👋 Hi, I’m Andre and welcome to my newsletter Data-Driven VC which is all about becoming a better investor with Data & AI. Join 32,880 thought leaders from VCs like a16z, Accel, Index, Sequoia, and more to understand how startup investing becomes more data-driven, why it matters, and what it means for you.

Brought to you by Affinity - Due Diligence 2.0: Strategies for the AI Era

When AI startups reach billion-dollar valuations in months and market conditions can shift overnight, traditional due diligence approaches are pushed to their limits. VCs are challenged to validate complex technologies, assess business model sustainability, and pick out the highest quality deals amid the hype.Join this webinar to see how Vanessa Larco, former Partner at New Enterprise Associates has evolved her due diligence process and the investments she’s considering to support the next generation of innovative companies.

Importance of Brand for GTM

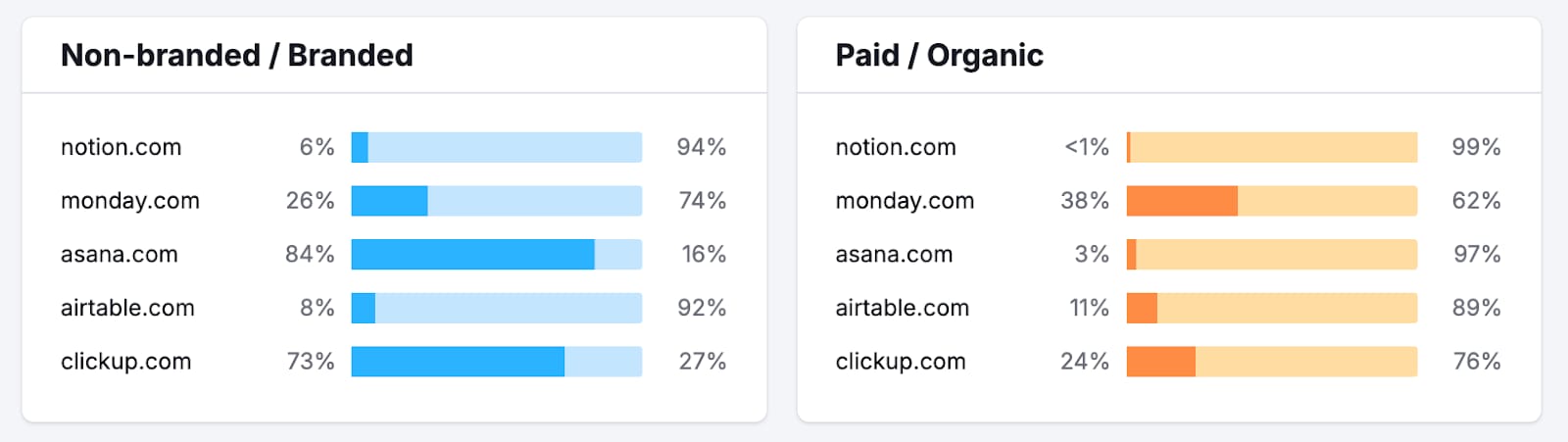

In this Growth Unhinged guest post, Kira Klaas breaks down how top companies like Notion, Figma, and Canva used brand as a force multiplier to scale their PLG motions. Klaas argues that the most successful startups don’t silo brand and growth—they combine them from the start.

Organic = Brand Power: Notion’s high branded search and Figma’s $12.5B valuation both trace back to organic momentum driven by strong brand identity, not just clever product features.

Tracking Brand Like a Pro: Brand health can be measured through viral loops, branded search volume, and CAC by acquisition channel—Klaas recommends starting small with 3–4 brand metrics tied to growth goals.

Invest Early, Scale Wisely: Early-stage efforts should focus on touchpoint audits and storytelling; mature teams should allocate up to 35% of their marketing budget toward brand initiatives like UGC and ambassador programs.

✈️ KEY TAKEAWAYS

Brand isn’t a soft add-on—it’s a core growth engine. Tracking and investing in brand early on drives word-of-mouth, lowers CAC, and extends PLG performance beyond early traction.

The 2025 Liquidity Puzzle

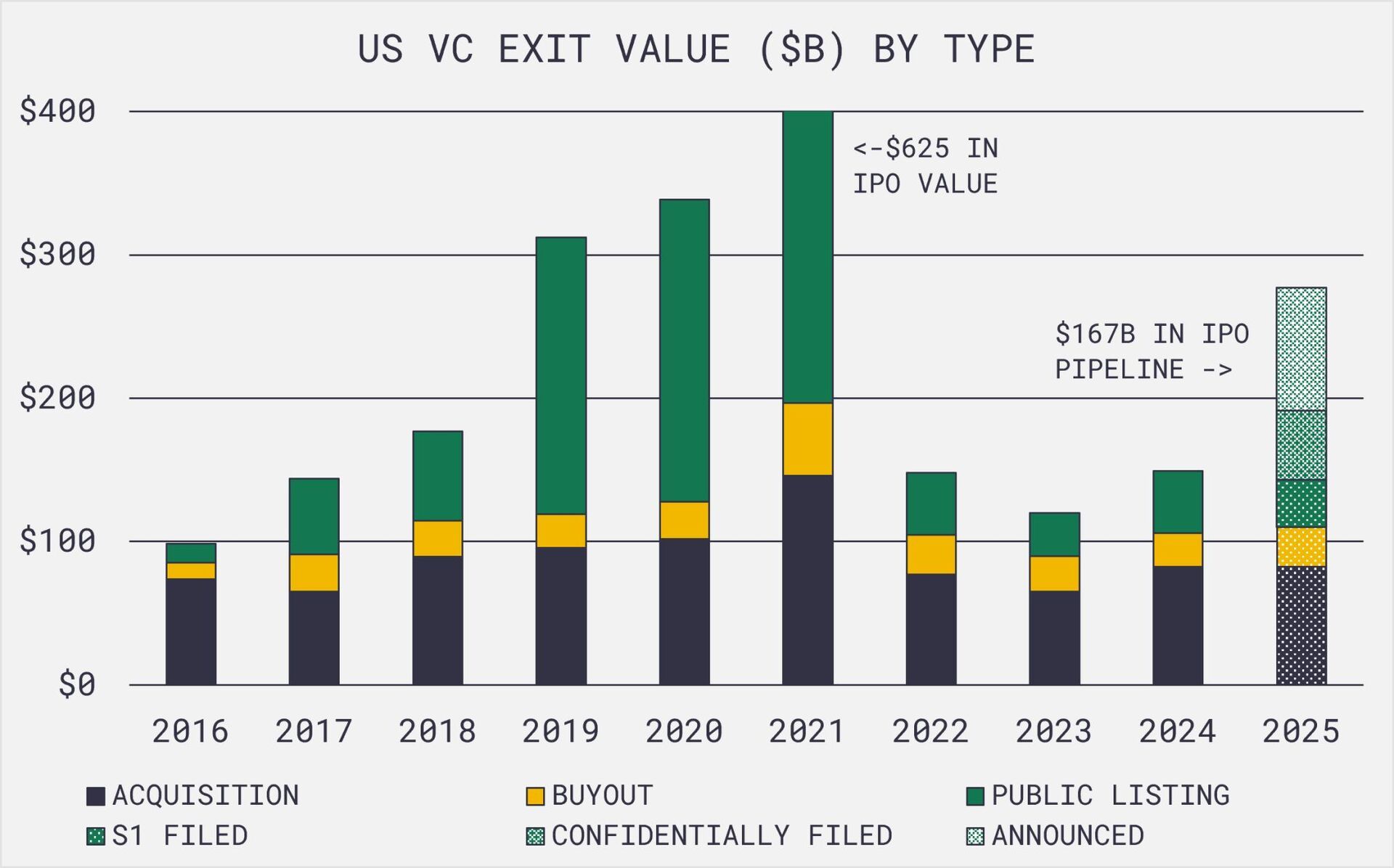

Jackie DiMonte’s latest analysis dives into whether 2025 could finally spark a liquidity wave amid years of muted exit values and locked capital. The article lays out a compelling data breakdown to question if we’re seeing the start of a sustained surge in liquidity or merely a small trickle.

Capital Lock-Up: Three years of depressed exit values echo early 2010s levels, even though a surge of capital flowed during 2020–2022, resulting in over 800 unicorns still waiting for an exit.

IPO Activity Surge: Data from the Forge Tech IPO Calendar shows over 30 companies have either filed or announced IPOs, representing up to $167B in last private market value, with S1 filings around $33B, confidential filings at $48B, and announced deals topping $86B.

Acquisitions & Exit Trends: Notably, Google’s recent $32B acquisition of Wiz underscores a broader trend where acquisitions are trending upward, making up 40% of last year’s total and hinting at a potential rebound in overall exit value.

✈️ KEY TAKEAWAYS

The article suggests that despite years of tepid exit activity and significant capital still locked up, the surge in IPO filings and strategic acquisitions might signal the early stages of a liquidity wave, though the scale remains uncertain.

Is Your Org Chart Too Top Heavy?

Subscribe to our premium content to read the rest.

Become a paying subscriber to get access to this post and other resources from the exclusive Data Driven VC community.

UpgradeA subscription gets you:

- Lists of 312 Family Offices + 59 Pension funds + 1513 angels

- Annual ticket for the virtual DDVC Summit

- Access our archive of 300+ articles

- 1 new premium article per week

- Virtual & physical meetups

- Masterclasses & videos

- Access to AI Copilots

- Prompt Database

- ... and lots more