👋 Hi, I’m Andre and welcome to my newsletter Data-Driven VC which is all about becoming a better investor with Data & AI. Join 31,990 thought leaders from VCs like a16z, Accel, Index, Sequoia, and more to understand how startup investing becomes more data-driven, why it matters, and what it means for you.

Brought to you by Deckmatch - Agentic Workflows and APIs for Data-Driven VCs

Connect your top-of-funnel to Deckmatch and transform pitch decks and URLs into structured and insightful data. Get detailed firmographic and people data, in-depth competitive and market analysis, and personalized investment memo without lifting a finger. The cherry on the cake? It's all seamlessly synced to your preferred tools like Affinity through our API integrations.

Never miss a deal, ditch the donkey work, and build meaningful relationships faster.

Raising Is Not a Numbers Game

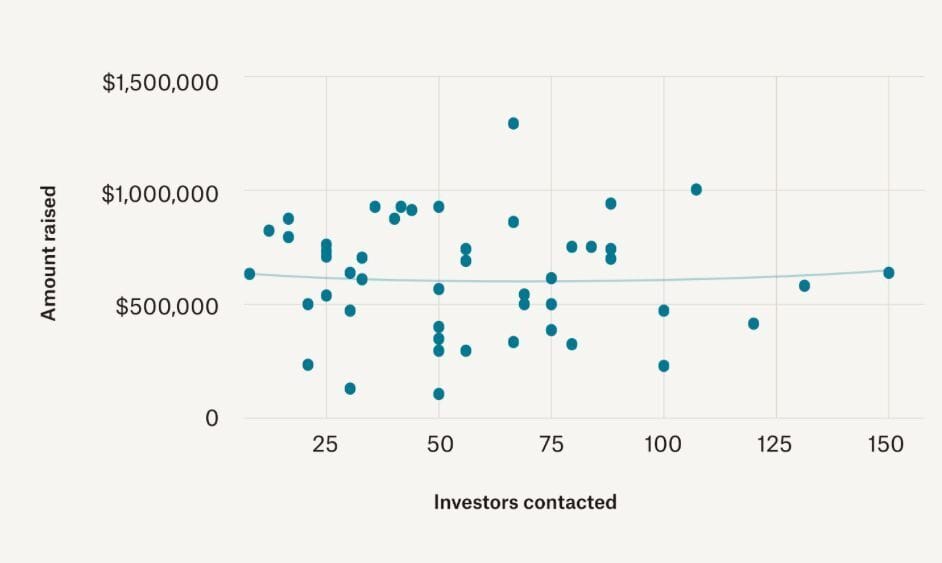

Adam Shuaib challenges the common belief that more VC meetings lead to better fundraising outcomes. Data from thousands of seed raises suggest that a smarter, targeted approach is far more effective than sheer volume:

VC Meetings and Funding: Founders who successfully raised funds had an average of 40 VC meetings, but meeting more investors didn’t translate to higher amounts raised.

Fundraising Timeline: Only 13% of seed raises were completed within six weeks, showing that rushing the process isn’t the norm.

Strategic Targeting: Founders should prioritize building relationships with VCs who back startups in their sector and stage instead of trying to pitch as many investors as possible.

✈️ KEY TAKEAWAYS

Pitching smarter, not harder, is the optimal approach—focusing on the right investors yields better results than maximizing meeting volume.

VC Money Means Long-Term Commitment

Raising venture capital is a multi-year commitment, whether the startup succeeds or not. We've all heard the stat that "9 out of 10 startups fail". But how long does each failure take? Peter Walker from Carta (who’ll speak at our Virtual DDVC Summit in 3 weeks too!) has the answer:

Survival Rates After Funding: After two years, 90% of seed-funded startups are still active, with about 25% progressing to Series A.

The Four-Year Mark: By year four, 78% of startups remain, but only ~45% have raised another round. Around 30% are stuck at seed, and 22% have shut down.

Impact of Market Conditions: Startup failure rates fluctuate with macroeconomic shifts—companies that raised seed funding just before COVID faced a tougher road despite the broader market recovery.

✈️ KEY TAKEAWAYS

Once you take VC money, you’re in it for the long haul—startups may fail, but it takes years, not months, to play out.