Beyond ESOP: Alternative Compensation & Incentive Mechanisms

Synthesizing Insights From the Data

👋 Hi, I’m Andre and welcome to my newsletter Data-Driven VC which is all about becoming a better investor with Data & AI. Join 32,990 thought leaders from VCs like a16z, Accel, Index, Sequoia, and more to understand how startup investing becomes more data-driven, why it matters, and what it means for you.

Brought to you by Affinity – Navigating 2025’s Investment Landscape

Market consolidation is reshaping venture capital, with fewer firms capturing the lion’s share of deals. How can investors adapt their dealmaking strategies to stay ahead?

Join Mercedes Bent, Partner at Lightspeed Venture Partners, on May 8 for key insights on evolving dealmaking trends, the behaviors of top-performing firms, and the strategies investors are using to thrive in a competitive market.

Rethinking Startup Equity Incentives

Employee stock option plans (ESOPs) have been the go-to method for aligning startup teams with a company’s success for decades. But they’re not the only game in town. Many are exploring incentive mechanisms beyond ESOPs.

In this episode, we dive into three alternative incentive designs making waves in tech startups: phantom shares, stock appreciation rights (SARs), and profit-sharing schemes. We’ll compare how they work, weigh their benefits and tradeoffs, and examine the U.S. vs EU implications. We’ll also look at real-world examples (from scrappy seed-stage companies to scaling Series B startups) and data on how adoption of these tools has trended in the last few years.

The goal: give you a research-driven, data-backed lens on whether these approaches can help your company motivate talent. Since startup outcomes and incentivisation structures can vary so broadly, we also wanted to include some founder testimonials and case studies to add some real-world flavor.

Let’s explore the incentive toolbox for founders.

Phantom Shares / VSOP: Synthetic Equity

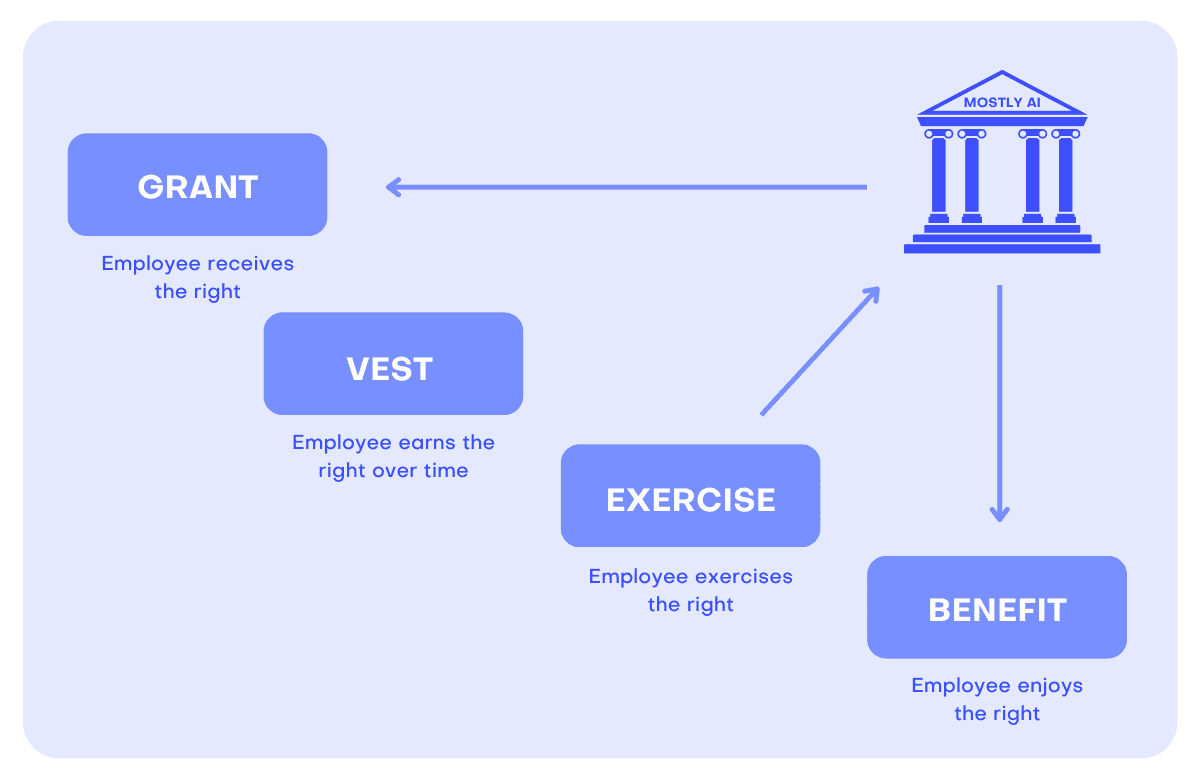

What They Are: Phantom shares (aka phantom stock or shadow stock) are essentially synthetic equity. Employees don’t receive actual shares or voting rights – instead, they’re promised a payout equivalent to the value of a certain number of shares (or the increase in value of those shares) over time (Capboard, 2024). Typically, phantom shares pay out upon a liquidity event (like an acquisition or IPO) or other milestones.

In some cases, they can also deliver periodic bonuses tied to company performance (even sharing in profits) (Carta, 2024). Phantom equity is granted for free (no exercise price), and it keeps employees as non-shareholders – more like a deferred cash bonus plan linked to the company’s value.

Benefits: For companies, phantom plans offer equity-like incentives without diluting ownership or control (Bushman, 2023). This can be crucial for founders who want to reward the team but aren’t ready (or able) to issue actual shares. It’s also simpler for the employee – there’s no need to pay to exercise options or figure out what “0.1% equity” really means.

As one startup founder put it, phantom stock rewards employees “in a meaningful and fair way across the globe,” uniting everyone around the company’s success regardless of location (Peter, 2022). Phantom shares can be a great tool to attract top talent internationally: in regions where traditional stock options are expected, phantom grants can mirror their value, and in regions unfamiliar with equity, they serve as a straightforward bonus for growth (Peter, 2022).

Tradeoffs: The flip side is that employees don’t become actual owners. They usually can’t vote or receive real stock dividends, and their payout is typically taxed as ordinary income (since it’s treated like a bonus) rather than the lower capital gains rates that stock sales might enjoy (Carta, 2024).

There’s also a cash flow consideration: when a phantom plan pays out (e.g., at exit), the company or its acquirer must shell out the cash. This liability often sits on the balance sheet; indeed, phantom shares are literally accounted for as liabilities in many jurisdictions (Ledgy, 2023).

Despite these drawbacks, many startups accept them as the price of flexibility. “Phantom stock can help us along the whole journey… everyone will benefit from their hard work when a liquidity event comes. It’s so simple that we wonder why this isn’t how things are done everywhere,” says the mostly.ai team after rolling out a company-wide phantom equity plan (Peter, 2022).

Legal/Tax in U.S. vs EU: Here the story really diverges. In the U.S., corporations usually favor actual equity (stock options or restricted stock units) because the legal framework is conducive (Bushman, 2023). Phantom plans in U.S. startups tend to appear in specific cases – for example, at LLCs (which can’t issue stock in the traditional sense) or in later-stage private companies for select exec incentives.

Notably, U.S. phantom plans must be carefully structured to comply with IRS deferred compensation rules (Section 409A); otherwise employees could face immediate tax plus a 20% penalty (Bushman, 2023). When compliant, taxes on phantom stock are deferred until payout (Bushman, 2023), at which point the gain is taxed as regular income.

The company typically gets a tax deduction on that payout. Bottom line: In the U.S., phantom stock is perfectly legal but often used sparingly – it’s one of several tools (alongside profits interests or unit appreciation rights for LLCs) to share value without issuing shares (Carta, 2024).

In Europe, phantom shares have been more of a necessity in certain countries. Nowhere is this clearer than in Germany. Until very recently, German startups had to grapple with punitive taxation and bureaucracy around employee equity.

In fact, a 2022 Index Ventures study ranked Germany 23rd out of 24 countries for stock option friendliness (Index Ventures, 2022). Tax law historically meant an employee could owe income tax (up to ~50%) upon exercising options (often long before any liquidity). A so-called “dry income” problem that made conventional ESOPs impractical (Carta, 2024).

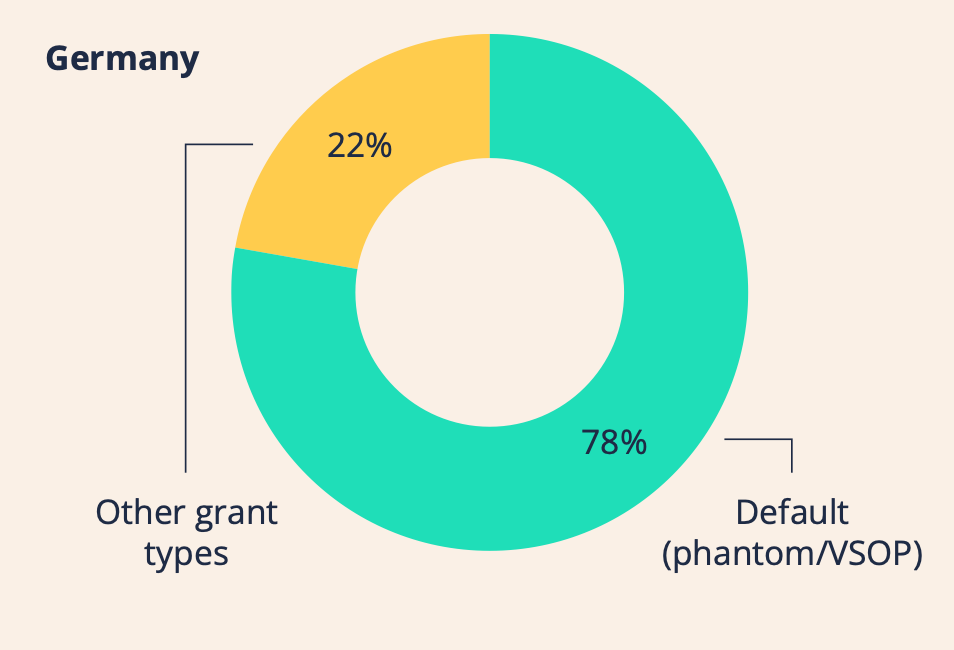

The result? German startups overwhelmingly adopted Virtual Stock Option Plans (VSOPs), which are essentially phantom share contracts. By one 2023 analysis, 78% of German startups used VSOP phantom shares as their default employee grant (Ledgy, 2023). This became the norm despite phantom shares “not being a perfect solution” – they create no ownership and are taxed as ordinary income on any gain (Woodford, 2023).

The German government’s recent reforms (effective December 2023) aim to make actual stock options more attractive, but through 2019–2023, phantom shares utterly dominated German startup equity pools (Ledgy, 2023).

Other European tech hubs show a different mix: France introduced the BSPCE stock option regime (with low tax on gains) and saw a surge in uptake after 2019, making BSPCE the de facto choice for French startups (Ledgy, 2023).

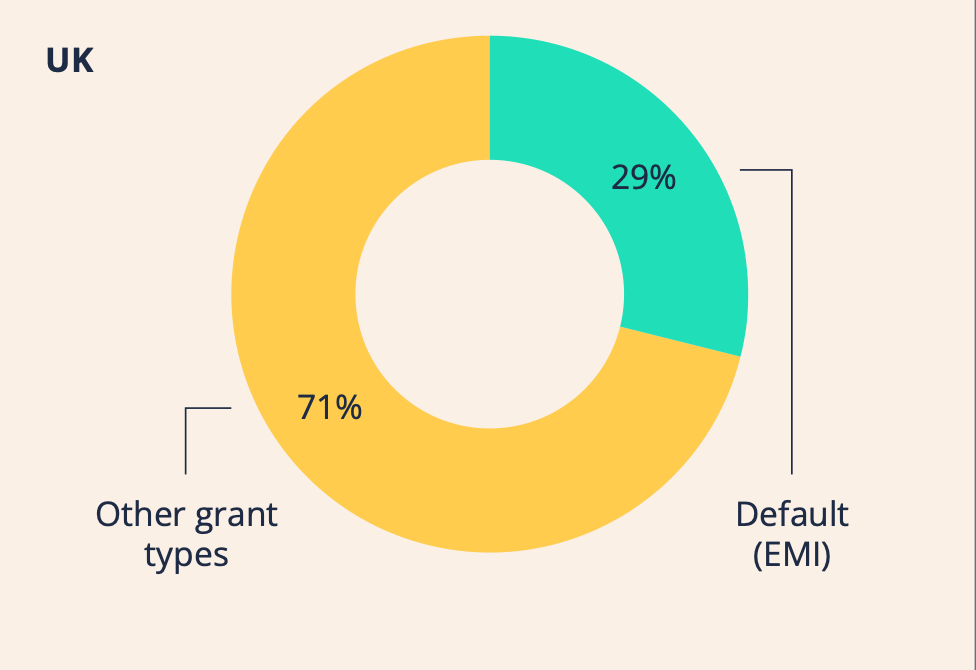

UK startups have the HMRC-approved EMI options, but interestingly, only ~29% of UK startup grants use EMI – many companies opt for other share schemes like growth shares or JSOPs (Ledgy, 2023). In those markets, phantom shares are less common because tax-optimized real equity is available.

But across much of continental Europe (and for global teams), phantom plans became the default workaround to involve employees in “the value they create” without onerous legal hurdles (Ledgy, 2023).

Adoption Trends: Over the past five years, phantom equity has seen steady or increased adoption in environments where traditional equity was problematic and had modest use elsewhere.

In Europe, VSOPs remained prevalent from 2019 to 2022 and even grew in popularity for early-stage teams as awareness spread. Cap table platforms note that in Germany, VSOP grants have had a “very high market share” (around 75–80% of all startup grants) throughout this period (Ledgy, 2023). In France, the need for phantom stock declined post-2019 as the improved BSPCE took over – a sign that when a real equity incentive became viable, founders preferred that (Ledgy, 2023).

In the U.S., phantom shares remained a niche: a typical Seed or Series A startup in the U.S. almost always sets up an actual stock option pool (often 10–20% of equity) rather than phantom units. By Series B, many U.S. startups even transition from options to RSUs (restricted stock units) as they mature, again sticking to real equity.

That said, there’s some uptake in phantom plans for specific cases. Carta reports that more private companies, especially LLCs and those with international talent, started leveraging phantom equity in the last few years as a flexible alternative (Ledgy, 2023).

The proliferation of cap table tools and standardized phantom plan templates (and services to manage them) has made it easier for a Seed-stage founder to grant phantom shares early on, whereas a decade ago, they might have skipped equity incentives entirely until a later funding round.

We’ve also seen new startups in places like Austria and Eastern Europe embracing phantom plans from inception to stay competitive in hiring. This trend of earlier and broader phantom equity grants is gradually picking up, especially in Europe’s seed-stage startups that compete internationally.

By 2024, with new reforms (like Germany’s) coming into effect, we may see phantom share usage peak and begin to ebb in favor of actual stock options – but for now, it remains a cornerstone of many non-US startup compensation strategies.

✈️ KEY INSIGHTS

Phantom shares are synthetic equity instruments that provide employees with cash bonuses tied to a company’s valuation, without granting actual ownership or voting rights. They are especially popular in European startups (particularly in Germany) due to historical tax and legal constraints around real equity, while in the U.S. they remain a niche tool used mainly in LLCs or for executive compensation.