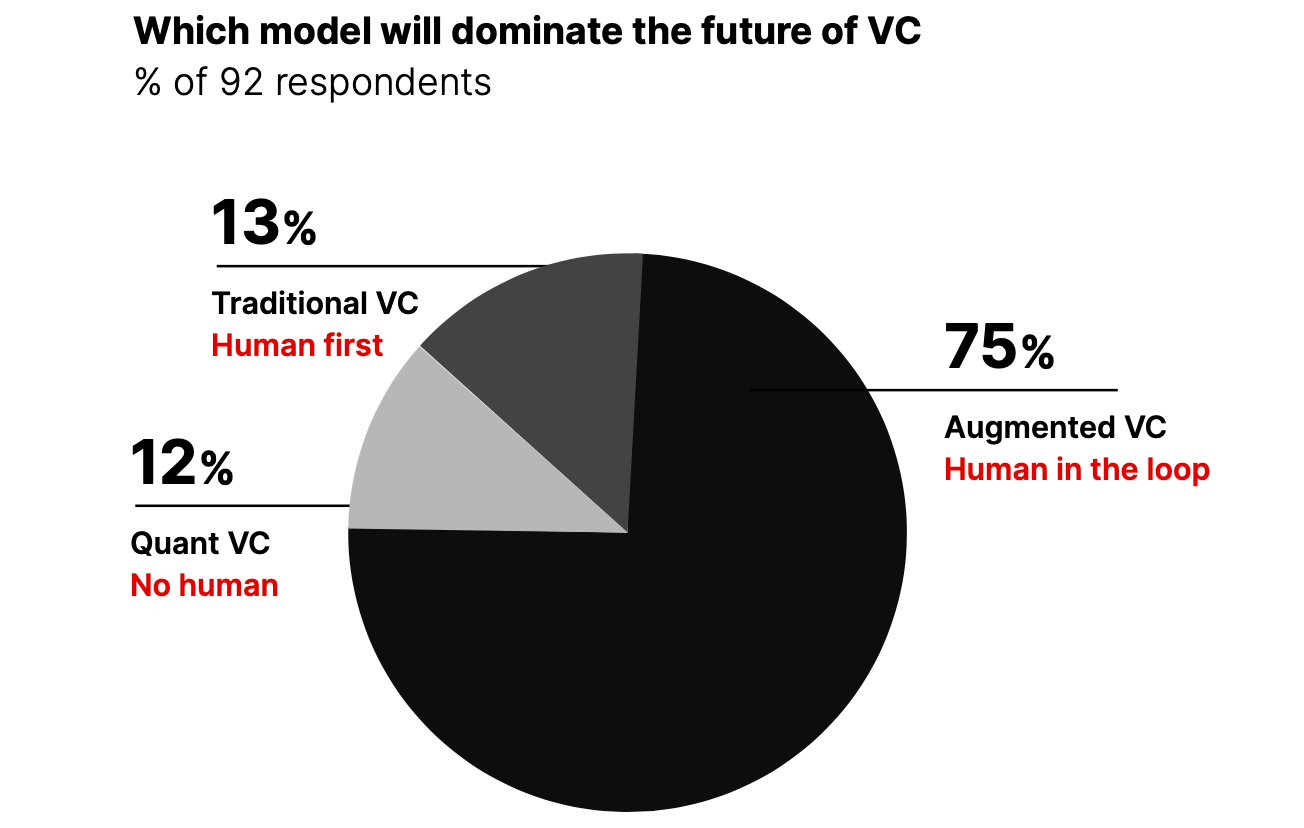

One of the most surprising insights from the Data-Driven VC Landscape 2024 for me is that every tenth survey respondent already believes that Quant VC will be the dominating model in the future of startup investing.

In light of the fact that only 191 firms, or 1-2% of the overall VC industry launched dedicated internal initiatives, it’s interesting to see such a high relative share of insiders already part of the purist algo-only camp. To shed more light on this disruptive approach, I had the founder of Quant VC “Koble” share a deep dive on their model here.

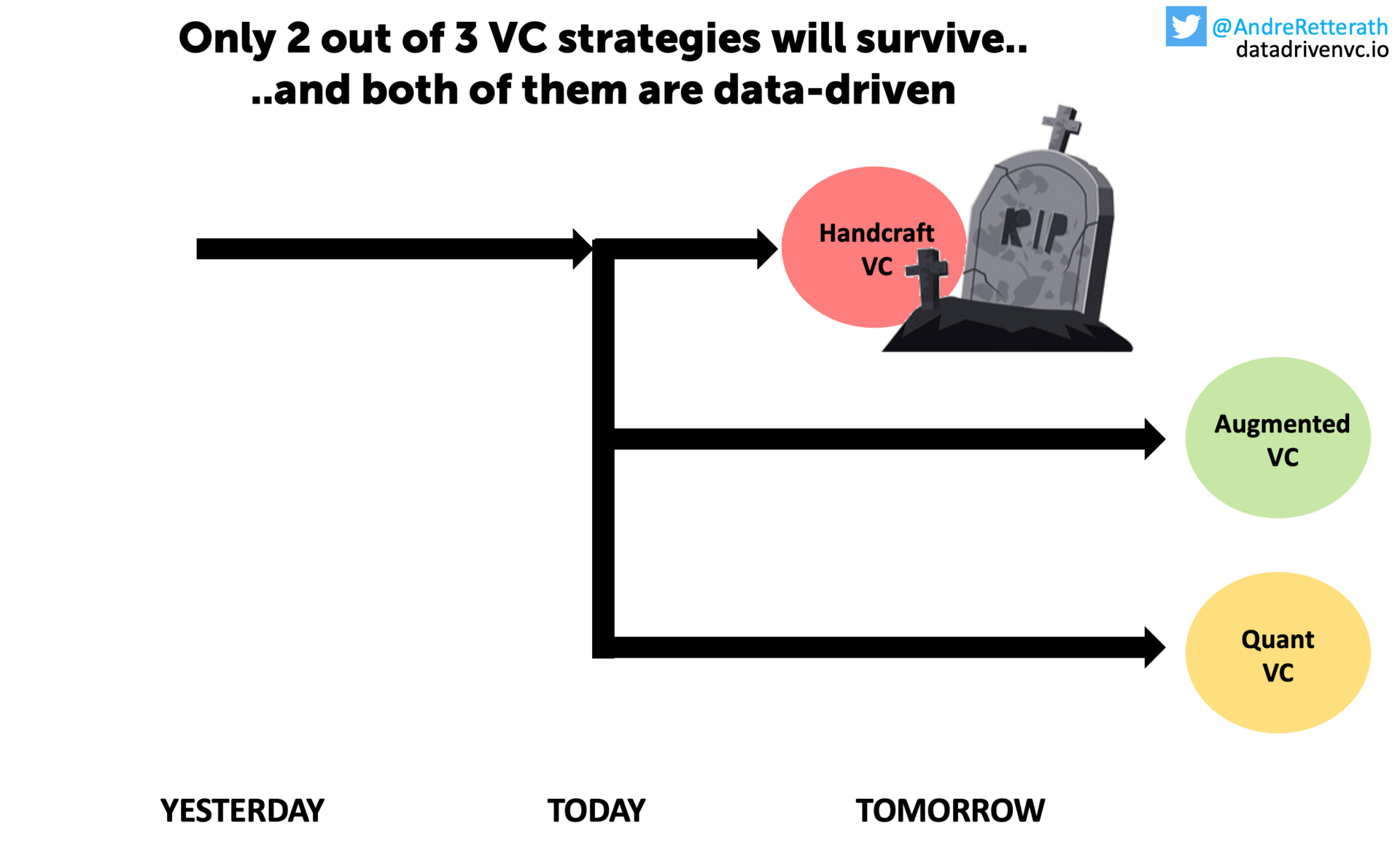

Together with “Traditional VC” and “Augmented VC”, “Quant VC” forms the trio of fundamentally different approaches to startup investing. I wrote about them for the first time early 2023 here. A recap of my “definitions” below:

Handcraft / Traditional VC: A shrinking group of senior, gray-hair industry veterans, characterized by a strong belief that VC is more art than science and that the best deals will always be sourced through their proprietary personal networks. Moreover, they are rarely aware of their biases (recency, similarity, confirmation, over-simplification, etc.) when making decisions and tend to overestimate their position based on their firm and personal brands as well as their (oftentimes impressive) investment track records.

Augmented VC: Combining the best of both worlds, where machines collect, process and contextualize vast amounts of data to achieve comprehensive coverage and give direction, and where human investors focus on a select number of founders to build deep relationships and assess the soft factors based on their intuition. While data provides coverage and guidance, the human makes the final decision.

Quant VC: A new species of purebred algorithmic VCs who believe that startup investment decisions should not involve humans at all, just like in pure-play quant public funds. Just algos, no humans. Fast, clean and repeatable. These investors believe that human involvement skews the models and reduces the likelihood to generate alpha.

Since then, a lot has happened and I’d like to share an updated and more nuanced view on the different approaches and their relevance for The Future of VC below.

No Room for Traditional VCs?

While my definitions for Augmented VC and Quant VC have not really changed, conversations with our DDVC community led me to rethink my perspective on the definition for Traditional/Handcraft VC.

Previously, it had a negative connotation. I even believed that the handcraft model wouldn’t survive and won’t be part of The Future of VC at all as it is structurally disadvantaged compared to data-driven models.

Subscribe to DDVC to read the rest.

Join the Data Driven VC community to get access to this post and other subscriber-only content.

Join the Community