💥ARR Milestones for Series A, Startup Graduation Rates, Number of Direct Reports per Manager, Impact of AI on GTM & More

Digesting Insights From the Data

👋 Hi, I’m Andre and welcome to my newsletter Data Driven VC which is all about becoming a better investor with Data & AI. Join 34,860 thought leaders from VCs like a16z, Accel, Index, Sequoia, and more to understand how startup investing becomes more data-driven, why it matters, and what it means for you.

Learn how top founders build and scale AI companies on autopilot! I’m working on a new project to uncover how next-gen founders ship faster and win with new AI tools, agents, and automation. Here’s what to expect:

✅ Interviews with top founders & operators — deep dives into the tactics, tools, and systems that power winning AI companies.

✅ Customer acquisition playbooks — from community-led growth to organic content, standout branding, paid campaigns, and partnerships.

✅ Pricing & monetization strategies — learn what works (and what doesn’t) to grow viral without churn.

The AI-GTM Illusion: Activity Up, Impact Down

The 2025 ZoomInfo Go-To-Market Intelligence Report outlines why traditional GTM systems and AI adoption have failed to deliver meaningful impact. It highlights how disjointed tools, bad data, and rigid playbooks slow revenue teams, while top performers focus on real-time signals, adaptive workflows, and creative execution.

Lost Revenue from Bad Data: Poor data quality costs companies 15–25% of revenue, while many still operate with information spread across 23 separate vendor tools. Only 19% of companies consider their data “AI-ready.”

AI Adoption Without Impact: AI product usage has risen 893% since 2022, but average ROI remains low, under 10% cost savings and under 5% revenue lift. Without high-quality data, AI often scales inefficiency.

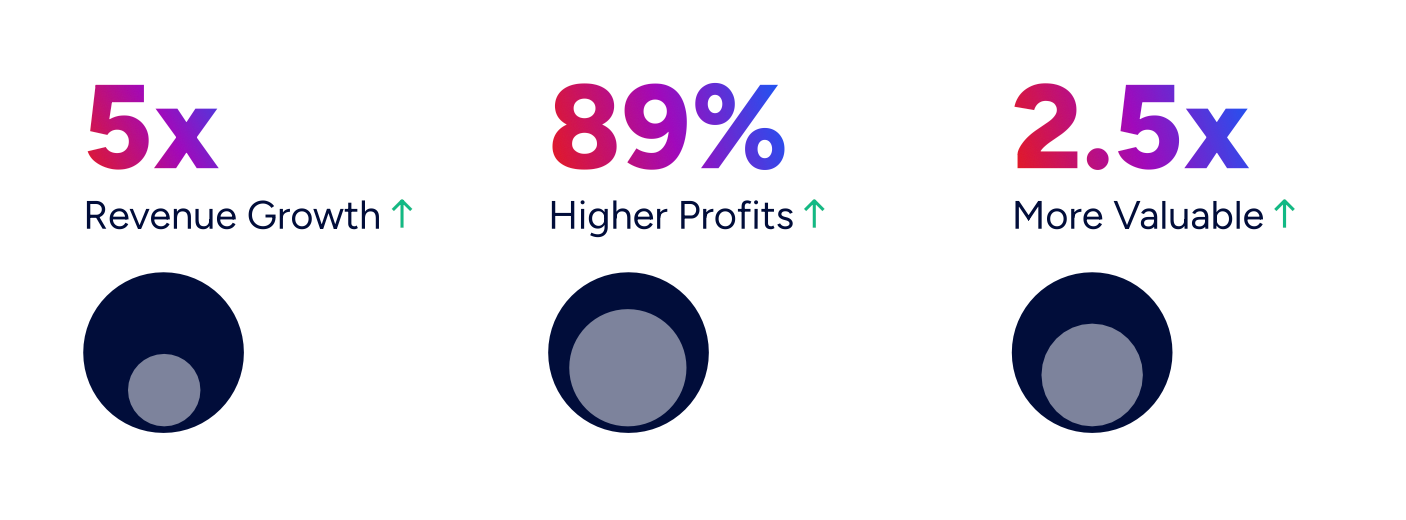

Performance Gains from GTM Intelligence: Companies using GTM Intelligence see 5x revenue growth, 89% higher profits, and are 2.5x more valuable. SAP, for example, cut buying cycles by two-thirds and doubled pipeline by integrating 40+ AI tools with signal-driven targeting.

✈️ KEY TAKEAWAYS

The future of GTM requires shifting from rigid, volume-based playbooks to adaptive, intelligence-driven systems. High performers integrate real-time signals with creative execution, leveraging AI only when underpinned by clean, unified data.

ARR Milestones for Series A Keep Rising

SVB’s latest State of the Markets report shows that ARR milestones for Series A doubled in the last four years. Here’s the key insights:

Top tier Series A: While the top quartile raises Series A at $7M ARR, the top decile has grown past $10M ARR already.

Median ARR nearly doubled: From $1.3M in 2021 to almost $3M in 2024 for US B2B software startups.

Low-quartile companies squeezed out: ARR values have increased more quickly at the lower quartile than the upper quartile, indicating that teams with mediocre traction do not make the cut anymore.

✈️ KEY TAKEAWAYS

ARR milestones keep increasing across stages. For Series A, they have roughly doubled in the last four years, making $3M the new $1M bar for the median company.

AI Founder Profiles Defy Stereotypes

Maggie Basta’s analysis of the past three years of AI unicorn founders shows no single demographic or credential reliably predicts success. While some trends exist—such as a concentration of MIT alumni and roughly one in four holding a technical PhD—the long tail of variation dominates.

Age and Geography: Founder ages at company inception range widely, with notable clusters in the late 20s to mid-30s but also representation from early 20s to late 40s. Over half were born outside the US, spanning regions from India to Sweden to Chile.

Education: Undergraduate backgrounds are diverse, with most founders coming from outside “top 10” schools. While MIT appears most often, the majority of institutions are represented only once.

Investor Origins: First lead investors vary significantly, from top-tier Silicon Valley firms to niche and international funds, with no dominant backer profile.

✈️ KEY TAKEAWAYS

Recent AI unicorn founders share few easily measurable traits, reinforcing that AI success remains an n-of-1 game. Surface-level pattern matching offers limited predictive value compared to deeper, case-by-case evaluation.

SaaS Companies Struggle to Reach Revenue Milestones

Sofia Faustino’s cohort analysis from 2019–2023 shows an increasingly difficult path for SaaS companies to reach early revenue milestones, with $100K ARR becoming a tougher hurdle and $1M ARR remaining elusive for most.

Slower Early-Stage Progress: Since 2022, more companies remain under $100K ARR even after two years, signaling a tougher early growth environment.

$1M ARR Still Rare: Across cohorts since 2020, only about 10% of SaaS companies reach $1M ARR within two years, a key benchmark for product–market fit.

Majority Stall Early: Most SaaS companies fail to pass $100K ARR in their first two years, underscoring the challenge of establishing sustainable traction in a selective buying market.

✈️ KEY TAKEAWAYS

Early ARR milestones are harder to reach for pure-play SaaS companies, requiring founders to rethink GTM strategies and focus on solving acute customer problems. On the flip side, AI-native founders reach milestones at a fraction of the time.

Number of Direct Reports per Manager Shifts with Company Size and Role

Matt Schulmann’s analysis of 199,000+ managers and executives across 9,052 companies reveals how management load varies by role and company size, showing substantial differences in direct report counts as organizations scale.

Early vs. Late-Stage Managers: M3 managers at companies with 1–100 employees average 2.9 reports, compared to 5.8 at 3,000+ employees, double the workload.

C-Suite and VP Loads: At large companies (3,000+ employees), C-Suite leaders average 7.7 reports, while VPs handle about 6.0, indicating high spans even at senior levels.

Overall Averages: Across all company sizes, average spans range from 4.5 (Directors) to 6.5 (C-Suite), with steady increases in direct reports at larger organizations.

✈️ KEY TAKEAWAYS

Span of control grows significantly with company size and level, turning the same title into a very different role at scale. Benchmarking against market data can highlight overloaded or underutilized management layers.

From Seed to Series B: A Long, Steep Climb

Peter Walker’s analysis of 12,258 US seed-stage startups shows just how rare it is to reach Series B, even in peak markets.

Peak vs. Normal Market Outcomes: In the frothiest conditions, about 35% of seed companies make it to Series B within seven years. In more typical markets, it’s closer to 16–20%.

Time-to-B Is Lengthy: Only ~22% of companies in the boom years reached Series B within four years, dropping to under 10% for recent cohorts. For Q1 2022 seeds, just 2.2% have reached Series B after three years.

Early Success Is Uncommon: Even the best seeds often take longer than expected to break into growth-stage funding, and many never do, M&A accounts for just 5–6% of early exits before Series B

✈️ KEY TAKEAWAYS

Raising a seed round is just the start. The path to Series B is long, uncertain, and dependent on market cycles, requiring founders to plan for extended timelines and potentially earlier profitability.

Thanks to Jérôme Jaggi for his help with this post.

Stay driven,

Andre

Thank you for reading this episode. If you enjoyed it, leave a like or comment, and share it with your friends. If you don’t like it, you can always update your preferences to reduce the frequency and focus on your preferred DDVC formats. Join our community below and follow me on LinkedIn or Twitter to never miss data-driven VC updates again.